A well-structured legal receipt protects both parties in a transaction. It serves as proof of payment and outlines key details such as the amount paid, date, and purpose. For legal compliance, ensure that your receipt includes the payer’s and payee’s information, a clear description of the goods or services, and any applicable taxes.

Essential Components:

- Transaction Details: Specify the date, amount, and method of payment.

- Parties Involved: Include the full names and contact details of both the payer and recipient.

- Description: Clearly state what was purchased or paid for.

- Legal Disclaimers: If necessary, add terms regarding refunds, warranties, or liabilities.

- Signature: For added security, require a signature from the recipient.

For consistency, use a standardized template with a professional layout. Digital receipts should follow the same structure, incorporating electronic signatures if needed. Retain copies for record-keeping and potential disputes.

Accuracy is crucial. Errors can invalidate the receipt or lead to legal complications. Double-check amounts, tax calculations, and legal wording before issuing. If corrections are necessary, issue a revised version with a clear notation.

Legal requirements vary by jurisdiction. If handling large transactions or sensitive agreements, consult a legal professional to ensure compliance with local laws.

Here’s the revised version with unnecessary repetitions removed while preserving the meaning:

Remove redundant phrases to improve clarity. For example, instead of saying “in the event that,” simply use “if.” Use shorter, more direct phrases to express the same idea. Replace complex structures with simpler ones that are easy to understand without losing any important detail.

Avoid repeating the same words or ideas within a sentence or paragraph. This reduces the risk of confusing the reader and makes the content more concise. Ensure every word serves a purpose and contributes to the message being conveyed.

When drafting content, it’s helpful to read through it and identify areas where repetition occurs. Then, revise these sections by eliminating unnecessary words or rephrasing sentences to make them more efficient.

- Template Legal Receipt: Key Aspects and Guidelines

A legal receipt template should include several specific details to ensure clarity and protect both parties involved in the transaction. The following elements are necessary for a legally valid receipt:

1. Transaction Details

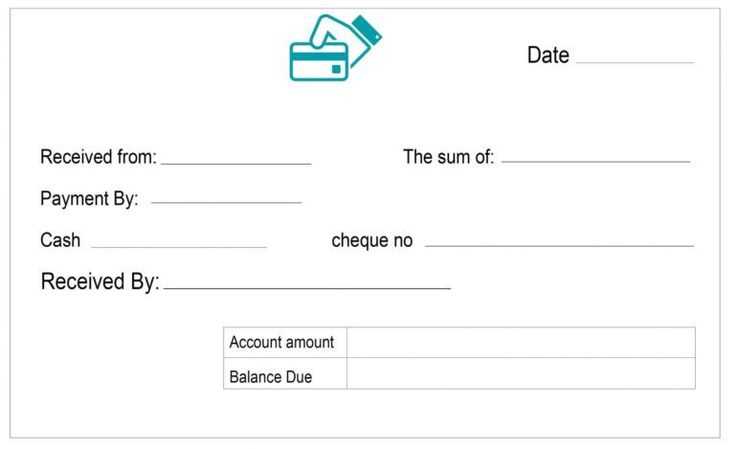

Always include the date of the transaction, the amount paid, and the method of payment. Whether the payment was made via cash, check, or electronic transfer, this should be specified clearly. For electronic payments, reference the transaction ID for accuracy.

