Every rental transaction should be properly documented, and a rental cash receipt is the easiest way to confirm payments. This simple document protects both landlords and tenants by providing proof of rent paid and helping to avoid disputes. Using a well-structured template saves time and ensures all necessary details are included.

A complete receipt should include the date of payment, the tenant’s name, the rental property address, the amount paid, and the payment method. It’s also good practice to add the rental period covered, the landlord’s name, and a signature for authentication. These elements make the receipt legally useful and easy to reference in case of any questions.

Many landlords prefer digital templates that can be filled out and printed, while others use handwritten receipts for quick transactions. A customizable template ensures consistency and avoids missing key details. Whether you manage a single property or multiple units, a standardized receipt system helps streamline record-keeping and tax reporting.

Using a structured rental cash receipt template simplifies rent tracking and provides clear documentation for all parties involved. Explore different formats to find one that fits your needs, whether it’s a printable PDF, an editable Word document, or a spreadsheet for automated calculations.

Here is the revised version with redundancy removed:

To streamline your rental cash receipt template, focus on including only the necessary details. Ensure the format is simple and clear, listing the payment amount, tenant name, rental period, and date. Avoid repeating the same information multiple times. For example, instead of stating “Received payment for the rental” in several places, use concise language that makes the intent clear once. This approach enhances clarity and prevents confusion during review.

Limit the use of similar phrases and make the template easy to understand. Remove repetitive sections that don’t add new value, such as multiple mentions of payment methods or rental agreements, unless it’s vital to track them separately. Stick to the core information that guarantees both parties have a clear record of the transaction.

By cutting unnecessary repetitions, you can ensure that the document is both user-friendly and professional. This will help reduce the chances of errors or miscommunication in the future.

- Rental Cash Receipt Template: A Practical Guide

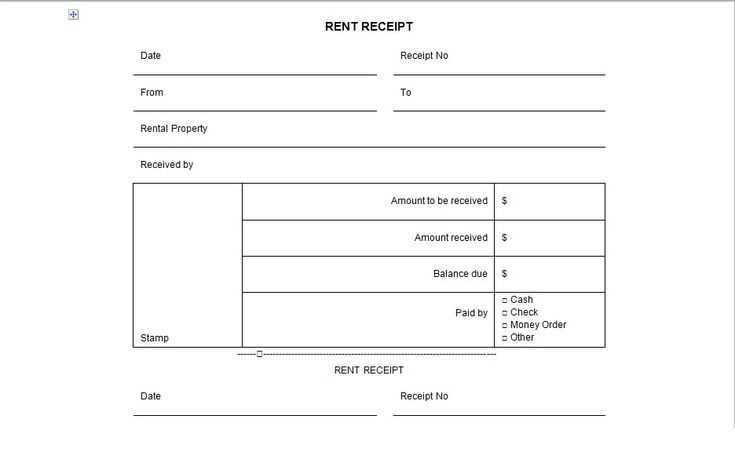

Ensure your rental cash receipt template includes key details like the tenant’s name, rental property address, payment amount, date of transaction, and payment method. These elements create clarity and accountability. Use a clear and professional layout that helps both parties track payments accurately.

1. Customize for Your Needs

Your template should allow for customization based on the specific terms of the rental agreement. Include fields for any additional charges such as late fees, cleaning fees, or security deposits. Tailoring the template makes it easier to track individual payments and stay organized.

2. Include Payment Confirmation

It’s vital to include a section confirming that payment has been received. This section should have a space for both the landlord’s signature and tenant’s acknowledgment. This provides proof of transaction and helps avoid any future disputes.

By following these guidelines, you can create a straightforward rental cash receipt template that serves as both a record for you and a guarantee for your tenant that their payment has been processed.

