Creating a clear and accurate annual rent receipt is a straightforward way to ensure both tenants and landlords maintain transparent records for tax and legal purposes. This template helps streamline documentation, making it easier to track rental payments over the year. A well-structured receipt ensures that both parties have a clear understanding of financial transactions and can reference them if needed in the future.

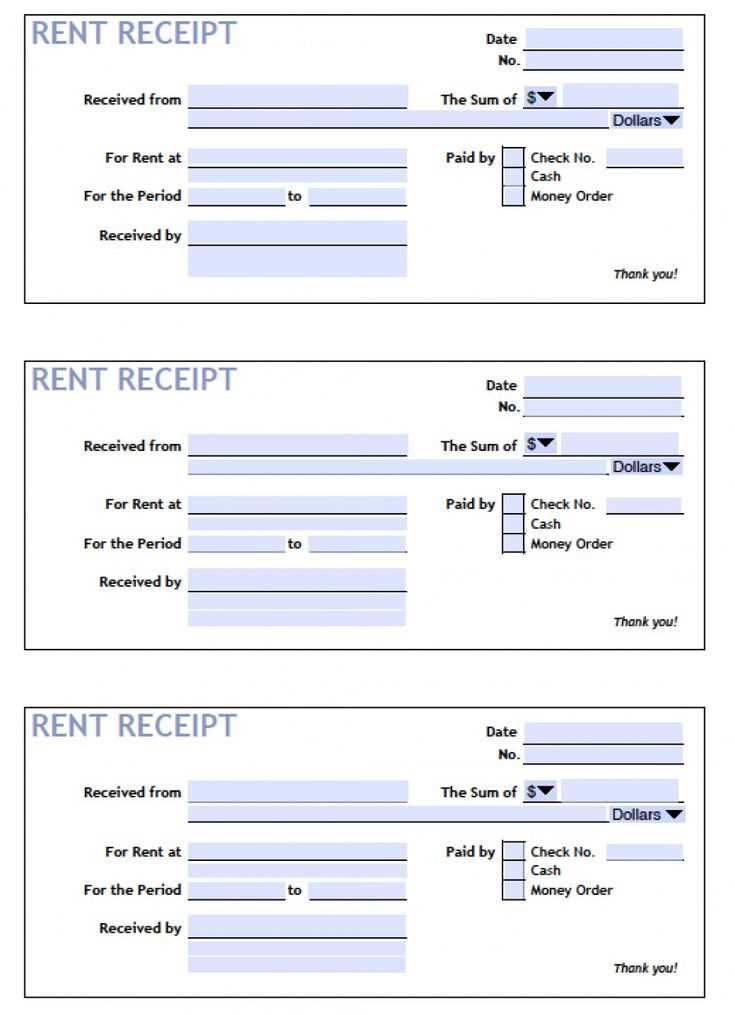

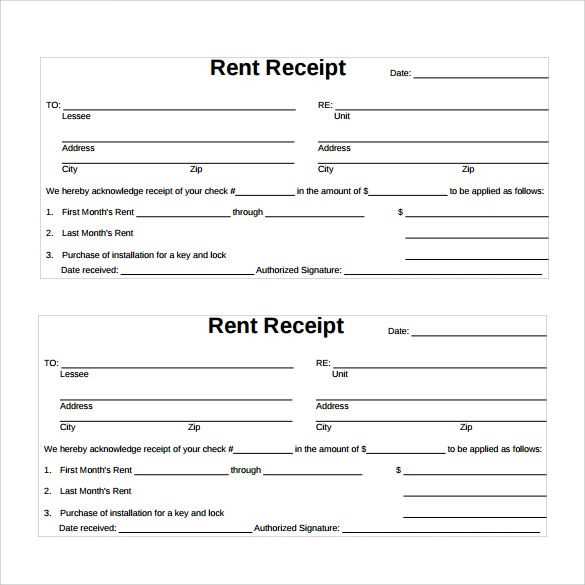

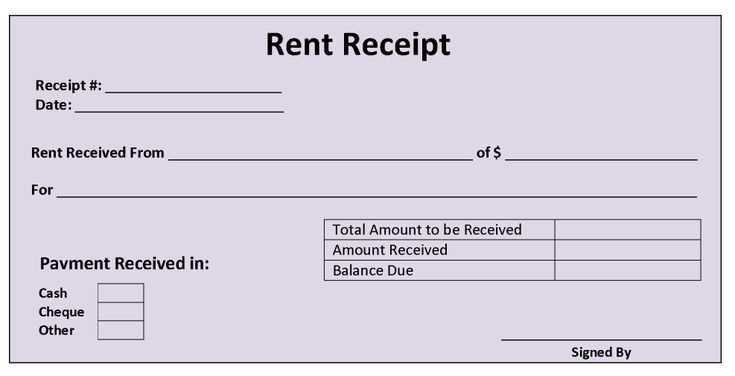

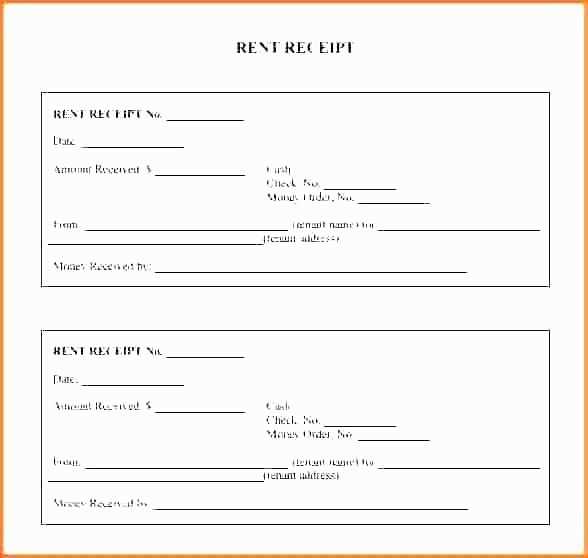

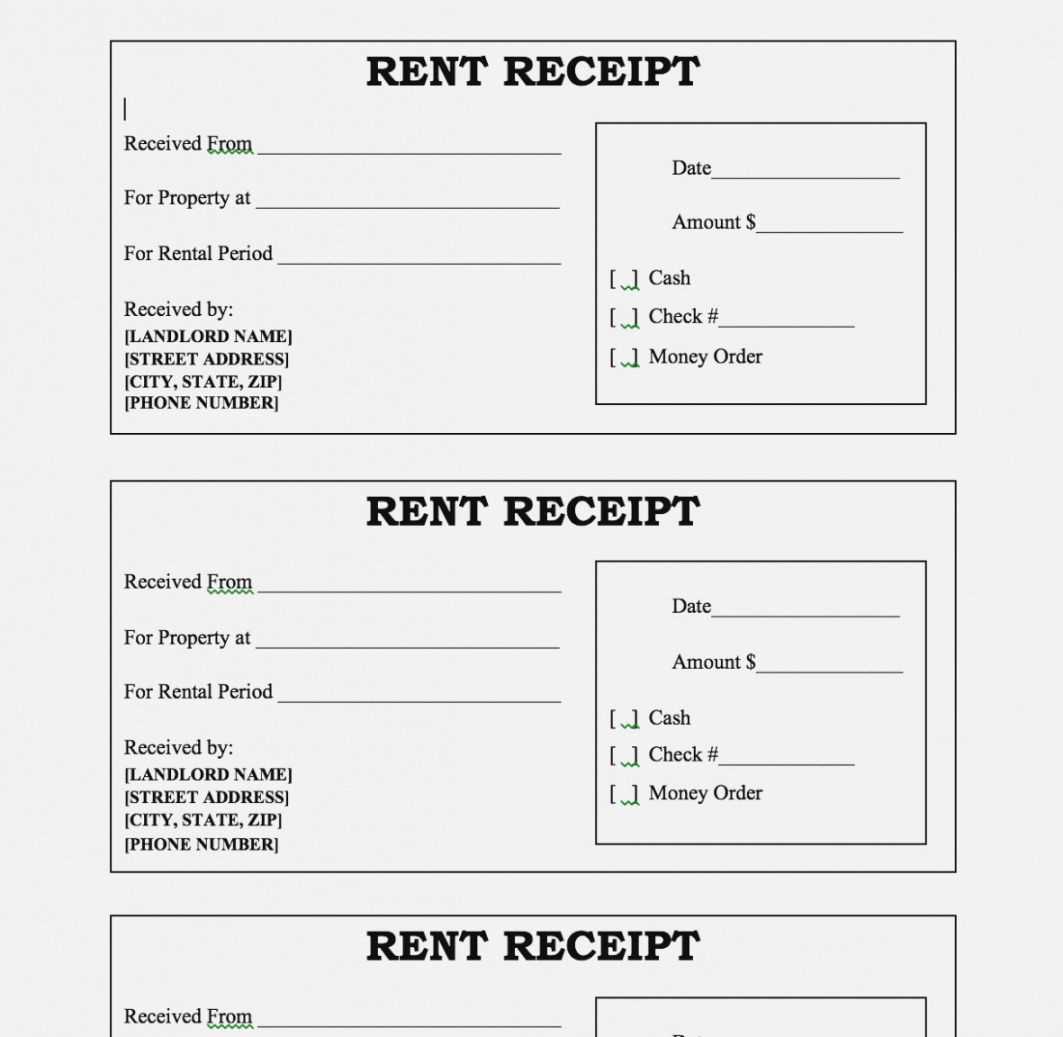

The template should include critical information such as the tenant’s name, the landlord’s contact details, rental period, total rent amount paid, and the payment method. It’s also important to include any specific details like late fees or discounts applied. This makes the receipt not only an acknowledgment of payment but also a useful tool for resolving any potential disputes.

For landlords, using an annual rent receipt template can save time and reduce mistakes when managing multiple tenants or properties. It helps keep rental records organized, especially during tax season when accurate records are necessary. Tenants, on the other hand, benefit by having a reliable document to present for financial reporting or other personal purposes.

