Creating a clear and concise security deposit receipt is a key part of managing rental agreements. This document outlines the terms of the deposit and provides both the tenant and landlord with a formal record of the transaction. Make sure to include specific details such as the deposit amount, the date of payment, and any conditions under which the deposit may be withheld or refunded.

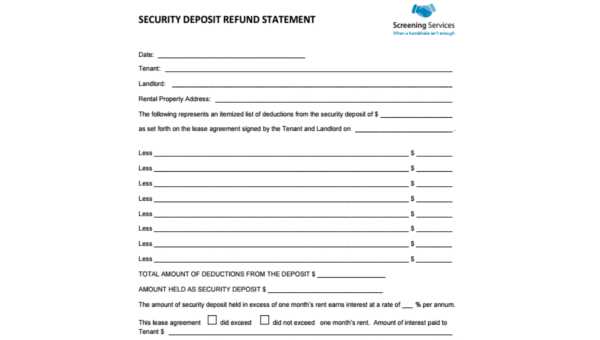

Transparency in the disclosure of the security deposit terms is essential. The receipt should clearly outline any deductions that might occur and the process for returning the deposit at the end of the lease. By including this information upfront, you protect both parties from misunderstandings and ensure compliance with local rental laws.

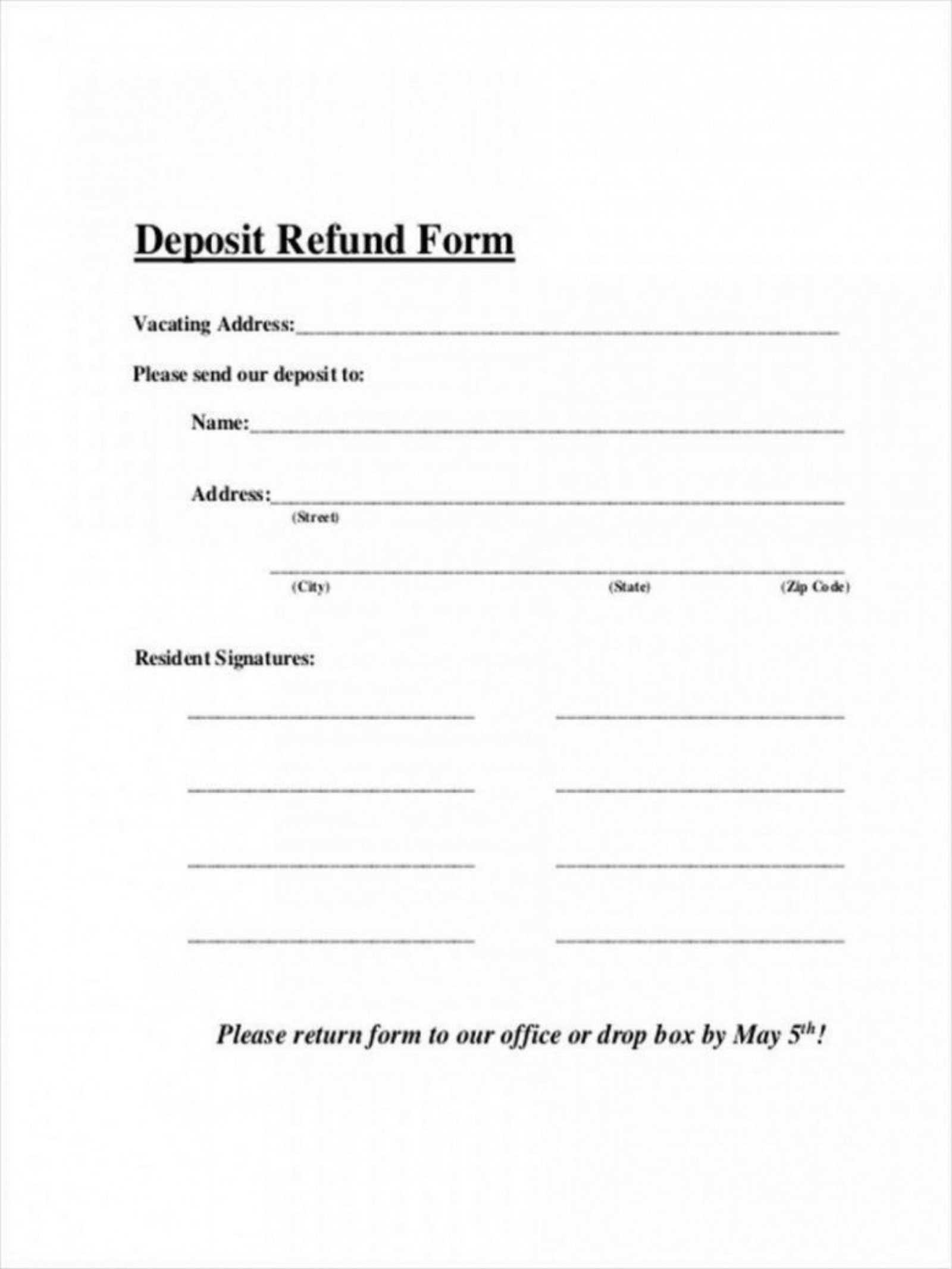

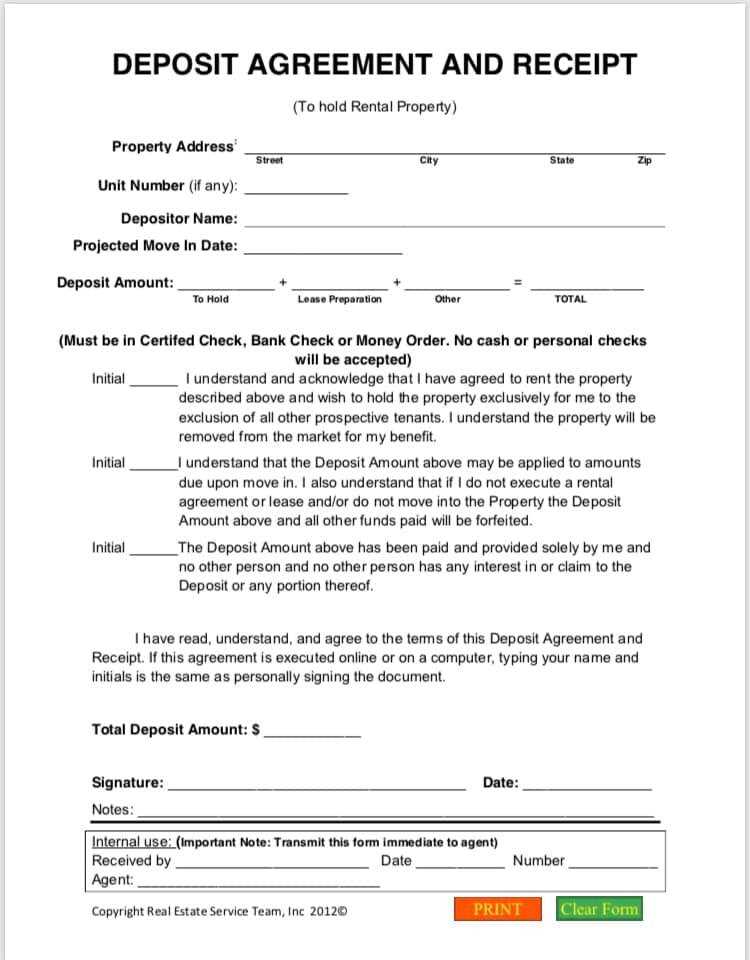

Consider using a template to simplify the process. A well-structured template saves time and helps ensure all necessary details are included. It should have space for the tenant’s name, the property address, the deposit amount, and signatures from both parties. This helps maintain clear communication and ensures that the terms of the deposit are understood by all involved.

Here’s the revised version with reduced repetition:

Focus on clarity when drafting a security deposit receipt. Remove redundant phrases and keep the information concise. Include only necessary details such as the amount, date, and conditions under which the deposit is refundable. Clearly state the tenant’s obligations and the landlord’s responsibilities.

For example, instead of repeating the terms of the deposit, highlight the most critical aspects in a structured format. A good template should list key points such as the amount paid, the purpose of the deposit, and any deductions that could be applied at the end of the lease.

Avoid using generic or excessive language. Stick to the facts. The tenant should be able to understand the document at a glance. Keep the tone professional, but make it readable and direct.

