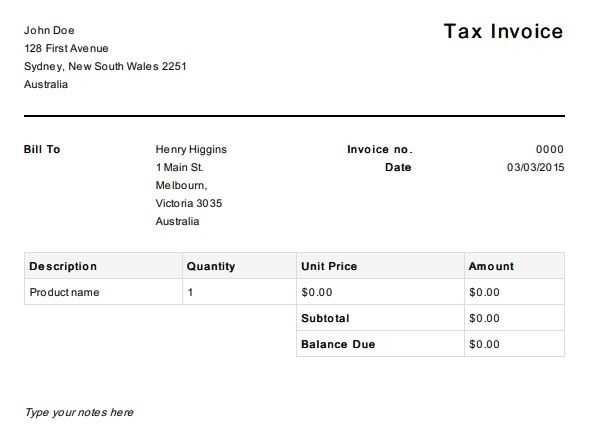

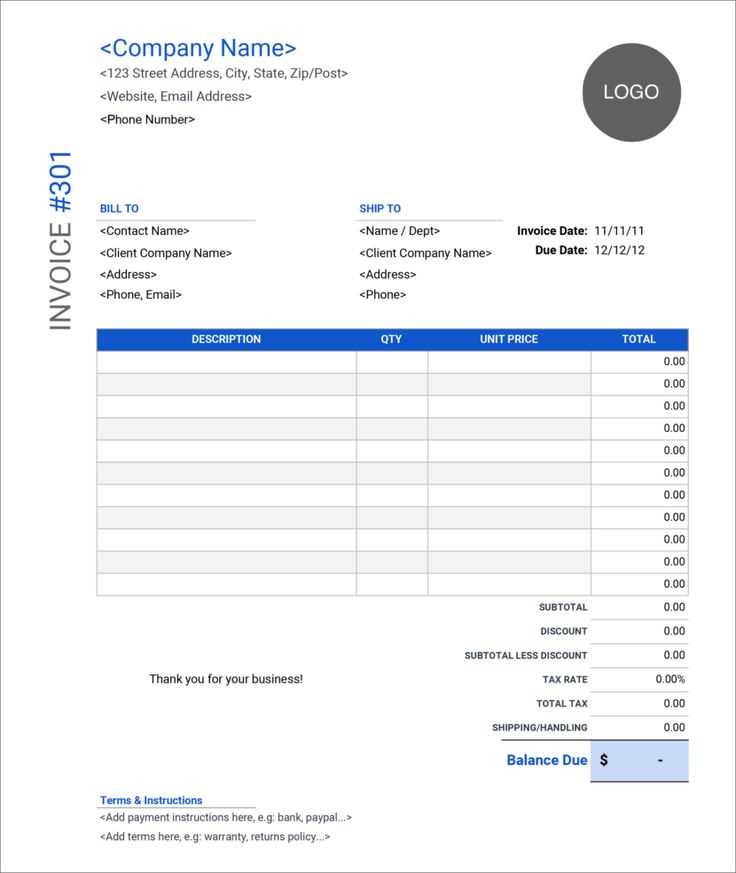

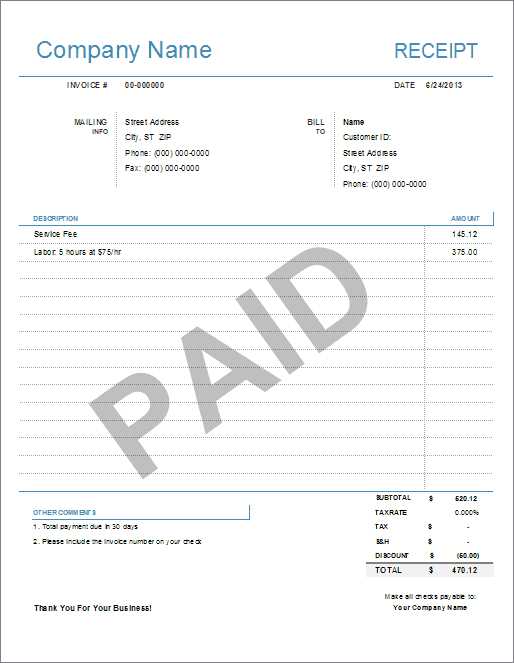

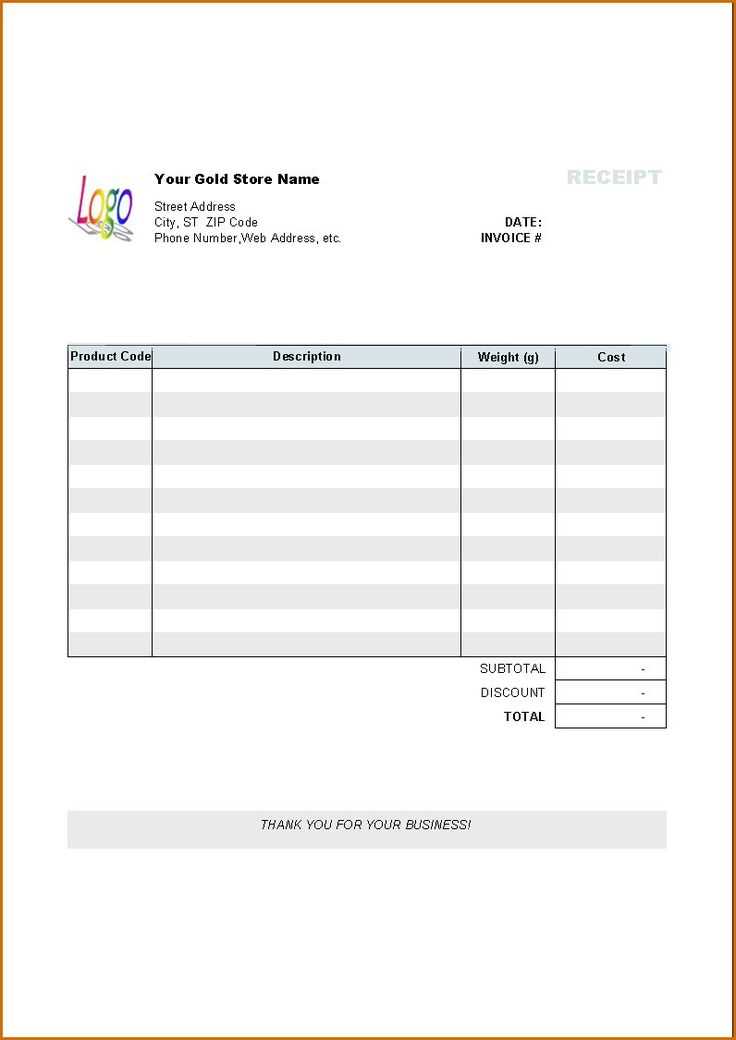

- Invoice and Receipt Template Download

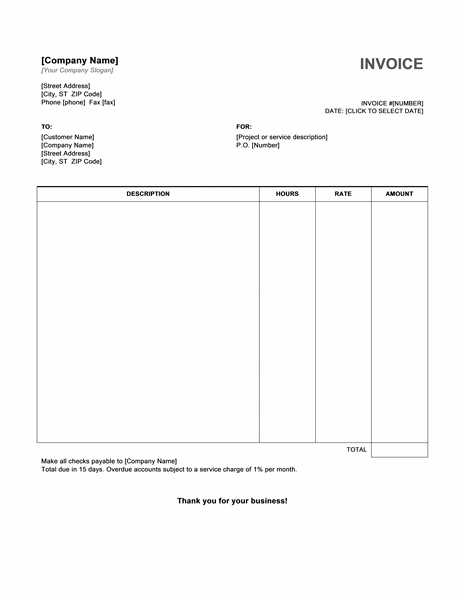

- How to Choose the Right Template for Your Business

- Clear headings and sections

