Mandatory Information for a French Receipt

To ensure compliance with French regulations, a receipt must include several essential elements. Missing details can result in penalties, so it’s important to be thorough. Below is a breakdown of the key components:

- Seller Information: Full name or company name, address, and SIRET number (French business identification number).

- Customer Details: Full name and address if the transaction amount exceeds €150 or upon customer request.

- Date of Transaction: The exact date when the transaction took place.

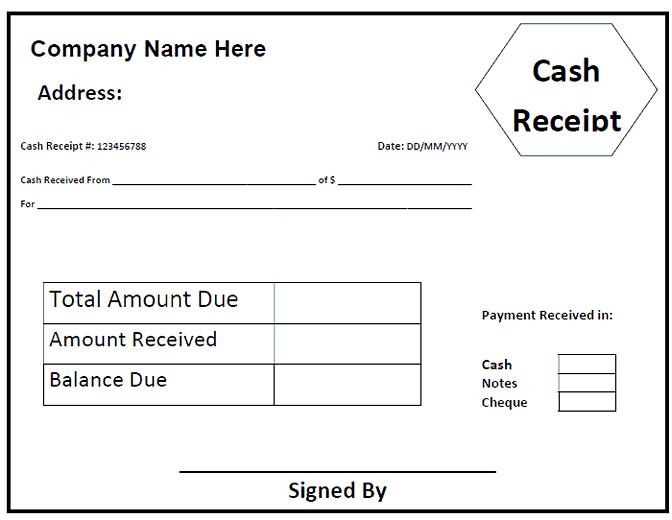

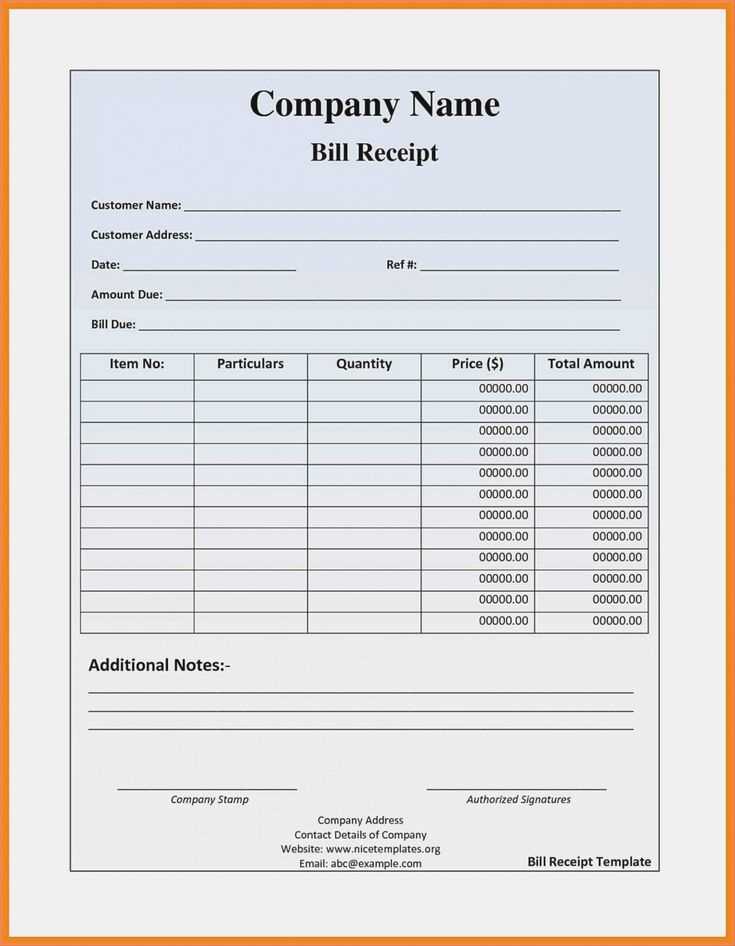

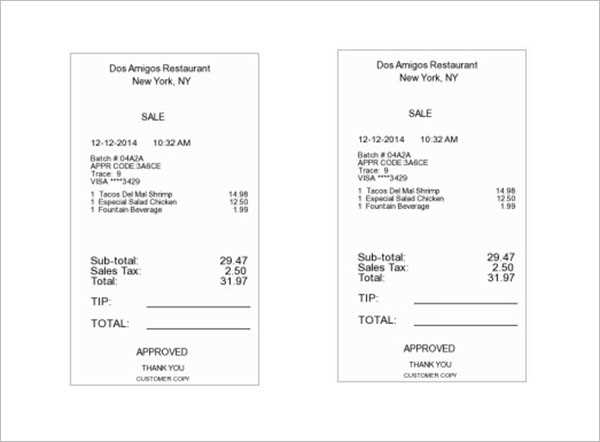

- Itemized Description: Detailed list of products or services provided, including quantities and unit prices.