This simple, focused approach will reduce the need for frequent clarifications and help ensure both parties are on the same page. This practice also minimizes misunderstandings and simplifies future references to the receipt.

- Security Deposit Receipt Template and Disclosure

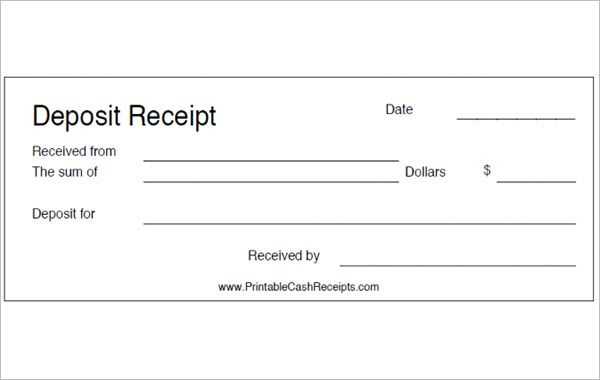

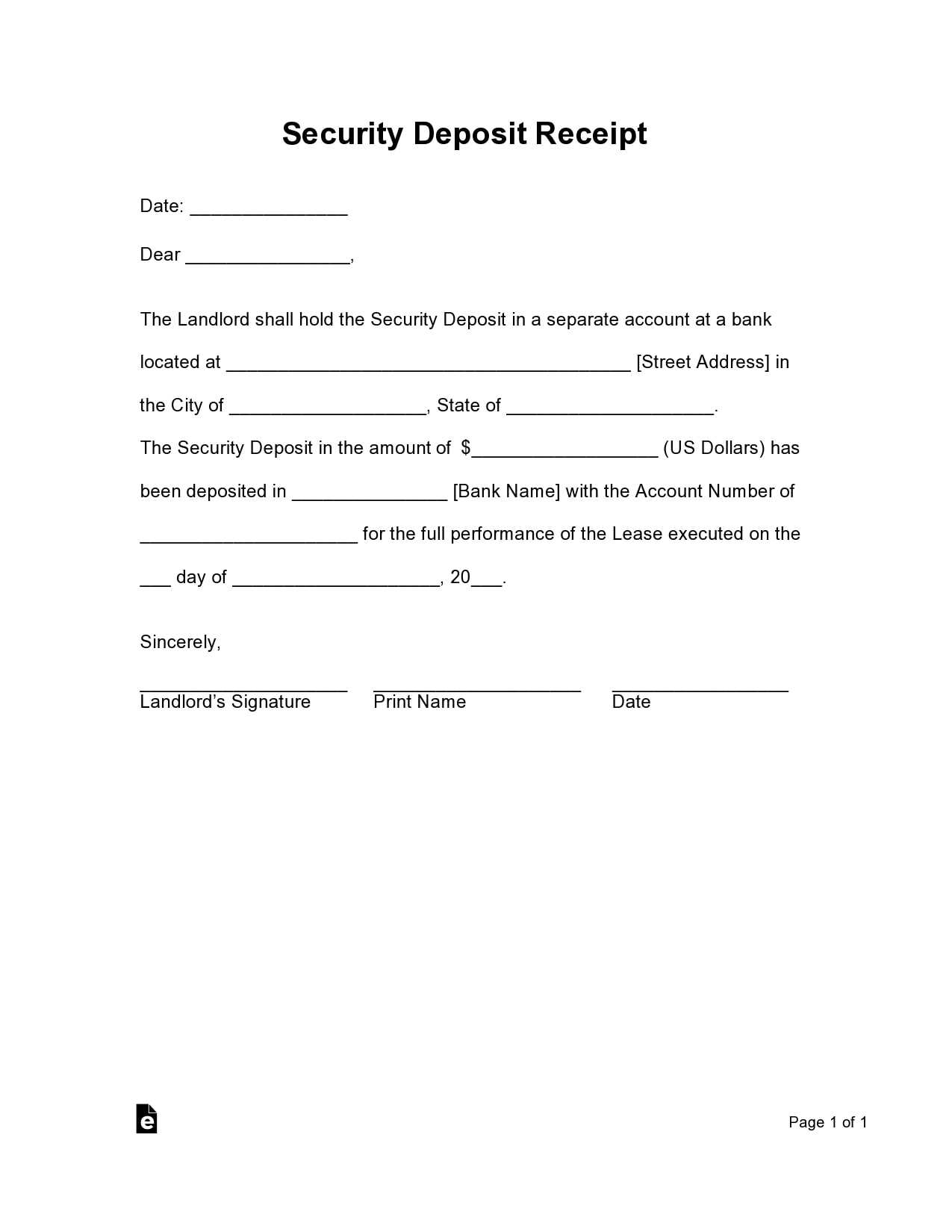

A security deposit receipt is a written acknowledgment from a landlord or property manager confirming the receipt of a tenant’s security deposit. It serves as an important document for both parties involved, ensuring clear communication regarding the amount received and the terms under which it was collected. This receipt should include specific details to protect both the landlord and tenant. Here is a recommended template and a disclosure guideline for security deposit receipts:

Security Deposit Receipt Template

| Item | Description |

|---|---|

| Landlord Name | Full name or business name of the landlord/property manager. |

| Tenant Name | Full name of the tenant who paid the security deposit. |

| Property Address | The address of the rental property. |

| Deposit Amount | Exact amount of the security deposit received. |

| Payment Method | Specify if the deposit was paid by check, cash, bank transfer, etc. |

| Receipt Date | The date the deposit was received. |

| Purpose of Deposit | State the reason for the deposit (e.g., damages, unpaid rent, etc.). |

| Terms of Refund | Conditions under which the deposit will be refunded, including timeframes. |

| Landlord Signature | Signature of the landlord or property manager. |