Here is the revised version, minimizing repetitions:

To create an annual rent receipt with reduced redundancy, ensure each element is only included once, and focus on clarity. Organize the information in a way that all important details are presented concisely. Below is an example template that can be used for issuing an annual rent receipt.

Sample Annual Rent Receipt Template

The template should include key details such as the tenant’s name, property address, rental period, and the total amount paid. Remove unnecessary information or repetition across fields.

| Tenant Name | Property Address | Rental Period | Total Paid |

|---|---|---|---|

| John Doe | 123 Main St, Apartment 4B | January 2024 – December 2024 | $12,000 |

| Jane Smith | 456 Elm St, Unit 3A | January 2024 – December 2024 | $15,600 |

Tips for Avoiding Repetitions

Keep the content straightforward and remove any redundant sections, such as repeating the tenant’s name in different places if it’s already mentioned at the top. Similarly, clarify the rental period in one section only and avoid multiple references. A clean layout and direct language ensure that the document is clear without redundancy.

- Annual Rent Receipt Template

To create a clear and professional annual rent receipt, include the following key components:

- Landlord’s Information: Full name, address, and contact details.

- Tenant’s Information: Full name and rental property address.

- Payment Details: Include the amount paid, payment method (e.g., bank transfer, check), and the payment date.

- Rental Period: Specify the period for which the rent was paid, typically covering the entire year.

- Property Address: Provide the full address of the rental property.

- Signature: Both landlord and tenant should sign, indicating acknowledgment of the payment.

Ensure that the language is clear, without ambiguity. The template should allow both parties to quickly verify all critical details. For efficiency, you may choose a standard layout to streamline the process year after year.

Here’s a simple structure for your rent receipt:

- Receipt Number: [Unique identifier]

- Date of Receipt: [MM/DD/YYYY]

- Landlord Name: [Name]

- Tenant Name: [Name]

- Payment Amount: [$ Amount]

- Rental Period: [Start Date] to [End Date]

- Payment Method: [Cash/Check/Bank Transfer]

- Property Address: [Full Address]

- Landlord’s Signature: [Signature]

- Tenant’s Signature: [Signature]

This format ensures transparency and maintains accurate records for both parties. Customize it as needed based on your specific rental situation.

