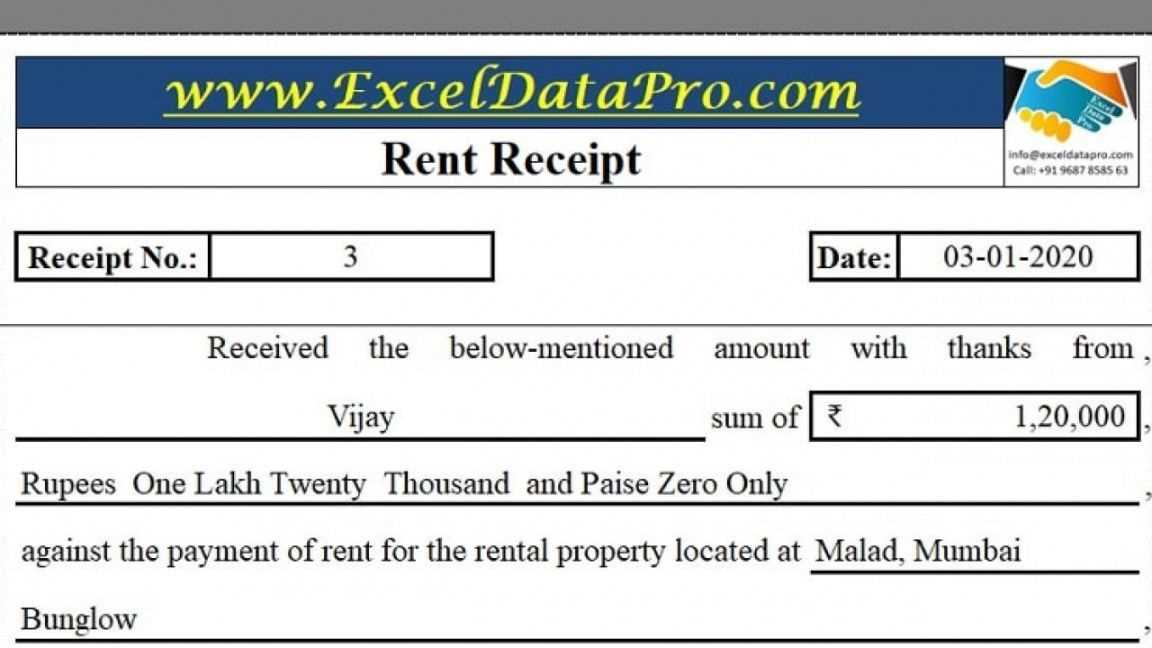

For businesses that need a quick and professional way to issue receipts, using a simple template can save time and avoid errors. A clear, easy-to-use receipt should always include the business name and its EIN (Employer Identification Number). These details establish credibility and ensure that the transaction is properly documented for tax purposes.

Start with a simple layout that includes the name of your business and EIN at the top. This makes it easy for customers to identify the source of the transaction. Make sure the EIN is displayed prominently, as it is often required for record-keeping and can help avoid any confusion when filing taxes.

