Creating a donation receipt template for your nonprofit is a straightforward way to show appreciation to donors while keeping your financial records organized. A well-designed receipt ensures compliance with tax laws and provides a transparent record for both your organization and the donor. You can customize the template to suit the needs of your nonprofit, making sure it reflects your brand and mission clearly.

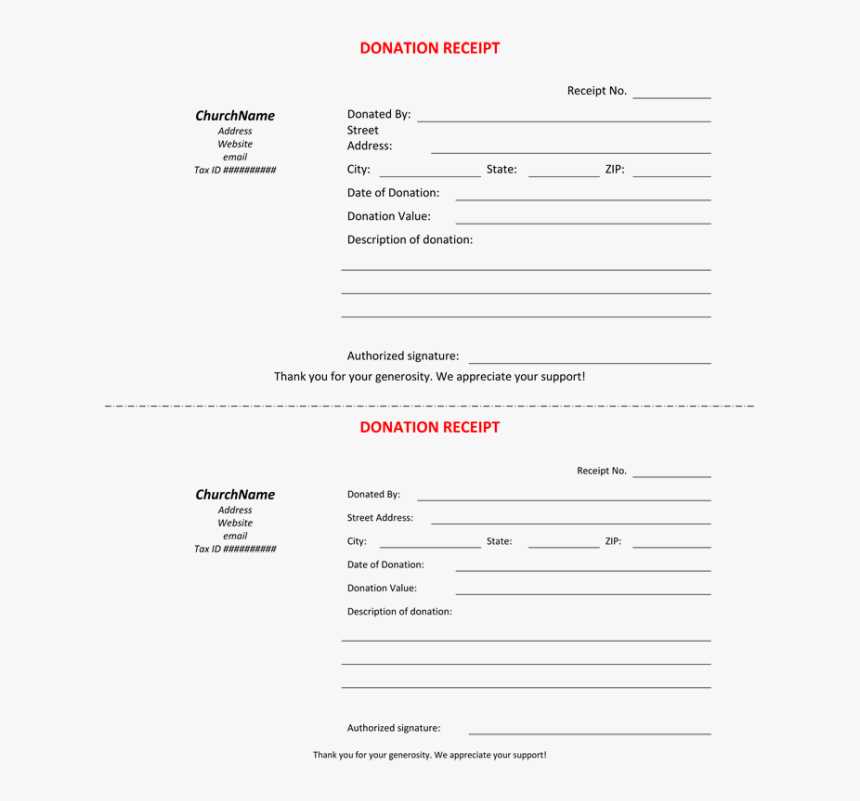

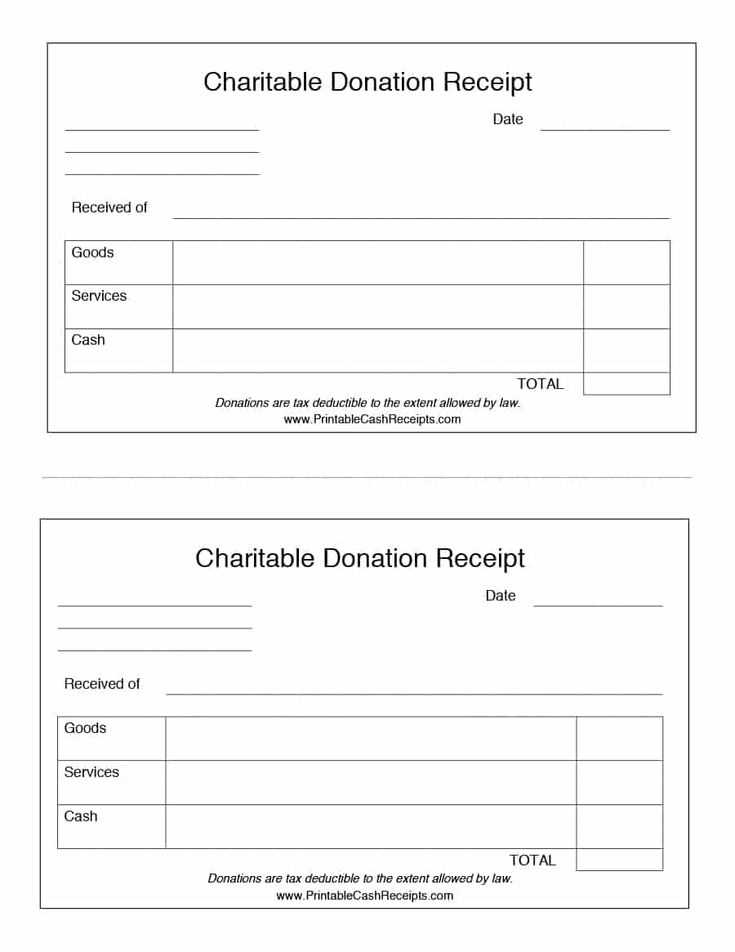

Each receipt should include key details like the donor’s name, donation amount, and date of contribution. For in-kind donations, be specific about the nature of the items received, while monetary donations require an accurate total. Including your nonprofit’s name, address, and tax-exempt status number makes the receipt a formal and official document.