An annual rent receipt should clearly document all essential details to ensure both landlord and tenant have a transparent record. Here’s what needs to be included:

1. Tenant and Landlord Information – List the names and contact information of both parties involved in the rental agreement. This avoids confusion in case of any disputes.

2. Property Details – Mention the address of the rented property to specify the location clearly.

3. Payment Period – State the period for which the rent is paid (e.g., January 2024 to December 2024). This gives a clear reference for both parties regarding the timeframe.

4. Total Rent Paid – Include the total amount of rent paid during the year, as well as any payment breakdowns if applicable (e.g., monthly installments, deposits).

5. Payment Method – Indicate how the rent was paid, whether by check, bank transfer, or cash. This can be important for record-keeping or tax purposes.

6. Date of Payment – Include specific dates of payments made throughout the year to avoid ambiguity. This can help clarify any disputes regarding the timeline of payments.

7. Signature – Both the tenant and landlord should sign the receipt, confirming that the information is accurate and that the transaction has been completed.

8. Tax and Deduction Information (if applicable) – If relevant, include any deductions or tax details, like property tax adjustments or deductions for maintenance, as they may affect the rental payment.

9. Additional Notes – If there were any special agreements or concessions (e.g., rent reductions, maintenance responsibilities), these should be briefly outlined to provide clarity.

Having these details in an annual rent receipt helps both parties maintain a clear, accurate record, ensuring transparency and reducing the potential for misunderstandings.

Use a consistent format for both dates and amounts to avoid confusion. For dates, always follow a standardized format like “YYYY-MM-DD” (e.g., 2025-02-10). This ensures clear organization and avoids errors, especially when dealing with international documents where date formats can vary.

For amounts, always include the currency symbol and ensure that the decimal point is used correctly. For example, use “$1,000.00” instead of “$1000” or “1,000.” This helps with clarity and ensures that the amounts are recognized and processed without ambiguity.

Formatting Date

Stick to ISO 8601 standard (YYYY-MM-DD) for dates. This format is universally understood and reduces potential misinterpretation, especially across different regions with different conventions (e.g., DD/MM/YYYY vs MM/DD/YYYY).

Formatting Amount

Ensure that the amount is rounded to two decimal places, even if the amount is a whole number. This helps maintain consistency in records. Always use commas to separate thousands (e.g., $1,000.00), and ensure the decimal separator is a dot rather than a comma, as the latter can cause confusion in some systems.

Adjust your rent receipt template to meet the specific terms of each lease agreement. Whether it’s a residential or commercial lease, certain elements should be tailored to reflect the unique conditions of each contract.

- Payment Frequency: For leases with monthly, quarterly, or annual payment schedules, ensure the payment frequency matches the agreement. Include fields to specify the start and end dates for the period covered by the receipt.

- Late Fees and Penalties: If the lease includes late payment penalties, incorporate a section that clearly outlines these fees. Specify the amount or percentage, along with the due date for any additional charges.

- Deposit Details: In cases where the rent includes a security deposit or prepaid rent, include a line to show the amount paid and whether any portion has been refunded or applied toward rent.

- Property-Specific Information: For commercial leases, include information about the space rented (such as square footage) or any specific facilities involved. For residential leases, address the property address and any unit numbers or additional features.

- Special Terms: If the lease has unique clauses (like rent escalations or rent concessions), make sure to list them in the receipt template for transparency.

By tailoring these aspects, your receipt will accurately reflect the terms of each lease agreement, providing both clarity and a professional record for both landlord and tenant.

Rent receipts are legally required in many regions to ensure proper documentation of rental transactions. Requirements vary depending on the country, state, or city, and landlords must comply with local regulations. Understanding these legal obligations helps prevent disputes and ensures transparency in rental agreements.

