Structured Layout for Quick Data Entry

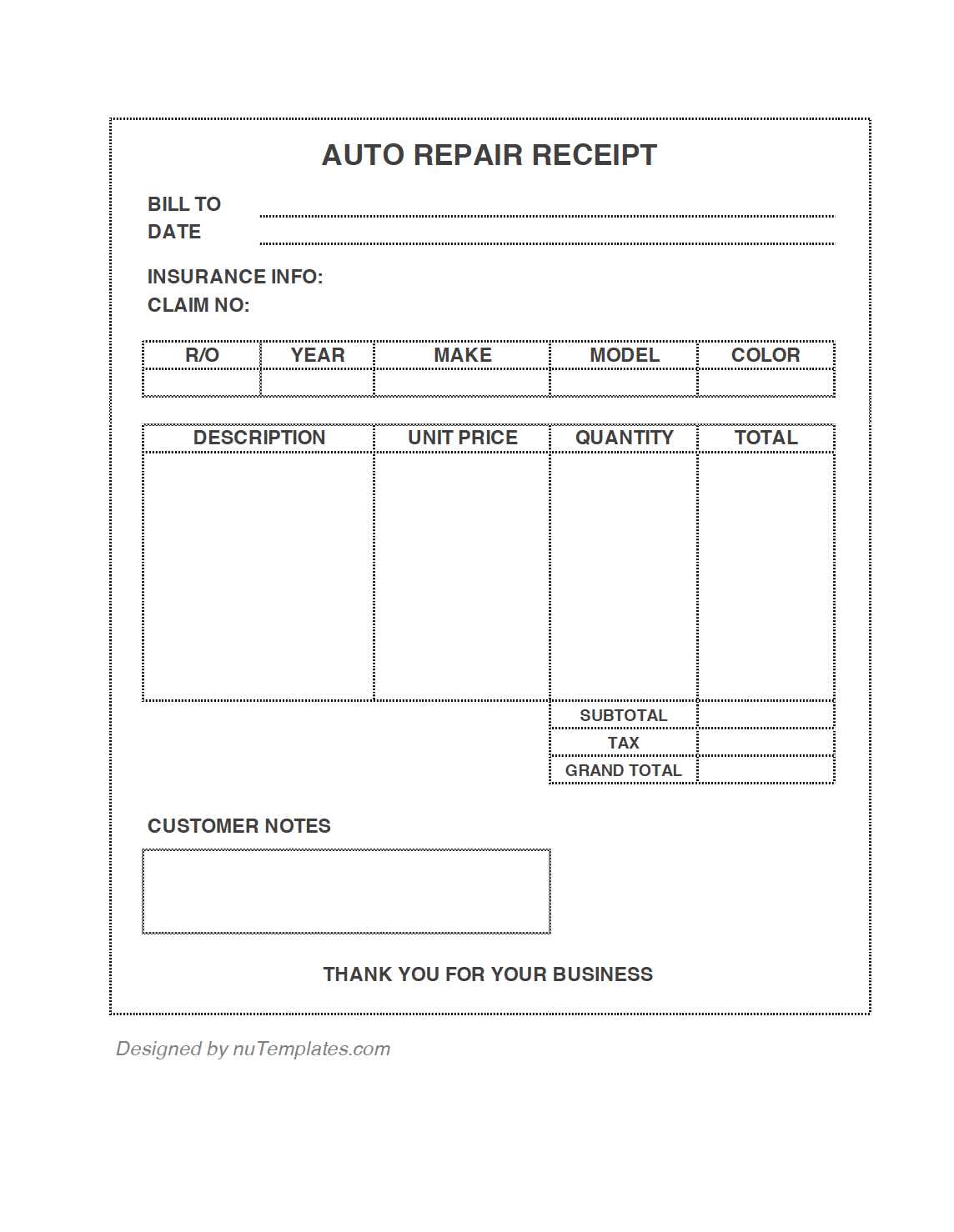

A well-organized spreadsheet makes tracking car parts purchases seamless. Use the following structure:

- Date: Auto-updated field for each new entry.