To make the process even easier, consider using a pre-made template that automatically fills in donor information. This reduces manual work and speeds up the receipt process. Make sure your template includes a thank-you message to personalize the experience and maintain positive donor relations.

- Donation Receipts for Nonprofits Template

A clear and well-structured donation receipt helps both nonprofits and donors maintain accurate records. The receipt should include specific information required by tax authorities and should reflect the nonprofit’s legal standing. Here’s how to create a donation receipt template that meets these needs:

- Nonprofit Name and Contact Information: Include the nonprofit’s full legal name, address, phone number, and email. This helps verify the legitimacy of the organization.

- Donor Information: Clearly state the donor’s name and address, ensuring accuracy for tax records.

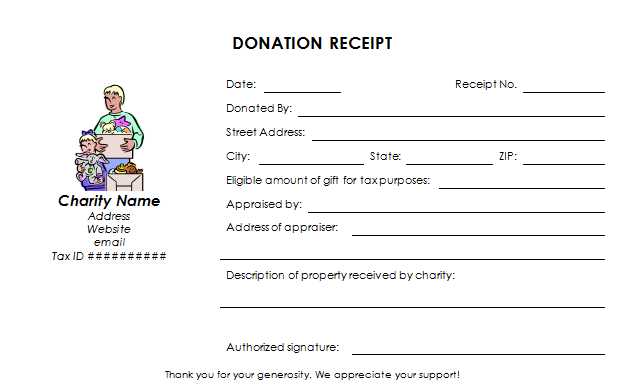

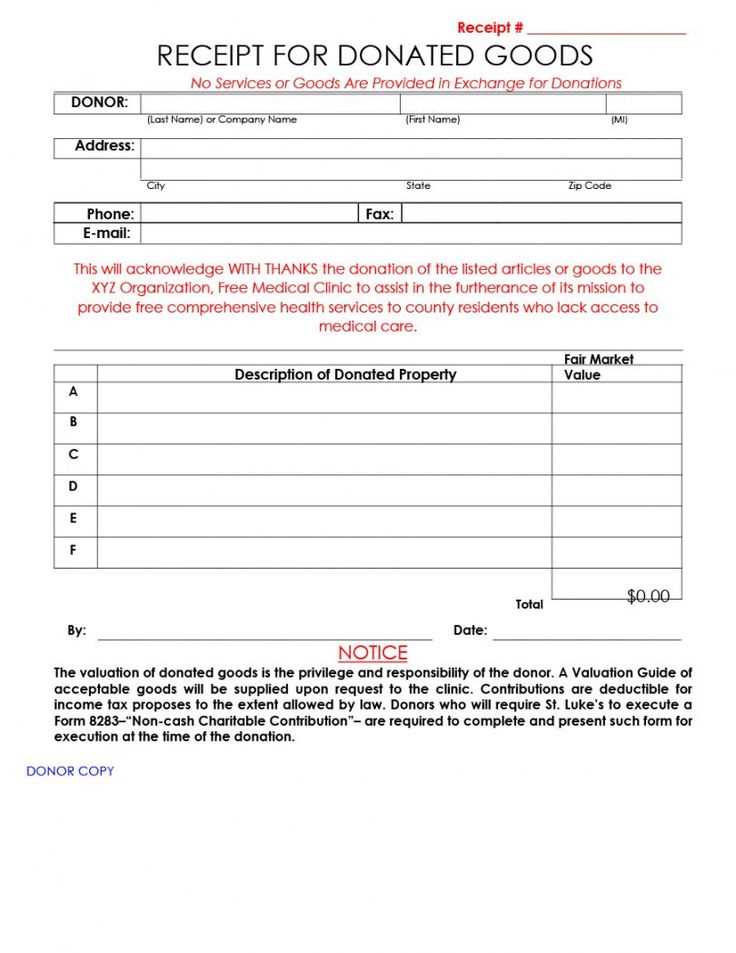

- Donation Details: Specify the date of the donation, the amount, and the type of gift (cash, check, goods, services). If it’s a non-cash donation, provide a description of the items received.

- Tax Deductibility Statement: Include a clear statement about the tax-deductible status of the donation, based on the nonprofit’s IRS designation. For example, “This donation is tax-deductible to the extent allowed by law.”

