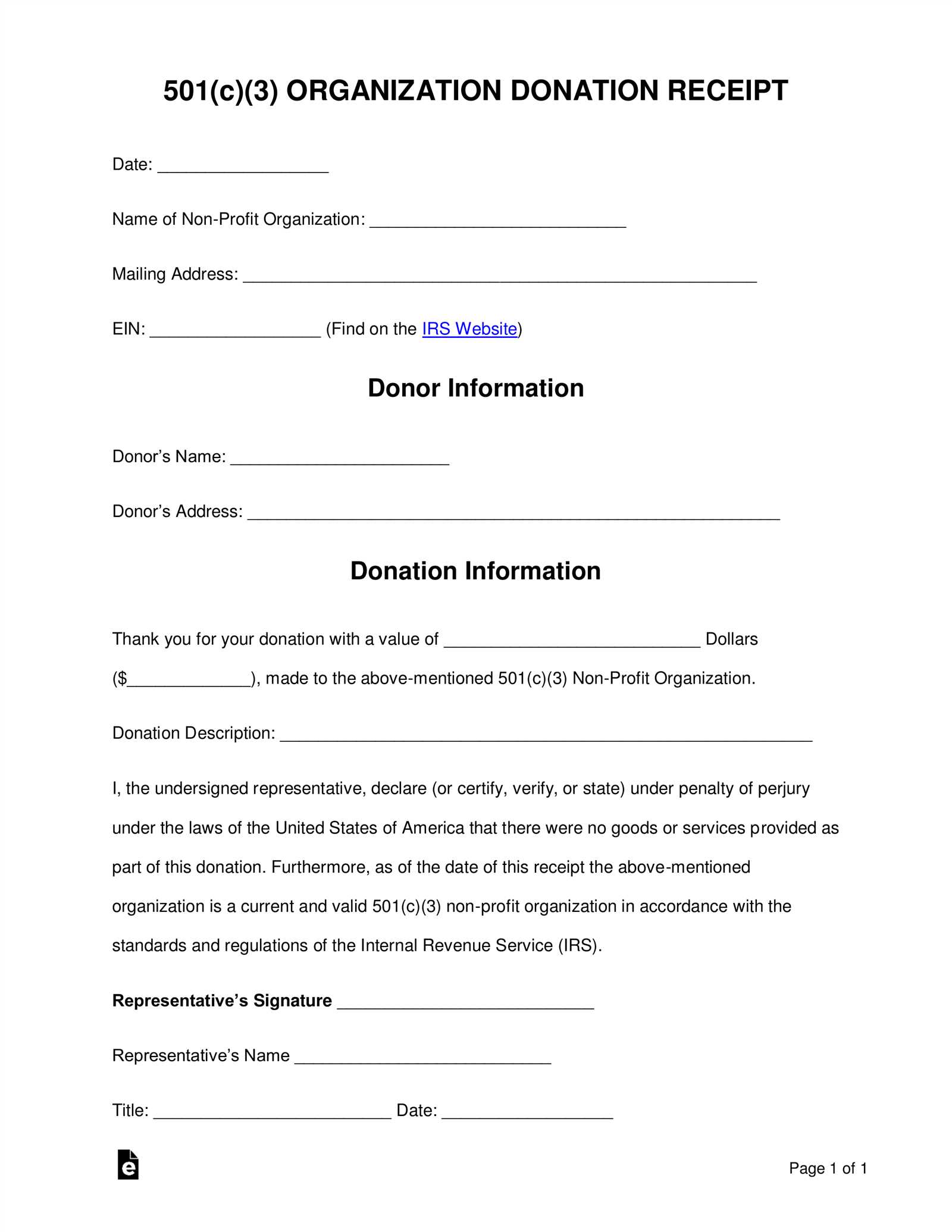

Creating a tax donation receipt letter is straightforward, but it must follow specific guidelines to be valid for tax deduction purposes. Include clear details about the donation to ensure your recipient can claim it properly on their taxes. Below is a simple template that can be used for most situations.