United States

In the U.S., the necessity of rent receipts is not universally mandated, but they are required in certain states. Typically, rent receipts are needed when a tenant pays rent in cash, as there may not be a bank record. Some states, such as California and New York, have specific laws requiring landlords to provide receipts for cash payments upon tenant request.

United Kingdom

In the UK, landlords are not legally obligated to provide rent receipts unless the tenant requests one. However, it is good practice for landlords to issue a receipt for every payment, as it serves as proof of payment in case of future disputes. Many landlords prefer to issue receipts for cash or check payments, even though bank transfers usually provide a traceable record.

Australia

Australian law requires that rent receipts be provided when a tenant requests one, particularly when rent is paid by cash or in a manner that isn’t traceable. In certain states, like Victoria and New South Wales, landlords must provide written receipts if the tenant pays rent in cash or at the tenant’s request for any method of payment.

| Region | Legal Requirement |

|---|---|

| United States | Required for cash payments upon tenant request (varies by state) |

| United Kingdom | Not mandatory unless requested by the tenant |

| Australia | Required upon tenant request, especially for cash payments |

Always review local laws to ensure compliance with specific rent receipt requirements in your region. In some cases, a receipt can be part of a broader rental agreement, so ensure it aligns with the terms set out in your lease contract.

When a tenant makes a partial payment, ensure it is clearly noted on the rent receipt. Acknowledge the amount received and specify the outstanding balance to maintain accurate records. This helps both the landlord and tenant track payment history and avoids confusion later.

- Record the total rent due, the partial payment made, and the remaining balance.

- Include the date of the partial payment and clearly label it as such. This ensures transparency.

- Consider adding a reference to the agreement or lease terms, specifying how partial payments will be handled if not already outlined.

If adjustments are necessary due to rent changes, repair reimbursements, or any other factors, update the rent receipt accordingly. Specify the reason for the adjustment, the amount altered, and the revised rent figure.

- For rent reductions, include the original rent amount, the reduction, and the new rent figure after the change.

- If a tenant has paid for maintenance or repairs, note the specific charges deducted from the rent payment.

Consistently handling partial payments and adjustments ensures a clear record for both parties and avoids misunderstandings over rent amounts. Always keep copies of these receipts for reference in case of future disputes.

Store receipts in a secure, organized system. Use cloud-based storage to ensure receipts are accessible from anywhere and protected from physical damage or loss. A well-structured folder system helps avoid clutter and confusion. Each receipt should be labeled with relevant details like the date, amount, and property address for easy retrieval.

Choosing the Right Storage Platform

Opt for reliable platforms that provide encrypted storage options. Cloud services like Google Drive or Dropbox allow for easy organization, quick access, and backup. Ensure that the platform you choose allows for the addition of tags or folders, which can simplify future searches.

Distributing Receipts Securely

When distributing receipts, ensure that the recipient can easily view and download the document in a readable format such as PDF. For added security, password-protect receipts or use platforms with built-in security features to avoid unauthorized access.

For physical receipts, make copies and store them in a safe place to prevent loss. If digital receipts are preferred, make sure to provide both formats when distributing them. This guarantees recipients can access the necessary information, regardless of their device preference.

Each sentence has been modified to retain its meaning while reducing repetitive words.

To create a precise annual rent receipt template, focus on clarity and brevity. Begin by including key elements such as the tenant’s name, address of the rental property, and the payment period. Ensure that the rent amount is clearly stated, alongside the payment method used, whether by check, wire transfer, or other means. This information provides a concise summary of the rental agreement without redundancy.

Next, mention any late fees or adjustments if applicable. List the total amount paid during the year and ensure it is accurate. Avoid over-explaining; one simple sentence stating the total rent received will suffice. If applicable, include any credits or deductions that were made throughout the year. This keeps the record clean and easy to reference for both the tenant and the landlord.

To finalize, include the date of issue and the signature of the landlord or property manager. These elements confirm the authenticity of the receipt. Always aim to limit excessive wording; each detail should contribute directly to the purpose of the receipt–clear documentation of the rental payment history.