- Total Amount: Clearly separate the amounts before and after tax (HT and TTC).

- VAT Details: Include the applicable VAT rate and total VAT amount, or specify if the transaction is VAT-exempt.

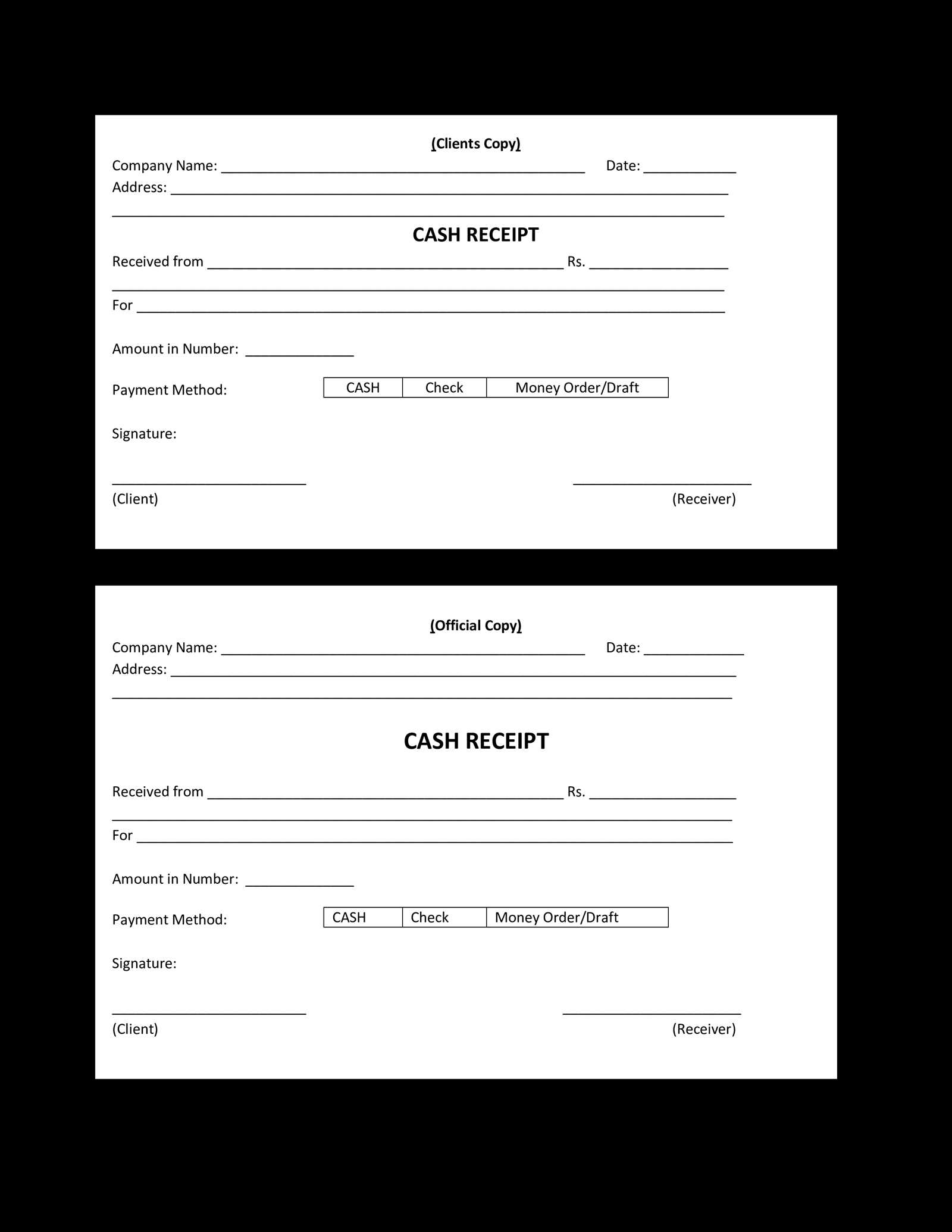

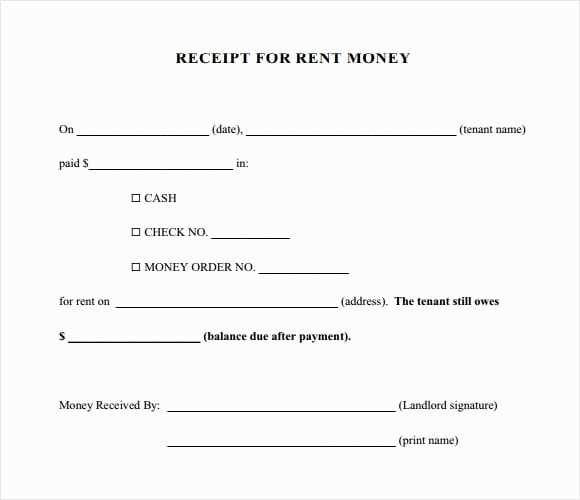

- Payment Method: Indicate whether payment was made by cash, card, or other means.

Additional Best Practices for Crafting Receipts

Use a Clear and Simple Layout

Organize the receipt in a logical manner to make it easy for customers and auditors to read. Group related information and maintain consistent formatting.

Include Legal Mentions

For businesses, phrases like “TVA non applicable, article 293 B du CGI” should be added if exempt from VAT. This clarifies compliance with French tax rules.

Digitization Options

Consider providing electronic receipts to customers as they are increasingly accepted and environmentally friendly. Ensure digital versions remain compliant by keeping detailed records.

With careful attention to detail and adherence to legal requirements, a French receipt becomes a reliable document that facilitates transparent transactions and smooth business operations.

French Receipt Template: Comprehensive Guide

Key Legal Aspects for Receipts in France

Ensure your receipt complies with French tax regulations by including the VAT number for applicable businesses and clearly stating “TVA non applicable, article 293B du CGI” if exempt. Receipts should also specify the payment date and include a unique serial number to maintain a reliable audit trail.