- Large, readable font sizes

- Logical flow of information

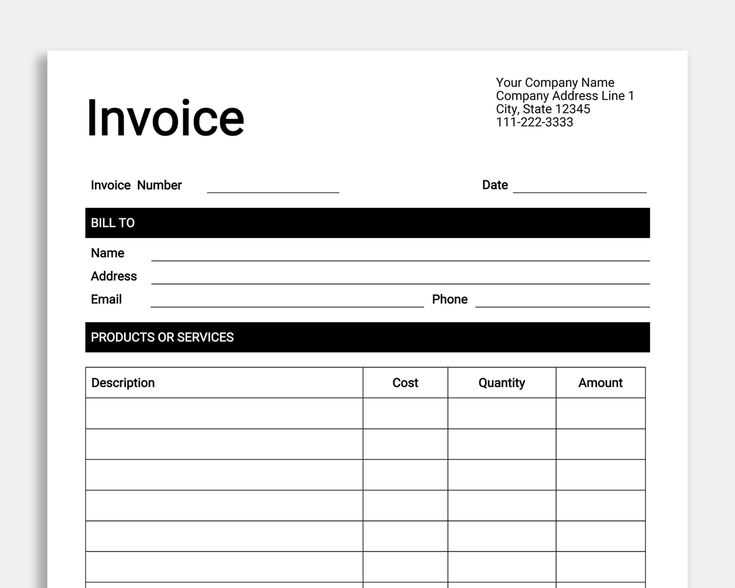

- Customizing Templates to Match Your Branding

- Choose colors that align with your branding guidelines. If your brand uses specific shades, ensure your template matches these to maintain consistency across all communications.