2. Parties Involved

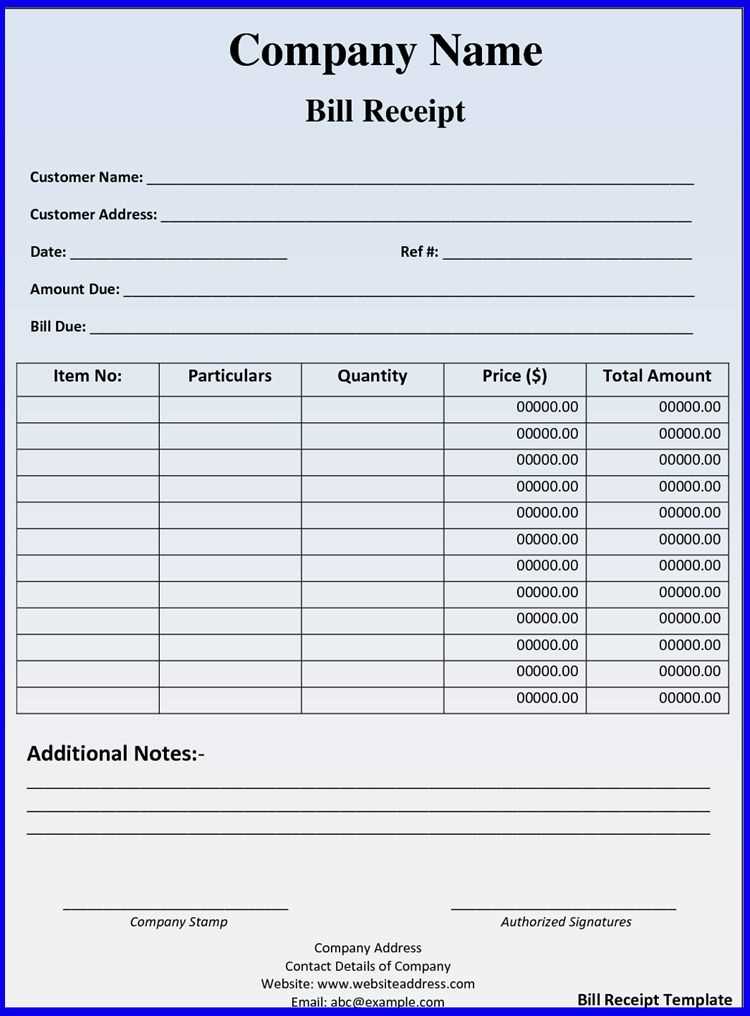

Identify both the payer and the payee. Full names, addresses, and contact information of both parties should be included. This ensures the receipt can be traced back to the correct individuals in case of any dispute.

3. Description of Goods or Services

Provide a detailed description of the goods or services rendered. This could include product names, quantities, and unit prices or a breakdown of services provided. The clearer the description, the better the receipt will serve as proof of the transaction.

4. Signature and Acknowledgement

Both parties should sign the receipt. The payer’s signature indicates acknowledgment of the transaction, while the payee’s signature affirms that the payment has been received.

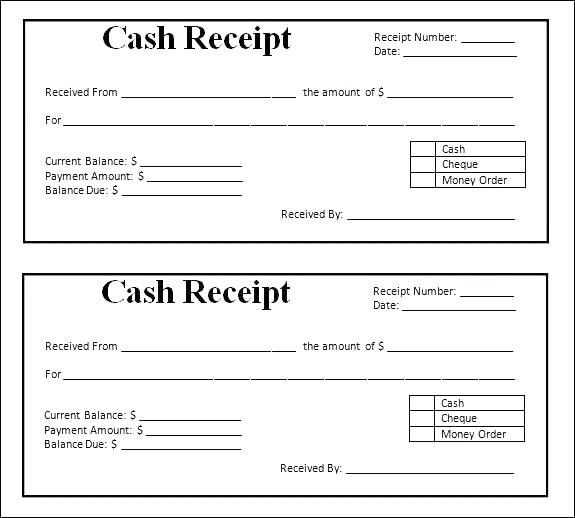

5. Receipt Number

A unique receipt number should be assigned to each transaction for easy tracking and reference. This is helpful for both the payer and the payee to maintain organized records of payments.

Ensure that the receipt is clear, legible, and free of errors. It should be presented in a way that both parties can easily understand and verify the details. Regularly update your template to reflect any changes in legal requirements or business practices.

A well-structured receipt template includes several key elements that ensure clarity and accuracy in documenting transactions. Below are the most important components to include:

- Business Information: Clearly display the business name, address, contact details, and logo (if applicable). This makes the receipt recognizable and easy for customers to refer back to.

- Receipt Number: Assign a unique identifier to each receipt. This helps with record-keeping and tracking transactions, especially for returns or audits.

- Date of Transaction: Include the date and time of the transaction. This is crucial for both the buyer and seller to have a record of the transaction for any future reference.

- Itemized List of Goods or Services: Provide a detailed list of all items or services purchased, including quantity, price per item, and any applicable taxes. Clear breakdowns help avoid confusion and disputes.

- Subtotal and Total Amount: Display both the subtotal (before taxes) and the final amount (including taxes or discounts). This ensures transparency in pricing.

- Payment Method: Specify the method of payment (e.g., credit card, cash, digital wallet) and any relevant transaction details, such as card type or authorization number.

- Refund and Return Policy: Include a brief note about the business’s policy on returns or refunds. This informs customers of their rights and provides clear guidance on how to proceed with any issues.

- Signature or Acknowledgment: While not always required, a signature or acknowledgment section can help confirm the transaction’s validity, especially for higher-value transactions.

Including these key components in your receipt template ensures professionalism and prevents any ambiguity in the transaction process.

Structuring Payment Details Clearly

Clearly present payment details by using a structured layout. Begin with the itemized list of charges, followed by the total amount due. This ensures that each charge is easily understood. Break down the pricing by product or service, including any applicable taxes or discounts. Each charge should be labeled clearly to avoid confusion.

Include Clear Dates and Payment Methods

Provide specific dates for the transaction, such as the invoice date and due date. List the accepted payment methods with their corresponding instructions. This may include credit card, bank transfer, or PayPal. If any additional payment instructions apply, make sure they are easy to find.

State Any Applicable Late Fees

If late fees apply, specify them explicitly on the receipt. Mention the exact percentage or fixed amount and when it will be charged. This avoids ambiguity and ensures the customer is aware of any extra costs that may arise if payment is delayed.

By presenting payment details in a logical, clear order, you reduce the chance of misunderstandings and improve the overall clarity of your receipt.

