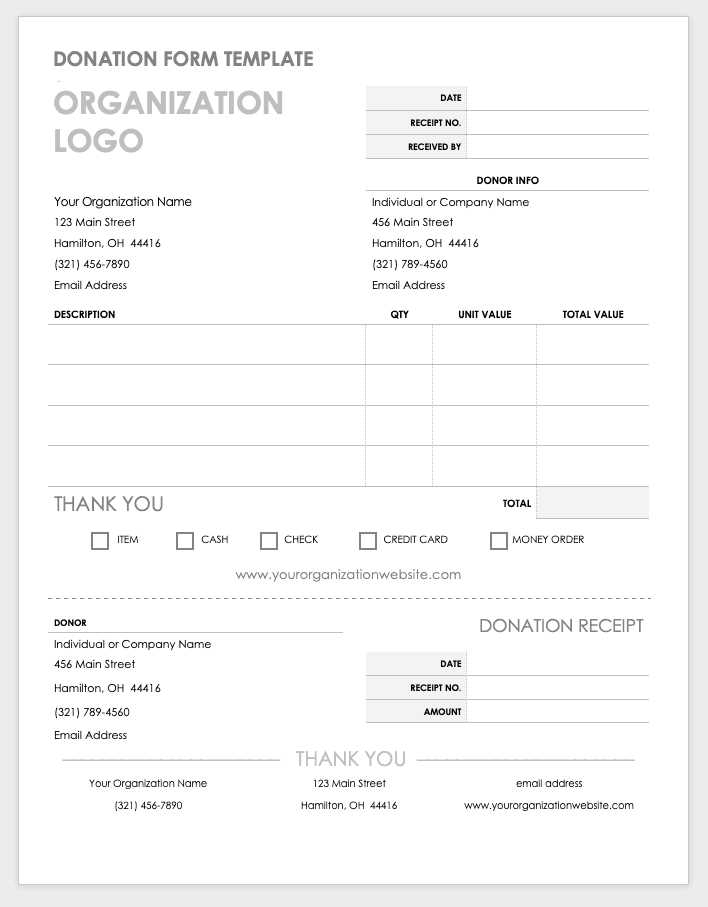

Download a ready-to-use donation receipt template to ensure proper documentation for charitable contributions. This template simplifies record-keeping, meets tax compliance requirements, and provides donors with clear confirmation of their generosity.

