Choose the Right Format

A well-structured receipt template simplifies transactions and record-keeping. Select a format based on your needs:

- PDF: Ideal for fixed-layout receipts with a professional look.

- Excel: Allows easy calculations and customization.

- Word: Suitable for editable text-based receipts.

- Google Docs: Best for collaboration and cloud access.

Essential Elements to Include

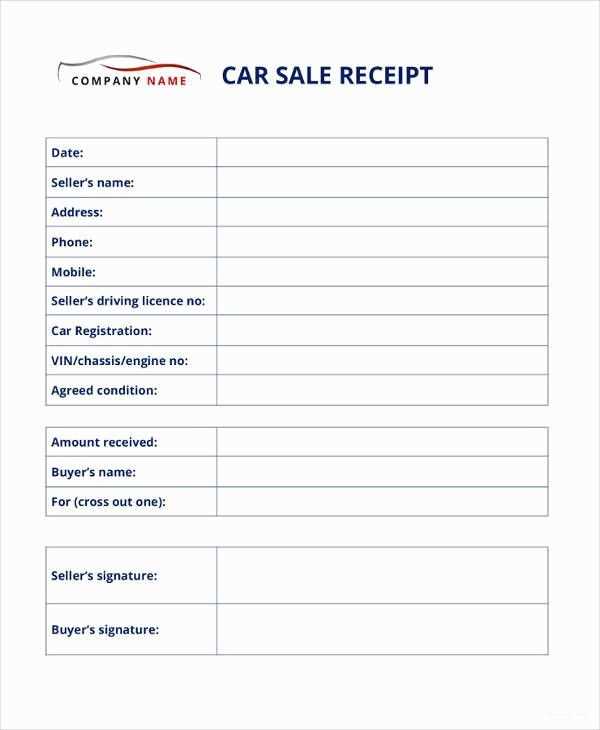

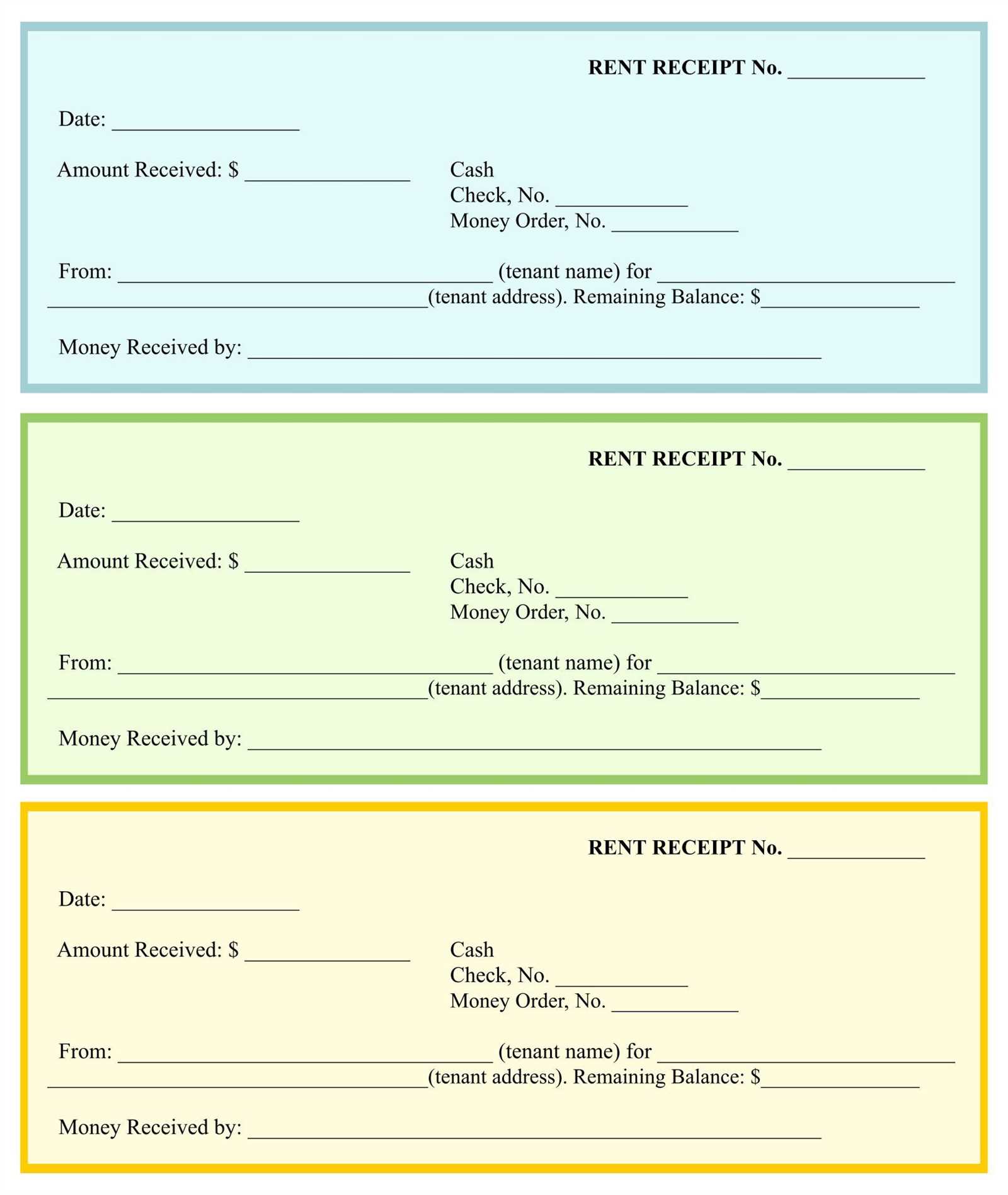

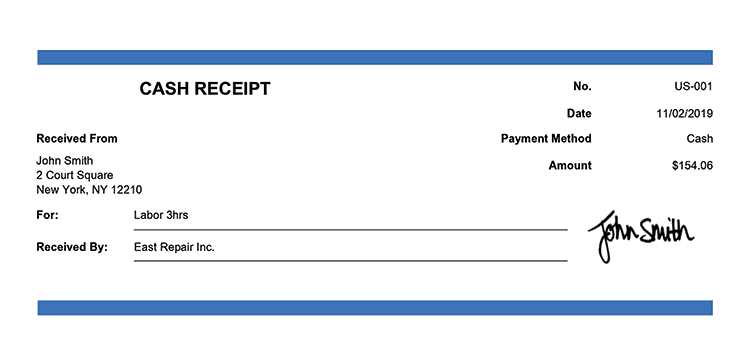

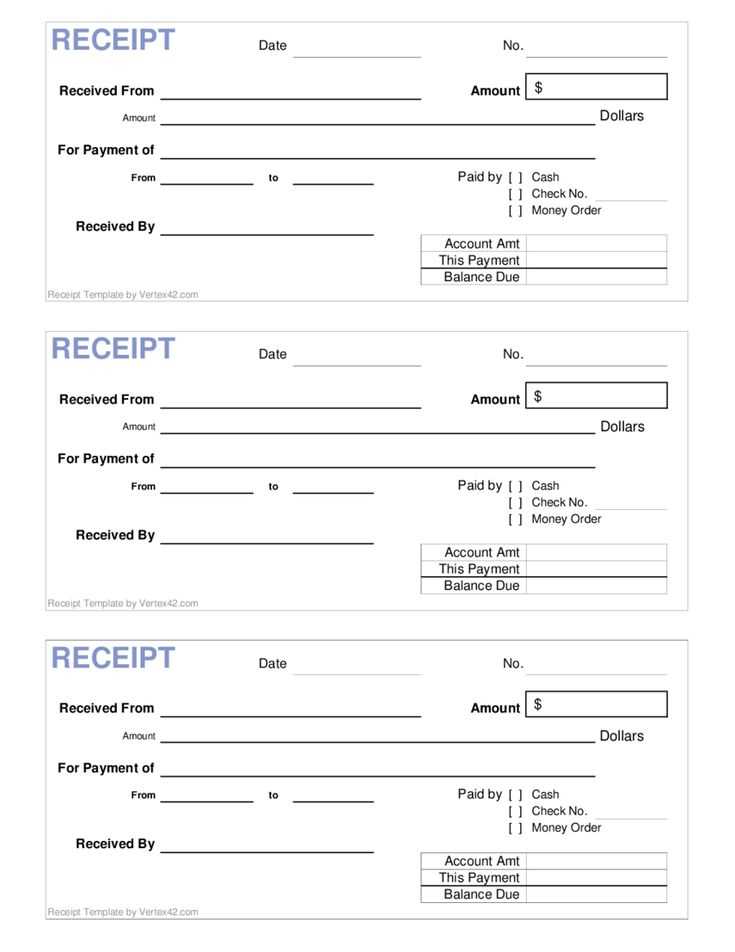

Ensure your receipt covers all necessary details:

- Business Name & Contact: Include a logo, address, phone, and email.

- Date & Receipt Number: Helps in tracking transactions.

- Customer Details: Name and contact for reference.

- Itemized List: Describe each item or service with price and quantity.

- Subtotal, Tax & Total: Provide a clear breakdown of charges.

- Payment Method: Specify cash, credit card, or digital payment.

- Terms & Notes: Add refund policies or special instructions.

Automate with Templates

Using ready-made templates speeds up the process. Many platforms offer pre-designed receipts with automated calculations and branding options. Modify them as needed and save time on repetitive tasks.

Cloud Storage & Accessibility

Storing receipts in Google Drive, Dropbox, or a similar service ensures easy retrieval and organization. Share access with your team or clients while keeping everything secure and backed up.

Receipt Template Drive

Choosing the Right Format for Your Receipt

Key Elements Every Receipt Should Include

Customizing Templates for Different Business Needs

How to Automate Generation Using Templates

Ensuring Compliance with Legal and Accounting Standards

Best Tools and Platforms for Storing and Sharing

Select a format based on your business needs. Use PDF or image formats for clear and professional presentations. Consider using CSV or Excel for businesses that need to process large volumes of data, as these formats allow for easy integration with accounting systems.

Include the transaction date, business details (name, address, contact), itemized list of products or services, amounts, taxes, and payment method. Ensure there’s a clear total amount paid and any applicable terms, such as return policies or service warranties.

Adapt templates to fit different sectors. For retail, an itemized list of goods or services is vital. Service-based businesses should focus on hours worked and service descriptions. For subscription models, include billing cycles and recurring charges. Each template should align with your business type and customer expectations.

Automate receipt generation by linking templates to your POS or accounting system. Integration allows automatic population of customer details, purchase information, and payment method. This reduces human error and streamlines processes, ensuring consistency with each transaction.

Stay compliant with legal and accounting standards. Ensure all required tax rates are included and that your receipt follows local regulations regarding VAT or sales tax. Many countries also require businesses to include a unique invoice number, so integrate this into your template design.

Use cloud storage platforms like Google Drive or OneDrive for easy storage and sharing. For more advanced management, consider platforms like QuickBooks or Zoho, which allow you to store receipts, customize templates, and share them with clients or your accounting team seamlessly.