Disclosure Requirements

According to most local laws, landlords must provide a clear and detailed security deposit receipt that includes both the deposit amount and the terms under which it may be refunded. Failure to provide this receipt can result in legal complications. Make sure to outline the following points:

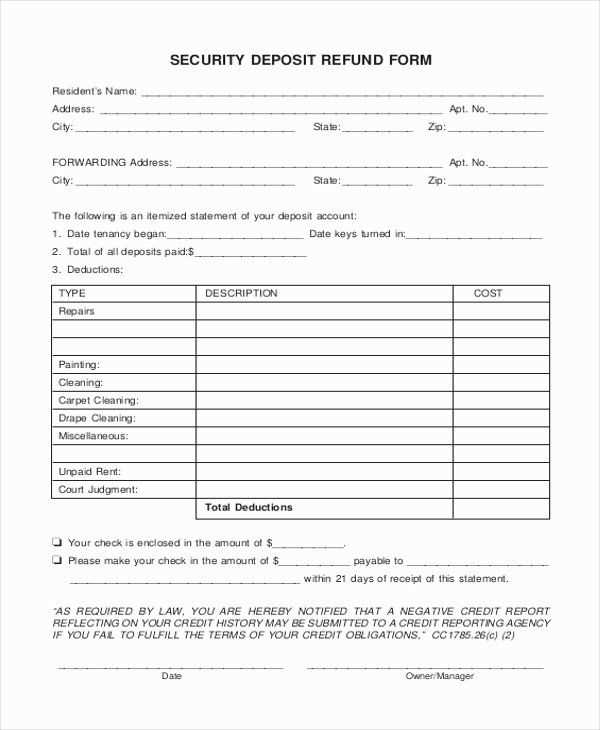

- The total amount of the security deposit and any specific breakdown (if applicable).

- The method and timing of how the deposit will be returned to the tenant after the lease ends.

- A list of potential deductions (if any) and a detailed process for how those will be applied.

Proper disclosure ensures transparency and reduces the likelihood of disputes at the end of the rental term. Be sure to always issue a receipt promptly after receiving the deposit, and keep a copy for your records.

Use a clear format with essential details. Include the date, tenant’s name, landlord’s name, property address, deposit amount, and payment method. Clearly state the purpose of the deposit and any conditions for its return.

Structure the Receipt for Easy Reference

Organize sections logically. Place the date at the top, followed by tenant and landlord details. Below, specify the amount received, the reason for payment, and any terms. Acknowledgment and signatures should be at the bottom.

Ensure Accuracy and Compliance

Check local regulations for any required disclosures. Use simple, precise language to avoid misinterpretation. Digital templates should allow easy updates, while printed versions should leave space for handwritten details.

