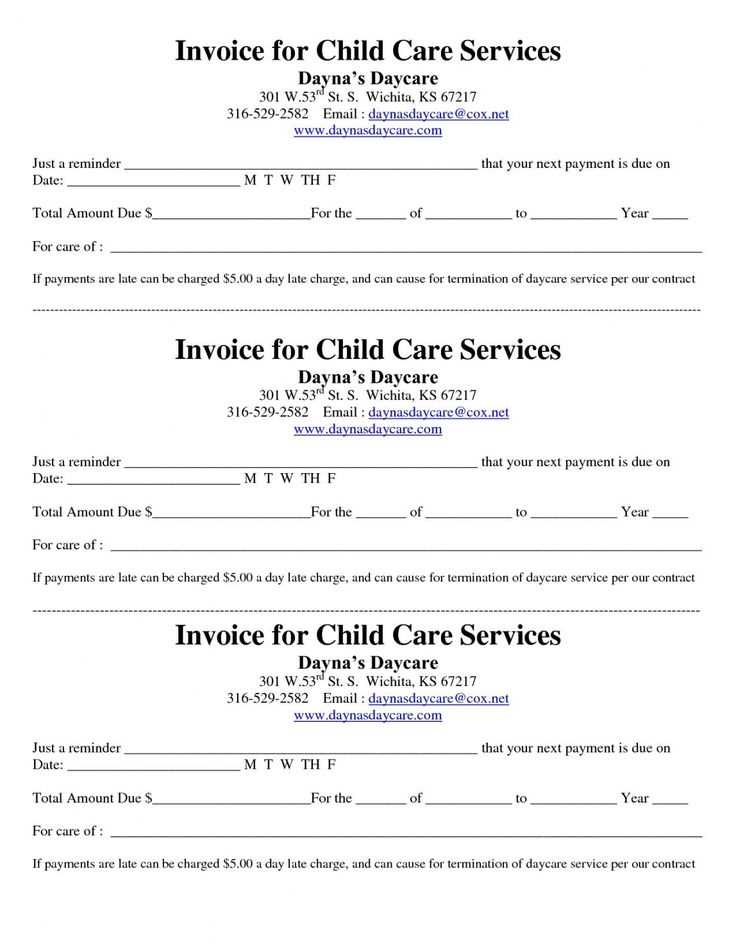

A well-organized child care receipt is a must-have for tracking payments and ensuring smooth financial management. A printable receipt template can simplify this task, providing a quick and professional solution. It helps both parents and child care providers keep accurate records for tax purposes and reimbursements.

