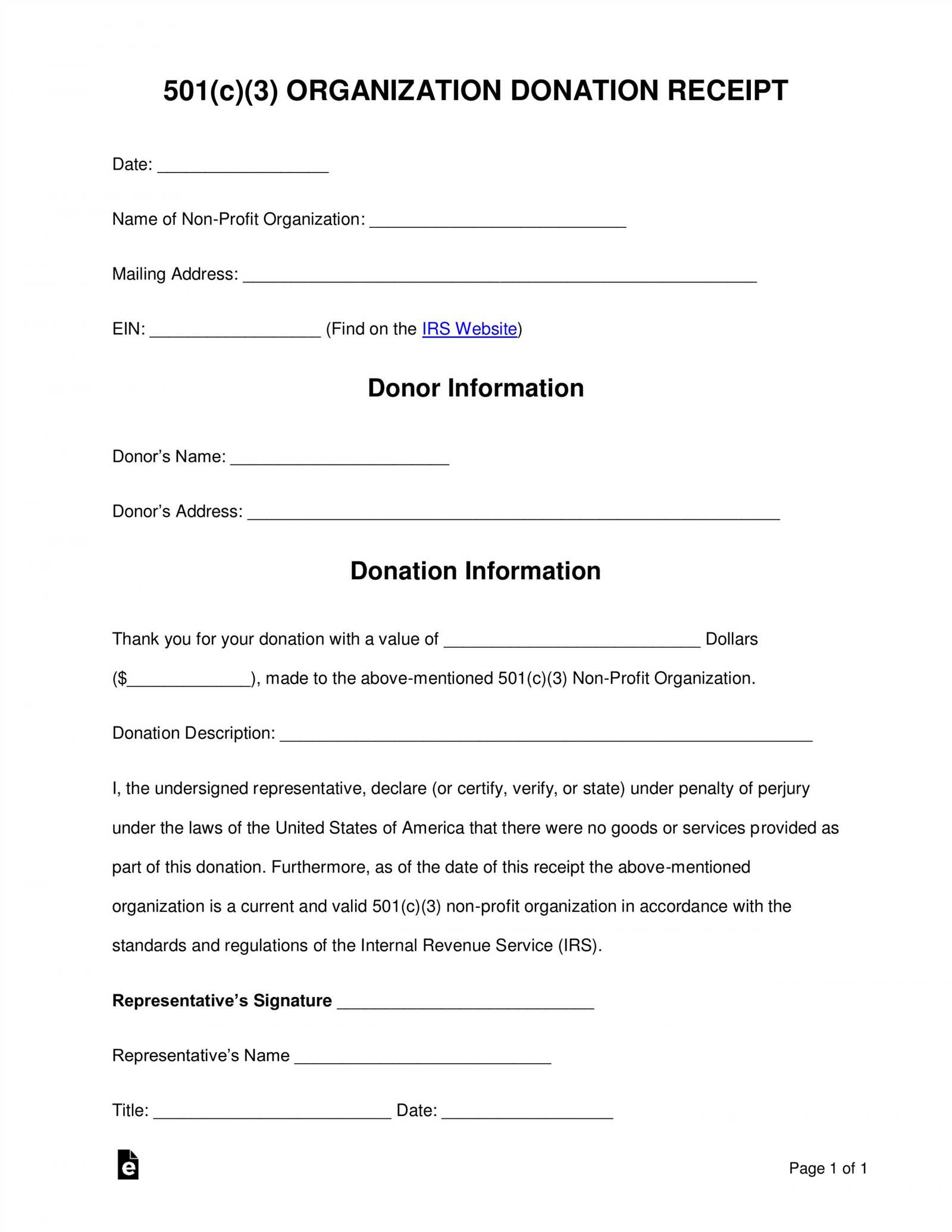

Key Elements of a Donation Receipt

Ensure every receipt includes the following details to meet legal and organizational needs:

- Organization Name and Address: Clearly state the full legal name and contact details.

- Donor’s Information: Include the name and, if applicable, the address of the contributor.

- Donation Date: Specify when the contribution was received.

- Contribution Description: Indicate whether it was monetary or in-kind, with relevant specifics.

- Statement of No Goods or Services: If no benefits were provided in return, include a disclaimer stating so.

- Tax ID Number: While optional, adding this enhances credibility and simplifies donor records.

Recommended Formats for Clarity

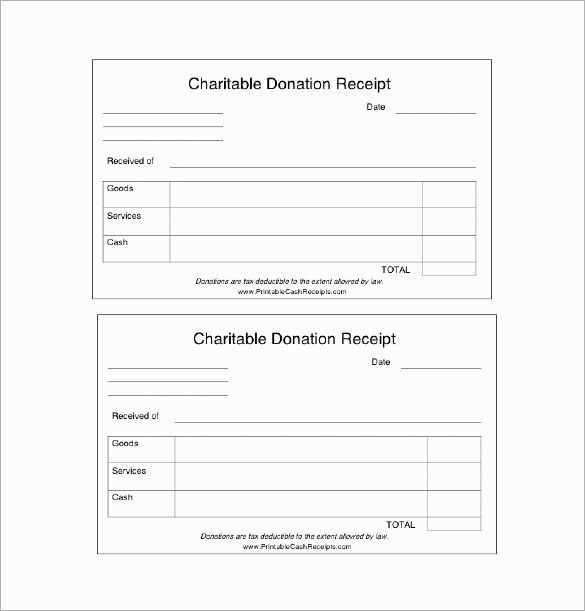

Standard Receipt for Cash Donations

For straightforward monetary gifts, use this template:

[Organization Name] [Address] [City, State, ZIP] [Email] | [Phone Number] Date: [MM/DD/YYYY] Donor: [Full Name] Amount: $[Donation Amount] This receipt confirms that no goods or services were exchanged for this contribution. Tax ID: [EIN or Charity Number] Thank you for your generous support!

