Creating clear and professional receipts is essential for self-employed individuals to maintain accurate financial records. A well-structured receipt helps track payments, manage taxes, and provide clients with transparent documentation of their transactions. Whether you’re a freelancer, contractor, or small business owner, having a reliable receipt template simplifies this process.

Start by ensuring that each receipt includes key details such as the transaction date, client information, description of services, amount paid, and payment method. Including a unique receipt number for easy reference is also a practical way to stay organized. This not only streamlines your bookkeeping but also reinforces trust and professionalism with your clients.

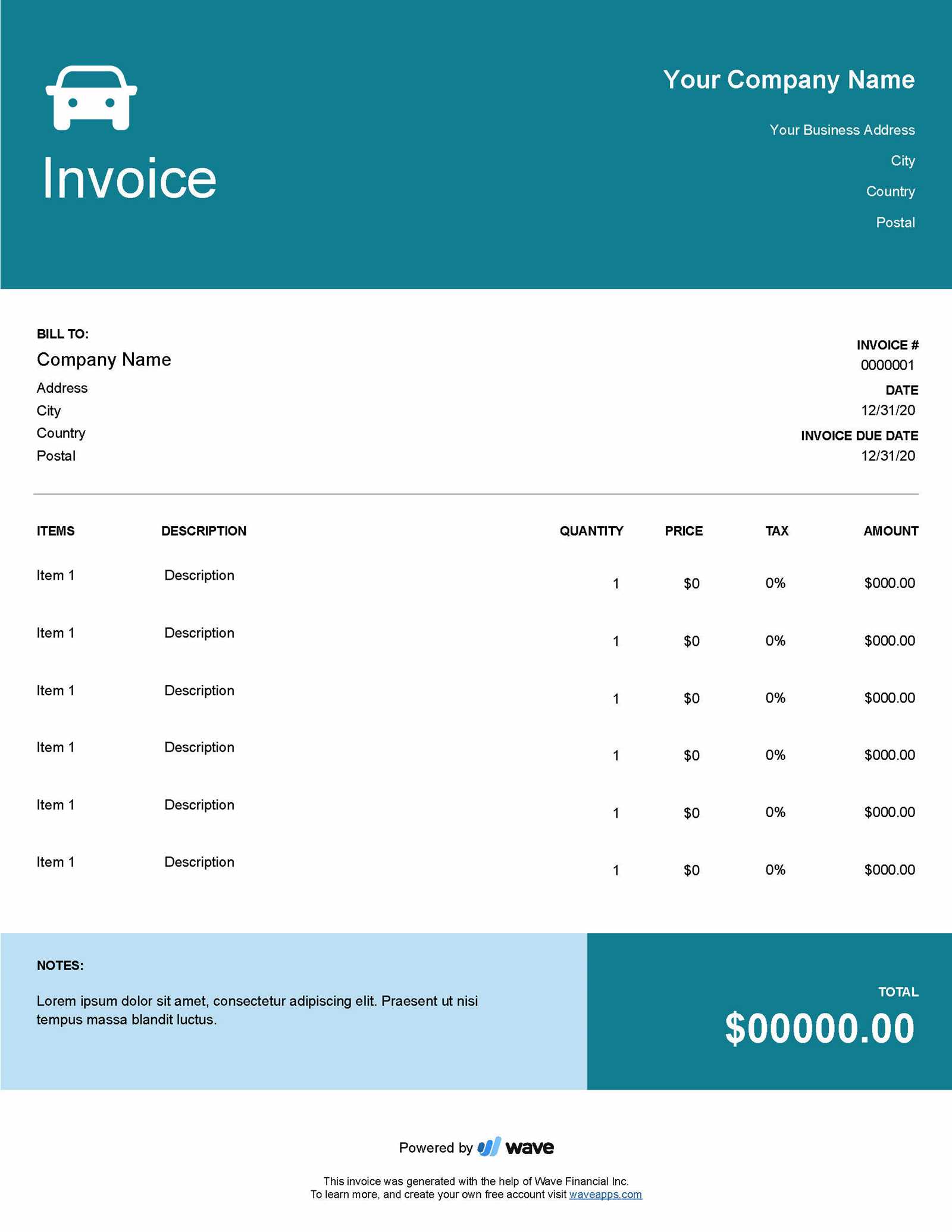

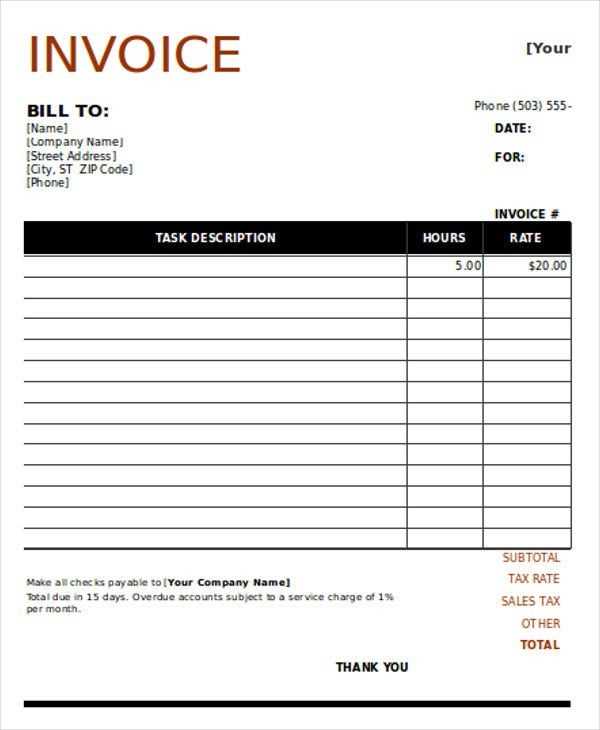

Using a customizable template is a great way to save time while maintaining consistency. You can tailor the format to fit your specific needs, such as adding your business logo, adjusting currency formats, or incorporating tax breakdowns. The right template makes generating receipts fast and hassle-free, ensuring you stay focused on growing your business without getting bogged down by administrative tasks.

Here are optimized lines with unnecessary word repetition removed:

To improve clarity and readability, avoid using the same words or phrases repeatedly in your receipt template. Below are key adjustments for streamlining your content:

- Use concise wording instead of repeating phrases like “in order to” and “for the purpose of.”

- Replace “due to the fact that” with “because” for simpler expression.

- Eliminate redundant qualifiers such as “very” or “extremely” unless they add meaningful emphasis.

- Remove overused fillers like “you will find” or “it is important to note,” which don’t contribute to the core message.

- Shorten long phrases such as “at this point in time” to “now” or “currently.”

By focusing on clear and direct language, you can create more efficient receipts that convey the necessary information without unnecessary repetition.

