If you’re managing donations for a non-profit organization, it’s important to provide donors with a professional and accurate receipt. A well-designed donation receipt template in Word format can simplify this process and ensure consistency. A clear and concise receipt not only helps with donor recognition but also assists in tax reporting and auditing processes.

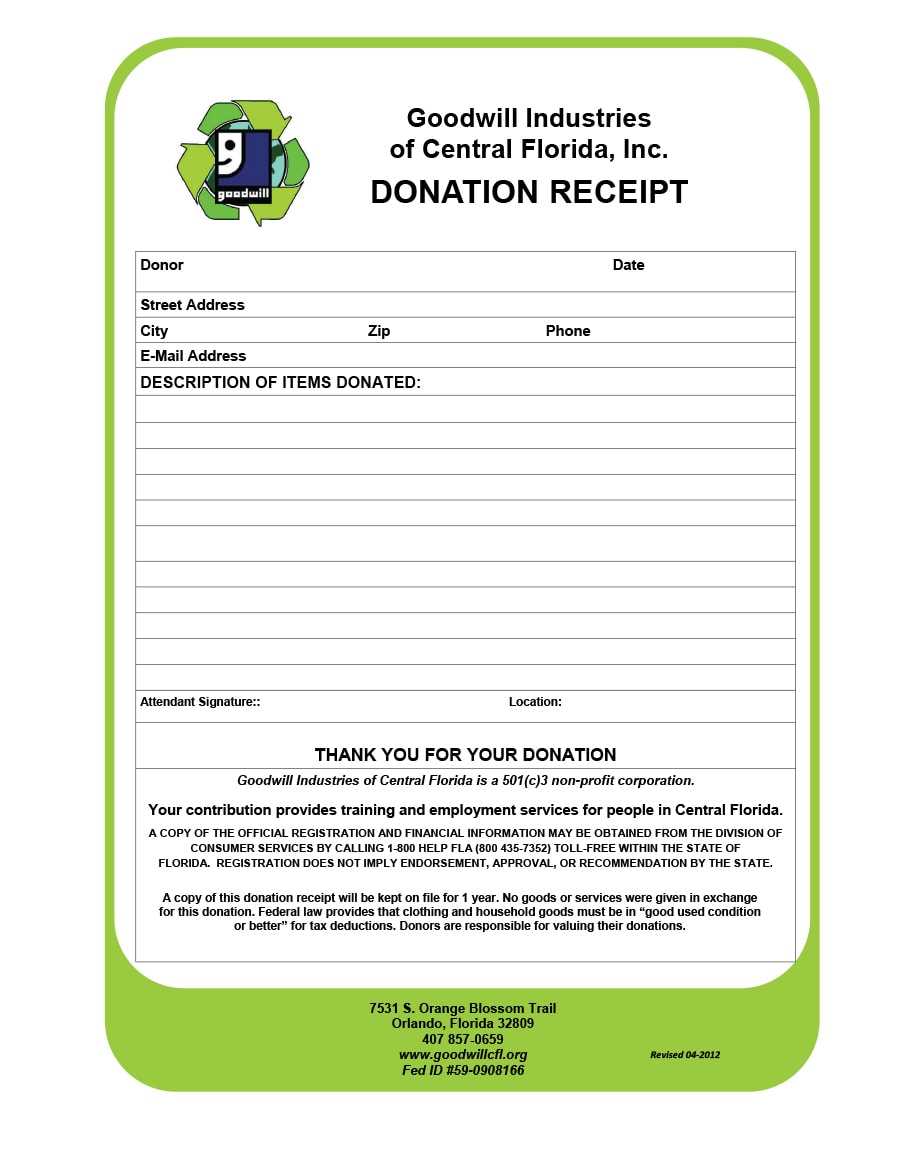

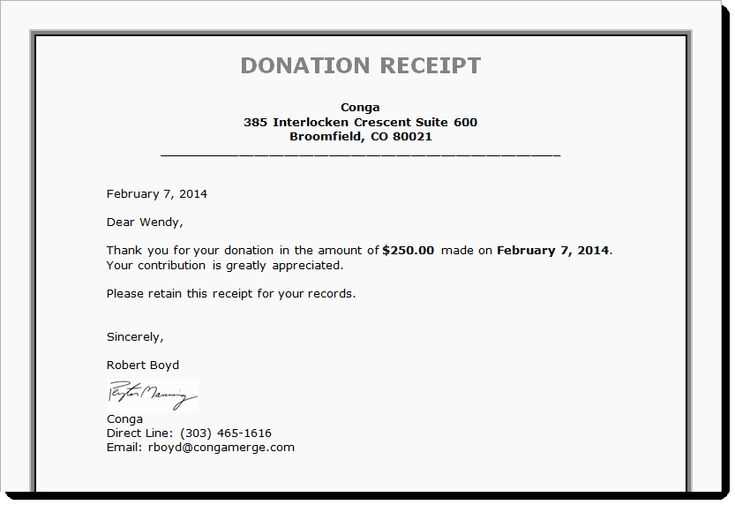

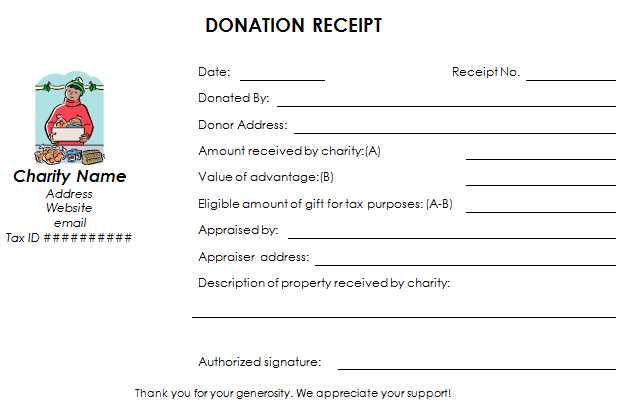

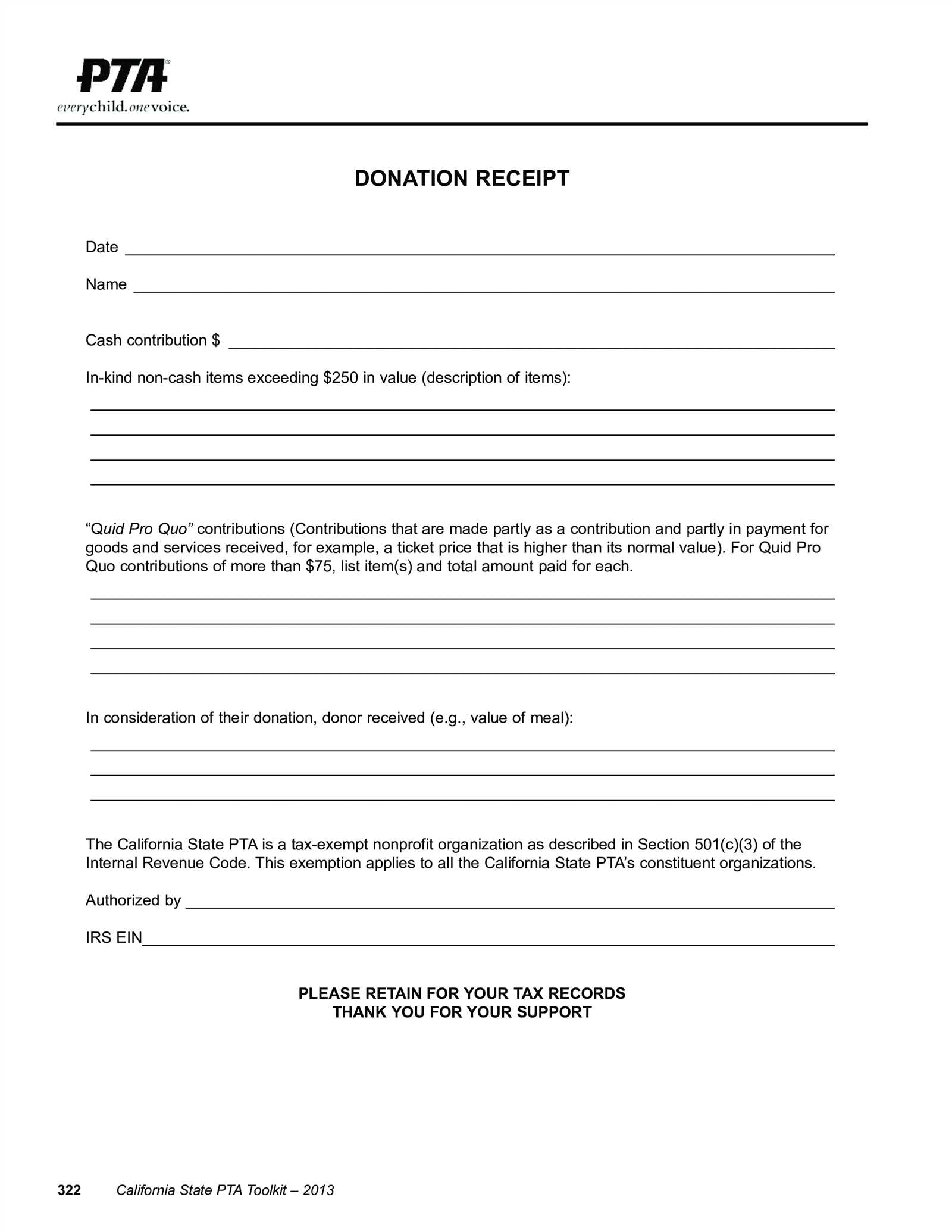

Use a template that includes key details such as the donor’s name, the amount donated, the date of the donation, and the non-profit’s contact information. Ensure that the template clearly states whether the donation is tax-deductible, which is required for transparency and compliance. A simple and clean design allows donors to easily understand the receipt’s purpose and use it for tax filing purposes.

Consider incorporating customizable fields into the template to allow for quick updates for different donation amounts and donor details. This ensures you can personalize the receipts without creating a new document from scratch each time. When done correctly, these templates save time while maintaining the professionalism of your organization.

Choosing the right format for your non-profit donation receipt can also be a time-saver. A Word document allows for easy edits, saving you the hassle of dealing with more complex software. With just a few adjustments, your organization can create donation receipts that look both polished and professional.

Here’s the corrected version with minimal repetition of words:

Make sure your non-profit donation receipt template is clear and professional. This template should include the donor’s name, donation amount, and the date of the contribution. It’s also essential to indicate that no goods or services were provided in exchange for the donation. This information is necessary for tax purposes and helps to maintain transparency.

