Use a structured bank receipt template to document cash deposits with accuracy and clarity. A well-organized layout helps avoid misunderstandings and ensures all essential details are recorded for financial tracking.

Include fields for date, depositor’s name, account number, deposit amount, and bank details. A section for a unique transaction reference number enhances security and simplifies future verification.

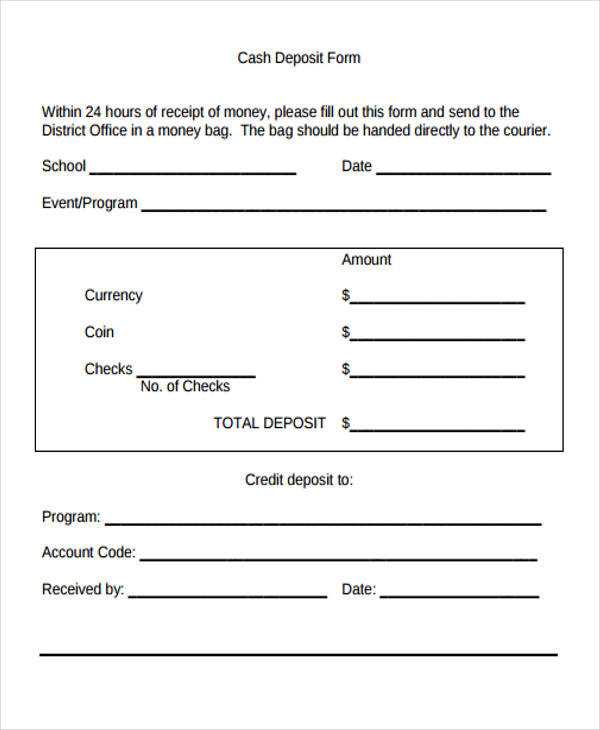

Design the template with a clear breakdown of denominations to prevent errors in cash counting. If applicable, add a signature line for both the depositor and bank representative.

Use a digital format such as a fillable PDF or spreadsheet for easy modifications and electronic record-keeping. Ensure the document follows banking regulations and includes any necessary disclaimers.

Bank Receipt for Cash Deposit Template

Ensure your bank receipt includes all critical details for transparency and accuracy. A well-structured template should contain the following:

- Bank Name & Logo: Clearly display the financial institution’s name and branding.

- Transaction Date & Time: Record the exact moment of the deposit for reference.

- Depositor’s Information: Include the name, contact details, and account number.

- Deposit Amount: Specify the total sum, both in numbers and words, to prevent errors.

- Breakdown of Denominations: List the quantity of each currency note for verification.

- Transaction Reference Number: Assign a unique identifier for tracking purposes.

- Bank Teller’s Signature & Stamp: Authenticate the receipt with an official endorsement.

Use a structured format with clear sections to enhance readability. Opt for a printable design with sufficient space for handwritten details if needed. Digital versions should support electronic signatures and PDF export for convenience.

Key Elements of a Cash Deposit Receipt

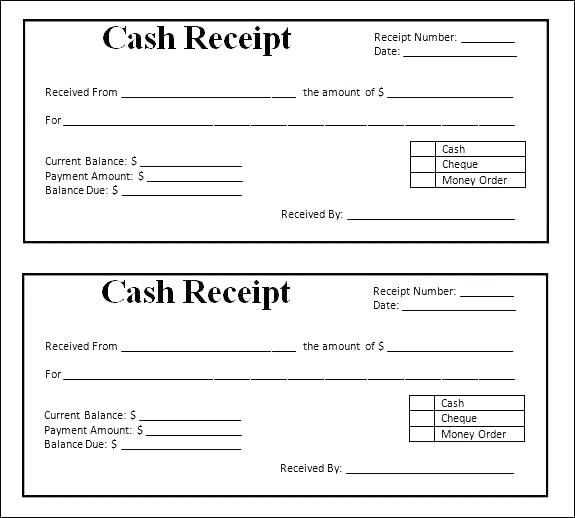

Date and Time: Ensure the receipt includes the exact date and time of the deposit. This detail confirms when the transaction took place and helps resolve discrepancies if needed.

Depositor Information: The name and contact details of the person making the deposit should be clearly stated. If depositing on behalf of someone else, include both names.

Bank Details: The issuing bank’s name, branch location, and contact information provide clarity on where the deposit was made.

Account Information: Include the recipient’s account number and name to confirm where the funds were credited. Mask part of the account number for security.