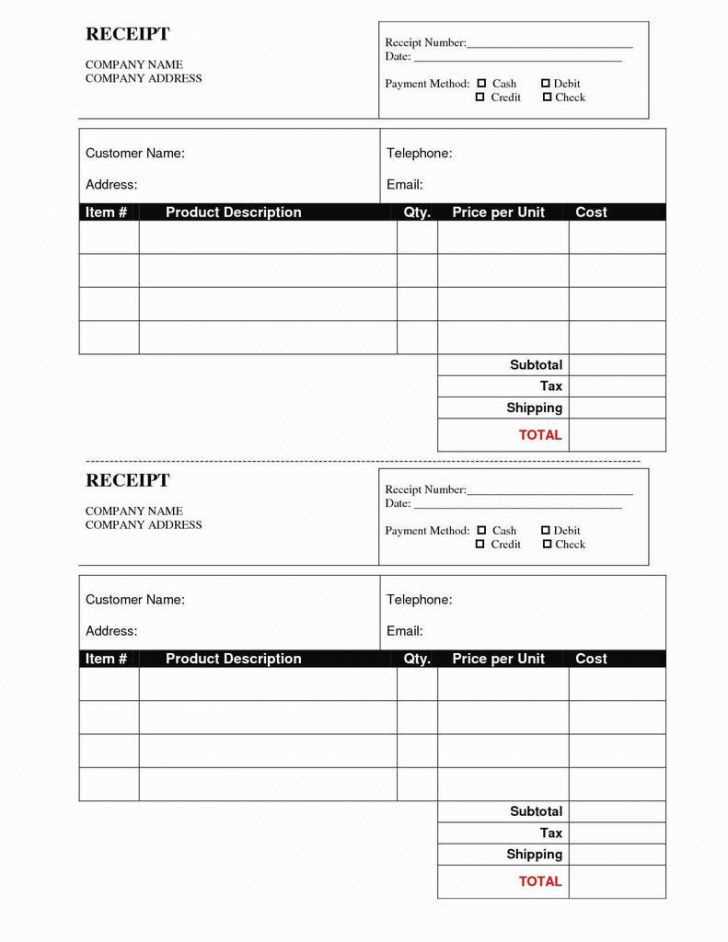

Additionally, include transaction specifics such as the item or service purchased, date, and amount paid. Keeping your receipt format consistent will make it easier for both you and your customers to track payments and maintain clear financial records.

Sure! Here’s the revised version with reduced repetition:

