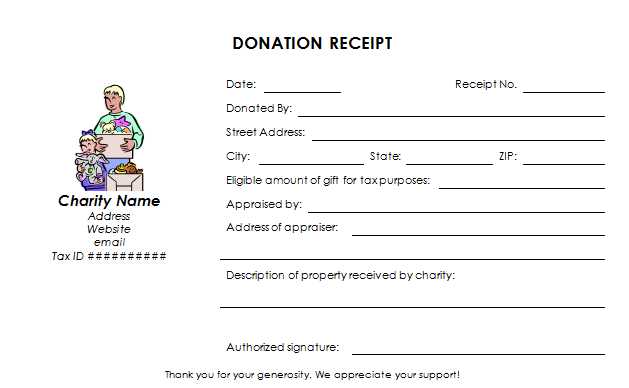

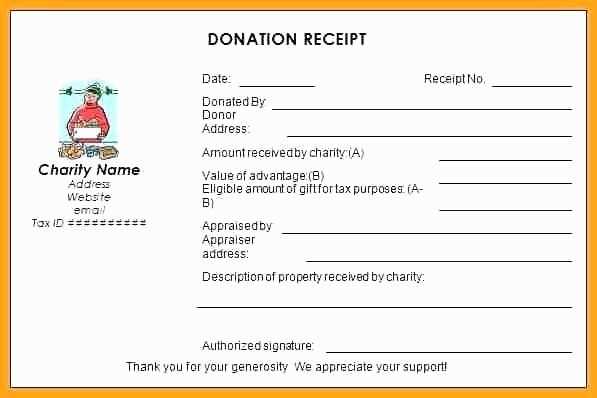

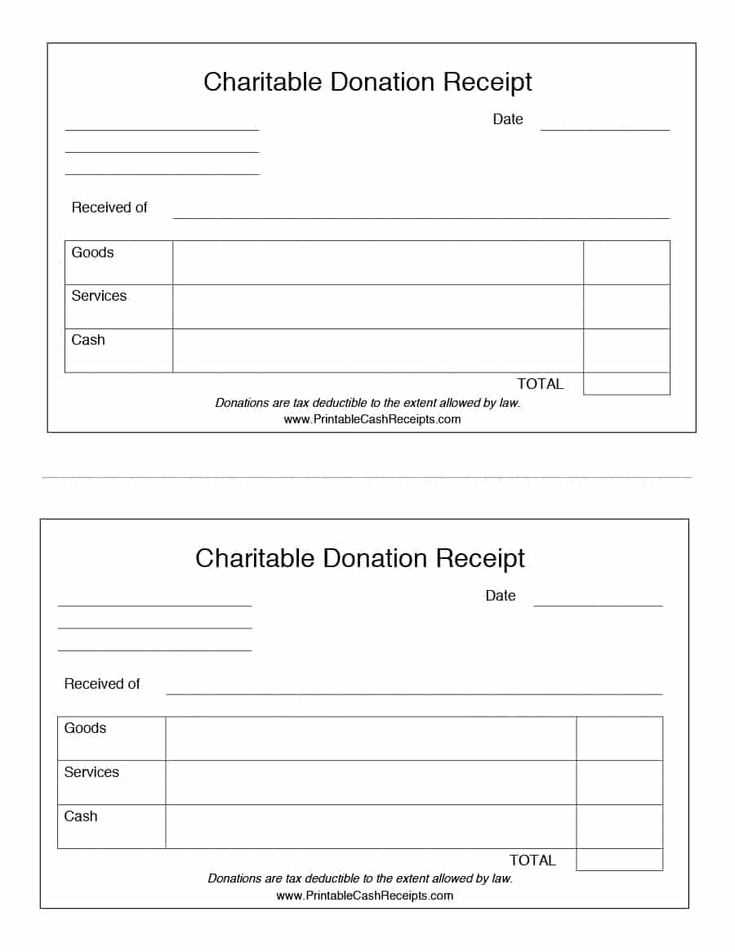

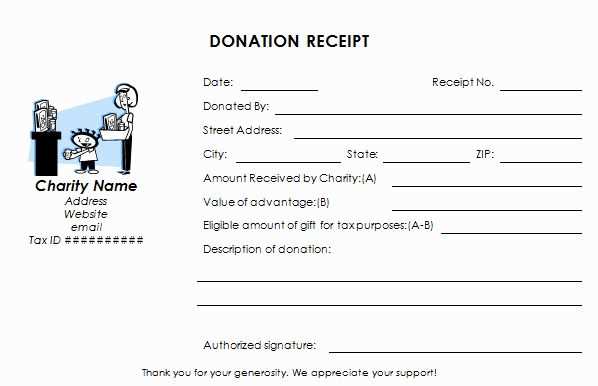

Creating a year-end donation receipt for your charitable contributions ensures transparency and makes tax filing easier. Make sure the document includes the donor’s name, donation amount, and the date of the contribution. Additionally, confirm whether the donation was cash, goods, or services, as this affects the tax-deductibility.

Include the organization’s name, address, and tax-exempt status. This establishes that the recipient is a registered charity. If the donation was in kind, describe the items donated and, if possible, estimate their fair market value. While cash donations are straightforward, non-cash items should be clearly listed to avoid any confusion.

Be precise with the donation amount. For cash gifts, list the exact sum donated. For goods, ensure that the description matches the donor’s records. The template should also state whether any goods or services were provided in exchange for the donation, as this impacts the amount that can be deducted.

A well-structured year-end receipt not only supports tax claims but also builds trust between donors and your organization. Keep it simple, clear, and accurate to meet both the legal requirements and the needs of your donors.

Year End Donation Receipt Template

A year-end donation receipt must contain specific details to ensure both donors and organizations comply with tax regulations. It is a formal acknowledgment of a contribution, helping the donor claim tax deductions. A clear, concise receipt protects both the giver and the recipient of donations.

Key Elements of the Template

Ensure the receipt includes:

- Organization Name: Clearly state the name of the charity or organization.

- Address: Include the organization’s full address for official purposes.

- Donor’s Information: Full name and contact details of the donor.

- Date of Donation: Record the exact date the donation was received.

- Donation Amount: Specify the monetary value or the description of the donated goods.