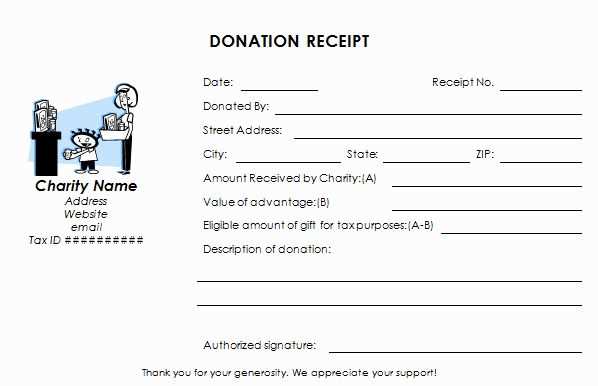

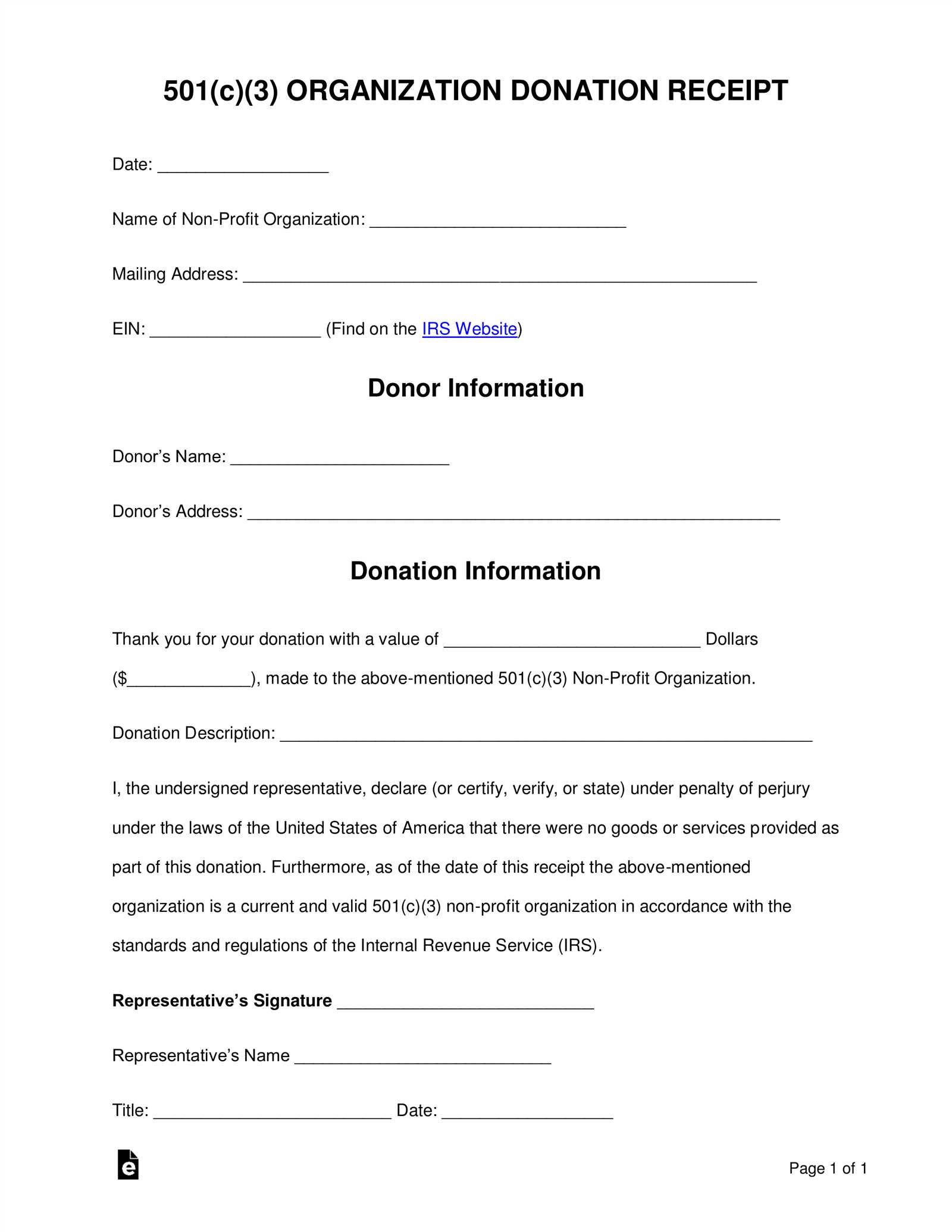

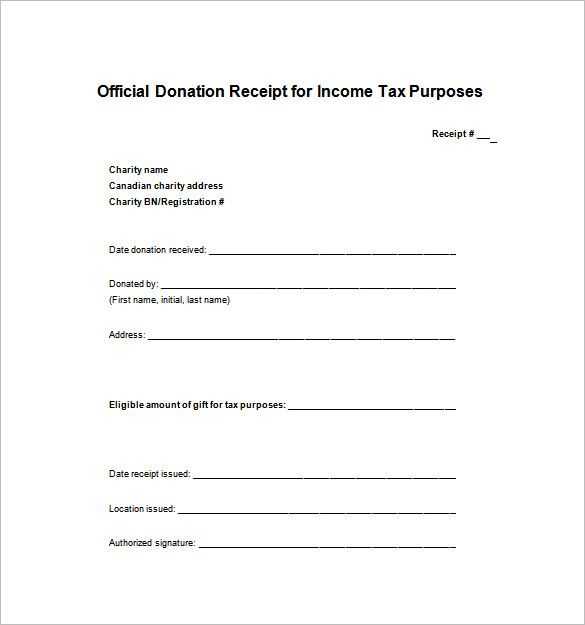

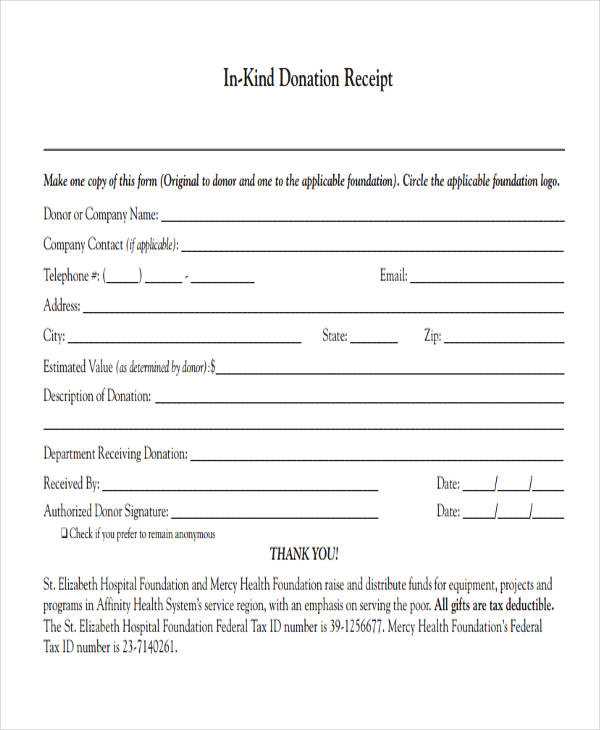

A well-structured receipt should include the donor’s name, the organization’s details, the donation amount, and the date of the contribution. If the donation is non-monetary, a brief description of the donated items is helpful. Adding a statement confirming that no goods or services were received in exchange (if applicable) ensures compliance with tax regulations.

