Every cash transaction requires a clear, well-structured receipt to ensure accuracy and transparency. A customer cash receipt template simplifies the process by providing a standardized format that records all essential details. It helps businesses track income, manage finances, and build trust with customers.

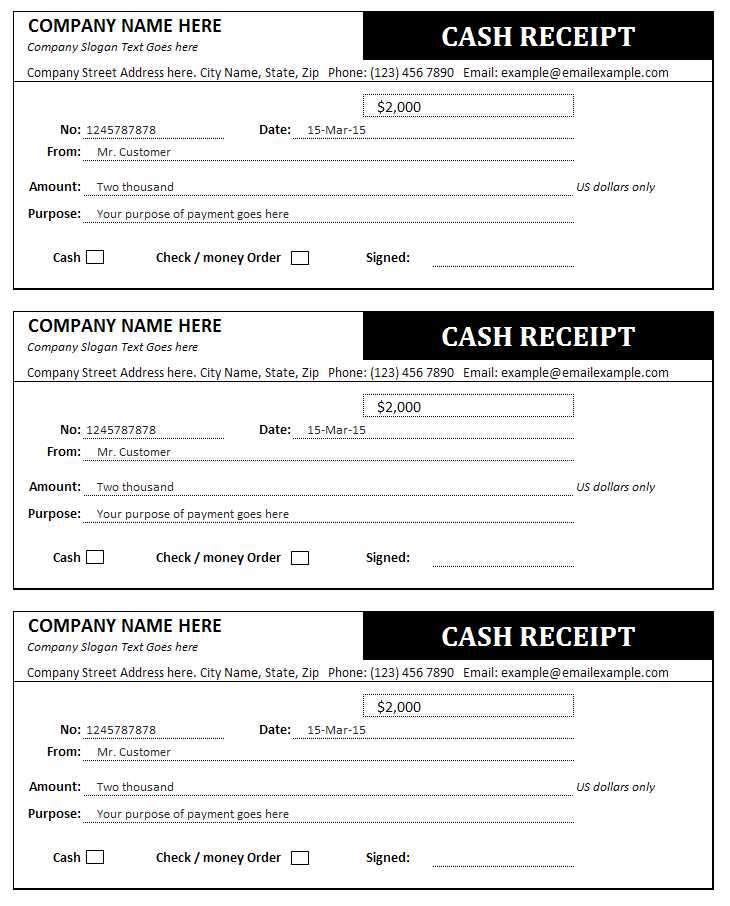

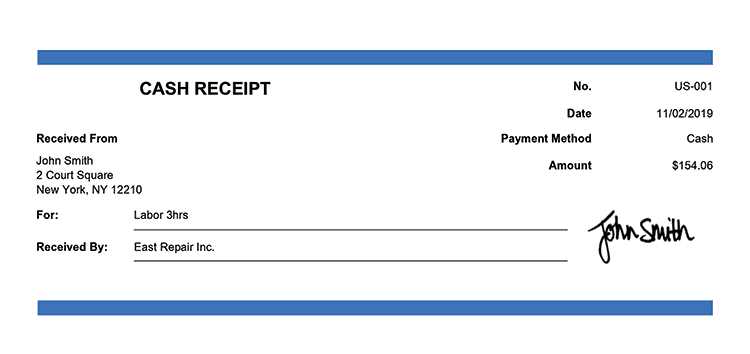

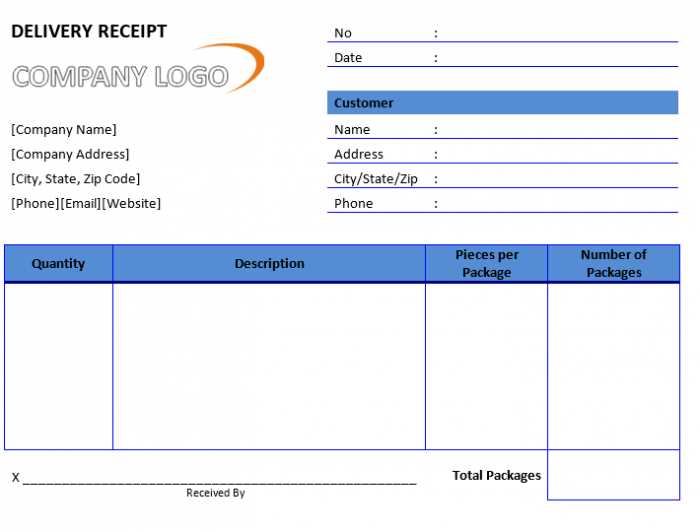

A well-designed template should include the date of the transaction, receipt number, payer and payee details, amount received, payment method, and authorized signature. Adding a section for notes or special terms can clarify specific conditions, such as refunds or service warranties.

Using a digital template improves efficiency, especially for businesses handling frequent cash payments. Formats like PDF, Excel, and Word offer flexibility for customization and easy sharing. Automation tools can further enhance the process by generating receipts instantly and reducing errors.

