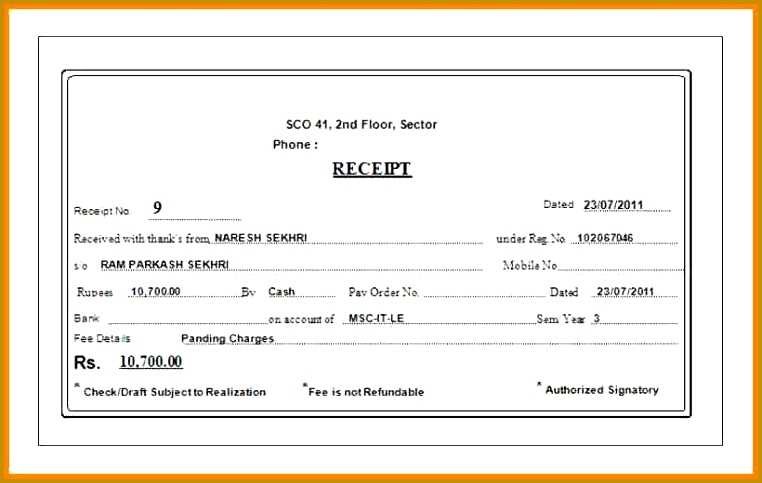

Key Components of a Tuition Receipt

A well-structured tuition receipt ensures clarity and proper documentation. It should include:

- Receipt Number: A unique identifier for tracking payments.

- Date: The exact date the payment was received.

- Student’s Name: Full name for accurate record-keeping.

- Institution Details: Name, address, and contact information.

- Payment Amount: The total amount paid, clearly stated.

- Payment Method: Cash, check, bank transfer, or digital transaction.

- Course or Program: Specify the program the payment covers.

- Authorized Signature: A signature from the institution confirming the transaction.

Digital vs. Paper Receipts

Both digital and paper receipts have advantages. Digital versions offer quick access and easy storage, while paper receipts provide a tangible record. Many institutions now use automated systems that generate receipts instantly.

