Looking for a quick way to create professional receipts? Online receipt templates are your best solution. These ready-to-use formats save time, ensure accuracy, and help maintain well-organized records for both businesses and personal finances.

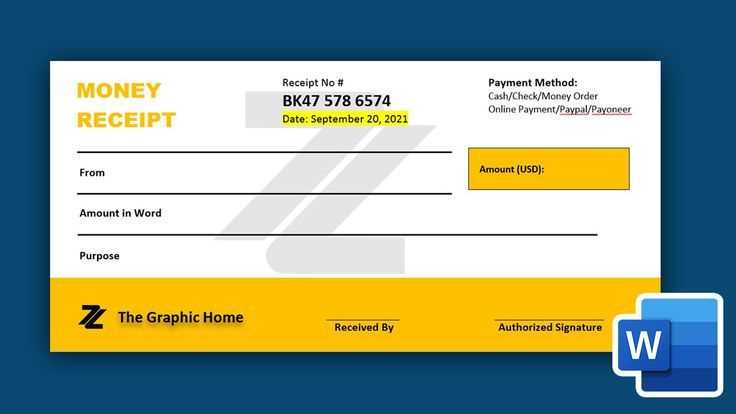

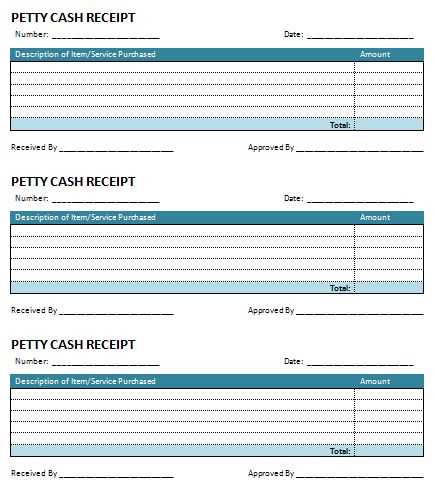

Most platforms offer customizable templates that allow you to adjust fields, colors, and branding to match your needs. Whether you’re issuing sales receipts, rental agreements, or service invoices, these templates come pre-formatted with essential elements like date, itemized lists, payment details, and company information.

Why choose online templates? They eliminate the hassle of starting from scratch. Many services also provide cloud storage options, making it easy to access your documents from anywhere. Plus, downloadable formats such as PDF ensure secure and shareable files.

Explore the available options and find templates that align with your requirements. With just a few clicks, you’ll have polished receipts ready to send or archive, streamlining your operations and saving valuable time.

Receipt Templates Online: Streamlined and Error-Free Solutions

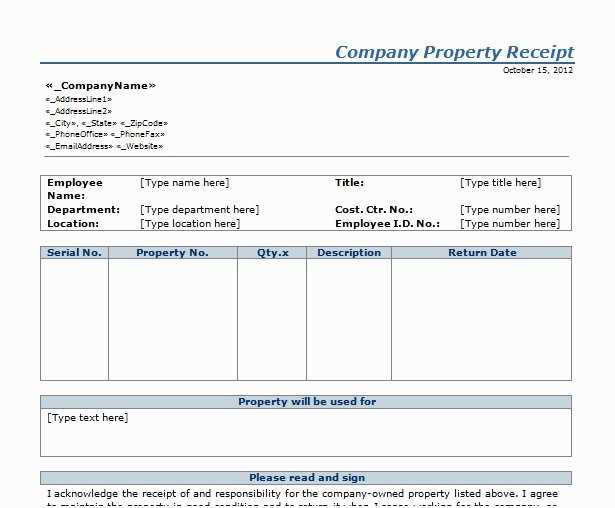

Choose a receipt template that matches your business needs by focusing on layout, customization options, and compatibility with software platforms. Templates should clearly display essential details, including business name, date, itemized list, total amount, and payment method.

Customizing Templates for Professional Presentation

Ensure the template allows easy adjustments for branding, such as logo placement, font selection, and color schemes. Customization helps create a consistent and professional appearance across all customer interactions.

Quick Tips for Accurate Receipt Generation

Use templates that support automatic calculations to reduce human errors and save time. Verify that essential fields are pre-labeled to avoid missing critical information. Test the template with sample data before rolling it out to ensure smooth operation.

