For a smooth and clear transaction, it’s crucial to have a detailed down payment receipt when purchasing a lawn tractor. A well-organized template ensures both buyer and seller are on the same page about the agreed terms and amounts. This document serves as proof of payment and outlines the balance due, offering clarity and protection for both parties.

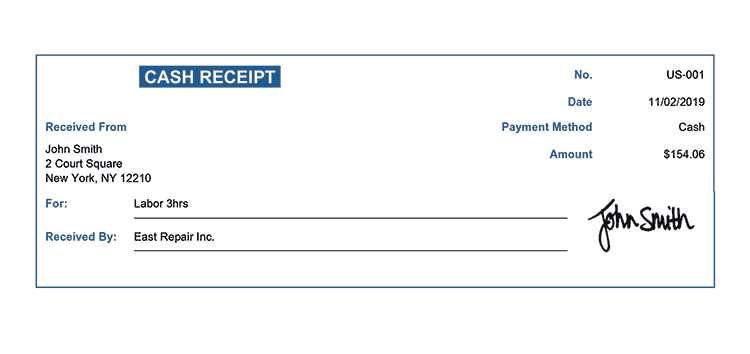

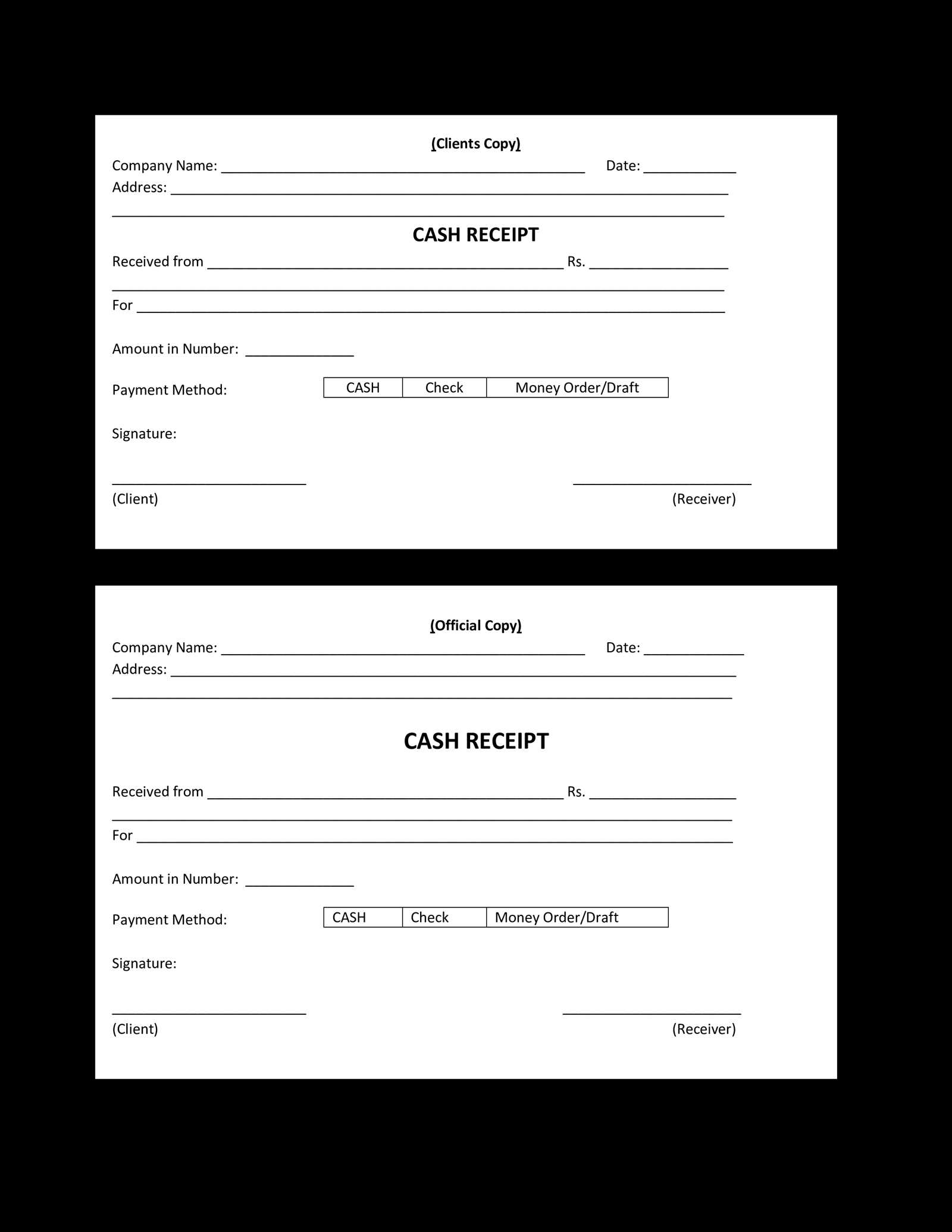

Use the template to include key details such as the buyer’s name, the total cost of the lawn tractor, the down payment amount, and the remaining balance. Specify the payment method and the date of the transaction. This approach reduces confusion and creates a transparent record of the transaction.

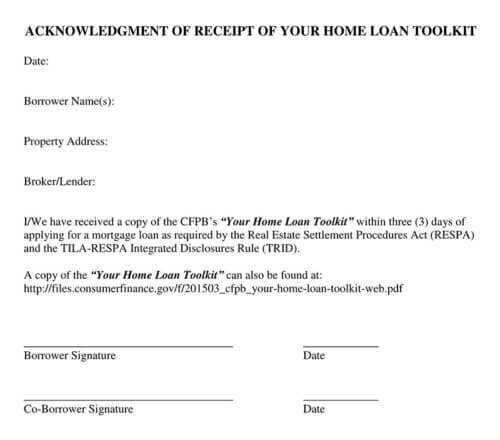

Ensure the receipt includes a section for both the seller’s and buyer’s signatures, which confirms acceptance of the terms. By including all relevant information, you create a solid foundation for completing the purchase and preventing any misunderstandings later in the process.

Here are the revised lines with minimal repetitions:

When creating a down payment receipt for a lawn tractor, be specific about the tractor model and the payment details. Clearly list the buyer’s name, payment amount, and payment method. Include the date of the transaction and the remaining balance to avoid any confusion later. Keep the tone professional and straightforward, while providing all necessary information for future reference.

Make sure to include the dealer’s information, including contact details, for the buyer’s convenience. Specify any additional conditions, such as delivery dates or maintenance agreements, if applicable. Keep the document simple, yet thorough, so both parties have a clear record of the transaction.

Ensure that the receipt is signed by both the buyer and the seller to confirm the terms. This will provide legal clarity in case of any disputes later on. Also, keep a copy of the receipt for your records and provide the buyer with one as well.

- Down Payment Receipt Template for Lawn Tractor

Creating a down payment receipt for a lawn tractor purchase is simple but important. It should clearly outline the transaction details for both the buyer and seller. Here’s what to include:

- Date of Payment: Record the exact date when the down payment was made.

- Buyer’s Information: Include the full name, address, and contact details of the buyer.

- Seller’s Information: Include the business name, address, and contact details of the seller.

- Amount Paid: Specify the exact amount of the down payment received.

- Payment Method: Note whether the payment was made via cash, check, or credit card.

- Remaining Balance: Indicate the remaining balance to be paid, if applicable.