Consistency in formatting is key. A professional layout with clear fonts, proper spacing, and company branding strengthens credibility. Whether for retail, services, or freelance work, a well-structured cash receipt template ensures smooth financial documentation and compliance with tax regulations.

Here’s an optimized version without excessive repetition of the term “Cash Receipt” while maintaining its meaning:

Use a clear format for documenting payments received. Include the payer’s name, the payment amount, and the date of the transaction. Specify the method of payment–whether it’s cash, check, or credit card. Ensure that all required fields are filled accurately for proper record-keeping. Include a unique reference number to easily identify each transaction. This simple and concise structure avoids redundancy while maintaining all necessary details for tracking purposes.

- Customer Cash Receipt Template

Creating a clear and concise cash receipt template ensures both the business and the customer understand the transaction details. Start by including the following key elements:

- Receipt Number: Assign a unique number for record-keeping and easy reference.

- Business Details: List the company name, address, and contact information at the top for transparency.

- Date of Payment: Include the specific date the payment was received to prevent confusion.

- Customer Information: Include the customer’s name and contact details.

- Amount Paid: Clearly state the exact amount paid and the payment method used (e.g., cash, check, or card).

- Description of Goods or Services: Provide a brief description of what the payment covers.

- Signature: Both the customer and the business representative should sign for confirmation.

- Balance Due (if applicable): If the payment is part of an installment plan, show the remaining balance.

Make sure to format the template in a way that allows room for customization, while keeping the design simple and professional. Include a footer with your business’s terms or return policy if relevant. This will help create transparency and protect both parties in case of future inquiries.

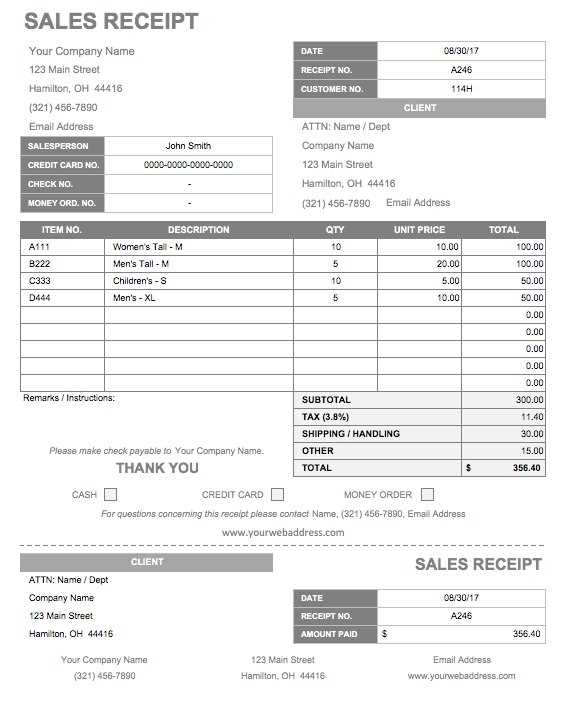

A well-organized customer receipt includes several key elements that ensure clarity and accuracy. These details help both the business and the customer keep track of transactions and avoid confusion. Below are the most important components to include:

- Business Information: Include the name, address, phone number, and website (if applicable) of the business. This makes it easy for the customer to contact you if needed.

- Receipt Number: A unique identifier for each transaction. This helps track the receipt for future reference or returns.

- Date and Time of Transaction: Accurate timestamps help both parties confirm the timing of the purchase.

- Itemized List of Purchases: Each item purchased should be listed separately, along with the quantity, price per unit, and total cost for that item.

- Total Amount: The final amount due, which includes the subtotal, applicable taxes, and any discounts, is essential for clarity.

- Payment Method: Specify whether the transaction was paid by credit card, cash, or another method. This helps track the payment type for accounting purposes.

- Refund/Return Policy: Including the policy can prevent misunderstandings regarding returns or exchanges in the future.

- Employee Information (optional): Listing the name or ID of the staff member handling the transaction can be useful for customer service or audit purposes.

Why These Elements Matter

Each component listed above plays a significant role in maintaining accurate records, protecting both the business and the customer. Proper receipts help avoid disputes, ensure transparency, and support effective business operations.

Start by adjusting the template to reflect your business’s unique identity. Add your logo, company name, and contact information in the appropriate sections. This ensures the receipt aligns with your branding and makes it easy for customers to recognize your business.

Customize Fields for Specific Information

- Include any additional fields relevant to your business, such as a payment method, transaction ID, or reference number. This helps you keep track of receipts for accounting and customer service purposes.

- Ensure that the fields for product or service descriptions are clear. You may want to adjust the layout to fit your product names and pricing structures.

Modify Layout and Design

- Adjust the layout to suit your preferences. You can modify the font size, colors, or placement of each section to create a more visually appealing and user-friendly design.

- Consider adding a section for terms and conditions, refund policies, or loyalty rewards if those are part of your business operations.