Key Elements to Include

For a straightforward receipt, start by adding the organization’s name, address, and contact details. Include a section for the donor’s name and address. Clearly state the amount donated, the donation’s purpose (if applicable), and the date of receipt. Provide a statement confirming the donor did not receive any goods or services in return for the donation.

Final Touches

Once the core details are in place, review the receipt for accuracy. A well-organized receipt can simplify tax filing for both the donor and your organization. Remember, offering a thank-you message can also enhance donor relationships and encourage future support.

Non Profit Donation Receipt Template in Word

How to Create a Simple Donation Receipt for Non Profits in Word

Key Elements to Include in Your Receipt Template

Steps to Customize Your Receipt for Various Donation Types

Formatting Tips for a Professional Receipt in Word

How to Ensure Tax Law Compliance in Donation Receipts

How to Save and Distribute Your Receipt Template in Word

To create a donation receipt in Word, open a new document and begin with a simple, clean layout. You can use a table for alignment or keep it minimal with clearly defined sections. The key is to make sure the receipt includes all necessary details for the donor to easily track their contribution.

Key Elements to Include in Your Receipt Template

Your template should cover the donor’s name, donation amount, donation date, charity name, tax-exempt status, and a statement regarding whether any goods or services were provided in exchange for the donation. Make sure to also include a unique receipt number for tracking purposes and your nonprofit’s contact information.