Include a signature section. Both the landlord and tenant should sign to confirm receipt, ensuring transparency and preventing disputes.

Include the full name of the tenant and landlord, along with the rental property address. This ensures clarity about the involved parties and the location of the leased unit.

Amount and Payment Details

Specify the exact deposit amount received, the date of payment, and the method used (cash, check, bank transfer). If applicable, include the check number or transaction ID for reference.

Terms of the Deposit

Outline the conditions for refund, including any deductions for damages or unpaid rent. Mention the timeframe for returning the deposit after lease termination, following local regulations.

Conclude with signatures from both parties to confirm acknowledgment and agreement. A copy should be provided to the tenant for their records.

Some states mandate that landlords provide a detailed receipt for security deposits, while others have minimal requirements. Check local laws to ensure compliance.

- California: Landlords must provide a written receipt if the tenant pays in cash. The receipt should include the amount, date, and purpose of the payment.

- New York: If a rental unit is in a building with six or more units, landlords must hold deposits in an interest-bearing account and provide annual statements.

- Illinois: In Chicago, landlords must issue a receipt specifying the amount, date, tenant’s name, and property address.

- Texas: No specific requirement for receipts, but landlords must return the deposit within 30 days, with an itemized deduction list if applicable.

- Florida: Landlords must notify tenants in writing within 30 days about where and how the deposit is held.

State laws differ, and failing to comply can lead to penalties. Always provide a clear, accurate receipt and retain a copy for records.

Omitting Key Details

Ensure the receipt includes the full names of both parties, the property address, the exact amount received, the date of payment, and the payment method. Missing any of these details can lead to disputes or legal complications.

Failing to Provide a Copy

Always give a copy of the receipt to the tenant and retain one for your records. A single copy increases the risk of misunderstandings, especially if a tenant later claims they never received proof of payment.

Clear documentation protects both landlords and tenants. Double-check all entries before issuing the receipt to prevent unnecessary conflicts.

How to Provide a Disclosure of the Security Deposit to Tenants

Clearly outline the terms regarding the security deposit in the lease agreement. Ensure tenants receive this document at the start of their tenancy.

Include Essential Details

- Specify the total amount of the security deposit.

- State the purpose of the deposit, highlighting that it covers potential damages or unpaid rent.

- Explain how the deposit will be held, whether in a separate account or as part of the rental income.

Communicate Return Procedures

- Detail the timeline for returning the security deposit after the lease ends.

- Describe the process for assessing damages and deductions.

- Provide tenants with a checklist of potential deductions to avoid surprises.

Offer a copy of the disclosure document to tenants, ensuring they acknowledge receipt. Maintain open communication channels for any questions they may have regarding the deposit.

What to Do If a Tenant Disputes the Amount of the Security Deposit

Begin by reviewing the lease agreement and any related documentation. Ensure you have a clear record of the security deposit amount, including any deductions made for damages or unpaid rent. Provide the tenant with a detailed breakdown of these deductions, including receipts or invoices for repairs or cleaning.

Open Communication

Encourage open dialogue with the tenant. Ask them to share their concerns regarding the deposit amount. Listen actively to their points and provide clarifications as needed. This approach can help resolve misunderstandings and build trust.

Documentation and Evidence

If the dispute escalates, gather all relevant documents, including the lease agreement, move-in and move-out inspection reports, and photographs of the property’s condition. This evidence can support your position and demonstrate the validity of the charges. If necessary, consider mediation to find a mutually acceptable solution.

Clearly outline the deposit amount, including a breakdown of how it’s calculated, in your receipt. Specify whether any part of the deposit is non-refundable and under what circumstances. Detail the conditions that may lead to a partial or full deduction, such as damages or outstanding payments, to ensure transparency.

Provide the full name and contact information of the landlord or property manager issuing the receipt. Include the tenant’s details, including their full name and address, for proper documentation. Also, mark the date the deposit was received and ensure both parties sign the receipt to confirm its validity.

State the return timeline for the deposit and the method of payment once the lease ends. Make sure to clarify whether the deposit will be returned with interest, or if deductions for repairs or damages will be itemized in a separate statement.