This template is available in PDF, Word, and Excel formats, allowing easy customization. Simply enter the necessary details, adjust the layout if needed, and print or email the receipt. Organizations can add their logo and contact information to maintain a professional appearance.

Using a structured template saves time and helps maintain consistent records. Download the file, personalize it, and provide donors with accurate receipts in just a few clicks.

Here’s a version without redundant repetition, while preserving the meaning:

To create a donation receipt, use this simple and clear template. The donor’s name, donation amount, and the purpose of the donation should be listed first. Include the date and any necessary tax information for compliance purposes. A professional tone will ensure that the receipt is clear and concise. Keep the layout straightforward for easy reading.

| Donor Name | [Donor’s Name] |

|---|---|

| Donation Amount | $[Amount] |

| Donation Purpose | [Purpose] |

| Date of Donation | [Date] |

| Tax ID (if applicable) | [Tax ID] |

This template provides clarity for both the donor and the recipient organization. Make sure to personalize it with accurate details and follow any local tax regulations as needed.

- Free Template for Donation Receipt

When you need a donation receipt, using a pre-designed template can simplify the process. A well-structured donation receipt ensures you meet the necessary tax requirements and provide your donors with clear proof of their contribution. Below is a free donation receipt template to help you get started.

Donation Receipt Template

Donor Name: [Insert Donor Name]

Donation Date: [Insert Date of Donation]

Amount Donated: [Insert Donation Amount]

Purpose of Donation: [Insert Purpose, e.g., Charity Event or Fundraiser]

Receipt Number: [Insert Unique Receipt Number]

Organization Name: [Insert Your Organization’s Name]

Organization Address: [Insert Organization’s Address]

Tax-Exempt Status: [Insert Confirmation of Non-Profit Status]

How to Use This Template

Customize the placeholders with the relevant details for each donation. Ensure that each receipt includes a unique receipt number for your records. Save a copy for both the donor and your own files. This simple format will meet most requirements for both charity organizations and donors.

A donation receipt template should capture specific details to ensure accuracy and provide clarity for both the donor and the organization. Here are the key elements to include:

- Organization Name and Contact Information: Clearly display the name, address, and contact details of your organization at the top of the receipt. This confirms who the donor made the contribution to.

- Receipt Number: Assign a unique number to each receipt to help with tracking and reference.

- Donor’s Information: Include the name, address, and email of the donor. This ensures the receipt is accurately linked to the correct person.

- Date of Donation: List the exact date the donation was received to provide a record for both the donor and the organization.

- Donation Amount: Clearly state the exact monetary value or the description of the donated items, including their estimated value if applicable. Specify if the donation is in cash, check, or another form.

- Tax-Exempt Status: Include a statement that the organization is a registered nonprofit and eligible for tax-exempt donations. This provides credibility and necessary information for the donor’s tax filing.

- Statement of Goods or Services (if applicable): If the donor received any goods or services in exchange for their contribution, make sure to state the fair market value of those items. This affects the amount that can be claimed as a tax-deductible donation.

- Signature of Authorized Representative: If possible, include the signature of an authorized representative from the organization to verify the receipt.

Additional Tips

- Use clear language: Keep the text easy to understand and free of legal jargon.

- Include branding: Customize the template with the organization’s logo for professionalism.

In the United States, donors must receive a written acknowledgment for donations over $250 to claim tax deductions. This receipt should include the amount donated and a statement indicating whether any goods or services were exchanged in return. For larger contributions, Form 8283 might be required.

In Canada, receipts must include specific details such as the charity’s registration number and the value of the donation. The receipt should clearly state whether the donor received anything in return for their gift, including any goods or services.

In the United Kingdom, charities are expected to provide receipts that detail the donation amount, the donor’s name, and the charity’s registration number. If the donation exceeds £100, charities must also mention if any benefits were received in exchange.

For Australian donors, receipts should list the name of the charity, the donation amount, and the date of the donation. If benefits were given, this must be disclosed. The receipt should also note whether the donation qualifies for tax deductions under Australian law.

In Germany, tax-exempt donations require a receipt that includes the charity’s details, the donor’s information, the date, and the amount donated. Additionally, the donation must be in line with specific laws for it to be considered deductible for tax purposes.

