Creating a donation receipt template that is clear and compliant with legal requirements can save time and simplify record-keeping for both organizations and donors. A well-structured template ensures that essential details are accurately captured and presented in a professional format.

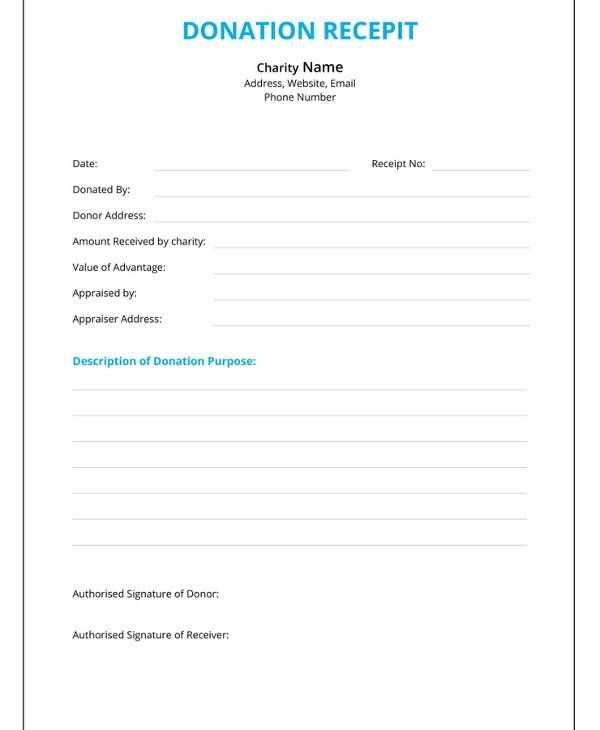

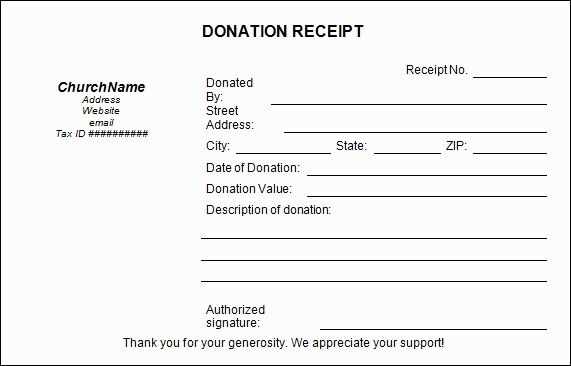

Start by including key information such as the organization’s name, address, and tax identification number. The receipt should specify the donor’s name, donation amount, and the date of the contribution. Adding a brief description of the donation, whether monetary or in-kind, helps maintain transparency and accuracy.

To enhance usability, consider offering the template in multiple formats like PDF and Word. This makes it easier for users to customize and print according to their needs. Adding an optional thank-you message at the end of the receipt can also help strengthen donor relationships and encourage future contributions.

Whether you manage a non-profit organization or need a personal template for small fundraising efforts, a free, ready-to-use donation receipt template can be an invaluable tool. By using a standardized format, you can ensure consistency while meeting reporting requirements.

Sure! Here’s the text with repetitions reduced:

A donation receipt template is a practical tool for tracking and documenting contributions. It ensures transparency and simplifies tax reporting for donors. A well-structured template should include key information and be easy to customize for different needs.

Key Elements to Include

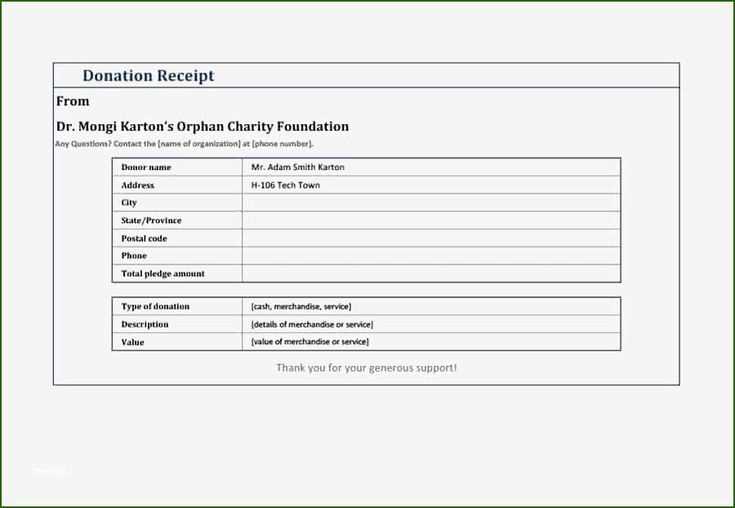

- Organization Details: Full name, address, and contact information of the recipient organization.

- Donor Information: Name, address, and contact details of the donor.