Deposit Amount: Clearly specify the amount in both numerical and written form to prevent misinterpretation.

Verification and Security Features

Transaction Reference Number: A unique reference or receipt number allows easy tracking and verification.

Authorized Signature or Stamp: A teller’s signature or official bank stamp validates the receipt’s authenticity.

Breakdown of Funds: If depositing cash, itemize the denominations to avoid disputes.

Terms and Conditions: Some receipts include disclaimers about fund availability or processing times, ensuring transparency.

Formatting Guidelines for a Professional Layout

Align all text elements to maintain a structured appearance. Use left alignment for general content and right alignment for numerical values, ensuring readability.

Set consistent margins and spacing between sections. A minimum of 0.5 inches on all sides keeps the document clean and uncluttered.

Choose a legible font like Arial or Times New Roman, with a size between 10 and 12 points. Bold key details such as deposit amount and date to enhance visibility.

Use clear headings and subheadings to separate information. Capitalize section titles for emphasis without overusing bold or italics.

Ensure adequate line spacing, typically 1.15 or 1.5, to improve readability and prevent overcrowding.

Include a designated area for signatures and verification stamps. Leave at least two inches of space at the bottom to accommodate official endorsements.

Maintain a monochrome color scheme for a professional look. If necessary, use a subtle shade of gray for secondary details instead of multiple colors.

Test print the template before finalizing to check alignment, clarity, and spacing. Adjust as needed to prevent truncation or misalignment.

Legal and Compliance Considerations

Ensure that all cash deposit receipts comply with financial regulations and anti-money laundering (AML) policies. Banks and financial institutions must maintain accurate records of deposits, verifying the source of funds to prevent illicit transactions.

Mandatory Information on Receipts

A valid receipt should include essential details to meet legal requirements. Missing or incorrect data may lead to compliance violations.

| Required Information | Purpose |

|---|---|

| Depositor’s Full Name | Identifies the individual making the deposit |

| Account Number | Ensures funds are allocated correctly |

| Deposit Amount | Confirms the exact value of the transaction |

| Date & Time | Provides a reference for record-keeping |

| Bank Stamp & Signature | Authenticates the transaction |

Regulatory Compliance

Financial institutions must adhere to reporting thresholds for large cash deposits. Many jurisdictions require reports for transactions exceeding a specified limit, typically $10,000, under AML laws. Failing to report such transactions may result in severe penalties.

Retention policies also play a key role. Banks must store receipts for a minimum period, often five years, ensuring accessibility for audits and regulatory inspections.

Customizing Templates for Business and Personal Use

Modify fields to match specific needs. Adjust names, dates, and reference numbers to align with business records. For personal use, simplify sections to highlight key details without unnecessary formalities.

Use a clear layout for easy readability. Align columns properly and ensure consistent font size. Business receipts should include tax details and official branding, while personal receipts can focus on essential transaction data.

Add security features like watermarking or unique serial numbers. For digital versions, convert to PDF to prevent unauthorized changes. For printed copies, use high-quality paper to enhance credibility.

Ensure compliance with financial regulations. Check local requirements for business receipts, including tax obligations and legal disclaimers. For personal transactions, keep records organized to track payments efficiently.

Common Errors and How to Avoid Them

Incorrect or Missing Details

Ensure all information matches the deposit slip exactly. A missing account number, incorrect date, or an illegible signature can delay processing. Double-check each entry before submission.

Mismatched Amounts

Verify that the written and numerical amounts are identical. Banks may reject receipts with discrepancies. Count the cash twice and confirm the total before finalizing the deposit.

Failure to Keep a Copy

Always retain a copy of the receipt for future reference. If an issue arises, having proof of the transaction can help resolve disputes quickly.

Using an Outdated Template

Ensure the template reflects the bank’s latest format. Some institutions update requirements periodically. Check with the bank if unsure.

Printable and Digital Receipt Options

For cash deposits, you can choose between printable and digital receipt formats. Both options offer clear records, but each has its own advantages.

Printable receipts provide a tangible copy that can be kept in physical files or attached to documents for future reference. These are useful if you need to present proof of deposit in person or store physical records for accounting purposes. Ensure the receipt includes all essential details: date, amount, deposit method, and account information.

Digital receipts offer convenience by being easily stored, accessed, and shared via email or cloud storage. They eliminate the need for physical space and can be retrieved anytime on various devices. Many banking systems or apps allow you to download or email the receipt instantly after completing the deposit. It’s important to verify that all transaction details are included and that the receipt is easily legible on digital platforms.