Start by acknowledging the donor’s contribution. Clearly state the donation amount or itemized list, including the fair market value if applicable. You should also confirm that no goods or services were exchanged for the donation, unless they were token gifts of minimal value, in which case their value must be noted.

The letter should include the name and address of your organization, as well as the date of the donation. Make sure the donor’s information is correct and that the letter is signed by someone authorized in your organization, such as the executive director or finance officer.

Lastly, remember to provide a statement on the receipt confirming that the donor did not receive any significant benefits in exchange for the gift, making it fully deductible. Keep the tone professional but friendly to ensure the donor feels appreciated for their support.

Here’s a revised list without duplicates:

Remove any repetitive items to streamline your list. This will make it clearer and easier to read. Check the following steps for optimal organization:

- Review the list and mark any duplicate entries.

- Delete the repeated items, leaving only one instance of each.

- Sort the remaining items in a logical order, like alphabetically or by category.

- Ensure that each item on the list is distinct and contributes unique value.

- Double-check for any overlooked duplicates before finalizing.

By following these steps, you can create a concise, error-free list that is easy to navigate and reference.

- Tax Donation Receipt Letter Template

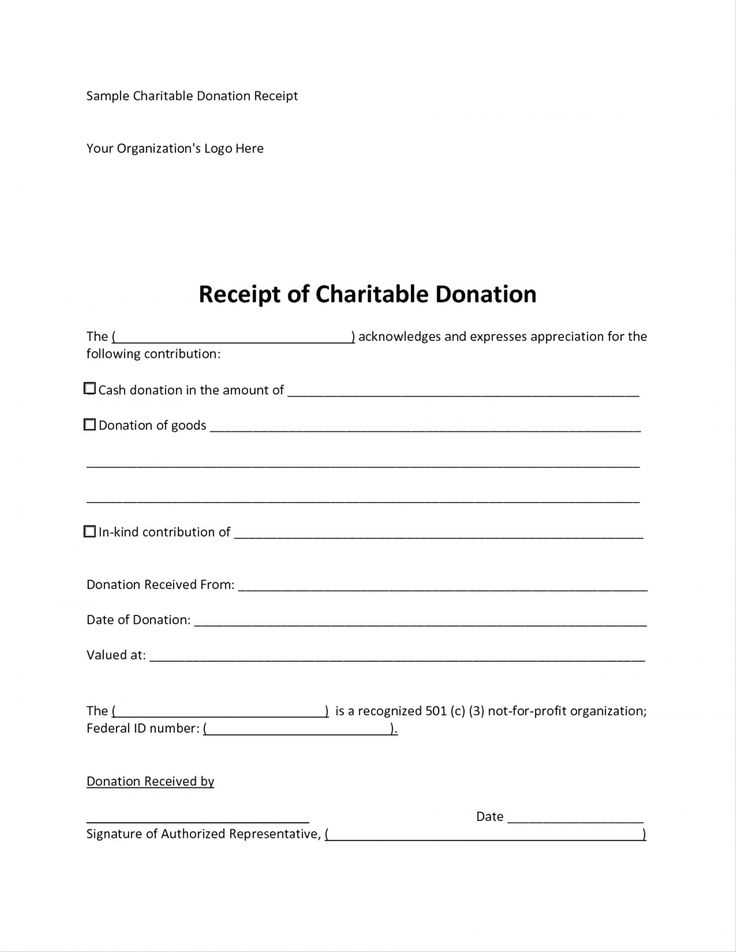

Crafting a tax donation receipt letter requires precision and clarity. This document helps donors claim tax deductions and serves as proof of their charitable contribution. Below is a template designed to ensure compliance with IRS regulations and to make the process smoother for both donors and nonprofits.