- Self-Employed Receipt Template

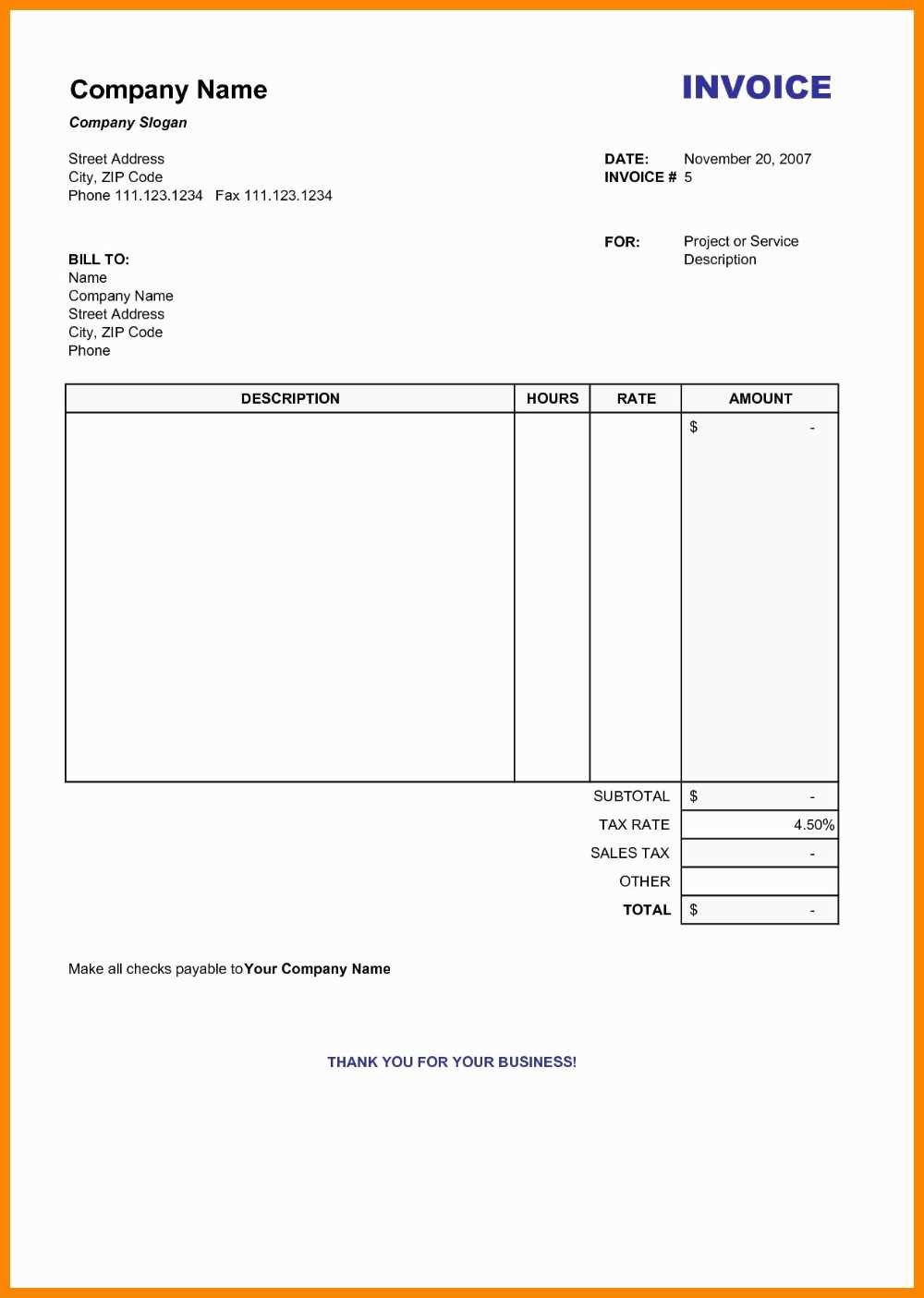

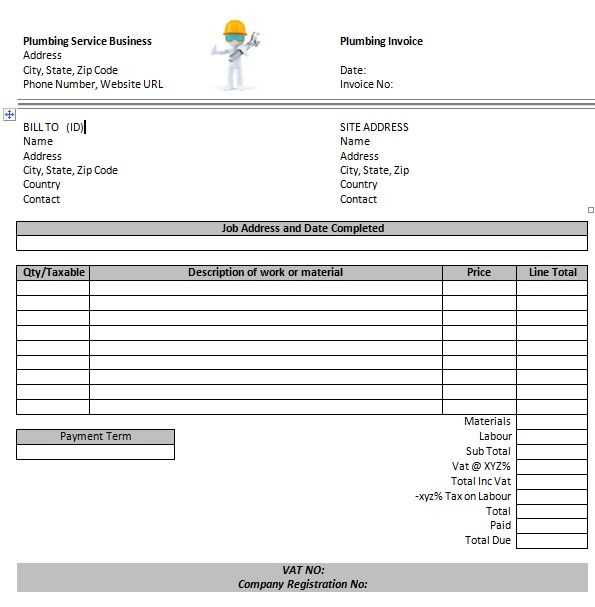

A self-employed receipt template should include key details to ensure clarity and meet legal requirements. Start by listing your business name, address, and contact information. Add the client’s name and address as well, as this establishes a clear record of the transaction.

Include a unique receipt number for easy tracking, followed by the date of the transaction. Specify the goods or services provided, along with the individual price and total amount charged. Ensure that any taxes applied, such as sales tax, are clearly stated, along with the applicable tax rate.

If relevant, mention the payment method used, such as cash, credit card, or bank transfer. Providing terms of payment, such as whether the payment was made in full or partially, adds transparency. Finally, offer a signature line or other form of confirmation from both parties to validate the receipt.

Keep your receipt template clear and straightforward, with no unnecessary information. A well-organized format prevents confusion and ensures both you and your client have a clear understanding of the transaction details.

A self-employment receipt should always include specific details that clarify the transaction. The first element is the name and contact information of the business or self-employed individual. Clearly display your business name, address, phone number, and email address. If you have a business registration number or VAT ID, include it too.

