Need a structured and professional receipt template for Aviation Business Ltd in Piarco? Use a format that includes all necessary details for compliance, record-keeping, and customer transparency. A well-designed receipt should clearly display transaction specifics, ensuring clarity for both businesses and clients.

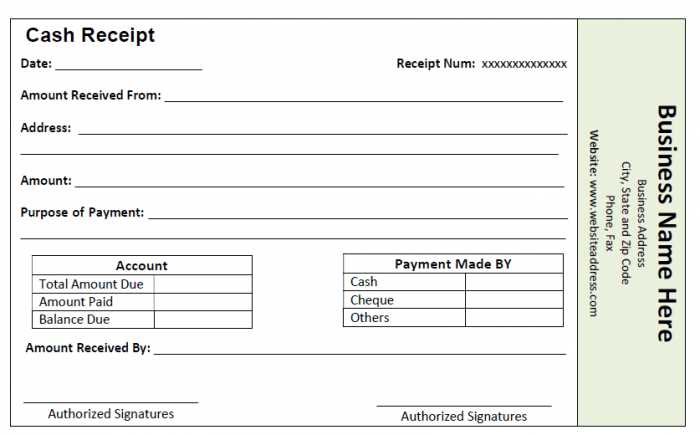

Include essential fields such as company name, transaction date, receipt number, customer details, and payment method. A breakdown of services or products, including quantities, prices, and applicable taxes, provides a clear financial summary. Ensure that your template features a designated section for authorized signatures or digital approval.

Standardizing the format improves efficiency and reduces errors. Whether used for aviation services, ticket sales, or logistics, a structured receipt helps maintain consistency in financial documentation. Digital templates can streamline the process, offering automated calculations and easy storage. Select a layout that aligns with professional standards while maintaining simplicity for quick processing.

Here is the revised version, eliminating redundant word repetitions while preserving the meaning:

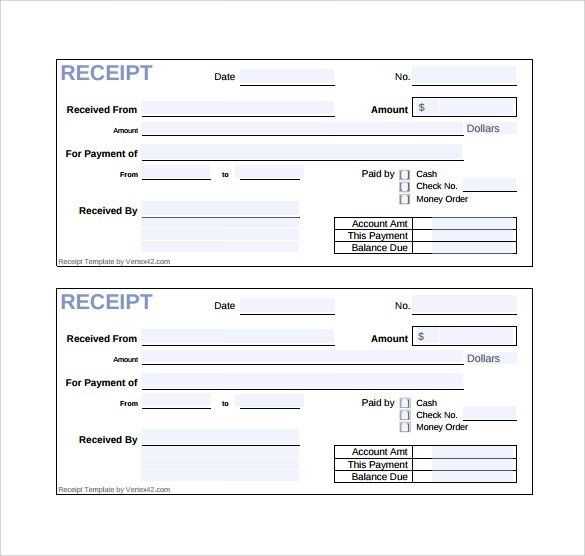

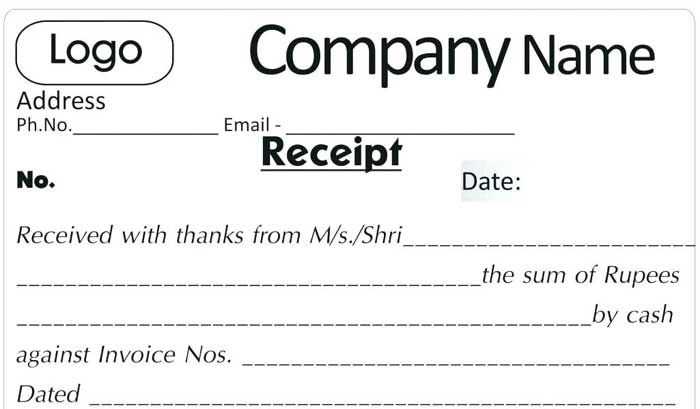

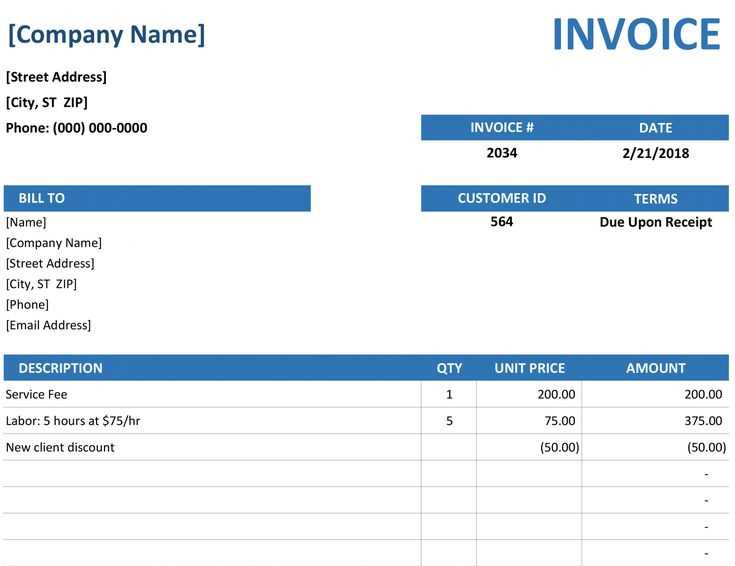

Use a clear and concise format for receipts. Ensure the information is easily readable, with relevant details arranged in a logical order. The header should include the business name, address, and contact information. Below, list the transaction details: item descriptions, quantities, unit prices, and total amounts. Include the date and time of the transaction, as well as a receipt number for future reference.

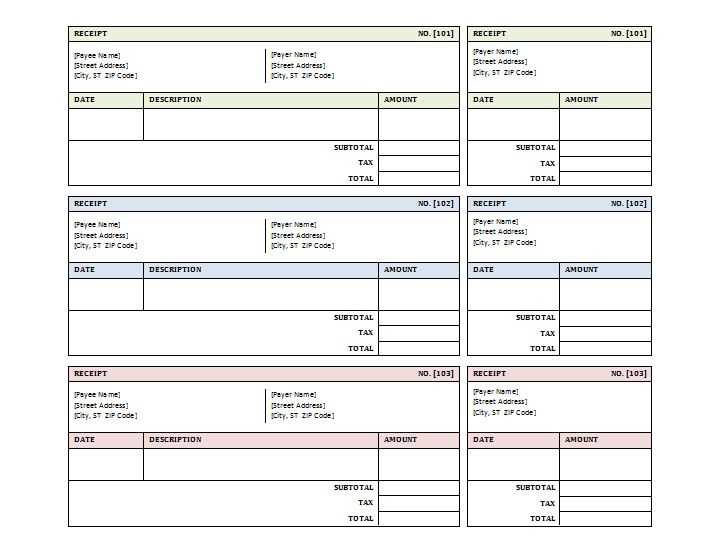

Receipt Layout Example:

Business Name: Aviation Business Ltd

Address: Piarco, Trinidad & Tobago

Phone: +1 (868) 555-1234

Date: February 9, 2025

Receipt Number: #A12345

Transaction Details:

- Item: Service Fee

Quantity: 1

Unit Price: $50.00 - Item: Parking Fee

Quantity: 2

Unit Price: $15.00

Total: $80.00

By structuring the receipt this way, you reduce the chance of confusion while making it easy for customers to review the details of their transaction.

- Aviation Business Ltd Piarco Receipt Template

The receipt template for Aviation Business Ltd Piarco provides a clear and professional way to present transaction details. It helps streamline accounting and customer service processes.

Key Components of the Receipt Template

- Header: Contains the company name, address, and contact details.

- Transaction ID: Unique identifier for the transaction, ensuring clarity and traceability.

- Item Description: A detailed list of products or services purchased, including quantity and unit prices.

- Taxes: Breakdown of applicable taxes, ensuring transparency in pricing.

- Total Amount: The final price, including all applicable fees and taxes.

- Payment Method: Specifies whether the payment was made via credit card, cash, or another method.

Tips for Using the Receipt Template

- Ensure that all fields are filled out accurately to avoid discrepancies in your records.

- Double-check the transaction ID to maintain consistency across receipts.

- Regularly update the template to reflect any changes in business information or tax rates.

The Piarco receipt format includes key details that ensure clarity and proper documentation for all transactions. These elements are designed to provide all necessary information for both the service provider and the recipient.