Opt for cloud-based platforms to enable access and updates from any device. This setup enhances flexibility and ensures your business stays organized with a centralized receipt archive.

- Receipt Templates Online: Comprehensive Guide

Choose online receipt templates that are editable, printable, and compatible with multiple formats to save time and maintain accurate records. Many platforms offer templates designed for various industries, including retail, freelance services, and hospitality.

Key Features to Look For

- Editable Fields: Ensure templates allow customization for business names, dates, services, and amounts.

- Export Options: Look for compatibility with PDF, Excel, and other formats to simplify sharing.

- Auto-Calculations: Select templates that automatically calculate taxes and totals.

- Professional Design: Templates should maintain a clean and structured layout for easy readability.

Top Template Categories

| Category | Description | Use Case |

|---|---|---|

| Service Receipts | Track payments for professional services rendered. | Freelancers, consultants |

| Sales Receipts | Provide proof of purchase for goods sold. | Retail stores, online sellers |

| Donation Receipts | Document charitable contributions. | Nonprofits, charities |

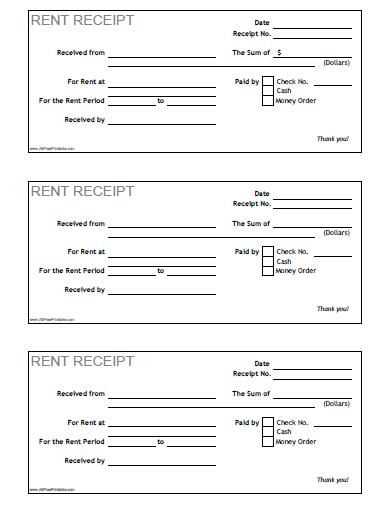

| Rental Receipts | Record payments for property or equipment rentals. | Landlords, rental companies |

Leverage trusted template providers or software tools with integrated design options to enhance efficiency and maintain accurate financial documentation.

Start by checking specialized template platforms like Canva and Template.net. These sites offer free templates tailored to various industries, including retail, hospitality, and healthcare. Use the search filters to narrow down options by industry and design type.

Explore Industry-Specific Websites

Many industry associations provide free template resources. For instance, hospitality organizations often share receipt templates for restaurants and hotels. Similarly, retail associations frequently offer templates designed for point-of-sale systems. Simply visit their official websites and check the resources or downloads section.

Search Open Template Libraries

Platforms like Google Docs Template Gallery and Microsoft Office Online have a wide range of customizable templates. Search by keywords such as “restaurant receipt,” “medical invoice,” or “boutique receipt” to find industry-relevant options quickly. Don’t forget to filter by free templates for cost-effective solutions.

By combining these strategies, you’ll gain access to a variety of templates without spending unnecessary time or resources.

For businesses seeking streamlined receipt customization, several platforms provide user-friendly tools to create personalized forms quickly. These platforms cater to a variety of industries, offering flexibility and practical features for tailoring receipts to specific needs.

1. Zoho Invoice

Zoho Invoice offers an intuitive platform for designing professional-looking receipts. With its drag-and-drop interface, users can easily customize layouts, add company logos, and modify fields such as taxes and discounts. The platform also supports multiple currencies and languages, making it ideal for businesses with international clients.

2. Canva

Canva stands out for its vast selection of templates and design tools. It allows users to customize receipt designs with ease, providing templates that can be modified with logos, colors, and personalized messages. Canva also supports exporting to various formats, ensuring that receipts can be printed or shared digitally without hassle.

Both platforms ensure that businesses can craft receipts that reflect their brand identity while maintaining clarity and professionalism. These tools save time and help enhance customer experience by providing well-designed, clear, and accurate transaction records.

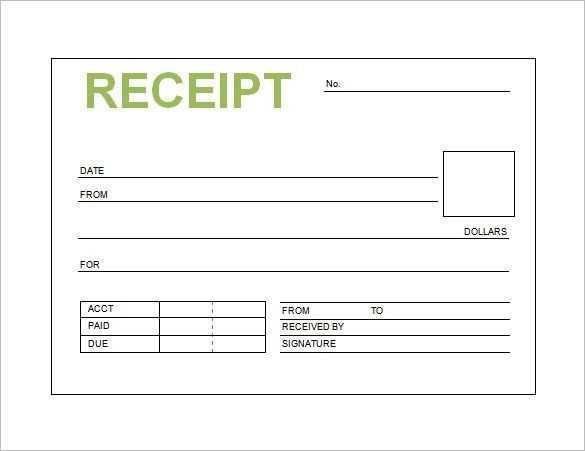

A professional receipt should include specific information to ensure clarity and legal validity. Start by providing the seller’s and buyer’s details–name, business name, and contact information. This establishes accountability for both parties involved.