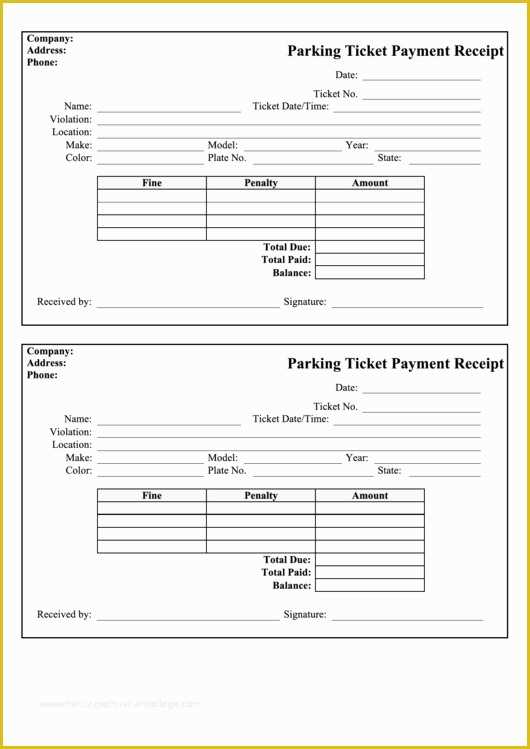

- Lawn Tractor Details: Include the make, model, and serial number of the lawn tractor.

- Signature: Ensure that both the buyer and seller sign the receipt to confirm the transaction.

Use this template to avoid any misunderstandings and ensure both parties are on the same page regarding the down payment. You can adjust the content based on the terms of your agreement.

A down payment receipt should clearly outline specific details to protect both the buyer and the seller. Start by including the date of the transaction. This marks the day when the down payment was made.

- Buyer’s Information: Include the full name, address, and contact details of the buyer. This ensures that the buyer is properly identified.

- Seller’s Information: List the seller’s name, address, and business details. This confirms who the payment is being made to.

- Item Description: Provide a detailed description of the lawn tractor, including model, make, and any serial numbers, if applicable.

- Down Payment Amount: Clearly state the exact amount of the down payment, along with the total price of the lawn tractor. This separates the amount paid from the remaining balance.

- Payment Method: Specify how the payment was made (cash, check, or credit card) and any reference numbers associated with the transaction.

- Balance Due: Mention the remaining amount to be paid. This helps both parties track the outstanding balance.

- Signatures: Have both the buyer and seller sign the receipt. This confirms that both parties agree to the terms outlined in the document.

Ensure all information is accurate and legible to avoid misunderstandings in the future. Keep a copy for both parties as proof of the agreement.