- Statement of Goods/Services: If applicable, state any goods or services provided in exchange for the donation. If none, indicate that the contribution is fully tax-deductible.

- Tax ID Number: Include the organization’s tax-exempt identification number for verification.

Additional Tips for Clarity

Ensure that the receipt is clear and easy to read. Use legible fonts, and ensure the donation amount is highlighted. Provide all required details, especially the value of non-cash donations, to avoid confusion. Be specific about any restrictions tied to the donation, such as funds designated for a particular program or event.

Customizing the Template for Different Donation Types

Adjust your donation receipt template to fit the specific type of contribution, ensuring it reflects the nature of the donation. Tailoring the template ensures clear documentation for tax purposes and transparency for both the donor and the recipient organization.

Monetary Donations

For cash or credit card donations, clearly state the exact amount contributed. Include the payment method used, whether by cash, check, or online transaction. This helps the donor confirm the transaction details. You may also wish to add the donor’s name, donation date, and any relevant reference numbers.

In-Kind Donations

For non-cash contributions, such as goods or services, describe the donated items in detail. If possible, estimate their fair market value. The donor should understand the item’s value for tax deductions. If applicable, note if the organization is unable to assign a value to the donation.

| Donation Type | Details to Include |

|---|---|

| Monetary Donations | Amount, Payment Method, Donor Name, Transaction Reference Number |

| In-Kind Donations | Item Description, Estimated Value, Donor Name |

Legal Requirements for Year-End Donation Receipts

To comply with tax regulations, year-end donation receipts must include specific details. Without these elements, donors may face challenges in claiming tax deductions.

Key Information to Include

- Organization’s Name and Address: Clearly state the full legal name and address of the nonprofit organization.

- Donor’s Name: Include the name of the individual or entity making the donation.