Itemization of Purchases

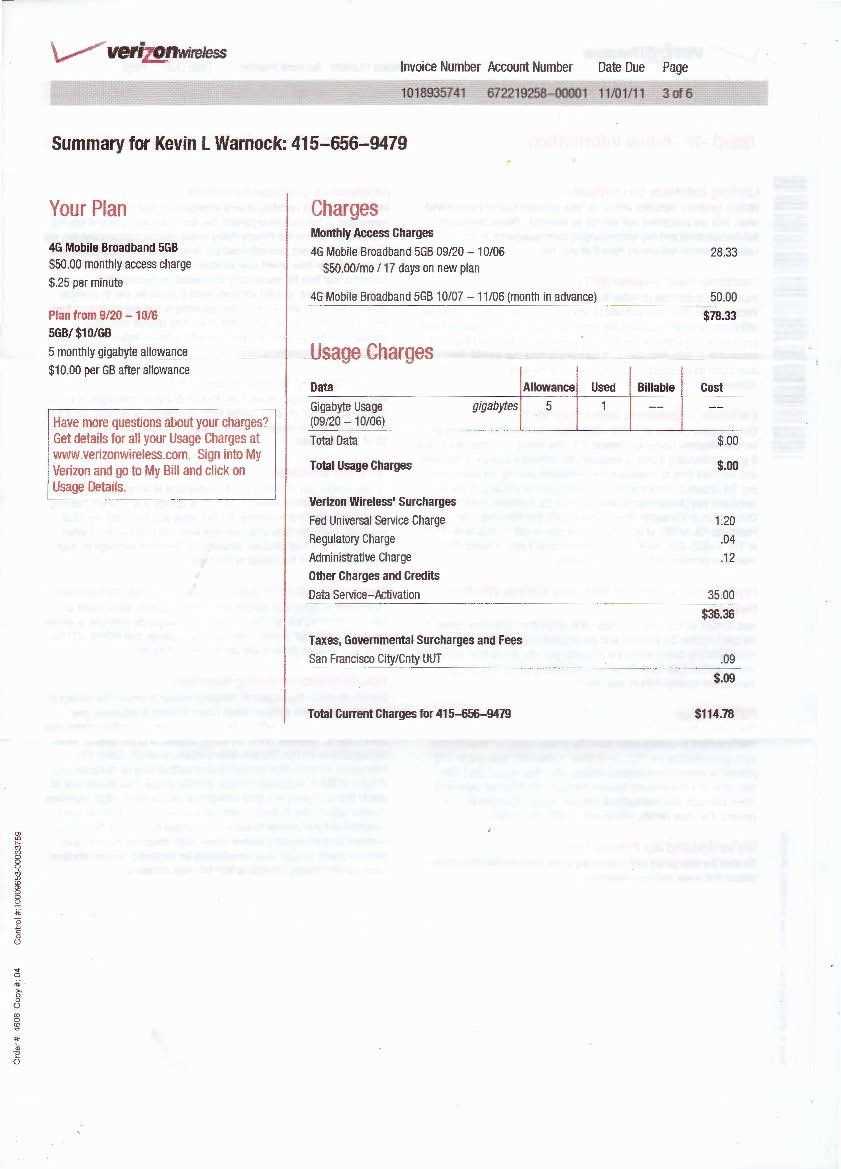

Each product or service purchased must be listed individually, with clear descriptions and the corresponding prices. Break down the total cost for transparency, including applicable taxes or discounts. This helps both parties understand the financial transaction clearly.

Transaction Date and Payment Method

Record the date the payment was made, as well as the method (e.g., credit card, cash, bank transfer). This timestamp verifies when the transaction occurred and provides a reference for future inquiries or returns.

Lastly, include a unique receipt number for easy tracking and reference. This number aids in organizing records, especially for businesses that handle numerous transactions.