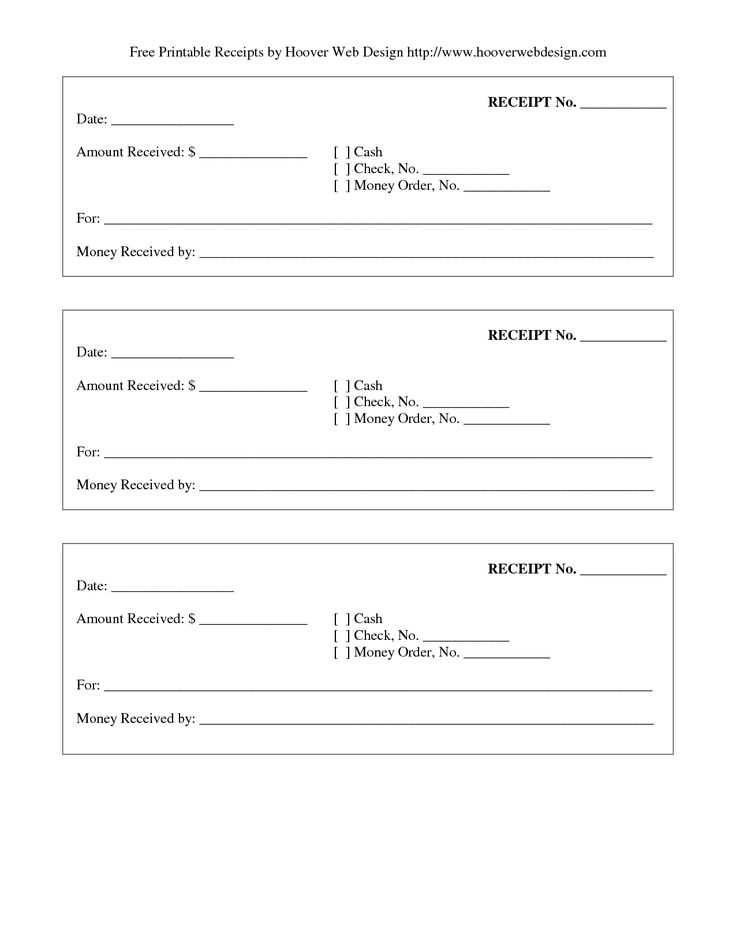

Using a child care receipt template saves time and ensures consistency. You can easily fill in details such as the service date, hours worked, total amount paid, and payment method. This structured format helps prevent mistakes and creates a clear paper trail for any future reference.

If you’re a child care provider, offering a printed receipt after each payment reassures clients and builds trust. For parents, having a receipt helps manage budgets and provides proof of expenses, which can be important for tax deductions or employer reimbursement programs.

Ensure the template you use includes all relevant details: provider’s name, address, and contact information, as well as the child’s name and the service provided. Having this information clearly laid out will prevent confusion and ensure both parties stay on the same page.

Here’s the corrected version:

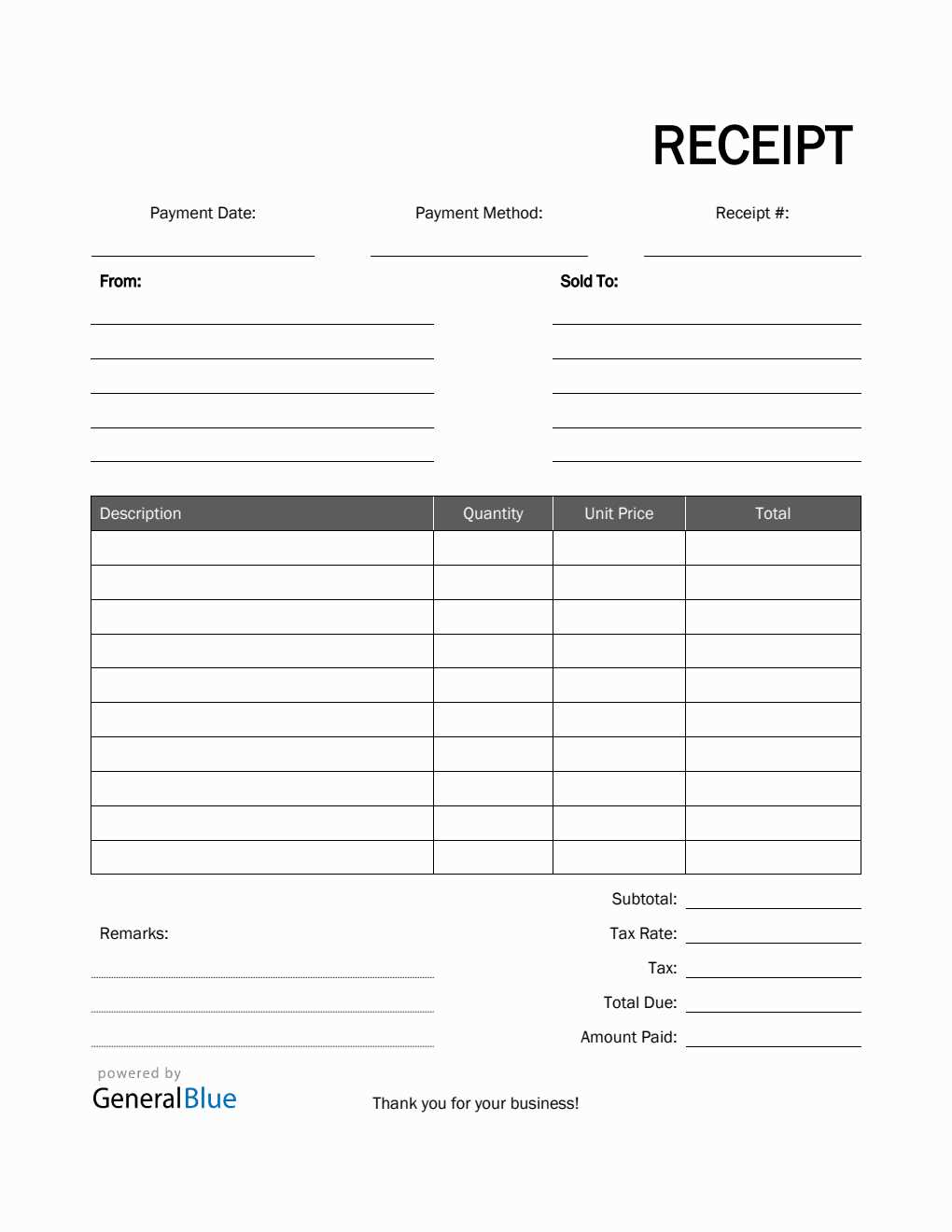

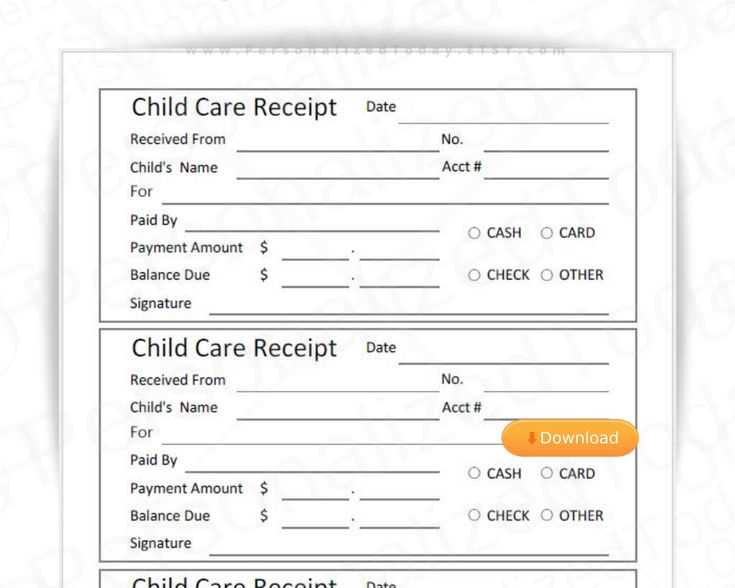

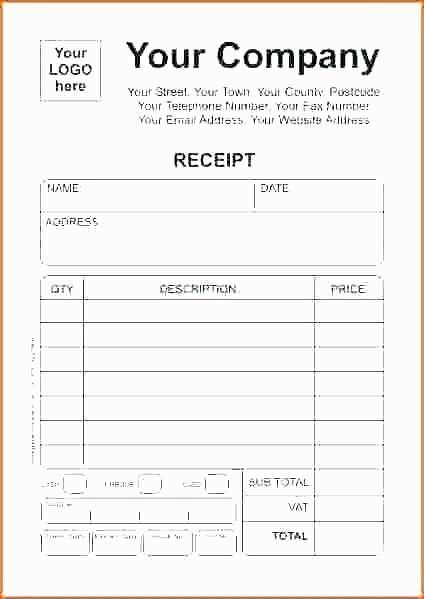

For a clear and professional child care receipt template, follow this structure to ensure it includes all necessary details. A well-organized receipt will help both the provider and the parent track payments effectively.

Key Elements to Include:

- Provider Information: Include the full name, address, phone number, and email of the child care provider.

- Parent/Guardian Information: The parent’s name and contact information should be listed clearly.

- Service Details: Mention the type of care provided, such as “full-time” or “part-time”, along with the child’s name and the period for which the care was given.

- Payment Information: Specify the total amount paid, the payment method, and the date the payment was made.

- Signature: A place for the provider’s signature to confirm the payment received and services rendered.

Additional Tips:

- Keep the template simple and uncluttered. Use a clean, readable font for easy printing.

- If the payment is recurring, include a section for the next due date and amount to make future transactions clearer.

- Ensure all details are correct, especially dates and amounts, to avoid confusion.

- Printable Child Care Receipt Template

A printable child care receipt template can streamline the process of keeping track of payments for child care services. It offers both parents and providers an organized, professional way to document transactions. When creating or using a template, make sure to include the essential details: provider name, child’s name, dates of care, service fees, and payment method. These components ensure clarity and accuracy for both parties involved.

