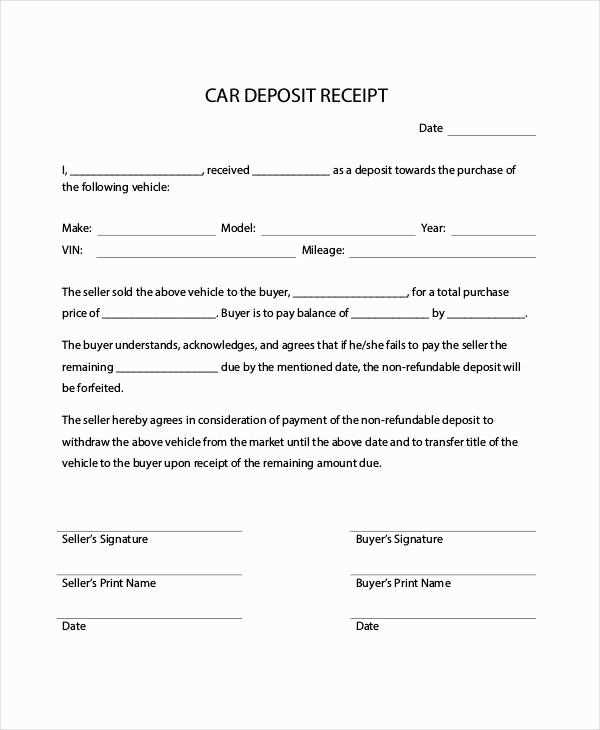

Always specify the deposit amount clearly. The receipt should indicate the exact sum received, along with the date of payment. This prevents misunderstandings and ensures both parties have a written record of the initial transaction.

Include the remaining balance and due date. Outline the outstanding amount and specify when it must be paid. If there are installment options, list them with corresponding deadlines to keep expectations clear.

Detail the services covered by the deposit. Whether it secures the date, covers specific equipment, or includes a portion of the performance fee, clarify what the initial payment guarantees. This helps avoid disputes later.

Add cancellation and refund terms. If deposits are non-refundable, state this explicitly. If partial refunds are possible under certain conditions, define them in precise terms. A transparent policy protects both the DJ and the client.

Provide contact details and a signature line. The receipt should list the DJ’s business name, phone number, and email for easy reference. A signature section for both parties adds another layer of verification, confirming mutual agreement on the terms.