- Supplier Name: Dropdown menu for quick selection.

- Part Description: Detailed input for clarity.

- Part Number: Standardized format for easy reference.

- Quantity: Numeric field with sum calculation.

- Unit Price: Automatically formatted as currency.

- Total Cost: Formula-driven calculation.

- Tax & Shipping: Separate fields for accurate cost tracking.

- Payment Method: Dropdown for consistency.

- Invoice Number: Unique identifier for record-keeping.

Automations for Accuracy

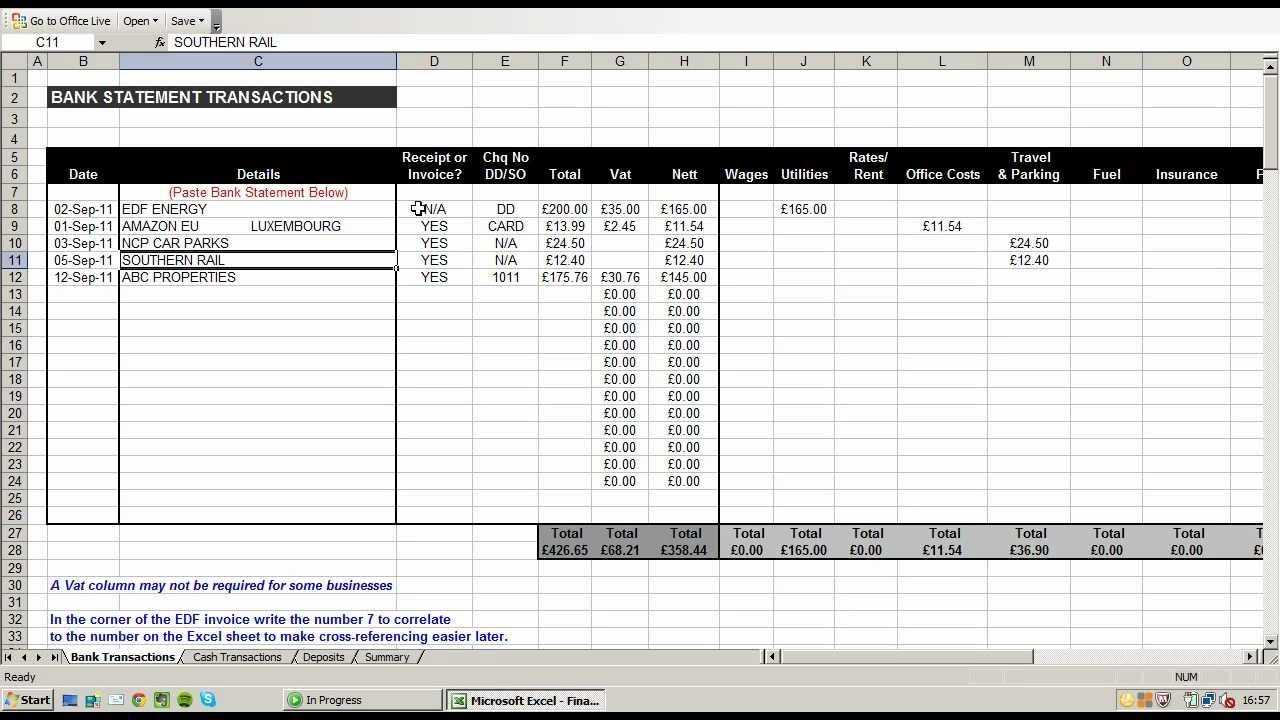

Google Sheets allows automation to minimize manual input errors. Use these features:

- Data Validation: Restrict inputs to predefined lists for suppliers and payment methods.

- Conditional Formatting: Highlight overdue payments or high-cost purchases.

- SUM and COUNT Functions: Track total expenses and number of transactions.

- Auto-Fill: Predict repetitive entries like tax rates.

- Google Forms Integration: Populate the sheet via mobile-friendly data entry.

