Key Elements of a Malaysian Official Receipt Template

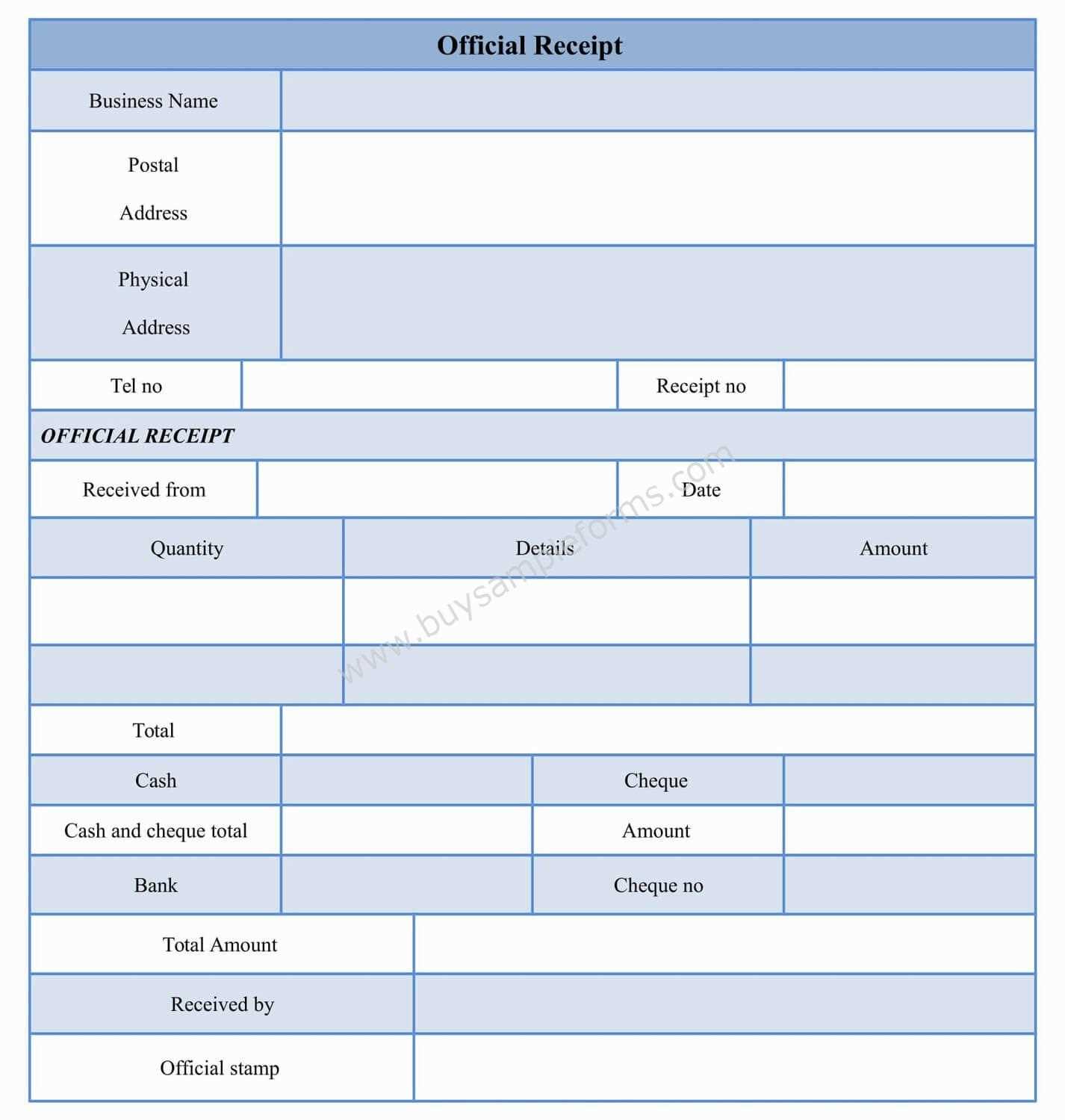

Creating an official receipt for transactions in Malaysia requires a few important elements that ensure both legality and clarity. Start by including the following mandatory details:

- Receipt Number: A unique identifier for each transaction.

- Date of Transaction: The exact date the payment was made.

- Seller’s Information: Include the business name, address, and contact details.