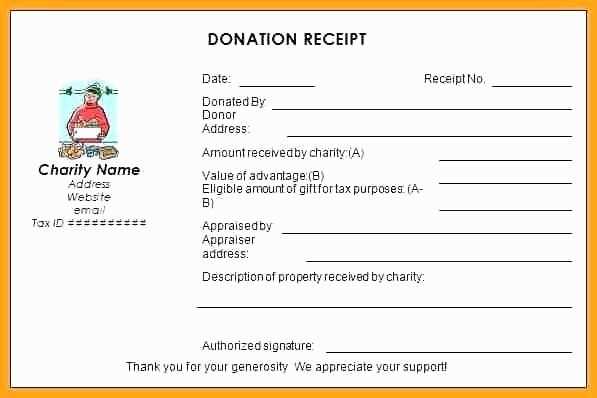

Receipt for In-Kind Contributions

When acknowledging non-monetary gifts, structure the document as follows:

[Organization Name] [Address] [City, State, ZIP] [Email] | [Phone Number] Date: [MM/DD/YYYY] Donor: [Full Name] Description of Item(s): [List Donated Goods] Estimated Value (provided by donor): $[Value] No goods or services were provided in exchange for this donation. Tax ID: [EIN or Charity Number] We appreciate your valuable contribution!

Electronic vs. Physical Receipts

Sending digital receipts via email ensures quick delivery and easy record-keeping. However, printed versions may still be preferred for formal acknowledgments. Consider offering both options based on donor preference.

Standardizing receipts not only helps with compliance but also builds trust. Maintain consistency in format and wording to streamline documentation and improve transparency.

Receipts Templates for Charitable Organizations

Key Elements of a Donation Acknowledgment

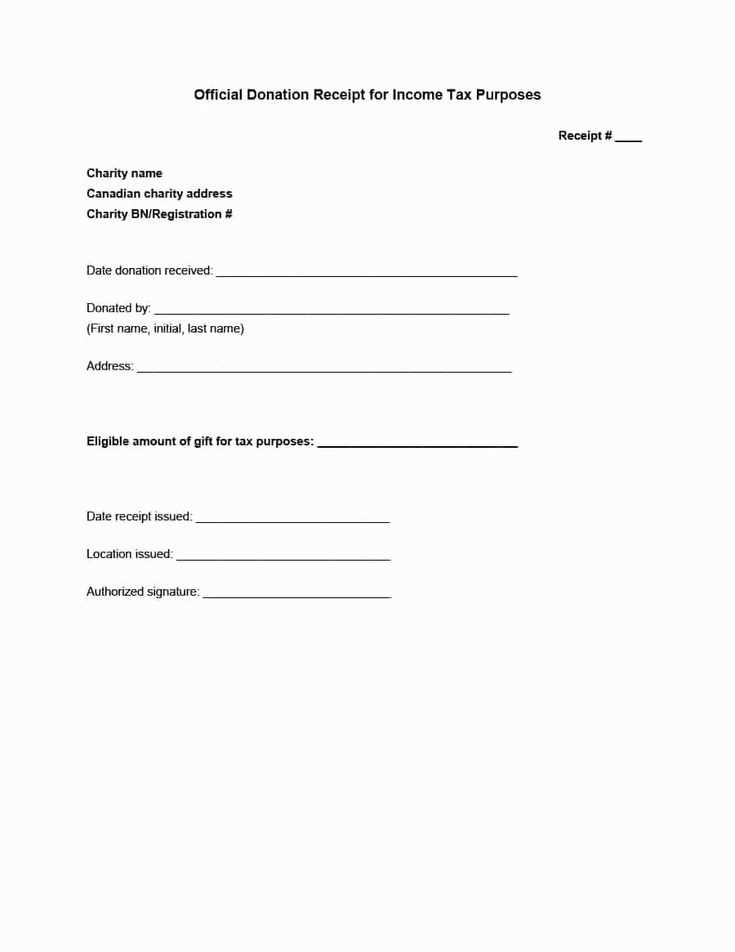

Legal Requirements for Confirming Contributions

Customizing Documents for Various Gift Types

Digital vs. Paper Formats: Pros and Cons

Common Errors in Documentation

Best Practices for Storage and Retrieval

Include the donor’s full name, contribution date, and amount on each receipt. Specify whether the gift was monetary or in-kind, and describe non-cash items with fair market value estimates when required.

Ensure compliance with tax regulations by stating whether goods or services were exchanged. If none were provided, include a declaration confirming that the contribution is tax-deductible.

Adapt templates for different donation types. For recurring gifts, provide annual summaries. For event-based contributions, detail sponsorship levels and associated benefits.

Choose between digital and paper formats based on donor preferences and regulatory requirements. Digital receipts offer convenience and automated tracking, while printed versions may be necessary for legal or donor-specific needs.

Avoid errors such as missing dates, incorrect amounts, or failure to include tax-deductibility statements. Regularly audit receipt templates to ensure accuracy and compliance.

Store records securely using encrypted digital systems or locked filing cabinets. Implement consistent naming conventions and backup procedures for quick retrieval when needed.