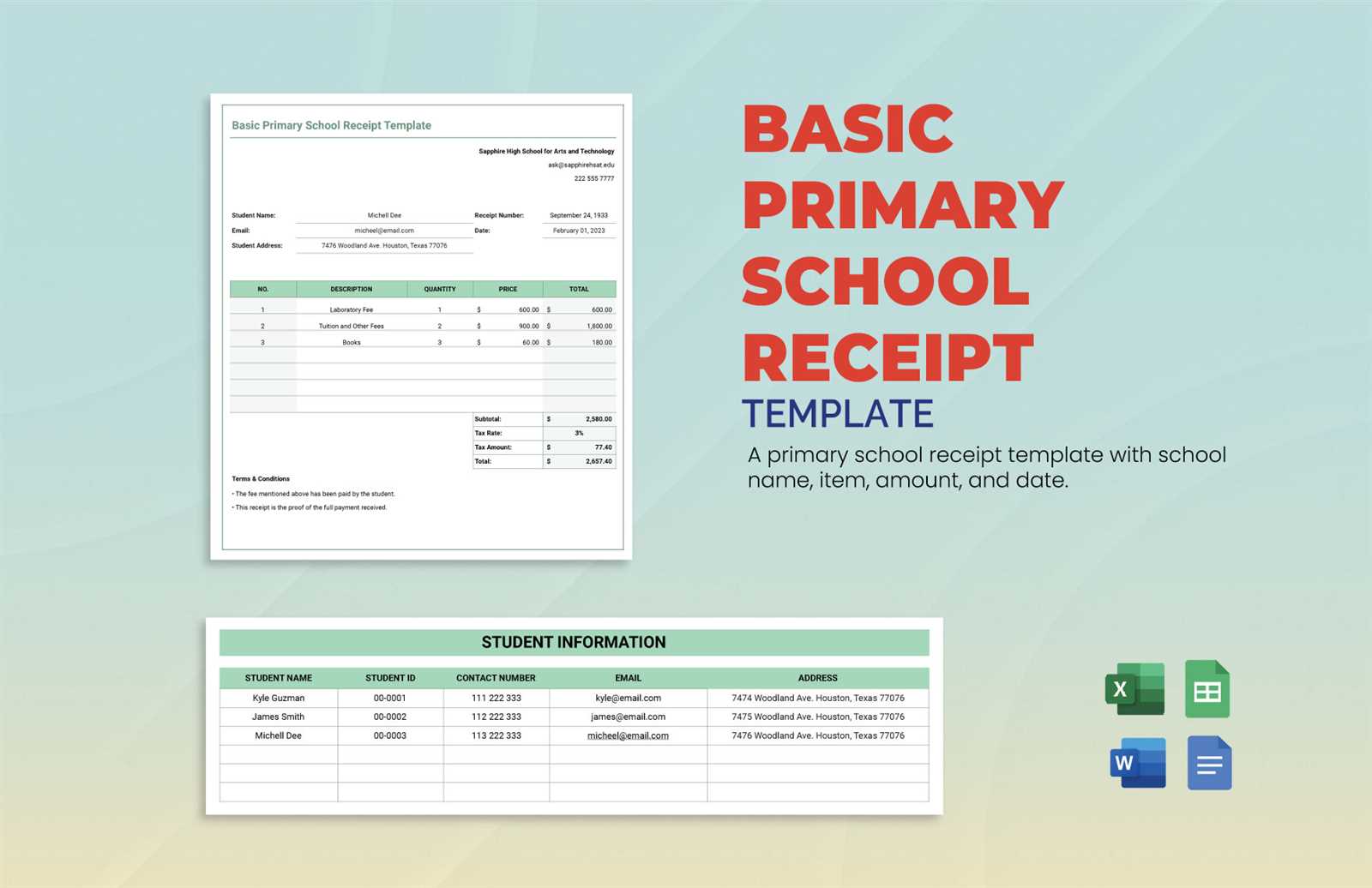

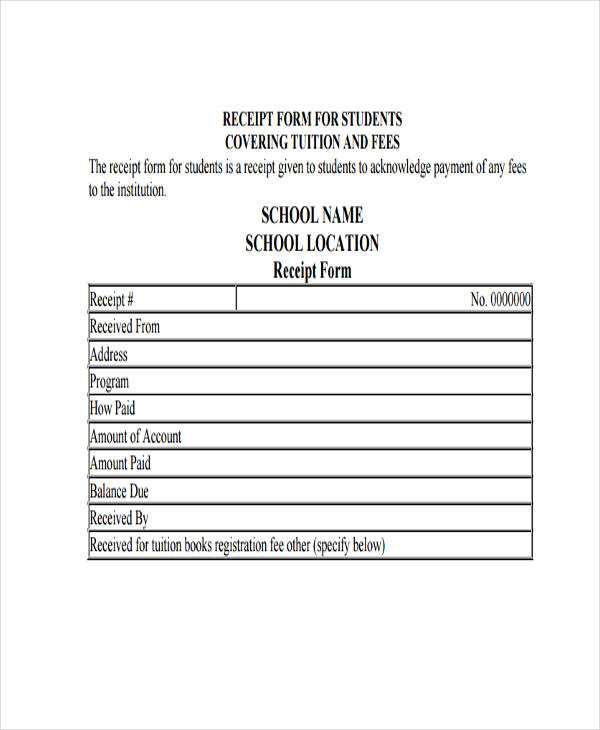

Simple Tuition Receipt Template

Below is a basic template that can be customized for any institution:

Receipt Number: [Unique ID]

Date: [MM/DD/YYYY]

Received From: [Student’s Name]

Institution Name: [School/College Name]

Course/Program: [Course Title]

Amount Paid: [Amount in USD]

Payment Method: [Cash/Card/Transfer]

Authorized By: [Name & Signature]

Ensure all details are accurate to prevent issues with financial records and audits.