Key Information to Include

Ensure the template includes fields for the provider’s name and contact details, the parent’s name, and the child’s name. Include the dates of service to specify the exact period for which payment is being made. Clearly outline the cost per day or hour, as well as any discounts or additional charges, to avoid confusion. Finally, provide space to document the payment method, whether it’s by check, credit card, or another form.

Customization Tips

Customize the template to fit the needs of your specific child care situation. For example, if the provider offers special services, like transportation or extended hours, include sections for those details. Adjust the layout to ensure the information is easy to read and well-organized. A printable template allows for flexibility in design while maintaining professionalism and functionality.

To tailor a child care receipt, focus on key elements relevant to your situation. Start with your business details: include your name, business name, and contact information. This ensures the receipt is clear and professional. Next, list the child care services provided with specific dates and times, reflecting your operational hours. This helps both you and your client track attendance accurately.

Customize the pricing section by detailing hourly rates or flat fees per session. If applicable, include any additional charges like transportation, special activities, or meals. Transparency in cost breakdowns minimizes confusion. Make sure to add payment method options and the total amount due or paid, specifying if any deposits were made earlier.

For a personalized touch, consider adding a unique receipt number for each transaction. This makes it easier to manage records and helps both you and your clients keep track of payments for tax purposes.

Lastly, include a section for both your signature and your client’s. This serves as an acknowledgment of the transaction and adds a layer of professionalism.

| Service Description | Date | Hours | Rate | Total |

|---|---|---|---|---|

| Child Care – Full Day | Feb 1, 2025 | 8:00 AM – 4:00 PM | $15/hr | $120 |

| Meal Charge | Feb 1, 2025 | – | – | $10 |

| Total | $130 | |||

A printable child care receipt should provide clear and concise information for both the provider and the client. These are the key elements you need to include:

1. Provider Information

Include the name of the childcare provider or business, address, phone number, and email. This ensures the receipt is identifiable and contactable if any questions arise.

2. Client Information

Include the parent’s name and address. This helps distinguish between clients and makes the receipt traceable to the right individual.

3. Date of Service

The receipt should clearly show the date or dates of service provided. This prevents any confusion and gives a reference for future inquiries.

4. Description of Services

List the type of childcare services provided, such as “full-day care,” “after-school care,” or “weekend care.” If any special services or activities were provided, be sure to specify them.

5. Payment Details

Include the total amount charged, the payment method (cash, check, credit card), and any discounts or adjustments. It’s helpful to break down the costs if applicable, such as hourly rates or fees for extra services.

6. Receipt Number

Assign a unique receipt number for each transaction. This helps with organizing and referencing payments in the future.

7. Provider’s Signature (Optional)

A signature, though not always required, can be added for validation and to give the receipt a formal touch. It’s helpful for clients who may need to show the receipt for tax or reimbursement purposes.

Incorporating these elements ensures the receipt is not only functional but also legally sound and professional for both parties involved.

1. Open your child care receipt template on your computer or online platform.

2. Fill in the required fields, such as your name, child care provider’s name, address, payment dates, and the total amount paid. Ensure all details are accurate and up to date.

3. Double-check for any missing information or errors in the receipt. Mistakes can cause issues with tax filing or reimbursement processes.

4. Once everything is complete, save the document on your computer to keep a backup for future reference.

5. Click the “Print” button on your printer settings to begin the printing process. If you are using a PDF template, select “Print” after opening the document in a PDF reader.

6. Choose the printer you wish to use and adjust the print settings, such as page orientation and paper size, if necessary. Select “Print” to produce a hard copy of your receipt.

7. Keep a printed copy for your records, and if required, submit a copy to your tax preparer, or to your employer for reimbursement, depending on the purpose of the receipt.

8. If needed, share the digital version via email or upload it to your financial management system for ease of tracking expenses.

Keep your receipts organized digitally or physically to ensure easy access during tax season. For digital storage, scan your receipts or take photos with a smartphone. Store them in cloud-based services like Google Drive or Dropbox, creating separate folders for each year or category. This way, you can easily track your expenses and find them when needed.

For physical receipts, use a dedicated folder or filing system. Group receipts by category, such as daycare or medical expenses, and organize them chronologically. A file box or expandable folder can help with this. Ensure the receipts are legible, as fading ink can cause issues later. If needed, consider making photocopies to preserve clarity.