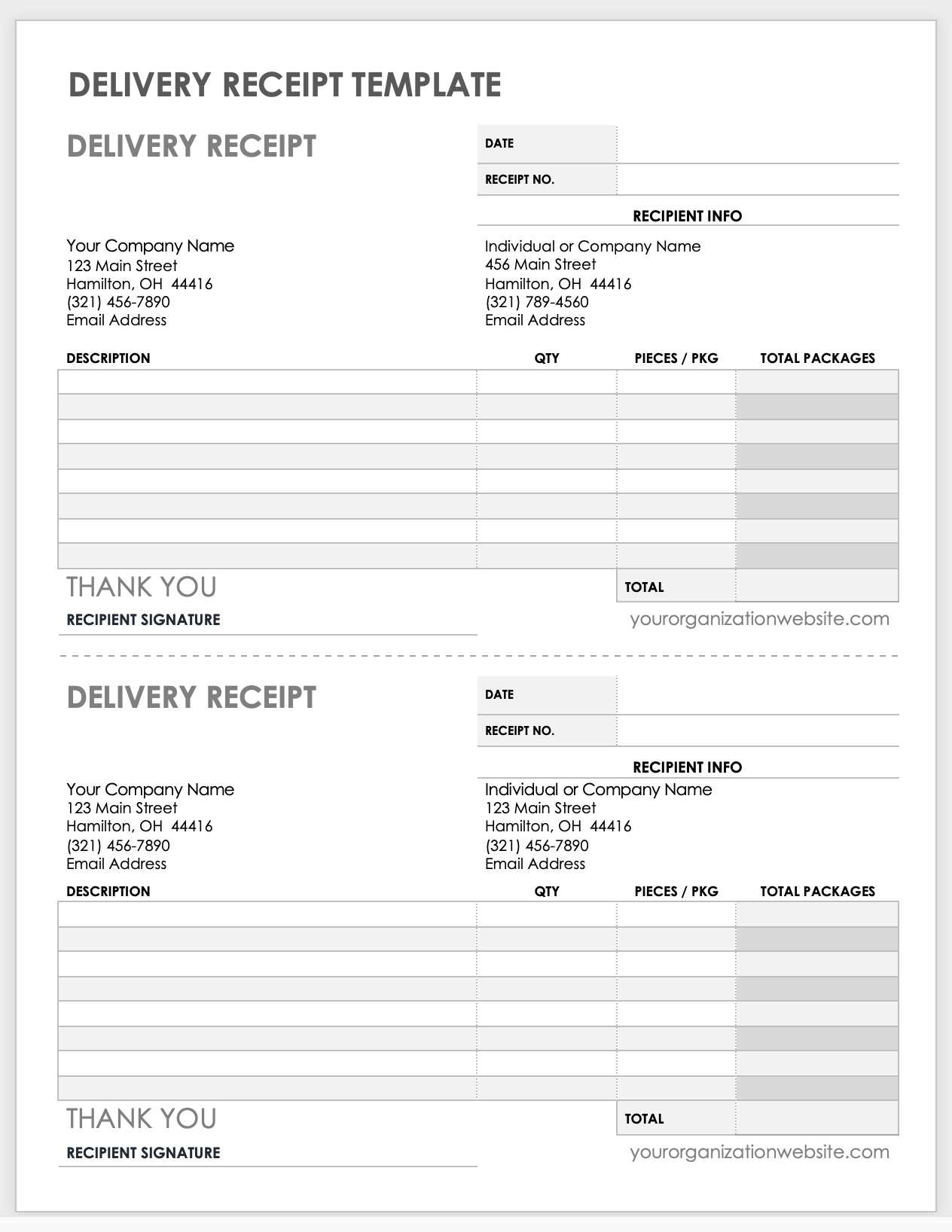

- Buyer’s Information: Name and contact details of the purchaser, if applicable.

- Item Description: Clear description of the goods or services provided.

- Amount Paid: The total sum paid, including taxes, if applicable.