Sharing and Collaboration

Enable real-time collaboration by setting permissions:

- View Only: For reference without edits.

- Edit Access: For team members adding new entries.

- Commenting: For approval or dispute resolution.

Keep a backup by linking to Google Drive for automatic version history.

Download the Template

To save time, use a prebuilt template. Copy an existing sheet, adjust column headers, and start tracking expenses instantly.

Car Parts Receipt Google Spreadsheet Template

How to Format a Car Parts Receipt in Google Sheets

Essential Columns for Comprehensive Tracking

Automating Cost and Tax Calculations

Sharing and Collaborating on the Template

Adapting the Template for Various Needs

Exporting and Printing for Record-Keeping

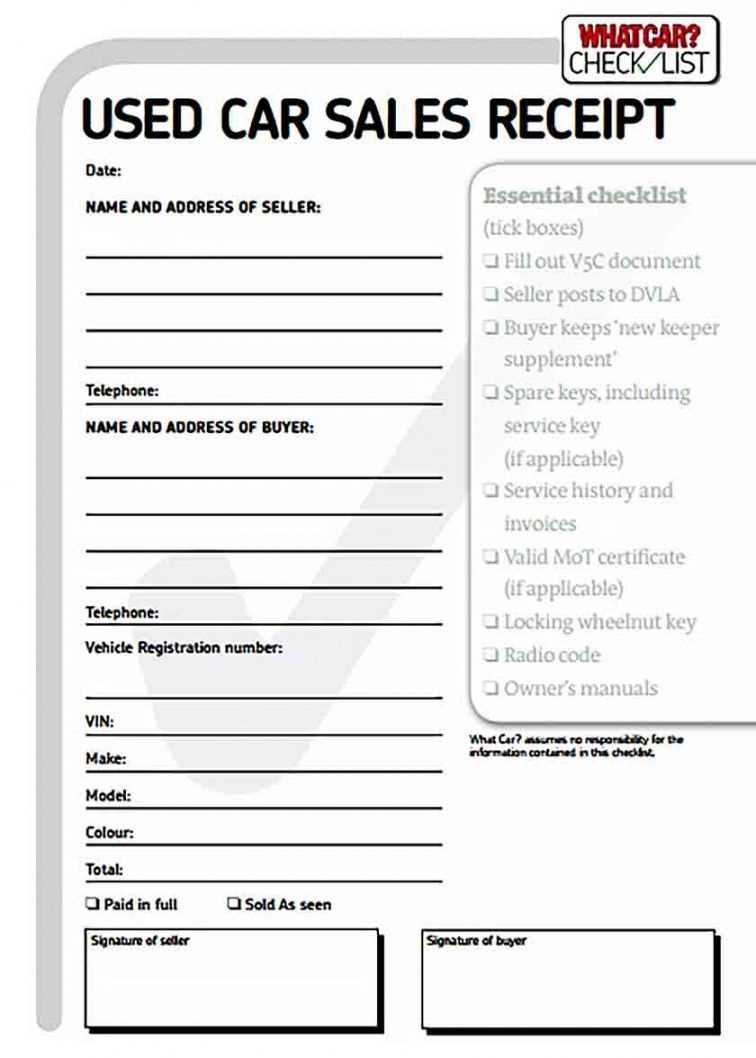

Use clear column headers like “Part Name,” “Quantity,” “Unit Price,” “Total Cost,” and “Supplier” to ensure easy tracking. Apply data validation to prevent entry errors. Set up conditional formatting to highlight overdue payments or low stock. Enable automatic calculations for taxes and discounts using formulas like =B2*C2 for total cost and =D2*0.08 for tax at 8%. Protect key formulas to avoid accidental changes.

Share the spreadsheet with a team by adjusting permissions in the “Share” menu. Use the comment feature to clarify entries or request updates. For exporting, select “File” > “Download” and choose PDF for easy printing or CSV for integration with other systems. Adjust print settings in “Page Setup” to fit receipts neatly on paper.