Key Elements of a Donation Receipt

A well-structured donation receipt is vital for both the donor and the organization. It serves as proof of the donation for tax purposes and helps maintain transparency. Ensure your receipt includes the following:

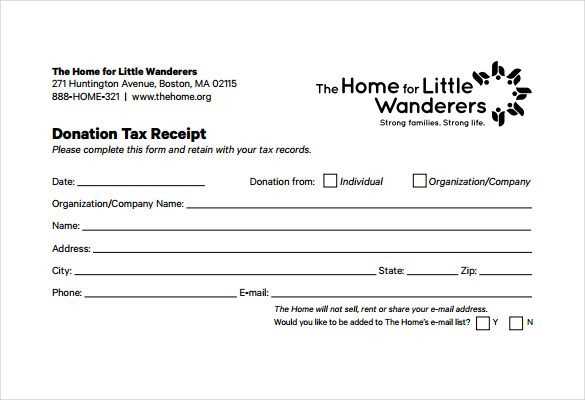

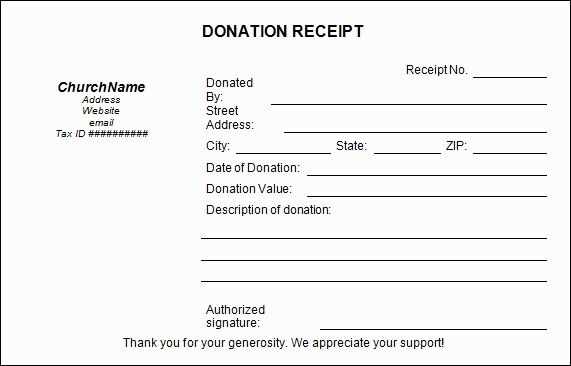

- Donor Information: Name, address, and contact details of the donor.

- Organization Information: Name, address, and contact details of the receiving organization, along with its tax identification number.

- Date of Donation: The exact date the donation was made.

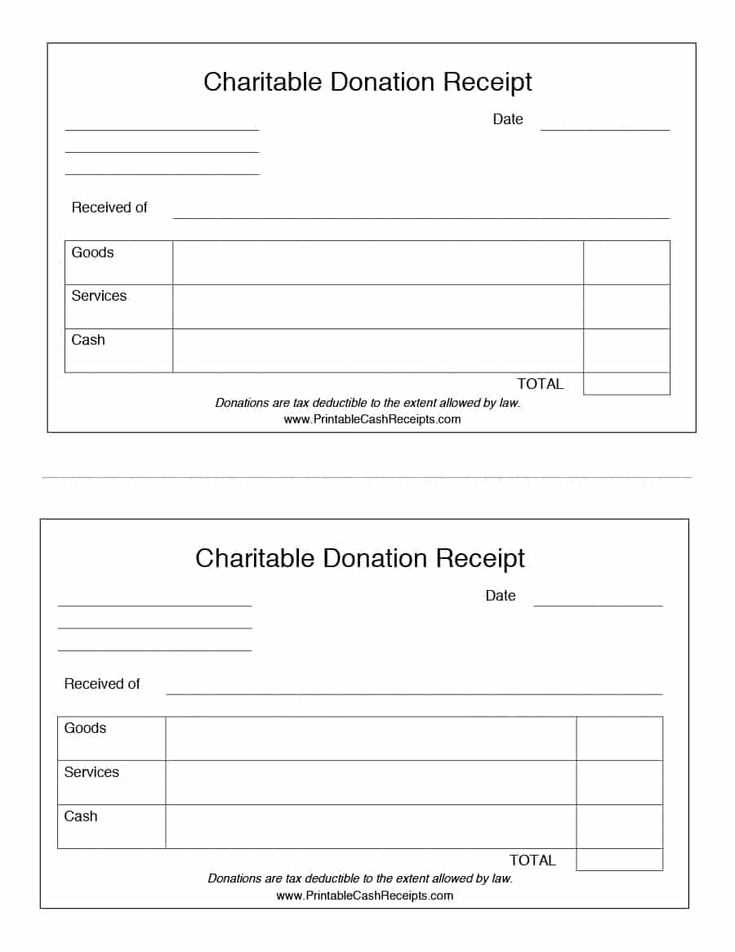

- Description of Donation: A clear description of the donated items or monetary value.