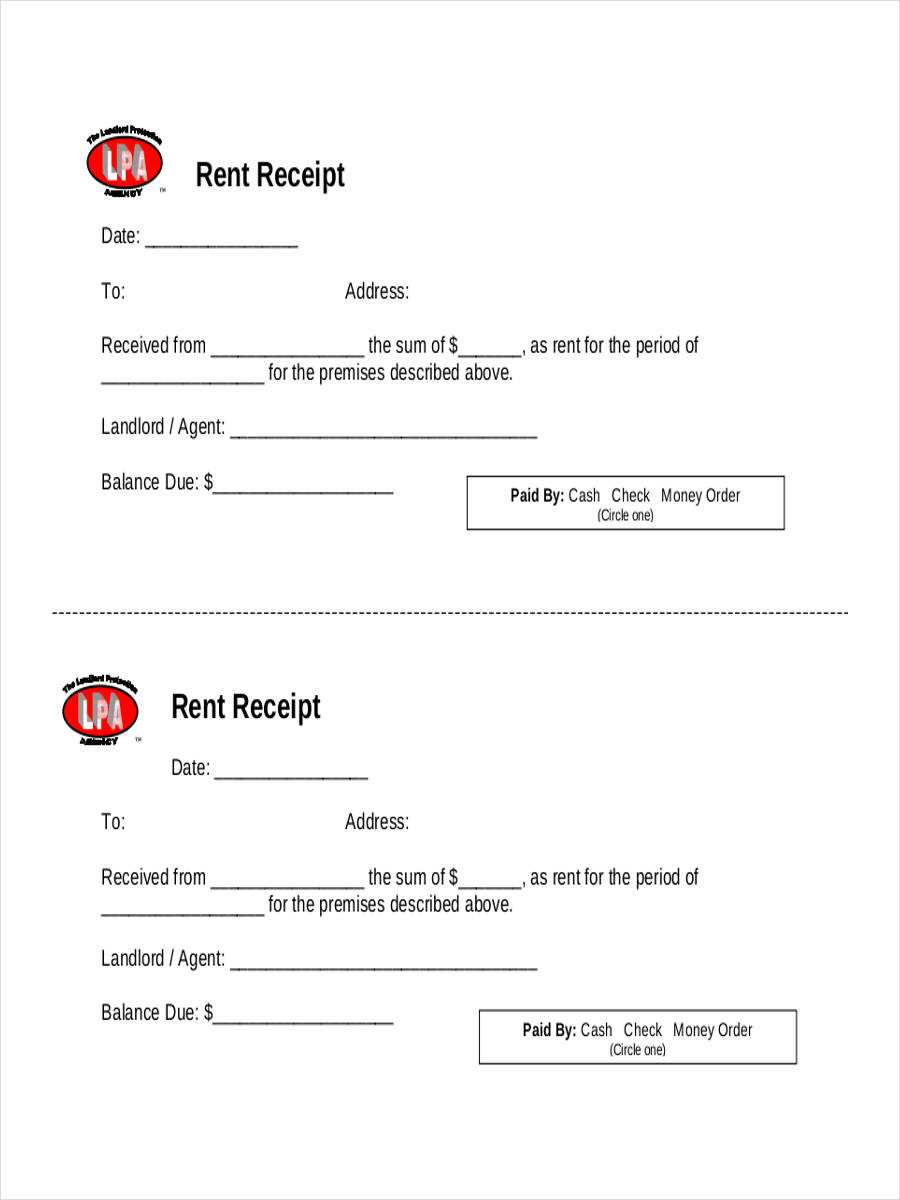

- Payment Method: Specify whether the payment was made via cash, bank transfer, credit card, or other methods.

- Tax Information: If applicable, include the Goods and Services Tax (GST) details, especially if your business is registered under GST.

Designing Your Official Receipt Template

Use a clean, professional layout. The receipt should be easy to read and clearly organized. A well-designed receipt not only makes transactions smoother but also ensures all parties have a transparent record. You can use simple templates available in various word processors or spreadsheets to create your official receipt.

Tips for Customizing the Template

When designing your official receipt template, make sure to:

- Use Legible Fonts: Choose fonts that are clear and easy to read.

- Incorporate Your Logo: Include your company’s logo at the top to personalize the receipt.

- Make Tax Information Clear: If the transaction involves GST, ensure the breakdown is visible.

- Check Compliance: Verify that your template meets Malaysia’s legal requirements for official receipts, particularly under tax laws.

Downloadable Official Receipt Templates

For convenience, various downloadable templates are available online. Ensure that the template you choose is suitable for your business type and complies with Malaysian regulations. Customizing a pre-made template can save time while ensuring accuracy and legal compliance.

Official Receipt Template Malaysia

How to Create an Official Receipt in Malaysia

Key Components of a Malaysian Receipt

Understanding Legal Requirements for Official Receipts in Malaysia

Customizing a Receipt Template for Different Business Needs

Best Practices for Issuing Receipts in Malaysia

Common Mistakes to Avoid When Using Receipt Templates

To create a proper official receipt in Malaysia, include the date of the transaction, a unique receipt number, the seller’s details (name, address, and registration number), and a description of the goods or services sold. Ensure that the amount paid is clear, including any taxes applied. Always provide the recipient’s details and the mode of payment used. This not only facilitates record-keeping but also builds trust with clients.

The legal framework governing receipts in Malaysia is guided by the Goods and Services Tax (GST) Act and other relevant business regulations. It’s important to understand that an official receipt must contain specific details to be considered legally valid. Ensure that tax identification numbers and the applicable GST rates are correctly reflected when required.

Customizing a receipt template helps cater to various business needs. Whether you run a small retail shop or a service-based business, a flexible template allows you to adjust the format based on your transaction type. Include fields for discounts, special offers, or bulk purchases to suit your customer base and streamline your invoicing process.

When issuing receipts, always ensure clarity. Double-check that the amounts are accurate and that all required details are included. Providing clear, organized receipts can save time during audits or tax filing and ensure compliance with Malaysian regulations. Avoid using complex language or vague terms that may confuse customers.

Some common mistakes to avoid when using receipt templates include failing to update the template for changes in tax rates or laws, overlooking customer details, or leaving out essential transaction information. Also, ensure that the receipt number is unique for each transaction to avoid any discrepancies in your records.