Wedding DJ Receipt Template That Includes Deposit

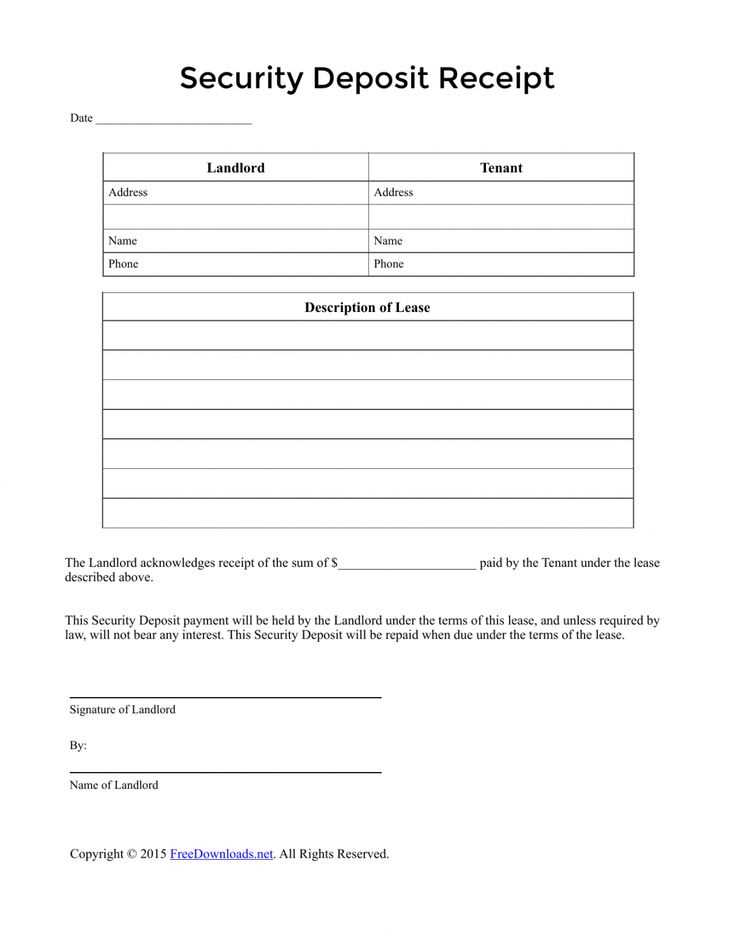

A well-structured receipt ensures transparency and professionalism. Include the DJ’s name, business details, and client’s information at the top. Clearly label it as a “Receipt” to avoid confusion with an invoice.

Deposit and Payment Breakdown

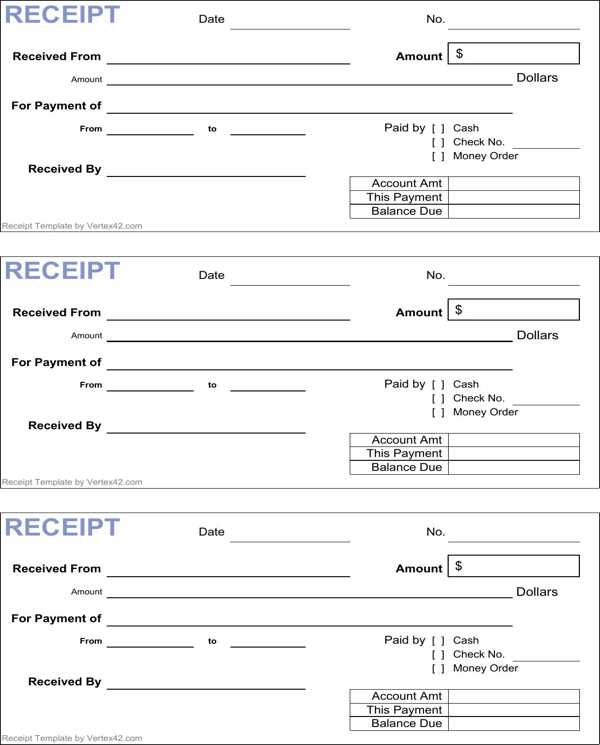

Specify the deposit amount paid, the total service fee, and the remaining balance. Use a table format for clarity:

| Description | Amount |

|---|---|

| Deposit Received | $XXX.XX |

| Remaining Balance | $XXX.XX |

| Total Service Cost | $XXX.XX |

Payment Terms and Confirmation

Outline accepted payment methods and due dates for the remaining balance. Include a signature or digital confirmation section for both parties to acknowledge receipt. This helps prevent disputes and keeps records clear.

Key Elements to Include in a DJ Deposit Receipt

A well-structured DJ deposit receipt provides clarity for both parties and ensures smooth financial transactions. Include these key elements:

Basic Transaction Details

Clearly list the names of both parties, the event date, and the agreed service details. Specify the deposit amount, total cost, and remaining balance.

Payment Breakdown

Outline the deposit amount, payment date, and accepted payment methods. A structured format helps avoid misunderstandings.

| Item | Details |

|---|---|

| Client Name | [Full Name] |

| DJ Name/Business | [DJ or Company Name] |

| Event Date | [MM/DD/YYYY] |

| Deposit Amount | [$ Amount] |

| Total Cost | [$ Amount] |

| Balance Due | [$ Amount] |

| Payment Method | [Cash, Credit, Bank Transfer] |

Adding a signature section strengthens the agreement and confirms acknowledgment by both parties.

Structuring Payment Terms for Clarity

Specify the total fee, deposit amount, and remaining balance in clear terms. Break down each component to prevent misunderstandings.

Deposit and Due Dates

- State the deposit percentage and when it must be paid to confirm the booking.

- Define the deadline for the final balance, ensuring it aligns with event logistics.

- Outline late payment penalties to encourage timely transactions.

Accepted Payment Methods

- List all payment options, including cash, card, or bank transfer.

- Provide clear instructions for each method to avoid delays.

- Mention processing times if applicable, particularly for checks or transfers.

Use a structured format on the receipt to highlight key payment terms, reducing potential disputes.