- Value of Donation: Fair market value of the items donated or the amount donated.

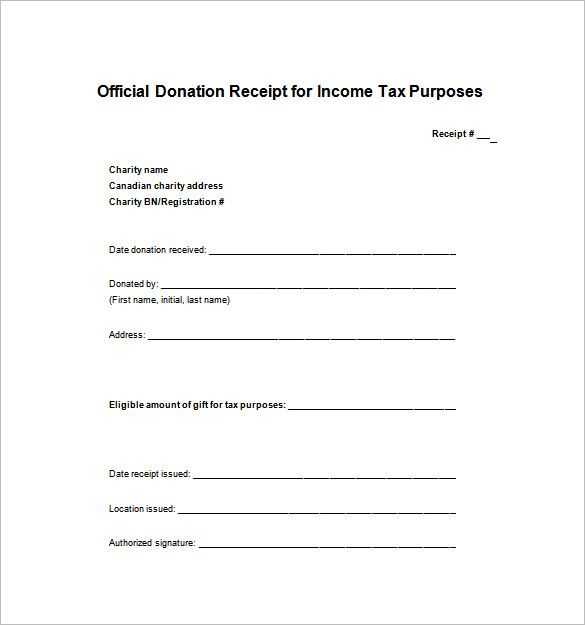

- Signature: A signature from an authorized person in the organization.

Template Example

Use the following template as a guide to create your donation receipt:

FAITH FARM [Organization Address] [City, State, Zip Code] [Phone Number] [Email Address] [Tax ID Number] Donation Receipt Date: [Insert Date] Donor Name: [Insert Donor Name] Address: [Insert Donor Address] Contact: [Insert Donor Contact] Description of Donation: [Insert Description] Value: $[Insert Value] Thank you for your generous support! Authorized Signature: ______________________

Additional Tips

- Keep Copies: Maintain copies of all receipts for your records.

- Send Timely Receipts: Provide receipts promptly after receiving donations.

- Follow Up: Consider sending a thank-you note to enhance donor relationships.

Conclusion

Creating a clear and concise donation receipt helps streamline the donation process and fosters trust between donors and organizations. Use this template and recommendations to ensure you meet all necessary requirements.

Faith Farm Donation Receipt Template

Key Details to Include in a Contribution Receipt

Formatting Tips for a Clear and Readable Document

Legal Aspects and Compliance Standards

How to Obtain a Receipt from Faith Farm

Adapting the Template for Various Donations

Digital or Paper: Advantages and Drawbacks

Ensure your donation receipt includes the donor’s name, address, date of the donation, the amount donated, and a description of the items or services given, if applicable. Include the Faith Farm’s official name, address, and tax-exempt status to comply with IRS regulations. A clear statement confirming that no goods or services were provided in exchange for the donation can also be important for tax purposes.

Keep the format simple. Use a legible font and avoid clutter. Break down key information into clear sections, such as the donor’s details, the donation information, and a summary at the bottom. This makes it easier to read and reference later. Leave space between sections for a cleaner look.

When preparing the donation receipt, ensure it aligns with IRS guidelines for non-profit receipts. Faith Farm must confirm its 501(c)(3) status and the receipt must include an appropriate disclaimer for tax deductions. Review current tax laws regularly to ensure your receipt meets all compliance requirements.

To obtain a receipt from Faith Farm, simply request one after making a donation. Many non-profits like Faith Farm will issue receipts automatically for donations above a certain amount. If you need a receipt for a smaller donation, it’s recommended to ask the organization directly.

Adapt the receipt template depending on the type of donation. Monetary donations should include a monetary amount and date, while in-kind donations should describe the items donated with estimated values where possible. Adjustments may also be made for special donations, like recurring donations, to ensure accurate record-keeping.

Choosing between a digital or paper receipt depends on personal preference. Digital receipts are easy to store and can be emailed immediately, but paper receipts may be preferred for physical record-keeping. Both formats have their pros and cons depending on the donor’s needs and the organization’s resources.