- Donation Date: Specify the exact date the donation was received.

- Amount or Description of Donation: For cash donations, list the amount. For non-cash donations, provide a detailed description of the items or services donated.

- Statement of Goods or Services: If any goods or services were exchanged, include a statement outlining their value. This ensures transparency for the donor’s tax filing.

- Tax-Exempt Status: Indicate the organization’s tax-exempt status, typically with a statement like, “A tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code.”

Additional Requirements

- Good Faith Estimate for Non-Cash Donations: For donations exceeding a certain value, it is necessary to provide a good faith estimate of the fair market value of non-cash items.

- Required IRS Statement: If the donor receives anything in return for their donation, include a statement that specifies whether the donation is fully tax-deductible or if it needs to be adjusted due to the benefit received.

How to Include Donor Information Properly

Ensure donor information is accurate and clear to maintain transparency and trust. Start with the donor’s full name, address, and contact details. This allows for easy identification and follow-up if necessary. Make sure to match the information provided by the donor with the details you have in your records.

Key Donor Information to Include

- Name: Full name of the donor, including any prefixes or titles (e.g., Dr., Mrs.).

- Address: Include the donor’s street address, city, state, and zip code.

- Contact Information: Include a phone number or email address for any future communication.

- Donation Amount: Clearly state the exact amount donated, whether it is in monetary terms or non-cash donations.

- Date of Donation: Indicate the exact date of the donation for record-keeping purposes.

Additional Tips for Clarity

- Double-check spelling, especially for names and addresses.

- Use consistent formats for dates and amounts to avoid confusion.

- Provide an easy-to-read summary of the donation for reference.

- If the donation is restricted, specify the purpose or fund the donor supports.

Key Dates to Feature on the Receipt

Include the donation date clearly on the receipt. This is the day the donor made the contribution and should be visible for reference during tax filing. If the donation was made in December but processed in January, ensure the date of the transaction reflects the actual donation date.

Donation Receipt Date

The date on which the receipt is issued must be listed separately. This date could be different from the donation date, especially if the receipt is issued at a later time for record-keeping purposes. It is vital to distinguish between these dates for tax and organizational tracking purposes.

Tax Year Cut-off Date

State clearly whether the donation applies to the current or previous tax year. If the donation occurs near the year’s end, make it obvious which year it counts toward. This will assist donors when calculating their tax deductions and avoid confusion regarding tax filing deadlines.

By including these dates accurately, you ensure both transparency and ease for the donor in managing their donations.

Design Tips for a Professional Appearance

Choose a clean, uncluttered layout to enhance readability. Limit the use of bold and italics to emphasize key details, such as the donation amount or donor name. Keep font choices simple and consistent–serif fonts for the header and sans-serif for the body text. This contrast helps create a balanced and easy-to-read document.

Use White Space Wisely

White space helps the recipient focus on important details. Avoid crowding the page with too much text or too many images. Leave margins wide and ensure there’s enough space between sections, like the donor’s information and the donation details.

Color and Branding

Incorporate your organization’s brand colors subtly in the header or footer. Stick to two or three complementary colors. Avoid using too many bright colors or overly complex color schemes that can distract from the document’s purpose.

Common Mistakes to Avoid When Issuing Receipts

Make sure the donation amount is clear and correctly listed. Avoid rounding off or leaving out decimals that could confuse the donor about the exact contribution.

Missing Donor Information

Ensure the donor’s full name and address are properly recorded. Inaccurate or incomplete contact details can create confusion for both your organization and the donor, especially during tax season.

Incorrect Dates

Always verify that the date of donation is accurate. A common mistake is using the date the receipt is issued rather than the date the donation was actually made. This can lead to tax discrepancies.

Don’t forget to include the official name of your organization. An unclear or incomplete organization name can make the receipt invalid for tax purposes.

Lastly, ensure all required legal disclaimers are included. Some regions require specific language about your nonprofit status or tax-exempt organization. Missing this information may invalidate the receipt for the donor’s records.