If you’re looking to manage your business transactions efficiently, using a cash receipts journal template is a smart move. This template is particularly helpful for businesses in South Africa, as it aligns with local accounting practices, helping to track incoming cash flows seamlessly. With a well-organized template, you can record every cash receipt from sales, loans, or any other source of income.

The cash receipts journal simplifies tracking cash transactions, enabling you to reconcile your records easily. Each entry should include details such as the date of the transaction, source, amount received, and the account affected. With this template, you can streamline your bookkeeping, ensuring that all cash receipts are accurately documented and categorized for financial reporting.

For businesses operating in South Africa, it’s crucial to adhere to local regulations, such as VAT reporting requirements. This template can also be customized to track VAT on received payments, which makes it easier to stay compliant with South African Revenue Service (SARS) rules. By maintaining organized records, you can reduce errors and avoid potential fines or audits.

Here’s the corrected version:

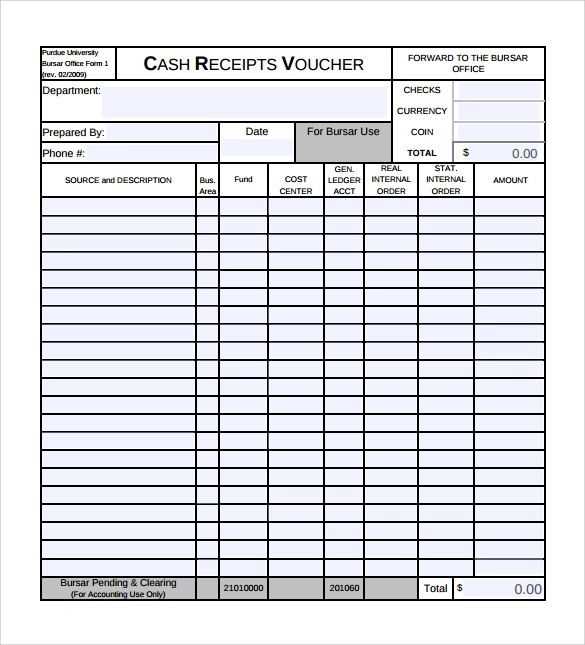

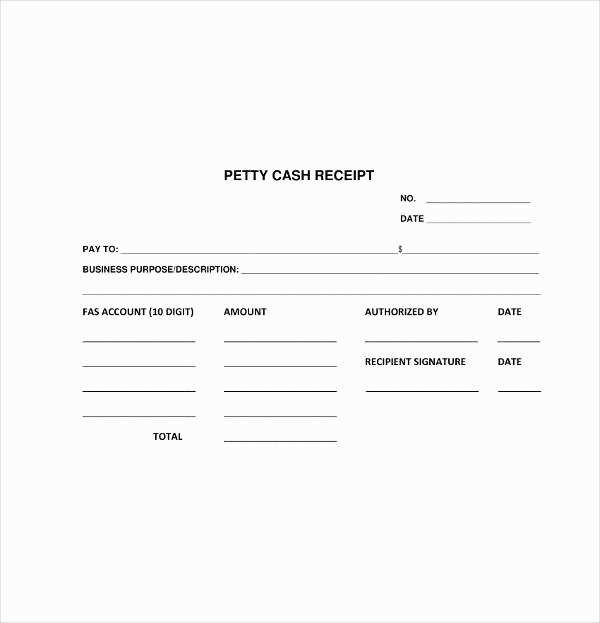

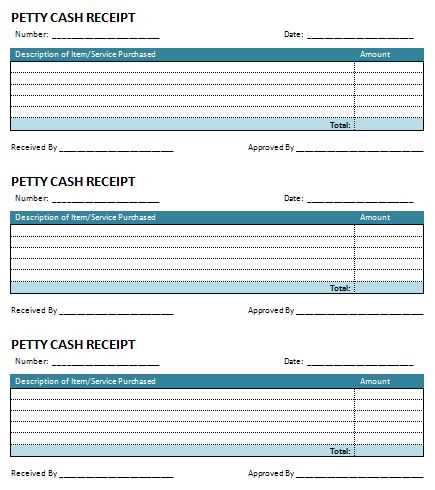

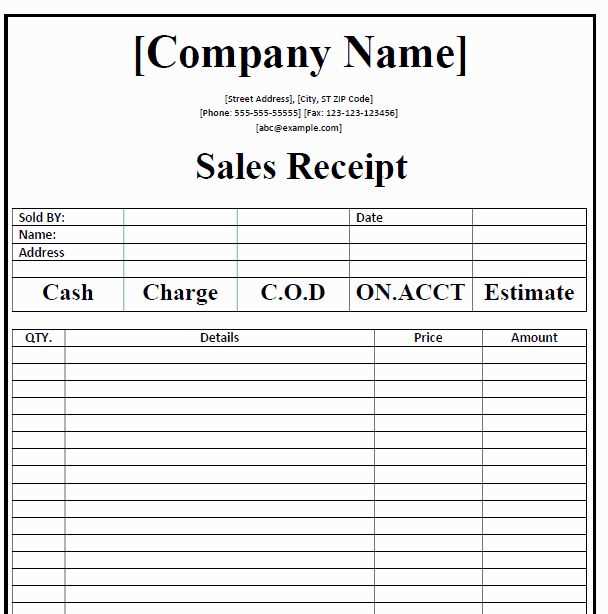

Use this template for organizing cash receipts efficiently. It allows for quick recording of daily transactions with clarity. Begin by creating columns for the date, description, amount received, payment method, and customer details. Ensure every entry includes supporting documentation, such as receipts or invoices, for reference.