- Pick fonts that are easy to read while also reflecting your brand’s personality. Avoid overloading the template with multiple fonts; choose one or two that are complementary and professional.

- Place your logo prominently, but make sure it doesn’t overpower other important details like the invoice amount or recipient’s name. It should fit seamlessly into the overall design.

- Incorporate other brand elements, such as a watermark, icons, or specific patterns, that help distinguish your documents from generic templates.

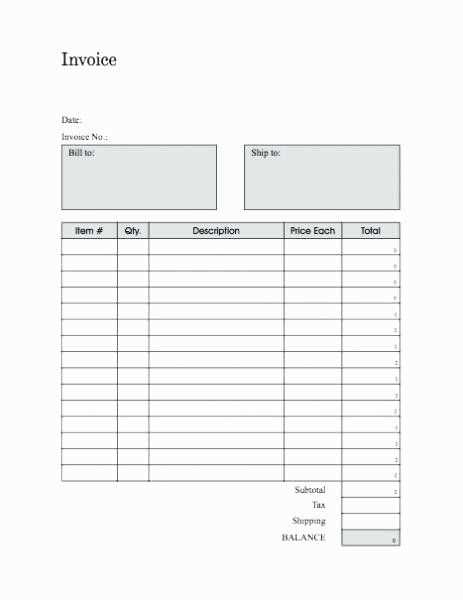

- Key Features to Look for in a Receipt Format

- Date and time of purchase

- Itemized list of purchased items or services

- Quantities and prices for each item

- Taxes, discounts, and shipping fees (if applicable)

- How to Download and Save Templates

Find and download an invoice and receipt template that suits your needs. Whether you’re managing a small business or handling personal transactions, these templates will help maintain clarity and organization in your financial records. Choose from a variety of formats and designs to match your requirements. Most templates are easy to customize, ensuring that you can quickly add or modify essential information like company name, client details, items, and prices.

How to Download

Select the template that works best for your purposes. Most websites offering free downloads provide a straightforward option to download as a Word document, Excel sheet, or PDF. Check for compatibility with your preferred software. Once you download, save it in a secure location on your device for quick access whenever needed.

Customization Tips

Make sure to fill in accurate details before sending out any invoice or receipt. You can adjust the template’s layout if necessary, but ensure that all key fields such as date, invoice/receipt number, and payment terms are included. If required, you can also add logos or specific branding elements to reflect your business identity.

Choosing the right template depends on the type of business you run and the image you want to project. Focus on clarity, simplicity, and functionality. Avoid clutter and choose a template that aligns with your brand identity.

Consider the Features You Need

Identify the specific elements your template should have. Does your business require an itemized breakdown, taxes, or discounts? Look for templates that allow customization, so you can add necessary details.

Prioritize User Experience

A clean layout enhances readability. Select a template that customers can easily understand. Use a format that makes it easy for clients to spot important information like the total amount or due date.

Finally, test a few options to see which one works best for your business operations. Customizing the template can make a huge difference in efficiency and customer satisfaction.

Adjust your templates to reflect your business identity. Customization goes beyond simply changing colors and logos; it involves making sure that the entire template feels cohesive with your brand message.

Colors and Fonts

Logo and Brand Elements

Fine-tuning these aspects creates a uniform look that reinforces your brand’s visual identity and builds recognition with clients.

Clarity is a top priority. Make sure the receipt clearly displays the business name, transaction details, and total amount paid. The font size should be large enough for easy reading, with sufficient space between sections.

Transaction Information

Ensure the receipt contains the following transaction details:

Payment Method

Include the method of payment used, whether it was cash, credit card, or digital payment. This helps track expenses and confirm the mode of payment for both parties.

| Feature | Why It Matters |

|---|---|

| Itemized list | Clear breakdown of the transaction makes it easier for customers to verify the purchase |

| Tax details | Helps with accurate record-keeping for refunds and accounting purposes |

| Payment method | Confirms the transaction’s completion and reduces confusion in case of disputes |

Adding a receipt number or order ID provides an extra layer of tracking and can help with returns or exchanges.

To download and save invoice or receipt templates, follow these steps:

- Go to the template provider’s website or platform offering the templates you need.

- Choose a template format (such as Word, PDF, or Excel) that suits your needs.

- Click the download button or link associated with the template.

- If prompted, select the location on your computer or cloud storage to save the file.