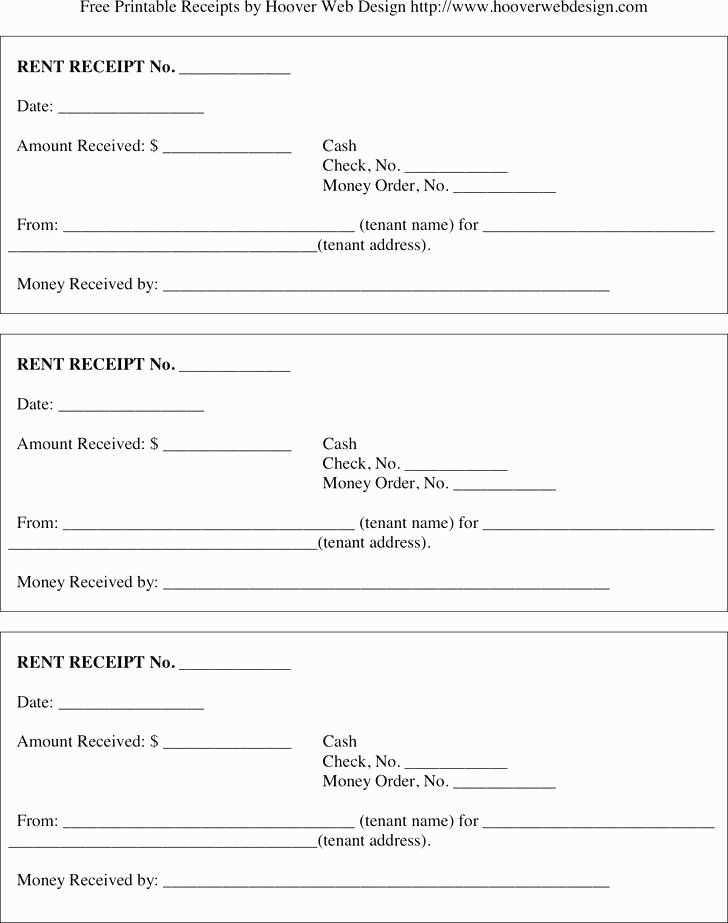

Ensure that your rental receipt includes the following key details:

| Element | Description |

|---|---|

| Receipt Number | Assign a unique number to each receipt for easy tracking and reference. |

| Date of Payment | Clearly specify the exact date when the payment was made. |

| Tenant’s Name | Include the full name of the person making the payment to avoid confusion. |

| Rental Property Address | List the address of the property being rented to confirm which location the receipt pertains to. |

| Amount Paid | Clearly state the exact amount received for the rental payment, including any additional fees if applicable. |

| Payment Method | Specify how the payment was made (e.g., cash, credit card, check, etc.). |

| Rental Period | Indicate the dates for which the payment is applicable, such as the start and end dates of the rental period. |

| Landlord’s Details | Include the name, address, and contact information of the landlord or property manager for reference. |

| Signature | Provide a space for the landlord or property manager to sign the receipt, confirming the transaction. |

Each of these elements ensures transparency and accountability in rental transactions.

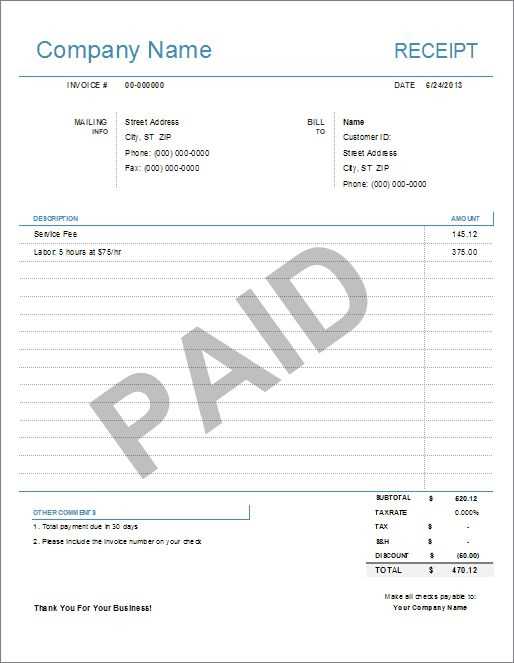

List all transaction details clearly, starting with the rental date and the exact amount paid. Ensure the format is consistent and easy to read, using simple fonts and adequate spacing. Use bold headings for important sections such as “Amount Paid,” “Rental Period,” and “Payment Method.” This makes it easier for the recipient to quickly locate key information.

Include Key Rental Details

Begin with the name and contact details of the rental company, followed by the renter’s name and address. Include the rental period (start and end dates) along with the description of the rented item or service. If applicable, provide serial numbers or any identifiers for the rented items. This ensures clarity and avoids confusion later.

Clearly Present Payment Information

Break down the total amount paid, including any taxes or additional fees. List payment methods, such as credit card, check, or cash. This helps in tracking the transaction and addressing potential disputes. Include any deposit information, if applicable, and specify if it is refundable or non-refundable.

Ensure that rental agreements comply with local laws and regulations. Clearly outline terms such as rental rates, payment deadlines, and lease duration to avoid future disputes. Verify that both parties understand their obligations and rights under the lease. Having written confirmation of these details is key to protecting both landlords and tenants.

Disclosures and Notifications

Include any mandatory disclosures in the rental agreement, such as lead paint information, security deposit rules, and tenant rights specific to your jurisdiction. Provide proper notice regarding any changes to the terms of the lease, including rent increases or property maintenance schedules.

Termination and Renewal Clauses

Clearly define procedures for terminating the lease, whether by the landlord or tenant. Include the required notice periods and any associated penalties. Additionally, if the lease can be renewed, outline the renewal process and any adjustments to terms.