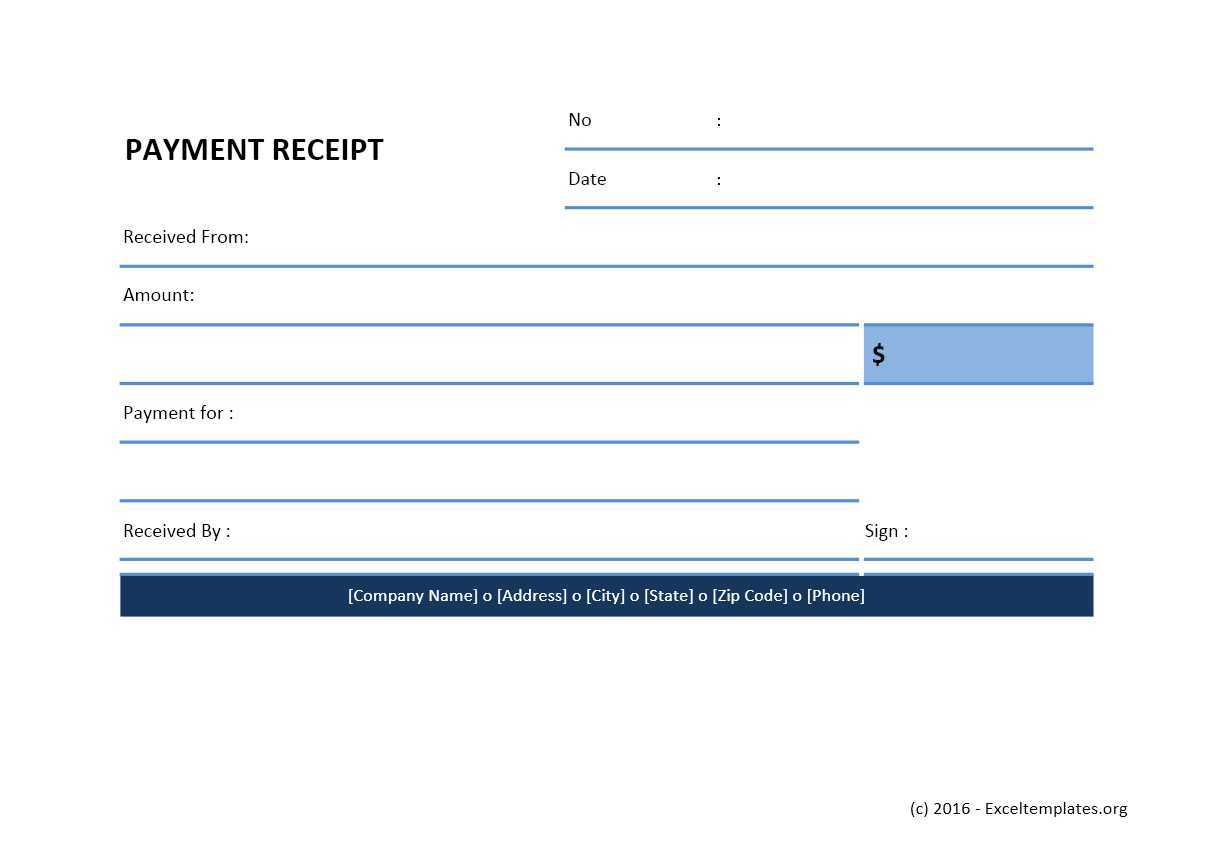

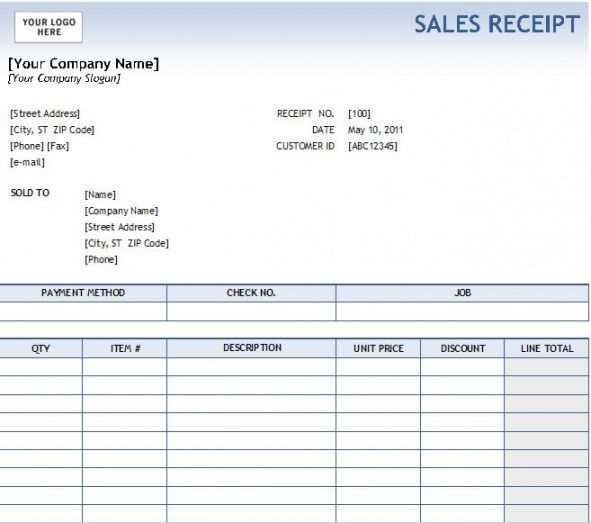

Start by creating a clear and straightforward receipt template that includes both your business name and EIN. These are crucial identifiers for your company and should appear prominently at the top of the document. Place your business name in bold to make it stand out. Next, list your EIN (Employer Identification Number) in a smaller font size under the business name. Ensure the layout remains clean and easy to read.

To keep the template professional, add spaces for transaction details, including the date, itemized list of products or services, and the total amount. This will ensure your receipts look organized and official. Be consistent in the formatting for all receipts you issue, maintaining a uniform style across different transactions.

Don’t forget to include a footer section with additional company information like contact details or payment methods. This gives clients all the information they may need, helping with future communications or inquiries.

- Simple Receipt Template for Business Name and EIN

Include your business name and EIN (Employer Identification Number) at the top of the receipt for easy reference. This ensures clarity and establishes trust with your customers, providing all necessary tax information in one place. Place your business name in bold at the top, followed by the EIN number below it, formatted as “EIN: XX-XXXXXXX” to keep it clear and readable. Make sure the font is legible and appropriately sized, allowing the key details to stand out. If the EIN is part of the legal requirements for your transactions, double-check its accuracy to avoid any future confusion.

For consistency, always use the same template format across all receipts. This saves time and keeps your records organized. If you’re using a digital template, save a version with these details pre-filled so you don’t have to enter them manually for every transaction.

To prevent errors, add clear sections for the transaction details, including the date, product/service description, amount, and payment method. This is a straightforward way to ensure your receipts are functional and compliant.

To add your company name to a receipt template, locate the header section where business details are displayed. This section usually appears at the top of the template, often in bold text. Use a clean, clear font for easy readability. Here are the steps:

- Identify the placeholder for the company name in the template, if available. If not, create a text box at the top of the receipt.

- Enter your full business name, ensuring that it matches the official records.

- Consider adding your business’s logo next to the name for brand recognition, but ensure it does not overwhelm the text.

- Make sure the company name stands out by using a larger font size or bolding the text.

- Double-check for any spelling errors or inconsistencies in the business name.

Additional Tips:

- Ensure your company name is placed in a visible location at the top or upper-left corner.

- If your business operates under a specific legal entity (LLC, Inc., etc.), include this designation after the name.

Include the Employer Identification Number (EIN) clearly on your receipts to ensure proper tax reporting and compliance. The EIN serves as the business’s tax identification number and is required by the IRS for various transactions. It helps distinguish your business from others for tax and legal purposes.

Placement of the EIN on Receipts

- Place the EIN in the business details section of the receipt. This is typically near your business name, address, and contact information.

- Avoid placing the EIN in the footer or unrelated areas of the receipt where it may be overlooked.

Format for Displaying the EIN

- Use the format: EIN: XX-XXXXXXX. This is the standard format that the IRS recognizes.