Next, make sure to add the date of the transaction. This helps both you and your client track payments and maintain accurate records. Include a unique receipt number for organizational purposes, especially when you deal with multiple clients or services.

For transparency, describe the services provided or products sold. Be specific about the work completed or items delivered, including quantities and pricing. If applicable, break down any taxes or additional charges separately, showing the total amount due.

Don’t forget payment details. Specify the payment method (e.g., cash, credit card, bank transfer) and note whether the payment is full or partial. If the payment was made in installments, list each payment along with its corresponding date and amount.

Lastly, include your client’s information, such as their name and contact details. Having this information ensures the receipt is valid for both parties, especially in case of future reference or disputes.

Focus on simplicity and readability. Use a clean, uncluttered design with clear sections to guide the reader’s eye. Prioritize key information, such as the amount and recipient details, in prominent positions. A good layout ensures users can easily find what they need without confusion.

Typography and Spacing

Select readable fonts, such as sans-serif types, that ensure clarity. Maintain consistent font sizes for different sections: larger for headings and smaller for body text. Use appropriate line spacing to avoid a crowded look, and ensure there’s enough space between sections for easy navigation.

Use of Colors and Borders

Stick to a neutral color palette that doesn’t distract. Borders can be used to separate sections, but avoid overuse. A subtle border around the receipt can add structure without overwhelming the content.

Ensure your receipts include accurate information to meet legal and tax obligations. This will help prevent any compliance issues during audits or tax filing.

- Business Name and Details: Clearly list your business name, address, and contact information. This helps identify your business in case of disputes or tax inquiries.

- Date and Time: Include the date and time of the transaction. This is important for tax record keeping and substantiating expenses.

- Itemized List of Goods or Services: Each item or service should be detailed, including the price, quantity, and any applicable taxes. This is critical for proper tax reporting and deductions.

- Total Amount and Taxes: The total amount due, including taxes, should be clearly stated. Itemize sales tax rates or VAT to avoid confusion with tax authorities.

- Receipt Number or ID: Numbering your receipts can help track and organize transactions, which simplifies bookkeeping and auditing processes.

- Tax Identification Number (TIN): If applicable, include your TIN. This is often required for businesses that deal with taxes at the national or regional level.

Complying with these details not only helps you stay within the law but also streamlines the process of filing taxes. Double-check your receipt template against local tax regulations to avoid mistakes.