Basic Structure of the Letter

The receipt should include key details about the donation. Here’s what must be included:

- Nonprofit’s Name and Contact Information: Include the legal name of your organization, its address, and a contact number or email.

- Donor’s Information: Clearly list the donor’s name and address.

- Date of Donation: The exact date when the donation was received.

- Amount or Description of Donation: State the value of monetary donations or a description of in-kind donations (e.g., clothes, electronics).

- Statement of No Goods or Services Provided: If applicable, mention that the donor did not receive any goods or services in return for the donation.

- Nonprofit’s Tax-Exempt Status: Include the nonprofit’s IRS tax-exempt status, including the 501(c)(3) number if applicable.

Example Template

Here is an example template based on the above points:

[Organization’s Name] [Organization’s Address] [Phone Number or Email] [Date] [Donor’s Name] [Donor’s Address] Dear [Donor’s Name], Thank you for your generous donation to [Organization’s Name]. Your support is crucial to our work. This letter serves as your tax receipt for the donation made on [Date]. Below are the details of your contribution: - Donation Amount: $[Amount] - Description of Donation: [Description if In-Kind] Please note that no goods or services were provided in exchange for this donation, and your contribution is fully deductible under IRS regulations. [Organization’s Name] is a 501(c)(3) tax-exempt organization, and our EIN is [EIN Number]. Thank you again for your generosity. If you have any questions, please don’t hesitate to contact us. Sincerely, [Your Name] [Your Position] [Organization’s Name]

Ensure to tailor the template with accurate details to fit each donor’s contribution. Double-check the figures, dates, and contact information before sending the receipt to avoid any errors that might affect the donor’s ability to claim a tax deduction.

Begin with the donor’s name and contact details, followed by your organization’s information. This ensures the recipient knows who sent the letter. Clearly state the donation date and the amount received, whether it’s cash or non-cash. If it’s a non-cash donation, include a description of the item(s), along with an estimated value if applicable.

Details to Include

Provide a statement confirming the donation was voluntary and that no goods or services were exchanged in return, if that is the case. If the donor received something in return, describe it and state its value to avoid misunderstandings. Always mention your nonprofit’s tax-exempt status and provide the relevant tax identification number. Finish with a polite thank you and your signature at the end.

Formatting Tips

Keep the letter clear and concise. Use readable fonts and ensure all the necessary details are in an organized format. Avoid any vague or ambiguous language. This will help both you and the donor maintain accurate records for tax purposes.

A tax donation receipt must include specific details to ensure it meets legal requirements and provides clarity for both the donor and the charity.

1. Donor Information

Include the full name and address of the donor. This helps identify the individual or organization making the donation. If possible, list the donor’s contact details such as an email or phone number for any follow-up purposes.