- Ensure that the number is legible and not obscured by any logos or decorative elements.

By correctly displaying the EIN, you make it easier for your customers and tax authorities to process any necessary documents related to business transactions. This helps maintain a clear, professional, and compliant business operation.

Focus on clarity and simplicity when designing your receipt layout. Start with key details like your business name, EIN, and contact information at the top for easy access. Ensure that the items or services purchased are listed clearly, including the price and any taxes. Align everything neatly to avoid confusion.

Avoid clutter by limiting unnecessary information. Use a clean, legible font and appropriate spacing to separate sections, making it easy for customers to read at a glance. If applicable, include a thank-you note or loyalty program details at the bottom, keeping it minimal yet inviting.

Test your layout on different devices or printers to ensure it remains clear and readable in various formats. Adjust margins and font sizes to accommodate different receipt paper sizes, but always keep it organized. Prioritize the most critical information to ensure a professional appearance while meeting all legal requirements for receipts.

Ensure your receipt includes all the necessary details required for tax reporting. List the business name, address, and the unique identification number (EIN) in the header. Clearly state the date of the transaction and the specific items or services purchased, along with their prices. The total amount due should be prominently displayed at the bottom. Keep the formatting simple, legible, and consistent to meet tax standards.

Key Elements to Include

| Field | Details |

|---|---|

| Business Name | Include your full business name as registered. |

| EIN | Provide the correct Employer Identification Number. |

| Date | Include the exact date of the transaction. |

| Item/Service Description | Clearly describe the goods or services provided. |

| Price | List the price for each item/service and the total amount. |

Formatting Tips

Use a clear font for readability and avoid unnecessary design elements. The receipt should focus on accuracy and clarity rather than decoration. Provide space between sections to make the information easy to read. Keep it concise, making sure no unnecessary details distract from the essential tax information.

Adjust your receipt format to reflect the specifics of different transactions, whether they involve sales, refunds, or exchanges. This makes sure all necessary details are included and aligns with legal or business requirements.

Sales Receipts

For standard sales transactions, ensure the receipt includes the buyer’s details, a breakdown of the items purchased, prices, and any applicable taxes. Include the business name, address, and EIN for tax purposes. If applicable, add payment methods used (credit card, cash, etc.) to clarify the transaction.

Refunds and Exchanges

For refunds or exchanges, clearly note the original transaction date, item returned, and reason for the refund. Specify any adjustments made, like restocking fees or discounts, and reissue the receipt with updated totals. This helps maintain accurate financial records and ensure transparency with customers.

Tailor each receipt type to the context, ensuring all transaction details are easy to follow and reflect the specific nature of the purchase or return.

Use clear, readable fonts like Arial or Times New Roman with a size between 10 and 12 points. Avoid overly decorative or condensed fonts that may be difficult to read, especially in low light or small print. Keep the text size consistent throughout the receipt to maintain uniformity.

Maintain a clean layout with ample spacing between sections to prevent a cluttered appearance. Ensure the business name, EIN, and total amount are prominently displayed, making it easy for customers to locate key information at a glance.

Ensure the color contrast between the text and background is high. Black text on a white or light-colored background is the most legible combination. Avoid using too many colors, as this can distract from important details and reduce readability.

Incorporate simple and clear labels for each section of the receipt (e.g., “Date”, “Item Description”, “Total”). This makes it easier for the customer to follow the transaction details quickly.

Use high-quality printing materials to avoid smudging, fading, or unclear text. A crisp, professional appearance will leave a positive impression on the customer and reflect well on your business.

Business Name and EIN on Simple Receipt Template

Include your business name and Employer Identification Number (EIN) clearly at the top of the receipt. These details confirm the legitimacy of your business and provide necessary information for tax purposes. The business name should match the registered name with the IRS or your local government. Make sure to list your EIN, which acts as a unique identifier for your business entity. This ensures that your transactions are properly tracked for legal and tax reasons.

Where to Place the Information

Position your business name and EIN near the top of the receipt, preferably next to your business logo or above the transaction details. This ensures visibility and proper identification of your business in case of any questions or disputes regarding the transaction.

Format Tips

Keep the format clean and simple. Use bold text for the business name and a slightly smaller font for the EIN. Ensure there is enough space between the name and the EIN so each piece of information is easy to read and distinguish.