After making these customizations, test the template to make sure everything is clear and functional for both your business and your customers. A professional, tailored receipt improves customer experience and ensures better organization for your records.

Best File Formats for Receipts

PDF is one of the most widely used formats for receipts. It maintains the layout and appearance across all devices, ensuring that no details are lost. The PDF format also offers high compatibility with different operating systems, making it easy to access and print. Additionally, you can easily secure PDFs with passwords, providing an extra layer of protection for sensitive data.

JPEG and PNG

For businesses that prefer image-based receipts, JPEG and PNG are solid choices. These formats are perfect for capturing printed receipts or scanned copies. JPEG is widely used for its smaller file size, which helps save storage space, while PNG offers higher quality and transparency, making it suitable for receipts with logos or designs.

CSV or Excel

If you need to manage large volumes of receipts or transaction data, CSV or Excel formats are practical. These formats are ideal for organizing receipts in tables and allow for easy import into accounting or inventory systems. They also provide the ability to add additional details like categories, dates, or notes for each transaction.

One common mistake is failing to include all necessary details. A customer cash receipt should clearly state the amount received, the date, the method of payment, and the reason for the transaction. Missing even one of these can cause confusion for both the customer and your records.

Another issue is neglecting to include a unique reference number for each receipt. This number helps to track transactions easily and prevents mixing up receipts, especially when dealing with multiple payments.

Be careful not to overlook the signature section. A signed receipt provides verification and protection for both parties. Without it, there may be disputes over the payment later.

Incorrect formatting can make the receipt look unprofessional. Keep the layout clean and consistent, ensuring all the important information is easy to find. Avoid cramming too much information into a small space or using fonts that are difficult to read.

Lastly, failing to update your template regularly can cause problems. If your company’s payment methods, tax rates, or legal requirements change, be sure to adjust your template to reflect those changes. Using outdated information can lead to compliance issues or customer misunderstandings.

In the United States, customer cash receipts must include specific details such as the date of transaction, total amount paid, and a breakdown of items or services purchased. Some states may also require including the seller’s tax identification number or sales tax amount.

In the European Union, receipts must reflect the applicable VAT rate and amount, including the seller’s VAT number. Countries like Germany and France mandate that receipts show the transaction’s VAT information clearly for transparency.

In Australia, receipts should display the Australian Business Number (ABN) and GST details if applicable. Businesses must adhere to the Australian Tax Office (ATO) standards for cash receipts to ensure compliance with tax laws.

Always verify the specific regulations for your region to ensure receipts meet local legal requirements. Non-compliance could result in fines or other legal issues.

For quick access to a variety of customer cash receipt templates, try these reliable platforms:

Free Templates

Free templates are widely available, catering to different business needs. A few excellent options include:

- Google Docs – Offers customizable templates within Google Drive. Search “cash receipt” in the template gallery for multiple options.

- Microsoft Office – A selection of free templates can be found on Microsoft’s website, perfect for creating professional receipts in Word or Excel.

- Template.net – This website provides many free templates, including cash receipt options. You can download them in various formats like PDF or DOCX.

- Canva – Ideal for those who want to add design elements to their receipts, Canva offers free templates with easy-to-edit features.

Paid Templates

If you’re looking for more advanced or premium templates, paid options are available that often include additional features and customization. Consider these resources:

- Envato Elements – This platform offers a wide range of professionally designed receipt templates with a subscription fee. Great for businesses that require frequent template updates.

- Creative Market – High-quality receipt templates are available for purchase, allowing you to choose from several styles and layouts.

- TemplateMonster – Known for offering templates that suit more complex business needs, TemplateMonster provides a selection of paid receipt templates that are fully customizable.

Whether you choose free or paid options, these resources provide a variety of templates suitable for personal or business use. Be sure to check for any usage restrictions, especially with free templates, to ensure they meet your requirements.

| Platform | Type | Features |

|---|---|---|

| Google Docs | Free | Simple, editable templates, cloud-based |

| Microsoft Office | Free | Office software integration, various formats |

| Envato Elements | Paid | Premium designs, subscription required |

| Creative Market | Paid | Variety of designs, one-time purchase |

Customer Cash Receipt Template

To ensure your cash receipts are clear and accurate, use a straightforward template that includes all relevant transaction details. Start with the customer’s name and address, followed by the date of the payment. Clearly list the amount received, the method of payment, and any reference numbers for easy tracking. Always include the reason for the payment (e.g., invoice number or service provided). This structure makes it easy for both parties to verify the transaction details at a glance.

Consider adding a section for the cashier’s name or signature to further validate the receipt. A clean, organized layout enhances readability and reduces the chance of mistakes. You can include additional notes, such as whether the payment was partial or full, to avoid confusion later on.

Always double-check the details before finalizing the receipt. Accuracy in these templates ensures transparency and maintains trust between you and your customers. If you need any further adjustments, don’t hesitate to make edits for specific needs or preferences.