Always ensure that your receipt includes all mandatory details for it to be legally recognized. This includes the full names and contact information of both parties involved, a clear description of the transaction, and an accurate record of the date, time, and amount paid. If your receipt serves as proof of a business transaction, include any tax identification numbers where applicable.

Verify that your receipt adheres to local regulations or industry-specific standards. Some jurisdictions may require additional elements, such as VAT information or the method of payment. Confirm the requirements for your specific business type to avoid legal complications.

Consider providing both a physical and a digital version of the receipt. Many jurisdictions recognize electronic receipts as legally binding, provided they follow the same standards as paper receipts. Ensure that your digital receipts can be easily stored, retrieved, and verified if needed for future reference.

Always include an itemized list of products or services provided. This transparency reduces disputes and ensures that both parties agree on the nature and value of the transaction. If discounts, promotions, or taxes apply, be clear about how these were calculated.

Use consistent formats and templates that meet legal requirements. Standardizing the layout of your receipts helps minimize mistakes and confusion. Review your receipt template regularly to stay compliant with any changes in local tax laws or consumer protection regulations.

Avoid vague language. Be specific in describing obligations, rights, and terms. Ambiguity can lead to disputes or confusion later on, so it’s important to use clear and precise wording.

Don’t neglect the details. Omitting essential clauses or skipping over smaller provisions may seem like a shortcut, but it often causes problems down the road. Each section should be thoughtfully considered and included.

Be cautious with deadlines. Misplacing or incorrectly defining timeframes can invalidate terms or cause delays in performance. Always verify that timelines are realistic and unambiguous.

Steer clear of one-sided clauses. Drafting agreements that disproportionately favor one party can lead to legal challenges. Fairness helps avoid potential conflicts and ensures the agreement remains enforceable.

Review legal terms regularly. Legal language can become outdated or misinterpreted. Reassess your templates regularly to ensure they align with current law and any recent rulings that may impact the document’s validity.

Lastly, avoid relying on generic templates without customization. Templates are a useful starting point, but tailoring them to the specifics of your situation is essential to avoid generic or incomplete agreements.

Tailor your receipts to fit the specifics of each transaction type. For example, a retail purchase will require different details than a service-based transaction. Here’s how to adjust:

- For Goods Sales: Include product descriptions, quantities, unit prices, and applicable taxes. If multiple items are purchased, list them individually for clarity.

- For Services: Clearly state the service provided, hours worked (if applicable), and the hourly rate or fixed price. It’s helpful to add a breakdown of charges, like consultation fees or additional expenses.

- For Online Transactions: Add relevant information such as the delivery address, shipping fees, and payment method. Mention any digital goods or services purchased, including activation codes if necessary.

- For Subscription-Based Payments: Specify the subscription period, payment frequency, and renewal dates. Add any discounts or special offers applied to the transaction.

By customizing the receipt to the nature of each transaction, you help ensure transparency and enhance the customer’s experience. The more detailed the receipt, the less room for misunderstandings.

Choose digital receipts for better storage, ease of access, and environmental benefits. A digital receipt allows you to search for information quickly and eliminates the risk of physical damage. Storing digital receipts in the cloud or an app ensures you have a backup, reducing the chance of losing records over time.

On the other hand, paper receipts provide a tangible record of a transaction that some users may prefer for personal record-keeping or situations where digital devices are unavailable. Paper receipts also offer immediate access without the need for a device or internet connection.

| Factor | Digital Receipts | Paper Receipts |

|---|---|---|

| Storage | Easy to store and access digitally in cloud-based apps | Requires physical space for storage and organization |

| Environmental Impact | Eco-friendly; reduces paper waste | Contributes to paper waste and environmental strain |

| Accessibility | Accessible from any device with internet access | Can only be accessed in person |

| Durability | Can be lost due to device failure or loss of account | Can fade, tear, or become unreadable over time |

Consider switching to digital receipts for better long-term organization and reduced environmental impact. However, if you prefer paper, organizing receipts with folders or a filing system ensures your records stay intact and accessible. Weigh these factors against your needs to make the best decision for you.

To craft a legal receipt template, it’s crucial to keep the structure clean and clear. Use a simple yet precise format to avoid confusion. The receipt should list the transaction details, including the item or service, the amount paid, and the date of purchase. It’s best to clearly label each section with headers for easy reference. Ensure the inclusion of legal disclaimers or tax information as required by local regulations.

Important Elements

Each legal receipt should contain these elements: name and address of the seller, the buyer’s details if applicable, the purchase date, a list of items or services sold with their prices, the total amount paid, and the payment method. Also, add a unique receipt number for identification. Avoid cluttering the document with unnecessary information to maintain its legal integrity.

Formatting Recommendations

Keep the font legible and consistent. Use bold or underlined text for section headers to differentiate them from the body content. Ensure the receipt is easy to read both in print and digital formats. If your template is digital, consider offering a downloadable PDF version for better accessibility.