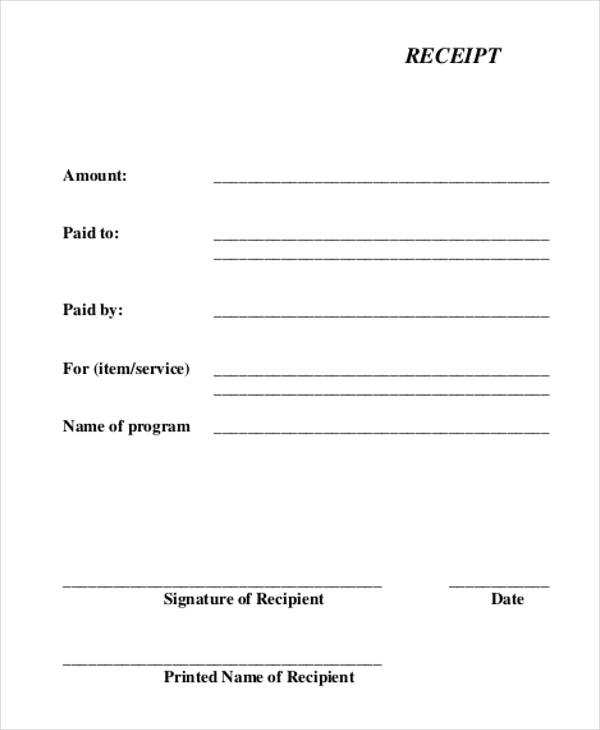

Essential Fields and Information to Include

Include the seller’s name, address, and contact information alongside the customer’s details. A detailed breakdown of goods or services provided is mandatory, specifying unit prices, quantities, and total costs. Display the payment method and issue date prominently.

Tips for Formatting a Professional Receipt

Keep the layout clean by aligning sections logically. Use bold text for key details like total amounts. Ensure all amounts, including VAT, are clearly distinguishable. Avoid clutter by limiting unnecessary elements.

Selecting Suitable Software for Receipt Creation

Opt for platforms that support compliance with French fiscal laws and offer customizable templates. Features like automated serial numbering and VAT calculations streamline operations significantly.

Effective Practices for Receipt Storage and Archiving

Store digital receipts securely for a minimum of ten years as required by French law. Use encrypted cloud storage to protect sensitive data while ensuring easy retrieval during audits.

Adapting Templates to Specific Business Requirements

Tailor your receipt template based on your industry. For service-based businesses, emphasize service descriptions. Retail businesses may benefit from integrating product codes and return policies.