Update the journal regularly to maintain an accurate record of all transactions. This template should also feature totals for easy reconciliation at the end of each period. Make sure to back up your data frequently to avoid loss of important financial information.

Finally, ensure that the format is compatible with your accounting software for seamless integration and reporting. Keeping your records clean and well-organized will simplify audits and improve financial oversight.

- Cash Receipts Journal Template South Africa

Using a cash receipts journal template in South Africa streamlines tracking incoming payments for businesses. This template captures essential details such as the date of the transaction, customer name, payment method, amount received, and any relevant reference numbers. By keeping a record of each payment, companies can ensure accurate accounting and financial transparency.

Make sure your template includes columns for categorizing receipts, whether they are from sales, customer advances, or other sources of income. Incorporate fields for the deposit account used and relevant notes that explain each transaction. This structure simplifies reconciliation and auditing processes.

To ensure compliance with local tax laws, include columns for VAT amounts and consider integrating the template with your accounting software to streamline data entry. By keeping your cash receipts organized, you reduce errors and improve the financial decision-making process.

If your business deals with various payment methods (e.g., cash, EFT, or credit card), ensure your template can accommodate these options and allows for quick tracking of different payment types. This setup makes it easy to monitor cash flow and reconcile accounts at any given time.

Creating a cash receipts journal in South Africa requires a clear structure to track all incoming cash transactions. This helps businesses maintain accurate records for accounting and taxation purposes.

1. Set Up Your Journal Format

- Create columns for the date, receipt number, account credited, cash received, and the source of payment.

- Ensure that the journal is easy to update and review by categorizing transactions properly.

- Consider using accounting software tailored for South African businesses, such as Xero or QuickBooks, to automate entries.

2. Record All Cash Receipts

- Each time a cash receipt is made, immediately enter the details into the journal.

- Include the date of the transaction and the unique receipt number for proper referencing.

- Ensure the payment method (e.g., cash, cheque, EFT) is clearly noted.

- Double-check that the correct account is credited to avoid errors in financial reports.

3. Reconcile the Journal with Bank Statements

- Regularly compare the cash receipts journal with your business’s bank statements to identify discrepancies.

- Ensure all recorded receipts match the deposits made to your business bank account.

- Address any differences promptly to maintain accurate financial reporting.

4. Comply with South African Tax Regulations

- Ensure that all cash receipts are reported correctly for tax purposes. South African businesses must adhere to VAT regulations, including the proper reporting of VAT on sales.

- Consult with a tax advisor to confirm that your cash receipts journal meets all SARS (South African Revenue Service) requirements.

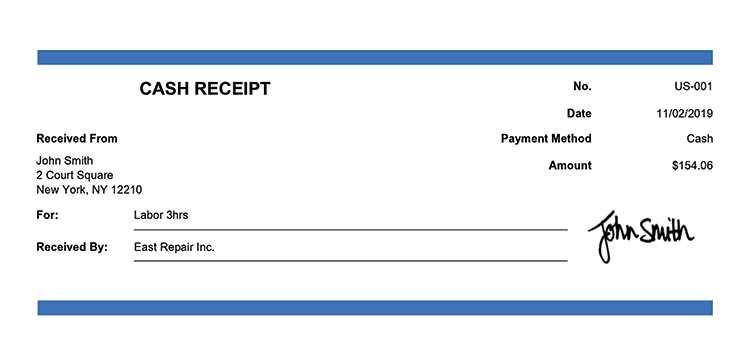

The record should include the date of receipt. This ensures that you have a clear timeline of cash transactions.

Next, include the payer’s details such as their name or business name. This identifies the source of the funds.

Specify the payment method, whether it’s cash, cheque, bank transfer, or other methods, for accurate tracking.

Provide a description or reference for the payment, such as the invoice number or reason for the payment, to link the receipt to the transaction.

Include the amount received, broken down into relevant currency if necessary, for transparency.

Record the name of the person handling the transaction. This helps track responsibility and accountability within the business.

Finally, a running balance after each transaction helps to ensure all records remain accurate and up-to-date.

In South Africa, businesses must comply with specific legal requirements for recording and managing cash receipts. These include adhering to the South African Revenue Service (SARS) regulations regarding taxation and financial reporting. A key requirement is ensuring that cash receipts are properly documented in a cash receipts journal, with accurate details about each transaction, such as the date, amount, payer information, and the purpose of the payment.

The Value Added Tax (VAT) system plays a significant role in cash receipt management. Businesses must ensure that VAT is correctly applied to taxable transactions and that receipts reflect the correct VAT amounts. Additionally, businesses need to maintain proper records for at least five years, as stipulated by the SARS tax laws. This helps ensure transparency and supports audits or tax reviews.