- Click “Save” to complete the download.

For easy access, save the template in a folder where you can quickly find it. You may also consider renaming the file for better organization.

If you’re working on a cloud platform (like Google Drive or OneDrive), the template will automatically be saved to your account. You can also use these services to keep your templates accessible across devices.

If you prefer using a template multiple times, consider creating a copy in your storage, so the original remains untouched. You can easily edit and customize the copy as needed for different uses.

To streamline your invoicing process, integrate your templates directly into your accounting software. Many accounting platforms offer built-in features or plugins that allow you to create and manage invoices seamlessly within the system. By linking your templates to the software, you reduce the chances of errors and save time on repetitive data entry.

For integration, choose a software solution that supports template customization or offers easy import options for pre-designed templates. This lets you maintain a professional, consistent look while simplifying the process. Some popular software even supports automatic population of client details and transaction data, making invoicing nearly automated.

Ensure that your template fields align with the software’s input structure to avoid formatting issues. If necessary, adjust template variables, such as dates, totals, and tax calculations, to ensure compatibility with the accounting platform. A successful integration will allow you to generate and send invoices directly from the software, keeping all records neatly organized in one place.

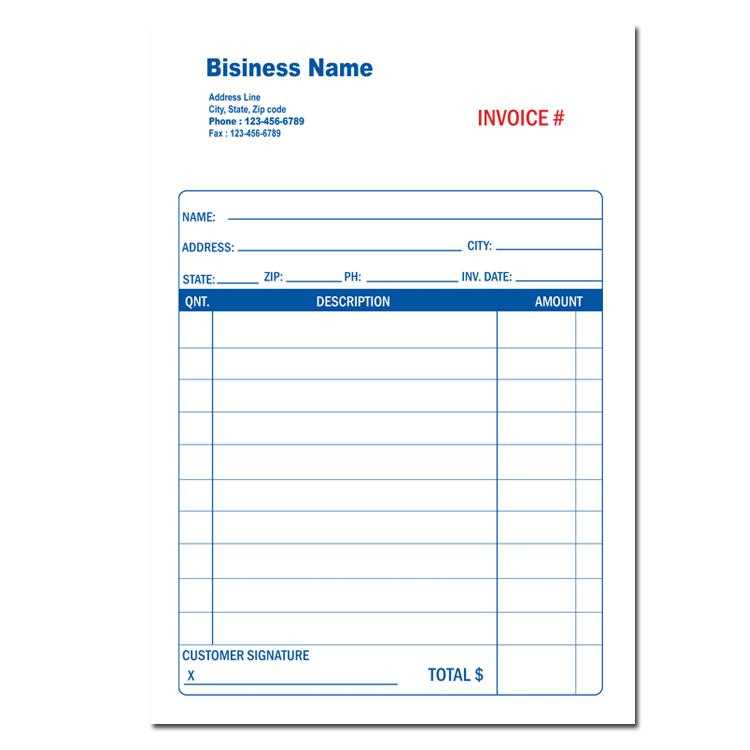

One of the biggest errors is leaving out key details like the transaction date, company information, or payment terms. Always make sure the invoice or receipt includes your business name, contact details, and the customer’s information, along with clear payment instructions. Missing these can cause confusion and delay payments.

Incorrect or Inconsistent Formatting

Inconsistent formats lead to confusion. For example, using different fonts, sizes, or layouts across multiple invoices or receipts can make documents harder to read and unprofessional. Stick to a standardized format to maintain clarity and professionalism.

Not Including Tax Information

Omitting tax details, such as tax rates or the total tax amount, can cause issues during audits or disputes. Always clearly display applicable taxes on both invoices and receipts to avoid misunderstandings or legal problems.

To create a streamlined process for managing invoices and receipts, it’s important to choose a downloadable template that fits your needs. A clean, well-structured format ensures clarity for both you and your clients. Ensure the template includes key fields like date, item description, quantity, price, and total amount, as well as your contact information and any applicable tax details.

Choosing the Right Template

Look for templates that allow customization to fit the specifics of your business, such as branding or payment terms. Some tools offer both invoice and receipt options in one download, helping to save time and effort in creating separate documents for different transactions. Select a format compatible with your preferred software, whether it’s Word, Excel, or a PDF option.

Features to Consider

Consider templates with auto-calculation for totals, tax, and discounts. This feature reduces errors and saves time. Make sure the template allows easy adjustments for recurring payments or discounts. Templates with a clean design will also help your invoices and receipts appear professional and clear.

By carefully selecting a template that matches your business style and operational needs, you can simplify your invoicing and receipt generation while ensuring consistent documentation for all transactions.