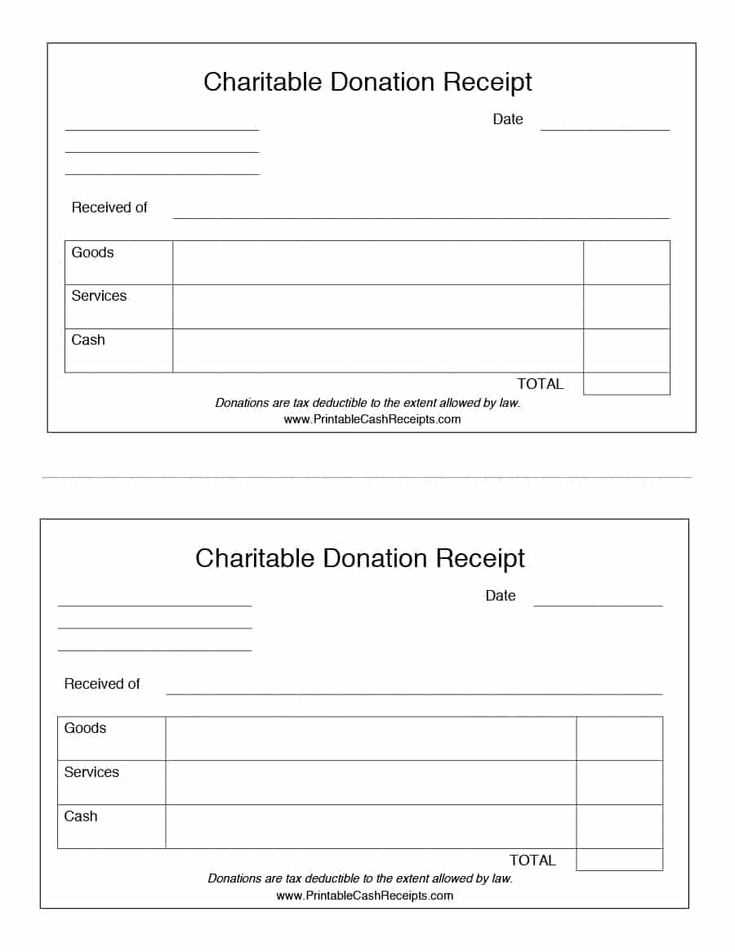

- Date and Description: The date of the donation and a brief description of the contribution.

- Donation Value: Specify the exact amount or estimated value of the donated items.

- Tax Statement: Include a note confirming the donation is tax-deductible, if applicable.

Recommended Formatting Tips

- Use a clean and simple design for easy readability.

- Highlight important fields such as donor name and donation amount.

- Provide space for the organization’s representative signature for authenticity.

A well-crafted template saves time and ensures accuracy, helping organizations maintain detailed records while providing donors with the necessary documentation for tax purposes.

- Donation Receipt Template Free

Use a donation receipt template to quickly generate professional receipts for contributions. A well-structured template should include key details such as the donor’s name, donation amount, date, and a brief description of the donation purpose.

Essential Elements:

- Donor Information: Full name and contact details of the donor for accurate record-keeping.

- Date and Amount: Clearly specify the date of the donation and the exact amount contributed.

- Description: Mention whether the donation was monetary or in-kind, along with a brief description.

- Organization Details: Include the full name, address, and tax identification number of the organization.

- Signature: Add a signature or a digital approval for authenticity.

Ensure your template follows local regulations, especially for tax deduction purposes. A customizable template simplifies the process and saves time, helping you focus on managing donor relationships and promoting future contributions.

Begin by ensuring the receipt template includes key elements such as the organization’s name, logo, contact details, and a unique receipt number. These details add credibility and help maintain accurate records.

Include Donation-Specific Information

Clearly indicate the donor’s name, donation amount, date, and purpose of the contribution. If applicable, specify whether the donation is tax-deductible and include a statement confirming no goods or services were provided in exchange.

Personalize for a Professional Touch

Add a personalized thank-you message to express gratitude to the donor. Customize the font, colors, and layout to match the nonprofit’s branding for a cohesive look. Ensure the format is clean and easy to read, avoiding clutter while highlighting key information.

Finally, save the template in multiple formats (PDF, Word, or Excel) to provide flexibility for editing and distribution. Regularly update the template to reflect any changes in tax regulations or organizational details.

Ensure every donation receipt complies with the necessary legal requirements by including key details. Missing essential information can lead to compliance issues and disputes.

Mandatory Information

- Donor’s Information: Full name and address of the donor.

- Organization’s Details: Legal name, address, and tax identification number (if applicable).

- Date of Donation: Specify the exact date when the donation was made.