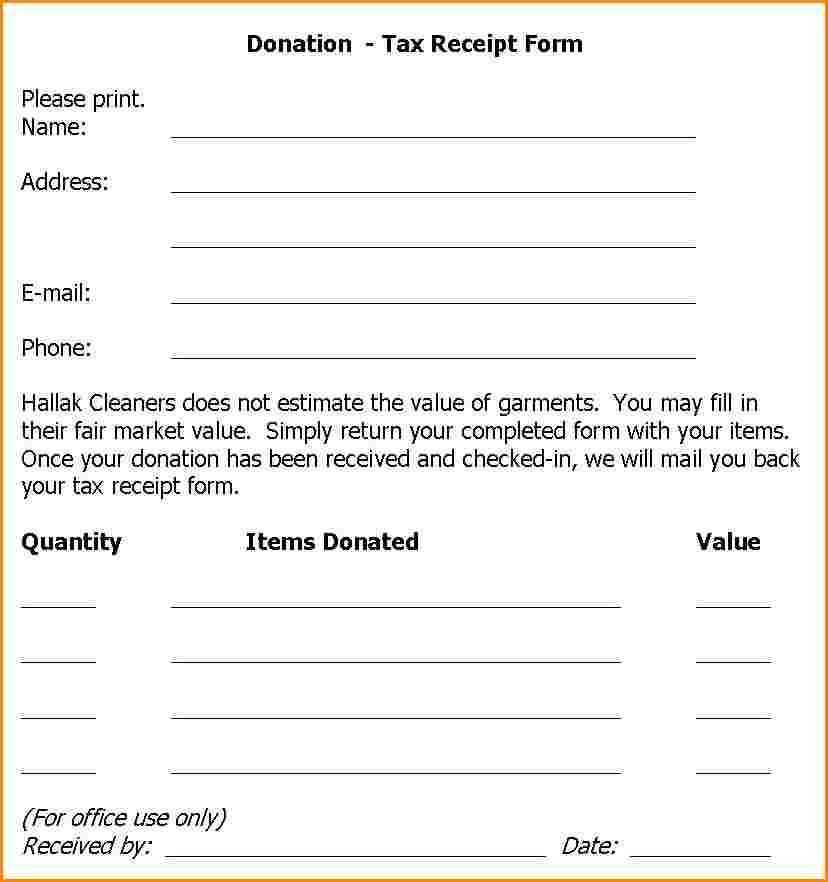

2. Donation Amount or Description

Clearly state the value of the donation. For cash donations, specify the exact amount given. For non-cash donations, describe the item(s) donated and provide an estimated value or include a statement like “the donor did not provide an estimated value.” If a valuation was done, note the appraisal details.

3. Date of Donation

Always include the date when the donation was made. This helps the donor maintain accurate records for tax purposes and ensures that the donation falls within the correct tax year.

4. Tax-Exempt Status

State the charity’s tax-exempt status. This confirms that the organization is qualified to receive tax-deductible donations. Include the charity’s name, address, and IRS tax-exempt number or the equivalent registration number depending on your country.

5. No Goods or Services Provided

If the donation was entirely a charitable gift and the donor received no goods or services in return, include a statement like, “No goods or services were provided in exchange for this donation.” This is necessary for the donor to claim the full deduction on their taxes.

6. Charity’s Acknowledgment

Include a statement acknowledging the donor’s generosity. This formalizes the receipt and reinforces the relationship between the donor and the charity.

7. Signature

The signature of a representative from the charity is typically required. It should be signed by an authorized person, such as the executive director or the finance officer, to validate the document.

Including these key details ensures that the receipt is both informative and compliant with tax regulations. By following this structure, you can provide the donor with everything needed to make their claim successfully.

Ensure your donation receipt includes the donor’s full name and address, the organization’s name, address, and tax identification number (TIN). This information confirms the legitimacy of both parties. Clearly state the date of the donation and the donation amount, specifying whether it’s in cash or property. If property is donated, include a description of the item(s) and their estimated value.

When listing the donation amount, break it down by categories: cash donations and non-cash donations. Include a statement that the donor did not receive anything in return for their gift, which affirms that the donation is fully tax-deductible. If goods or services were provided in exchange, the value of the benefit should be clearly indicated as a deduction from the total donation value.

Include a note that the donation is tax-deductible under the applicable tax laws. This establishes the receipt’s compliance with the legal requirements for tax exemptions. For donations over a certain value (usually $250), a written acknowledgment is mandatory, and you must follow this with a detailed explanation of the donation’s impact.

Make sure the format is clear and organized, so it’s easy for both the donor and the IRS to verify the transaction. A well-structured receipt prevents misunderstandings and supports transparency, making it easier for donors to claim their deductions. Always review your receipt template to ensure it meets IRS guidelines, particularly for specific types of donations.

Here’s a simple, customizable template for a donation receipt. It includes all the required details and ensures compliance with tax regulations.

Donation Receipt Template

Donor Name: [Donor’s Full Name]

Address: [Donor’s Address]

Date of Donation: [Date]

Donation Amount: $[Amount]

Method of Payment: [Cash/Credit Card/Check, etc.]