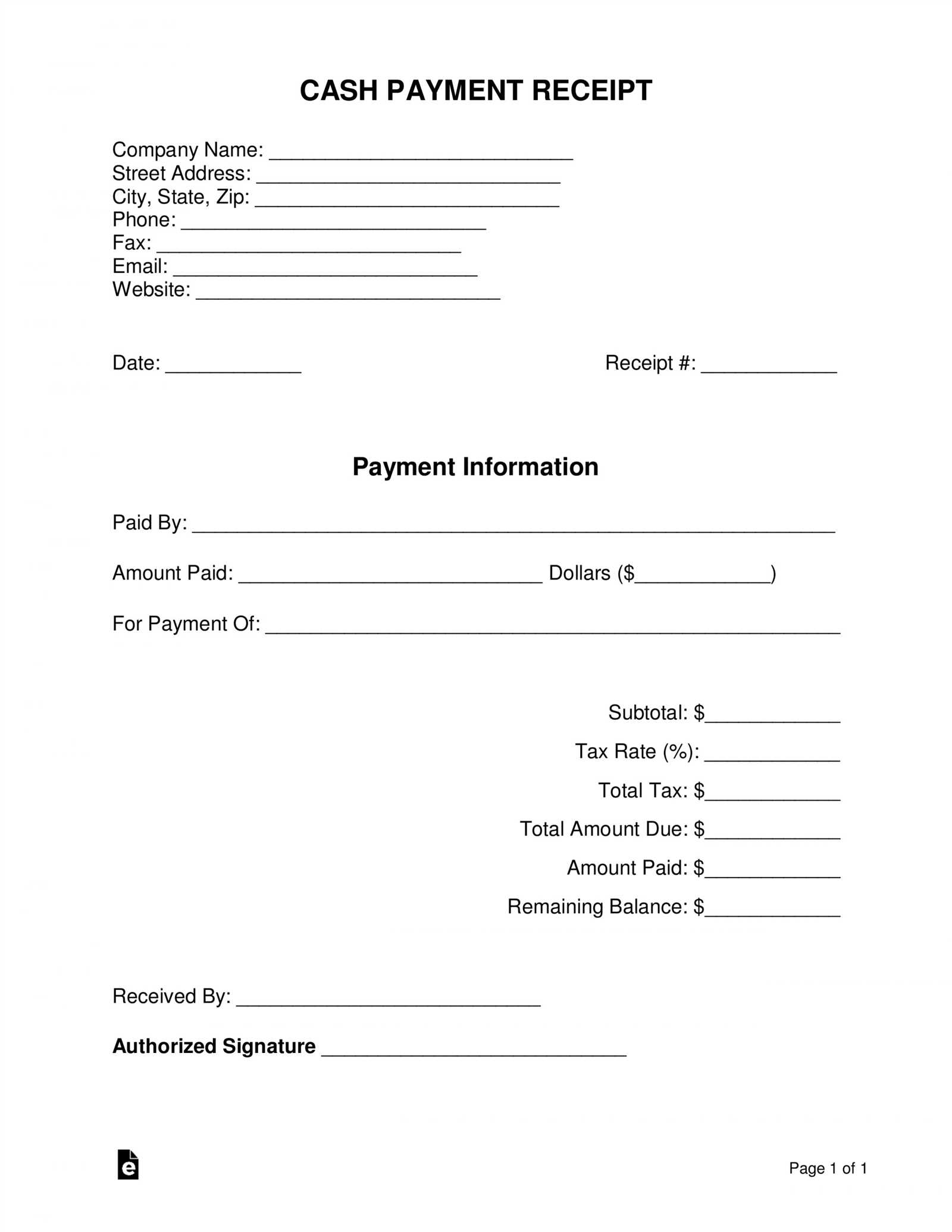

Use clear headings for each section of the receipt. Label key elements like “Payment Date,” “Amount Paid,” and “Remaining Balance” so the reader can quickly find relevant information.

Organize details in a table to separate the different pieces of information, such as item description, price, and payment method. A well-structured table improves readability.

Choose legible fonts with a size that is easy to read at a glance. Avoid overly decorative or complicated fonts that can distract from the information.

Align text neatly so each section is clearly separated. Use left or center alignment for better readability, and avoid cramming information too close together.

Provide adequate spacing between sections to help guide the reader’s eyes through the document. White space makes the receipt feel less cluttered and easier to understand.

Highlight important details by making key figures like the total amount bold or in a larger font size. This draws attention to crucial information without overwhelming the reader.

Ensure consistency in formatting across the receipt. If you use bullet points for one section, keep that format throughout the document to maintain clarity.

Ensure that all relevant details are included, such as the buyer’s full name, the amount of the down payment, and a clear description of the item or service. Missing or unclear information can cause confusion and lead to disputes later.

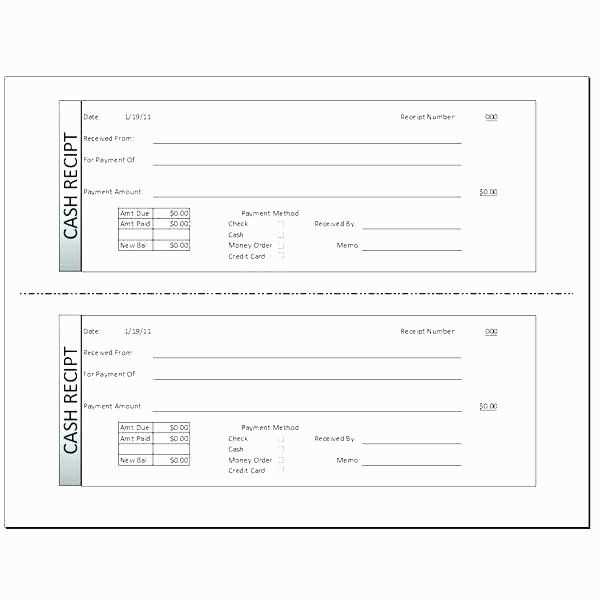

Incorrect Payment Amounts

Double-check the payment amount. Even a small error, such as a misplaced decimal, can create problems. Verify the total amount received and ensure it matches what was agreed upon during the transaction.