- Donation Description: Provide a clear description of the donation. For cash donations, include the amount. For non-cash donations, describe the donated item without assigning a monetary value unless legally required.

- Statement of No Goods or Services: If no goods or services were provided in return, add a statement confirming this.

Additional Considerations

- Tax-Deductibility Statement: Indicate whether the donation is tax-deductible according to relevant laws.

- Signature (Optional): While not always mandatory, adding a signature from an authorized representative can enhance authenticity.

- Donation Receipt Number: Include a unique identifier for record-keeping and tracking purposes.

Always verify the specific legal requirements in your jurisdiction to ensure full compliance.

For a donation receipt, the right format depends on how you plan to distribute and store it. PDF offers a reliable, printable option with a consistent layout across all devices, while digital formats like online forms or emails provide flexibility and real-time access.

Choose PDF if you prioritize offline access and secure, easily shareable files. PDFs are ideal for formal records and can be digitally signed for authenticity. However, they require more manual effort for tracking and updating compared to digital options.

| Feature | Digital (Online Forms/Emails) | |

|---|---|---|

| Accessibility | Available offline | Requires internet access |

| Customizability | Limited after creation | Highly customizable in real-time |

| Security | Supports encryption and digital signatures | May require additional security measures |

| Distribution | Email or print | Instant sharing and automation |

Digital formats work best for automated systems, allowing for seamless integration with databases and easy access for donors. Consider combining both options: offer a PDF download while maintaining a digital record for faster processing and future reference.

To edit and personalize your donation receipt template effectively, begin by opening the file in your preferred text editor or document software. Ensure the format is compatible with your editing tool, such as Word, Google Docs, or PDF editor.

1. Update Basic Information

Replace placeholder text with accurate details. Add your organization’s name, address, contact information, and logo. This creates a professional and recognizable look.

2. Customize the Content

Modify sections like donor’s name, donation date, and amount to match your specific needs. Ensure consistency in font type, size, and alignment for a polished appearance. Use tables to organize data for readability if the template supports it.

For digital templates, embed hyperlinks to relevant pages like tax documentation or donation history. If the template will be printed, ensure margins and spacing are adjusted for a clean final version.

Once your edits are complete, save the template in multiple formats (PDF, Word) to ensure accessibility for different users. Test print a sample copy to check layout accuracy before sharing it with donors.

Verify essential details on each receipt. Ensure that the receipt includes the organization’s legal name, donation date, and the exact amount contributed. For non-cash donations, describe the items in detail without assigning a monetary value.

Include a statement of tax-exempt status. Clearly indicate that the organization is a registered tax-exempt entity. Add a note specifying that no goods or services were provided in exchange for the donation, unless applicable, in which case the fair market value must be disclosed.

Maintain consistency in formatting and terminology. Use a standardized template for all donation receipts to avoid errors and omissions. Ensure dates, donation descriptions, and legal references align with current tax regulations.

Keep digital and physical records secure. Store receipts in both formats to simplify retrieval during audits. Regularly back up digital files and organize them by tax year for quick access.

Consult tax guidelines for specific requirements. Tax laws may vary depending on the donor’s location. Regularly review the latest regulations to stay compliant and update templates accordingly.

Start with Microsoft Office Templates, where you’ll find a wide selection of customizable receipt templates for Word and Excel. These templates are easy to edit and cover various needs, from donation receipts to sales invoices.

Template.net offers a comprehensive library of free receipt templates in multiple formats like Word, Excel, and PDF. Simply browse their collection, choose the template that fits your purpose, and download it instantly. Many templates include professional designs that are ready for use without extensive customization.

Open-Source and Design Platforms

Platforms like Canva provide stylish receipt templates that are both free and highly customizable. Use their drag-and-drop editor to personalize the layout, fonts, and colors. For more formal needs, Invoice Home has pre-built templates with a focus on clarity and simplicity.

Specialized Business Tools

Websites such as Zoho and Invoice Generator offer free receipt templates along with options to generate receipts directly online. These tools save time and ensure consistency across all your receipts.

When creating a donation receipt template, ensure it includes all necessary details to maintain transparency and meet legal requirements. Focus on key elements such as donor information, donation date, amount, and a clear description of the contribution.

Essential sections:

- Donor Details: Full name and contact information of the donor.

- Organization Information: Name, address, and tax identification number of the organization issuing the receipt.

- Donation Description: Specify if it’s a monetary donation or an in-kind contribution.

- Donation Amount: For monetary donations, state the exact amount. For in-kind donations, provide a brief description without assigning a monetary value unless required.

- Date of Donation: Indicate the date the donation was received.

- Statement of No Goods or Services Provided: Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable.

For added convenience, use a standardized format to ensure consistency across all receipts. This will save time and reduce errors while maintaining a professional appearance.