Steps to Customize Your Receipt for Various Donation Types

For monetary donations, simply state the donation amount and include a thank-you message. For in-kind gifts, describe the item donated along with an estimate of its value. Ensure you mention that the donor is responsible for valuing their non-cash contributions. If donations were made in installments, include the total amount and remaining balance.

When customizing the receipt, consider adding any specific instructions or requirements for tax filing, like the donor’s ability to claim tax deductions. Adjust the layout as necessary, but keep it simple to maintain professionalism.

Once you finalize the layout, save the template for future use. You can distribute it either by email or print for donors to retain a physical copy.

Formatting Tips for a Professional Receipt in Word

Keep the font clean and readable, like Arial or Times New Roman, with consistent sizes throughout. Add the organization’s logo at the top to enhance brand recognition. Adjust margins and spacing to ensure the document is easy to read. Use bold or italics to highlight key sections like the donor’s name and donation amount for clarity.

Ensure alignment is neat and uniform, especially when dealing with tables or multiple sections. Avoid excessive graphics or complicated designs that may distract from the content.

To comply with tax laws, include any legal disclaimers that may apply to your nonprofit organization, such as the statement that no goods or services were exchanged for the donation, or list any non-monetary items donated with an estimated value.

Once you’ve customized the template, save it as a reusable document in Word format. To distribute it, you can email it directly or print physical copies to be handed out to donors. Save multiple versions if necessary for different types of donations or campaigns.