If you’re unsure how long to keep receipts, hold on to them for at least three years. The IRS can audit your returns for this period, and having all receipts on hand ensures you’re prepared. After the three-year mark, you can discard most receipts unless they are tied to a property or asset you still own.

Label each receipt clearly with the date, amount, and purpose of the expense. This can be done digitally by renaming files or using notes in cloud storage. For physical receipts, write the necessary details on the back of each one. This extra step makes referencing your documents faster and smoother when tax time arrives.

Double-check the date on the receipt to ensure it matches the actual transaction date. Incorrect dates can lead to confusion or even disputes regarding payment records.

Always fill in the total amount paid and make sure it’s accurate. A small mistake in the total can cause significant issues, especially when clients need to report payments for tax purposes.

Be precise with the payer’s information. Ensure the name and address are spelled correctly and match the records. Any discrepancies could make the receipt invalid.

List all services or products separately with their correct amounts. Avoid lumping everything together under one line. This way, clients can clearly understand what they’re being charged for.

Leave no field blank. If a particular section doesn’t apply, mark it as “N/A” instead of leaving it empty. This prevents any confusion later on.

Use a consistent format throughout the receipt. Avoid changing fonts, styles, or sizes, as this can make the document appear unprofessional and harder to read.

Make sure you’re including all required tax information if applicable. Failing to include tax rates or totals could lead to issues with legal compliance.

Verify that the payment method is correctly stated. Whether the payment was made via cash, check, or credit card, it’s important to note this for accurate record-keeping.

Creating child care receipt templates can be straightforward with the right tools. Below are some of the best options for crafting professional and customized receipts quickly.

- Canva: Canva offers an easy-to-use interface for creating custom child care receipts. With drag-and-drop features, users can design receipts with logos, colors, and personal details. It also provides templates specifically tailored for service receipts, which can be adapted for child care purposes.

- Microsoft Word: Microsoft Word remains a reliable tool for creating receipt templates. It offers pre-designed receipt templates that you can modify for child care services. The flexibility of editing text, adding tables, and inserting images makes it a solid choice for those familiar with Word.

- Google Docs: For those who prefer cloud-based solutions, Google Docs is an excellent option. Its built-in templates are easy to use, and it’s accessible from anywhere. You can also share and store your receipts in the cloud, making them easy to manage.

- Zoho Invoice: Zoho Invoice is a specialized tool designed for creating professional invoices and receipts. While it is primarily an invoicing platform, its receipt templates can be easily adapted for child care services. Features like recurring payments and customizable fields are useful for long-term child care contracts.

- Receipt Generator by FreshBooks: FreshBooks provides a straightforward receipt generator that is simple and intuitive. While the platform is typically used for invoicing, the receipt feature allows you to input essential details like date, services, and amounts, making it ideal for creating child care receipts.

- Adobe Spark: Adobe Spark is perfect for those who want to create highly polished and visually appealing receipts. With its wide range of templates, you can easily craft a receipt that reflects your child care business’s style. Customization options include fonts, logos, and colors to match your branding.

- Wave Accounting: Wave is an all-in-one accounting software with a free receipt generator. It’s especially useful for small businesses, including child care providers. Users can create receipts, track payments, and manage finances with ease in one platform.

These tools make it easy to create receipts tailored to your child care service, ensuring a professional and organized approach to client billing.

Printable Child Care Receipt Template

Use a printable child care receipt template to streamline your documentation process. Ensure the template includes the provider’s name, address, and contact information, as well as the child’s name, the dates of care, and the total amount paid. Clearly specify the payment method, whether it’s cash, check, or electronic transfer. Be sure to list any applicable taxes, fees, or discounts to avoid confusion. A detailed breakdown helps both the provider and the parent keep accurate records for tax purposes and reimbursements. Always keep a copy for your own reference and encourage your provider to do the same for their records.

Design a template that is easy to fill out, ideally with pre-defined fields for all necessary information. This prevents forgetting key details and ensures consistency in receipts across different time periods. Make sure the template is printer-friendly to ensure legibility, and save it as a PDF for easy sharing via email or hard copy. Customizing the template to your specific needs–whether for daily, weekly, or monthly billing–will also save time and minimize errors in payment tracking.