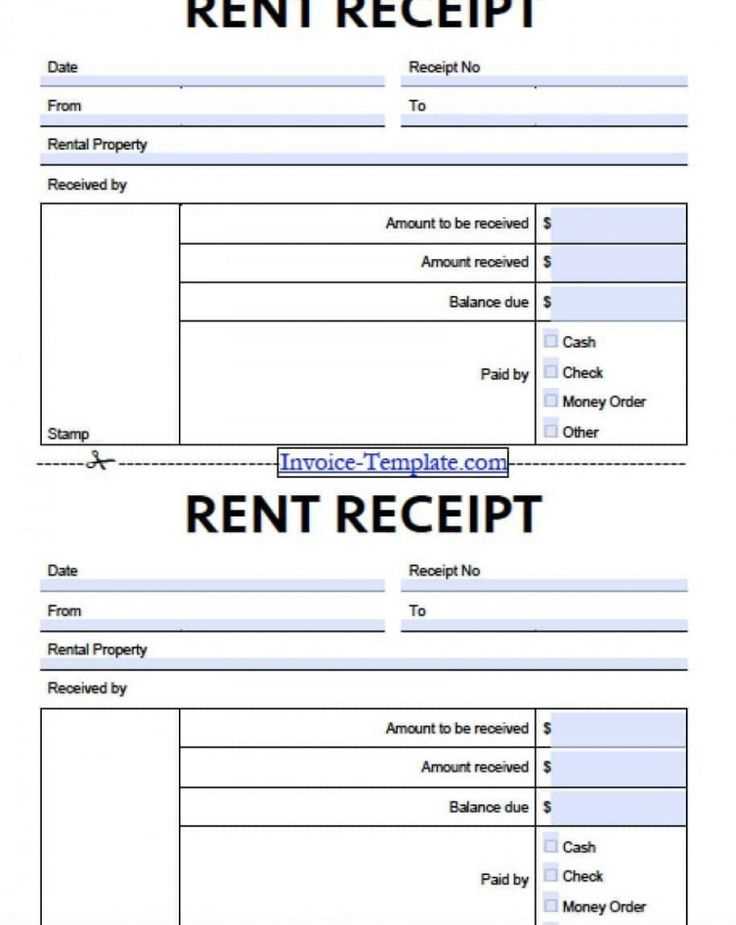

1. Transaction Date and Time

Each receipt begins with the date and time of the transaction. This allows for accurate record-keeping and helps in resolving any potential discrepancies. The date should be in a standardized format, typically dd/mm/yyyy, and the time is often displayed in the 24-hour format for consistency.

2. Unique Receipt Number

A unique receipt number is essential for tracking and referencing individual transactions. This number is usually auto-generated by the system and ensures that every receipt is identifiable and traceable, aiding in auditing and support processes.

3. Service or Product Details

The receipt lists the specific services or products purchased, including descriptions, quantities, and prices. This information helps to verify the transaction and provides transparency on the items involved.

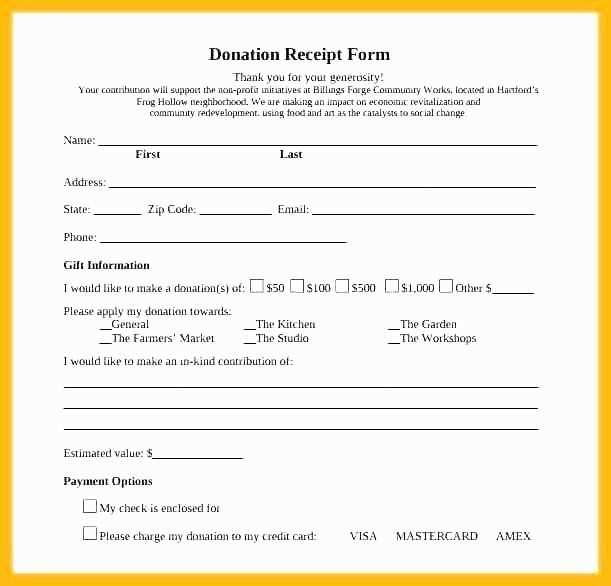

4. Payment Information

Payment details, including the method of payment (cash, card, etc.), are clearly displayed. This section may also include the total amount paid, tax breakdowns, and any applied discounts or fees.

5. Contact Information

The receipt should contain the service provider’s contact details, including name, address, and customer service phone number. This ensures that customers can reach out for any follow-up inquiries or concerns.

6. Terms and Conditions

Important terms and conditions related to the transaction, such as return policies, service guarantees, or other relevant details, should be included. This provides the customer with full transparency on the terms of the purchase.

A valid receipt must include specific details that validate a transaction. These details ensure transparency and allow for easy verification of the payment. Here’s what should be included:

- Business Name and Contact Information: The company’s official name, address, phone number, and email should be clearly visible.

- Date of Purchase: The exact date and time when the transaction occurred must be present.

- Transaction Amount: The total amount paid, including taxes, discounts, and any additional charges, should be accurately listed.

- Payment Method: Specify whether the payment was made via cash, card, or other methods.

- Itemized List of Purchases: All items or services purchased should be listed, including quantities, prices, and descriptions.

Additional Elements

- Receipt Number or Identifier: A unique number for tracking purposes helps in identifying the receipt in future queries.