Begin by including your organization’s name, logo, and contact information at the top. This ensures recognition and makes the receipt feel official.

Next, add sections for donor details such as name, donation amount, and date. This helps both you and the donor track contributions clearly.

Incorporate a short description of the donation’s purpose or the specific fund the donation is supporting. This adds clarity and shows transparency in how funds are used.

Don’t forget to include a thank-you note to show appreciation for the donor’s contribution. This can be a simple message, but it goes a long way in building goodwill.

Lastly, make sure to add a statement about your organization’s tax-exempt status, if applicable. This is necessary for the donor to use the receipt for tax purposes.

The best file formats for creating and sharing donation records depend on the need for accessibility, compatibility, and ease of use. Below are some popular choices:

- PDF: Ideal for creating formal, uneditable donation receipts. PDFs ensure that your records look professional and are viewable across all devices and platforms. They are easy to share via email or download from websites.

- CSV: A simple, text-based format that is perfect for compiling donation lists. CSV files can be opened in spreadsheet software like Excel or Google Sheets, making them great for organizing and sorting donations.

- Excel (XLSX): This format is great for those who need more advanced features like formulas, sorting, and filtering. It allows easy tracking and management of donations over time.

- Word (DOCX): Useful for creating more detailed, customizable donation receipts. Word documents allow you to add logos, signatures, and formatting, though they may not be as universally accessible as PDFs.

- Google Docs/Sheets: Excellent for collaborative environments, where multiple users may need to access, edit, or view donation records in real-time. Both formats are cloud-based, ensuring easy sharing and storage.

- JSON: A format best suited for users who are tech-savvy or managing large amounts of donation data through automated systems or APIs. It’s great for developers who need to integrate donation records with other software.

Choosing the right file format depends on how the records will be used, shared, and stored. PDFs are great for formal receipts, while CSVs and Excel files offer flexibility in data management. Word and Google Docs provide easy-to-edit solutions, and JSON is excellent for automated workflows.

Automating Receipt Generation with Software Tools

Use dedicated software tools to streamline donation receipt generation. These platforms offer templates and automation features that allow you to quickly issue receipts without manual input. Many tools integrate with your donation systems, automatically populating necessary details such as donor names, amounts, and dates.

For ease of use, consider software that allows for bulk receipt generation. This way, you can issue receipts for multiple donations at once, saving time on manual data entry. Look for tools with customization options, so you can tailor the receipt format to match your organization’s branding.

Some platforms offer integration with accounting systems, ensuring that donation data is synchronized across both your financial records and donor receipts. This reduces the risk of errors and keeps everything organized in one place. Check if the software allows for exporting data to common file formats, such as CSV or PDF, for easier reporting and record-keeping.

Additionally, automate follow-up emails with receipts attached. Set up triggers within the software so that as soon as a donation is processed, the system sends the receipt to the donor, ensuring prompt acknowledgment. This helps maintain a professional and responsive relationship with your supporters.

Accurately documenting donation details is important to ensure smooth processing for both parties. Avoid these common mistakes to ensure donation receipts meet tax requirements and donor expectations.

1. Lack of a Detailed Donation Description

Vague descriptions or missing information about the donated items or cash amounts can cause confusion. Always provide specific details about the donation, such as the value of in-kind contributions or the exact amount donated.

2. Not Including the Donor’s Contact Information

Without the donor’s full name and address, it becomes difficult to verify the donation for tax purposes. Ensure that all receipts include the donor’s accurate contact details.

3. Omitting a Donation Date

The donation date is necessary for record-keeping and tax reporting. Always include the donation date to ensure everything is properly documented.

| Item | Common Mistake | Correct Approach |

|---|---|---|

| Donation Description | Missing or unclear details | Provide a clear and specific description |

| Donor Information | Incomplete or incorrect data | Include full name and contact details |

| Donation Date | Not stated or incorrect | Always include the accurate date |

By avoiding these mistakes, you ensure that donation receipts are both reliable and clear, making the process easier for the donor and the organization.

So the natural flow and meaning are preserved without overloading with repetitions.

Focus on clarity by structuring your content with concise points. Remove redundant phrases and emphasize key ideas to keep the message clean. It’s best to use specific terms that serve the purpose of the communication rather than general or overused expressions. This approach ensures the core message stands out without unnecessary repetition.

Instead of rephrasing the same concept multiple times, try breaking it into smaller, digestible parts. Each sentence should contribute something new or expand on what was previously said. By doing so, the content feels fresh and organized while retaining its impact.

Keep your language straightforward and to the point. Avoid fillers and vague language that doesn’t add meaningful context to the discussion. This method helps maintain reader engagement and prevents the content from feeling like it’s dragging on.