Creating an online receipt is straightforward with the right tools. Follow these steps to generate one quickly:

1. Choose an Online Receipt Generator

Select a reliable receipt generator from available platforms. Look for ones that offer customizable templates, secure data handling, and easy export options, such as PDF or email. Some popular options are online tools like “Invoice Generator” or “Zoho Invoice.”

2. Enter Your Business Information

- Fill in your business name, address, and contact details.

- Add your logo if applicable for a professional touch.

3. Add Customer Details

- Include the customer’s name, address, and contact information.

- Make sure the information is accurate to ensure the receipt’s authenticity.

4. List the Items or Services

- Provide a detailed description of each item or service purchased.

- Include unit prices, quantities, and total amounts.

- Ensure clarity to avoid confusion over the charges.

5. Include Payment Details

- Record the total amount paid.

- Note the payment method (credit card, cash, bank transfer, etc.).

- Provide the transaction or receipt number if needed.

6. Add a Date and Receipt Number

- Specify the transaction date.

- Include a unique receipt number for future reference.

7. Double-Check and Customize

- Review all information for accuracy.

- Make sure your receipt is legible and easy to understand.

- Customize fonts, colors, and layout to fit your brand style.

8. Download or Send the Receipt

- After finalizing, download the receipt as a PDF or send it directly to the customer via email.

- Make sure to store a copy for your records.

By following these steps, you’ll be able to generate clear, professional receipts in no time. Ensure accuracy and consistency across your transactions to build trust with your customers.

Use password-protected folders or cloud storage services with two-factor authentication to safeguard receipts. This extra layer of security minimizes the risk of unauthorized access. Many cloud providers offer encrypted storage options that ensure only you can view your files.

Regular Backup of Files

Store your receipts in multiple locations–on your computer and on a secure cloud service. Regularly back up your files to prevent data loss due to device failure. Automatic backup tools can simplify this process, ensuring your receipts are always stored safely.

Organize and Label Files Properly

Label each receipt with relevant information such as the date of purchase, store name, and the amount spent. Organizing receipts into folders based on categories like “Business Expenses” or “Personal Purchases” will make it easier to retrieve them when needed.

Consider using receipt management software to scan and store physical receipts digitally. This can reduce clutter and ensure that important records are not lost. Many apps also offer optical character recognition (OCR), which makes receipts searchable and easier to organize.

Ensure that your storage solution complies with any privacy regulations relevant to your region. Some cloud providers offer options specifically tailored to meet data protection standards, giving you peace of mind while storing sensitive information.

Digital receipts must comply with specific legal and tax requirements depending on the jurisdiction. Businesses should ensure they meet the standards for electronic documentation to avoid penalties or complications during audits. Here are key considerations:

1. Tax Reporting Compliance

- Digital receipts must include all necessary tax details such as tax amount, tax rate, and the tax identification number of the business.

- Ensure your digital receipts comply with local tax laws. Some regions require receipts to have specific formatting, such as QR codes or secure signatures, to be valid for tax purposes.

- Maintain proper record-keeping practices for digital receipts as per tax authority requirements to substantiate tax filings.

2. Consumer Protection and Data Privacy

- Digital receipts must not compromise consumer data. Ensure secure encryption methods for storing and transmitting receipt data.

- Check the privacy regulations in your area to ensure compliance with data protection laws (e.g., GDPR or CCPA) regarding the handling of customer information in digital receipts.

Failure to adhere to legal and tax standards can result in financial penalties and damage to business reputation. Be proactive about staying informed on these requirements to maintain smooth operations.

If you want to smoothen the wording even more – just let me know!

For a clearer and friendlier tone in your receipts, try using simpler language and avoiding overly technical terms. For instance, instead of saying “transaction successfully processed,” opt for “payment received” or “order confirmed.” Small tweaks like this make your message more approachable without losing its meaning.

How to Make Your Receipt Friendly

When drafting receipts, you can make the phrasing more personable. Use “Thank you for your purchase!” instead of “Transaction complete.” This simple adjustment creates a positive connection with your customer.

Sample Receipt Structure

| Item | Price |

|---|---|

| Product A | $20.00 |

| Product B | $15.00 |

| Total | $35.00 |

Feel free to use this as a base template and modify it according to your needs. You can even add a small note like “Hope you enjoy your purchase!” to make the interaction more engaging.