Failure to comply with these legal requirements can result in penalties or fines. It’s also important to remember that businesses must reconcile cash receipts with their bank statements regularly, providing a clear audit trail of all transactions. This practice helps reduce errors and ensures the accuracy of financial reporting, ultimately minimizing the risk of legal issues or financial discrepancies.

To tailor a cash receipts journal template for small businesses in South Africa, follow these practical steps:

- Incorporate Local Tax Requirements: South African businesses need to comply with VAT regulations. Make sure the template includes columns for VAT-exclusive and VAT-inclusive amounts, as well as a field for VAT amounts, to accurately report transactions.

- Set Up Payment Methods: Add categories for different types of payments like cash, EFT (Electronic Funds Transfer), and card payments. This ensures clarity in tracking all revenue streams and streamlines bank reconciliation.

- Include Invoice Numbers: Every transaction should link back to a unique invoice number. This will help track outstanding payments and make tax filing more efficient. Make sure this column is clearly marked to avoid confusion.

- Allocate Space for Transaction Descriptions: Some small businesses may offer discounts or operate in industries that require additional notes. Include a space where transaction details can be summarized for easy reference.

- Consider User-Friendliness: Simplify the format for employees or business owners who may not be familiar with complex accounting systems. Avoid overwhelming columns or excessive data fields, ensuring that the template remains intuitive and quick to fill out.

- Record Date of Receipt: A column for the date each receipt was recorded ensures proper tracking of income over time, which is key for financial management and meeting deadlines for tax filings.

- Allow for Total Calculations: The template should automatically calculate totals, especially for weekly, monthly, or yearly summaries. This reduces human error and improves financial accuracy when reviewing cash flow.

Accuracy is key when filling out a cash receipts journal template. A common mistake is entering incorrect amounts, especially when handling multiple transactions. Double-check each payment or receipt to ensure the figures are accurate, and verify if taxes or discounts are properly accounted for.

Not Categorizing Receipts Correctly

Ensure receipts are categorized accurately according to your business’s chart of accounts. Misclassifying receipts can lead to confusion and inaccurate financial statements. For example, separating sales income from refunds or deposits ensures clarity and compliance with accounting standards.

Failing to Record the Date Correctly

Recording the wrong date is another frequent error. Accurate date entries are crucial for tracking cash flow over time. Ensure that each transaction is entered with the exact date it occurred, and avoid entering future dates that could distort your financial reporting.

Skipping the description or reference number field is another mistake. Include clear details about each transaction for future reference and audit trails. This will help track transactions efficiently and avoid confusion during later reviews.

Finally, neglecting to reconcile your receipts regularly can cause discrepancies between your journal and bank account records. Set a routine to reconcile your template with your bank statements to identify any errors early on.

Integrating your cash receipts journal with accounting software is key to improving efficiency and accuracy in your financial processes. The first step is choosing accounting software that suits your business needs, such as QuickBooks, Xero, or Sage, which are widely used in South Africa. Ensure that the software you select supports the integration of manual journal entries and offers a user-friendly interface for easy updates.

Linking Your Cash Receipts Journal with the Software

Once you’ve selected the software, you can begin linking your journal. Most accounting platforms allow for the importation of CSV or Excel files, so ensure your journal is formatted correctly. If manual entry is required, the software usually provides templates to guide you in entering transaction details such as date, description, amount, and account classification. Regularly update your journal within the software for real-time accuracy.

Automating Data Entry

To reduce errors and save time, automate your data entry as much as possible. Many South African businesses link their accounting software to bank accounts or payment gateways (like PayFast or PayPal). This way, cash receipts can be directly imported into the journal, eliminating manual input. Once integrated, the software can automatically categorize income and reconcile it with bank statements, providing real-time financial reports.

By setting up automated workflows, you can ensure that your journal entries are always up-to-date and in sync with your accounting system, making tax filings and financial analysis more straightforward.

To create a functional cash receipts journal template for South Africa, focus on the specific categories and fields that reflect local financial practices. Ensure the template is simple, yet detailed enough for accurate tracking of cash receipts.

Start by including columns such as:

| Date | Receipt Number | Account Name | Description | Amount | Payment Method |

|---|---|---|---|---|---|

| 01/02/2025 | 00123 | XYZ Corporation | Payment for invoice #456 | R5,000.00 | Cash |

The “Date” column records the day of the transaction. The “Receipt Number” provides a unique identifier for each cash receipt, which helps in organizing and referencing. The “Account Name” should capture the name of the customer or payer.

Under “Description,” input brief details of the transaction, such as invoice numbers or service descriptions. The “Amount” field is for the exact value received, with the currency marked clearly as ZAR (South African Rand). The “Payment Method” section will list whether the transaction was made in cash, via bank transfer, or another method.

Additionally, for compliance with South African financial regulations, include space for relevant taxes, such as VAT, and a total for each day’s receipts. This ensures accuracy in financial reporting and simplifies tax filings.

Lastly, it’s crucial to keep a running balance. This will help track available cash at any given point, as well as assist in reconciliations at the end of each period.