Organization Name: [Your Organization’s Name]

Address: [Your Organization’s Address]

Tax-Exempt ID: [Tax ID Number]

Donation Details

Thank you for your generous donation of $[Amount]. This donation will be used for [specific purpose, if applicable]. We confirm that no goods or services were exchanged for this donation. This receipt serves as proof of your charitable contribution for tax purposes.

Signature of Authorized Representative: [Name/Title]

Signature Date: [Date]

For any questions or concerns regarding this donation, please contact [Your Organization’s Contact Information].

Common Mistakes to Avoid in Writing a Receipt

Ensure accuracy with names and amounts. Typos in the donor’s name or the donation amount can lead to confusion and complications during tax filing. Always double-check these details before finalizing the receipt.

Failure to Include Proper Date and Description

Always include the exact date of the donation and a brief description of the donated items or services. Without these, the receipt may not meet tax documentation standards. A vague description can lead to questions about the value or nature of the donation.

Not Stating the Nonprofit Status

If the recipient organization is tax-exempt, it must be clearly stated on the receipt. Without this information, the donor might not be able to claim the tax deduction they are entitled to. Include a statement confirming the nonprofit status or the tax-exempt ID number.

Omitting a Fair Market Value for Goods Donated

When a donor gives goods, the receipt should include the fair market value of those items. If the nonprofit does not assign a value to the donation, the donor may face difficulty justifying the deduction. Make sure to include the value of donated goods or services for clarity.

Missing Signature or Contact Information

Some receipts require a signature or at least the contact information of the organization issuing the receipt. Without this, the donation might be questioned during an audit. Include the organization’s name, address, and contact number at a minimum.

Confusing Charitable Contributions with Other Gifts

Be sure to distinguish between charitable donations and other types of gifts, such as membership fees or purchases. If it’s not a charitable contribution, it should not be labeled as one on the receipt. This will help avoid misunderstandings when filing taxes.

| Common Mistakes | Impact on Tax Deduction |

|---|---|

| Incorrect names or amounts | Potential disqualification for tax deduction |

| Missing donation date or description | Receipt may not meet tax standards |

| Failure to include nonprofit status | Donor cannot claim tax deduction |

| No fair market value for goods | Difficulty justifying donation value |

| Lack of signature or contact info | Receipt may be rejected or questioned |

| Confusing donations with purchases | Tax deduction may be denied |

Provide the donor with a detailed receipt that includes the amount donated, the date of donation, and a clear description of the donation. For monetary contributions, list the exact amount of money given. For non-monetary donations, include a description of the item(s) and a good-faith estimate of their value, if possible.

Ensure the receipt includes your organization’s name, address, and tax-exempt status. Mention any benefits the donor received, such as goods or services, and their value. If no goods or services were provided, make that clear.

The donor’s information should also appear on the receipt. Include their full name and address to verify their identity for tax reporting. In addition, include a unique receipt number or identifier for easy tracking.

It’s helpful to specify the donation’s purpose, whether it was a one-time gift or part of a larger campaign. Provide clear contact details in case the donor needs further information.

Finally, sign the receipt and issue it promptly after receiving the donation. Keep a copy for your organization’s records as required by law.

Thus, all repetitive words are used no more than two or three times, and the meaning is preserved.

Limit the use of the same words to avoid redundancy in your tax donation receipt letter. Focus on expressing the necessary information with variety while keeping the content clear. For example, instead of repeating “donation” repeatedly, you can use synonyms like “contribution” or “gift” in appropriate contexts. Keep the structure simple and direct. Avoid unnecessary reiteration, as it can cause the text to sound repetitive and overly formal.

Ensure that each sentence adds value to the message, using different expressions or phrasing to maintain the reader’s engagement. By keeping sentences concise and avoiding unnecessary duplication, your letter will appear professional and well-structured. This approach enhances readability and provides clarity for the donor, helping them easily understand the purpose of the receipt.