Failure to Include Signatures

Both parties should sign the receipt to confirm the transaction. Not including signatures, whether from the buyer or the seller, can make the receipt less legitimate and harder to enforce if there is a disagreement later.

Keep the language simple and to the point. Avoid ambiguous terms and make sure the wording is clear to prevent misinterpretation. Stick to specific details like the type of tractor, model, or any distinguishing features that may apply.

Clearly outline the buyer’s and seller’s names, addresses, and contact information on the receipt. Ensure that both parties’ identities are unmistakably clear, as this can prevent future disputes over payment details or transactions. Include a statement of the transaction date and the total amount received, with an itemized breakdown if possible. This ensures transparency and can act as proof of the agreed-upon terms.

Terms and Conditions

It’s advisable to include any relevant terms and conditions regarding the down payment. This should specify if the payment is refundable, the agreed-upon schedule for the remainder of the payment, and any penalties for late payments or breaches. This protects both parties and ensures clarity in case of any disputes regarding payment terms.

Legal Disclaimers

Consider adding a legal disclaimer that both parties acknowledge the receipt’s authenticity and understand the terms of the agreement. This clause reinforces the commitment of both parties to the payment schedule and can safeguard against future disagreements. Such clauses are a simple way to provide legal backing for the receipt without complicating the document unnecessarily.

Ensure that your down payment receipt template accurately reflects the details of the lawn tractor purchase. Include the model and year of the tractor, the agreed-upon payment amount, and the total cost. This avoids confusion and keeps all involved parties informed.

Include Clear Payment Terms

Specify the payment method used for the down payment, whether it’s credit, check, or cash. Note the transaction date and any due dates for remaining payments. This makes the document clear and easy to track, eliminating potential disputes later.

Personalize With Contact Information

Make sure to add both the buyer’s and seller’s contact information at the top of the receipt. This can include names, phone numbers, and addresses, so both parties can quickly resolve any follow-up questions or issues without needing to search for contact details.

Use a clear system to store receipts safely. Create labeled folders for each transaction type, and keep physical receipts in a secure place. Organize digital receipts in well-named files or folders on your computer. Use cloud storage for easy access and backup.

For physical receipts, consider using a filing cabinet with labeled sections or binders with protective sleeves. Keep receipts in a cool, dry place to prevent fading or damage over time. If needed, scan and store the documents digitally for easy retrieval.

For digital receipts, store them in a dedicated folder on your computer or an external hard drive. Use file names that clearly identify the purchase and date. Cloud storage offers quick access, especially if you need to retrieve the information while away from home.

| Storage Type | Recommendation |

|---|---|

| Physical Receipts | Store in labeled folders or binders in a safe location |

| Digital Receipts | Save in clearly named files on a computer or cloud service |

| Backup | Consider a secondary cloud storage or external hard drive |

Review receipts annually to discard outdated ones or archive them for future reference. Set up a calendar reminder to keep track of when it’s time to clear out old receipts. This helps maintain a clean and organized system for future needs.

Make sure to include the date of the payment and the exact amount in the receipt. Specify the name of the buyer and the seller, along with the item being purchased– in this case, the lawn tractor. Clearly state that the payment is a down payment, not the full price, and mention the remaining balance. Include a payment method (e.g., check, credit card) and any relevant transaction reference numbers for clarity. Always include a space for both parties to sign, ensuring mutual agreement on the terms of the down payment.

For transparency, provide a brief description of the terms regarding the remaining balance, such as due dates or any additional payments expected. It’s helpful to specify whether the down payment is refundable or non-refundable, depending on the agreement. Be sure to keep a copy for your records, as this document serves as a legally binding acknowledgment of the transaction.