Legal Considerations for Protecting Both Parties

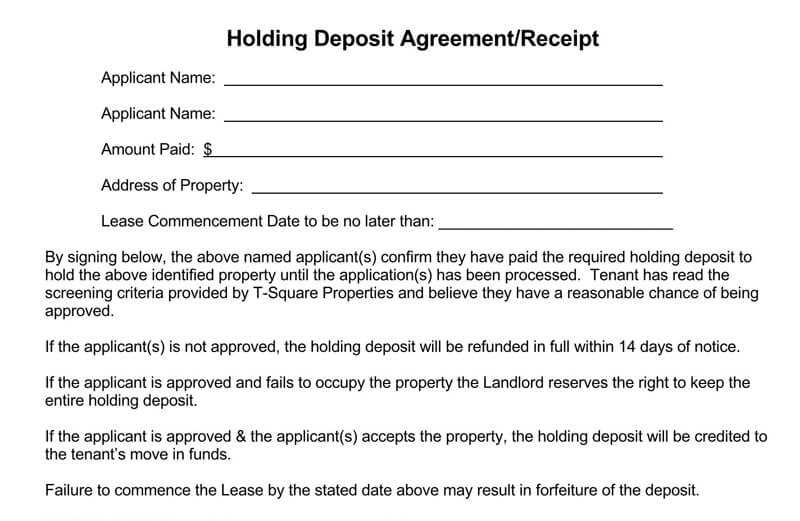

Specify the deposit amount and due date in writing to prevent disputes. A well-defined payment schedule clarifies expectations and ensures financial security for both the DJ and the client.

Include a cancellation policy that outlines refund conditions. If the DJ cancels, state whether a replacement will be provided or a full refund will be issued. If the client cancels, define the non-refundable portion of the deposit.

Detail the services covered by the fee, including performance duration, setup time, and any additional charges. Ambiguities in service expectations can lead to misunderstandings and conflicts.

Clarify liability for equipment damage or technical failures. Indicate whether the DJ is responsible for backup equipment or if the client must provide certain resources, such as power sources or shelter for outdoor events.

Ensure both parties sign the contract and receive copies. A signed agreement strengthens legal standing and reduces the risk of misinterpretation.

Customizing the Receipt for Branding and Professionalism

Use a consistent color scheme and logo placement to align the receipt with your brand. Include the DJ service name, contact details, and website link at the top for easy reference.

- Typography: Choose a readable font that matches your branding. Avoid overly decorative styles that reduce clarity.

- Header Layout: Position your business name prominently, followed by a tagline or a short description of your services.

- Custom Sections: Add a space for special notes, such as event-specific agreements or additional services.

- Digital Signature: Include a section for an e-signature or initials to confirm deposit terms and final payment expectations.

- QR Code: Generate a QR code linking to your terms, policies, or payment options for seamless access.

Formatting matters. Align elements properly, ensuring clarity and professionalism. Test the layout on different devices to confirm readability, and update the design as needed to maintain a polished appearance.

Common Mistakes to Avoid in Deposit Documentation

Unclear Payment Terms

Specify the exact deposit amount, due date, and accepted payment methods. Vague wording can lead to disputes and delayed payments. Include a clause outlining consequences for late or missed payments.

Omitting Refund and Cancellation Policies

Define whether the deposit is refundable or non-refundable and under what circumstances. Without clear terms, clients may assume they can get their money back, leading to conflicts. If partial refunds apply, detail the percentages and timelines.

Ensure both parties sign the document and retain copies. Without proper signatures, enforcing terms becomes difficult. Digital signatures are valid but verify their legal standing in your region.

Best Practices for Sending and Storing DJ Receipts

Send receipts immediately after receiving a deposit to maintain transparency. Use email for quick delivery and attach a PDF to prevent edits. If mailing a physical copy, use high-quality paper and keep a scanned version for reference.

Organizing Digital Copies

Store all receipts in a dedicated cloud folder categorized by client name and event date. Use consistent file names like “Smith_Wedding_Deposit_2025-06-12.pdf” for easy retrieval. Set up automated backups to prevent data loss.

Ensuring Security and Compliance

Encrypt files containing payment details to protect client information. If using accounting software, enable access controls to limit viewing permissions. Keep digital and physical copies for at least three years to comply with tax requirements.