- VAT or Tax Identification Number: This is particularly important for businesses that are required to provide VAT details.

- Return or Refund Policy: Briefly outline the conditions under which a return or refund can be processed.

When creating documents within the aviation sector, clarity and consistency are key. Use standardized formats to ensure documents are universally understandable. All documents should follow a clean, structured layout that includes clear headings, consistent font styles, and uniform margins. This standardization simplifies communication and maintains professionalism.

Text should be formatted with legible fonts such as Arial or Times New Roman, sized between 10 and 12 points. Ensure there is adequate spacing between lines to enhance readability. Always align text to the left, as this makes it easier for readers to follow the content.

Headings must be concise and informative. They should be consistent in size, style, and hierarchy, with larger fonts for main titles and progressively smaller fonts for subheadings. Each section should begin with a clear title, followed by relevant information or data, keeping paragraphs short and direct.

For important details, like dates, times, or aircraft specifications, use bold formatting to highlight these key elements without overcrowding the document. Bullet points and numbered lists are useful for presenting items clearly and concisely.

Ensure there is a header and footer on each page containing essential details, such as document title, version number, and date. This helps maintain organization across all pages. If the document is particularly long, include a table of contents for easy navigation.

In aviation documents, accuracy is critical. Double-check all data, especially technical details, to avoid errors that could impact safety or operations. Consistent formatting paired with accuracy creates trust and professionalism in all communications.

Examine the receipt for clear signs of authenticity, such as a unique receipt number, the date and time of issue, and a specific payment reference or transaction ID. These details help confirm the receipt’s legitimacy.

Check the company’s name and contact details on the receipt. Compare them with the official details listed on the company’s website or official documents to ensure they match.

Look for official branding elements like logos, watermarks, or other security features that the company may include on its receipts to prevent fraud.

If available, cross-check the amount and items listed on the receipt against your purchase or service records. Any discrepancies should be addressed immediately.

Confirm the method of payment, whether it is a credit card, cash, or online transaction, as some companies may issue different types of receipts for different payment methods.

If in doubt, contact the business directly using their official contact details to verify the receipt’s authenticity.

Adapt the receipt template to fit the specific needs of different transaction types. Ensure that the layout accommodates distinct transaction categories, such as sales, refunds, and deposits, with appropriate sections for each. For example, a refund transaction might require additional space to show the refunded amount, reason for the refund, and method of reimbursement, whereas a sales transaction focuses on product details, taxes, and total price.

Incorporating Payment Methods

Include a section for various payment methods such as credit card, cash, or bank transfer. Adjust this area based on the transaction type to reflect the correct payment mode used. For instance, if the payment was made via credit card, the receipt could list the last four digits of the card number, while cash payments may simply state “Paid in Cash.” This customization ensures the receipt accurately represents the transaction.

Adding Discounts and Taxes

For sales transactions involving discounts, include a clear breakdown of discounts applied and the final price after the discount. Similarly, ensure tax calculations are clearly displayed, with separate sections for applicable tax rates and the total tax amount. Customize these areas based on local tax laws and any promotional offers applied to the transaction.

Ensure that all receipts comply with local tax laws and regulations. The details on the receipt must include the company’s registered name, tax identification number (TIN), and a breakdown of the goods or services purchased. This ensures transparency and provides clear records for audits.

For accounting purposes, receipts should clearly itemize the amount paid, including any applicable taxes such as VAT. This allows businesses to maintain accurate financial records and meet tax reporting requirements. It’s also critical to keep all receipts organized for easy access in case of tax audits or financial reviews.

Keep in mind that receipts serve as a legal document in disputes. The accuracy of the information, such as the date of the transaction and the amount paid, can be crucial for resolving legal matters. Businesses should retain copies for a prescribed period, often 5 to 7 years, as required by tax authorities.

Additionally, consider using automated receipt generation systems. These systems reduce human error and ensure that all necessary information is included. Proper documentation not only supports financial accuracy but also protects businesses legally in case of disputes or investigations.

To create a clear and accurate receipt template for Aviation Business Ltd at Piarco, structure your document in a way that reflects all necessary transaction details, with easy-to-read sections. Follow this format:

Receipt Information

| Description | Amount |

|---|---|

| Service Type | Specify the service or product provided |

| Date of Service | Include the date of transaction |

| Transaction ID | Unique identifier for the transaction |

| Total Amount | Sum of all charges, including applicable taxes |

Ensure that the template includes spaces for all necessary fields, especially the transaction number, date, and details of the services provided. This will guarantee a professional, clean, and organized receipt every time.