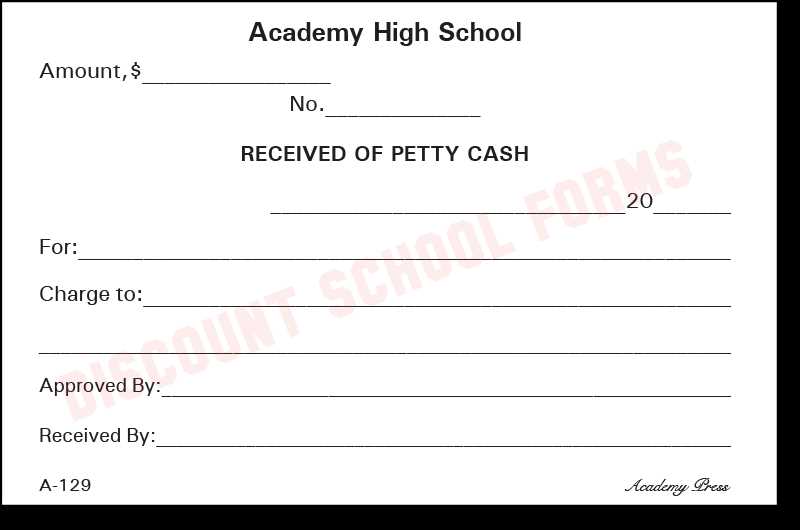

Tuition Receipt Template

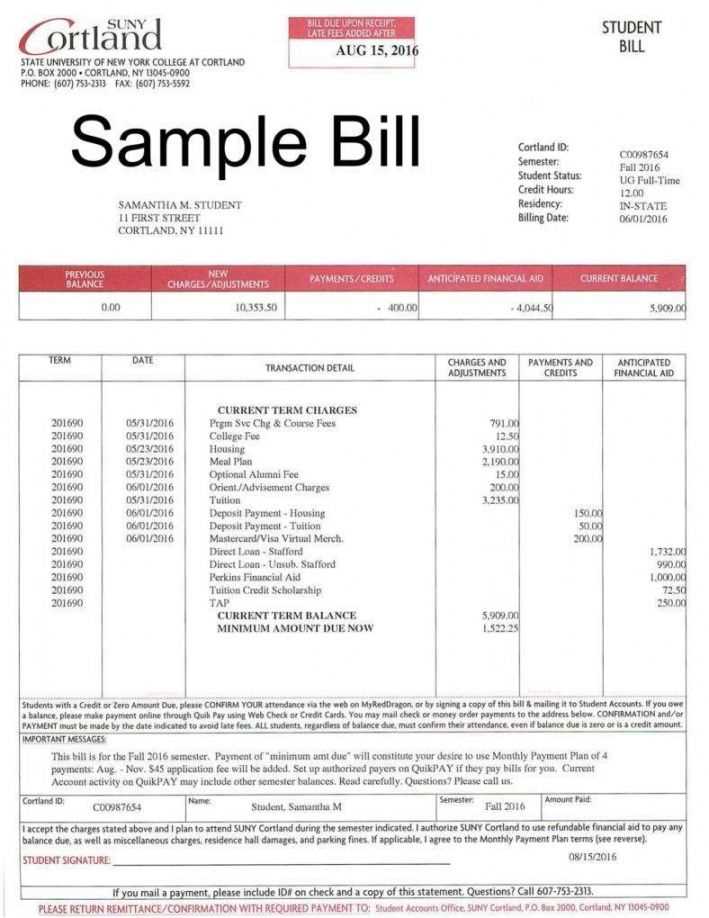

Key Elements to Include in a Payment Confirmation

Include the payer’s full name, student ID, institution details, amount paid, payment method, date, and receipt number. Specify the purpose of payment and any applicable tax details.

Formatting Guidelines for a Clear and Professional Layout

Use a structured format with distinct sections. Align text properly, use readable fonts, and highlight critical information such as total amount and due date. Keep spacing consistent.

Customizing a Form for Different Educational Institutions

Adjust fields based on institution needs. Private schools may require parent details, while universities might include course specifics. Ensure branding elements like logos and official stamps are present.

Ensuring Legal and Tax Compliance in Payment Records

Include legally required disclaimers and tax identification numbers. Verify local tax laws for required deductions or exemptions. Retain records for audit purposes.

Common Mistakes to Avoid When Drafting a Receipt

Omitting crucial details like payment date or receipt number can cause disputes. Avoid cluttered layouts, inconsistent fonts, and missing institution information. Double-check figures to prevent errors.

Best File Formats for Sharing and Archiving Documents

PDF ensures document integrity and easy sharing. Excel allows structured data for internal records. Use secure cloud storage for long-term accessibility while protecting sensitive data.