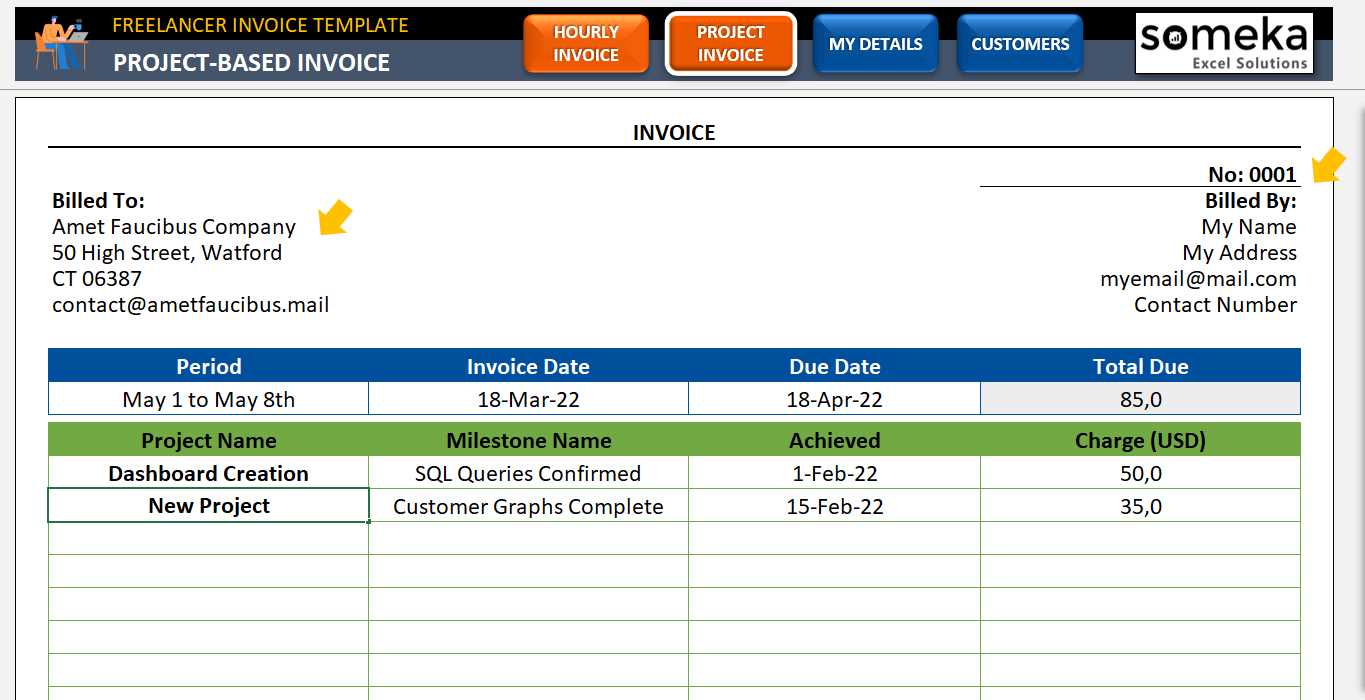

Freelancers should include the following details in their digital receipts for clarity and professionalism:

| Field | Description |

|---|---|

| Receipt Number | Assign a unique number for easy tracking. |

| Freelancer Name and Contact | List your full name, business name (if applicable), and contact information. |

| Client Name and Contact | Include the client’s full name or company name and their contact details. |

| Date of Service | Include the exact date when the service was rendered. |

| Description of Work | Clearly describe the service provided, including project details and hours worked. |

| Amount Charged | List the agreed amount for the service, including any applicable taxes. |

| Payment Method | Specify how the client paid (e.g., bank transfer, PayPal). |

| Due Date | If the payment is pending, include the due date. |

Ensure the receipt is in a format that is easy to read and can be accessed or printed by both parties. PDF is a commonly used format for this purpose. Using a template can save time, but make sure to personalize it for each transaction.

Use templates to streamline your record-keeping. This simple approach saves time and reduces errors in managing financial data. Templates provide consistency, ensuring all necessary information is included in each receipt. Customize the fields to suit your business needs, such as including payment methods, service descriptions, and client details.

Stay Organized

Organize your receipts by category–whether by client, service, or date. This makes retrieving and reviewing records easier. Templates help standardize the format, so you can quickly identify key information, preventing mix-ups in your bookkeeping process.

Minimize Mistakes

Using a template ensures that you don’t forget essential details, like tax rates or total amounts. By having a ready-made structure, you avoid errors that can occur when creating receipts from scratch each time.

Templates help you stay accurate and consistent in your record-keeping, reducing the likelihood of costly mistakes and making tax time much smoother.

Accurate details are key. Double-check all figures to avoid incorrect totals or calculations. This can easily lead to confusion and disputes later on.

Incorrect Date Entries

Always verify the date of the transaction. An incorrect date may cause problems with tax reporting or legal issues. Ensure the date matches the actual sale or service rendered.

Omitting Necessary Information

Include all required information, such as the seller’s details, customer details, and a description of the product or service. Skipping any of this data can lead to misunderstandings or legal issues. Avoid vague item descriptions; be specific.

Check that the total amount reflects all applicable taxes and discounts. Failing to do this accurately might lead to non-compliance with tax regulations.

Unclear Payment Method

Clearly specify the method of payment used. Whether it’s cash, card, or online transfer, this provides clarity for both you and the customer. Don’t leave it to assumption.

How to Simplify Your Receipt Template

If you’d like, you can reduce the frequency of the word “Receipt” in your template. Instead of using it in every line, consider using “Payment” or “Transaction” in some cases. This variation helps the template feel less repetitive and more natural while maintaining its purpose.

Another approach is to tweak the design for a more streamlined look. For example, you could remove any redundant sections, such as a repeated business address or contact info, if those are already included elsewhere in your documents. Keep the format clean, with only the necessary details: the date, amount, and recipient’s information.

Additionally, you can adjust the style of your template to match your branding. A subtle logo or color accent can make the receipt look more professional while keeping it clear and easy to read. Small adjustments like these can elevate the entire presentation without overcomplicating things.