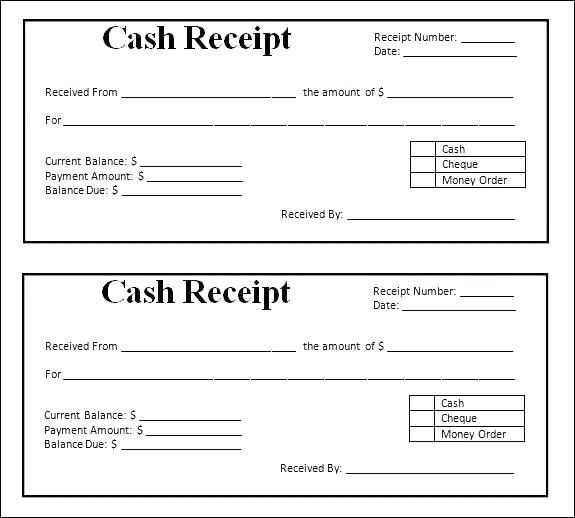

Choosing between printable and digital receipts depends on your needs and preferences. Both options have specific advantages that can suit different situations.

- Printable Receipts:

- Physical copies are easy to store and organize, especially for individuals who prefer tangible documents.

- Ideal for returning items, as stores often request paper receipts for refunds or exchanges.

- They can serve as immediate proof of payment, especially when using cash transactions.

- Digital Receipts:

- Accessible from anywhere, providing quick reference without the risk of losing or damaging paper receipts.

- Environmentally friendly, eliminating paper waste and reducing clutter.

- Easy to back up and store securely in digital formats, allowing for more space-saving solutions.

Ultimately, consider your storage preferences and the specific transaction types when choosing between printable and digital receipts.

Ensure all payment details are clearly stated. Failing to specify the rental amount, payment frequency, and due dates can lead to confusion. Always include the exact amounts and deadlines, as well as the acceptable methods of payment.

Omit vague clauses regarding late fees. Clearly outline any penalties for late payments, including the amount charged and the grace period. Without these specifics, renters may dispute charges.

Do not neglect security deposit terms. Define the amount, conditions for return, and any potential deductions. Failure to outline these can result in disputes about the deposit after the rental period ends.

Ensure the rental period is explicit. Avoid ambiguous start and end dates. Clearly marking the rental period will prevent misunderstandings about the length of the agreement.

Be precise with the condition of the property or item being rented. Include a detailed inventory or description to avoid disagreements regarding damage or missing items upon return.

Neglecting to specify maintenance responsibilities can lead to confusion. Clearly indicate whether the renter is responsible for repairs or if it is the property owner’s obligation to maintain the rented item.

Do not leave insurance details ambiguous. Specify the renter’s responsibility for insurance, whether it’s required, and the coverage provided, if applicable.

FreshBooks offers an intuitive receipt creation tool with customizable templates that save time and reduce errors. It’s perfect for businesses of all sizes, letting you create professional invoices and receipts within minutes.

If you’re looking for a free option, Wave Accounting is a great choice. It has simple, no-cost features for generating and managing receipts, along with tools for tracking payments and expenses, making it a good option for smaller operations.

Zoho Invoice delivers a more advanced solution with a wide array of customizable receipt templates. It allows users to automate recurring receipts and integrates seamlessly with other Zoho products to streamline business operations.

For those who prefer mobile apps, QuickBooks Online is a solid option. It lets you create receipts on-the-go and syncs seamlessly with your accounting system, helping you stay on top of your financials wherever you are.

Lastly, Invoice Ninja stands out for its open-source receipt template tool. It provides a variety of customization options and allows businesses to host the software on their own server, offering full control over receipts and invoicing processes.

Now “Rental Cash Receipt” does not repeat excessively, but keywords are maintained for clarity and SEO.

To ensure the Rental Cash Receipt is clear and precise, avoid unnecessary repetition of the term. However, using the key phrase naturally enhances both readability and SEO performance. Here are a few strategies to achieve this balance:

- Use synonyms or related phrases: Instead of repeatedly using “Rental Cash Receipt”, try alternatives like “receipt for rental payment” or “rental payment confirmation”.

- Structure sentences to focus on the content: Instead of emphasizing the term, center the text around what the receipt represents, such as payment details, rental terms, and tenant information.

- Incorporate headings and bullet points to break up information: This method helps avoid excessive use of the keyword while maintaining clarity.

Optimize Without Overusing the Keyword

For SEO, maintain the keyword density at a reasonable level without overstuffing. Include it in headings, the introduction, and the conclusion to signal the relevance to search engines, while not making the content feel forced.

Provide Clear Information in the Receipt

- Start by detailing the date of the transaction, the rental period, and payment amount.

- Include both the tenant’s and the landlord’s details for transparency.

- Finally, ensure the receipt clearly states the method of payment, whether by cash, check, or another form of payment.