- No Goods or Services Provided: If no goods or services were exchanged for the donation, include this statement: “No goods or services were provided in exchange for this contribution.”

- Receipt Number or Unique Identifier: To maintain organized records, assign each receipt a unique number.

- Signature: The receipt should be signed by an authorized person within the nonprofit, such as a director or officer.

Ensure the layout is simple and readable, making it easy for donors to understand the key details for their tax filing. Consider providing receipts immediately following a donation or sending them at regular intervals during the year.

List the donor’s name, address, and donation date clearly. Specify the amount for cash donations and a detailed description for non-cash donations, ensuring you do not assign a value to items. Leave that up to the donor’s assessment.

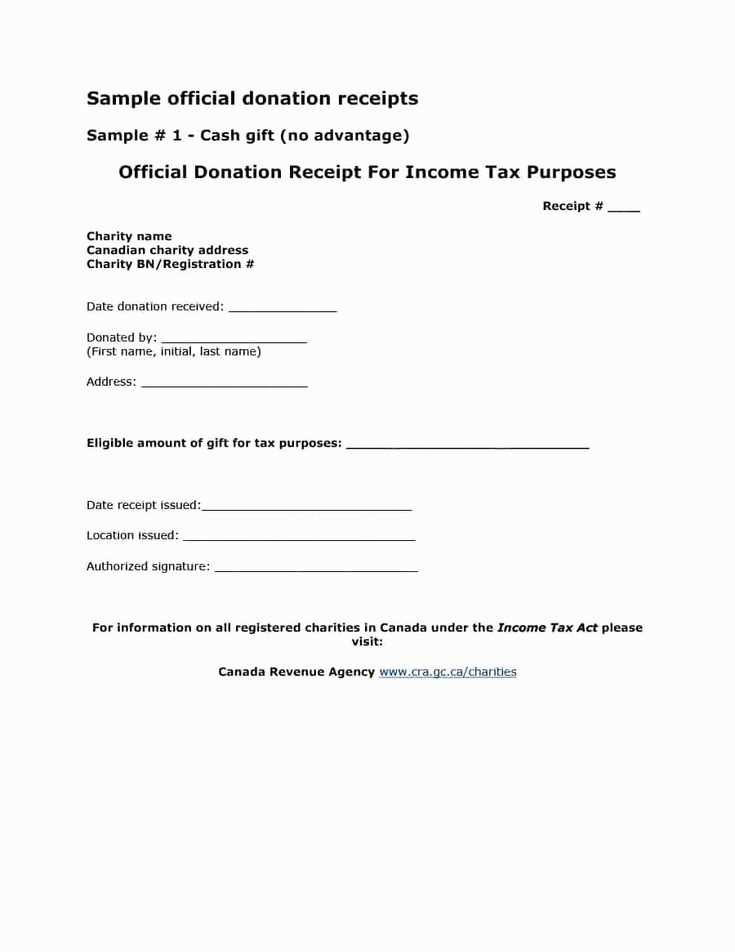

Include your nonprofit’s full name, address, and Employer Identification Number (EIN) to confirm tax-exempt status. This validates the receipt for tax deductions.

If the donor received goods or services in return, state their fair market value and subtract it from the total donation to reflect the deductible amount.

State whether or not any goods or services were exchanged for the donation. If none were, clarify that the donation is fully tax-deductible.

End with a note reminding the donor to keep the receipt for their tax records, and mention if additional documentation is required for their filing process.

Nonprofit donation receipts must include specific details to comply with tax laws and regulations. First, they should clearly state the nonprofit’s name, address, and tax-exempt status, typically indicated by the IRS determination letter. This ensures the donor knows that their contribution is tax-deductible.

The receipt must specify the date and amount of the donation. If the donation is in-kind (non-monetary), the description of the donated goods or services should be included. However, nonprofits should avoid placing a value on the donated items; that responsibility lies with the donor.

If the donation includes a quid pro quo (i.e., a gift or service provided in exchange), the receipt must disclose the fair market value of the goods or services received by the donor. This allows the donor to properly deduct only the amount of their gift exceeding the value of what they received in return.

Finally, the nonprofit should state whether the donor received any goods or services in exchange for their donation, ensuring compliance with IRS requirements for reporting charitable contributions. By following these guidelines, nonprofits help donors claim the appropriate deductions and maintain transparency in their financial operations.

Adjust your donation receipt templates based on the donation type. For one-time contributions, include fields for the donor’s name, donation amount, and date. Add a thank you message to personalize the receipt and reinforce their support. For recurring donations, show the total annual contribution, along with individual amounts and payment dates. This helps donors track their giving over time.

If you’re processing in-kind donations, add specific details about the items donated, including descriptions, quantities, and estimated value. This allows donors to report their gifts correctly for tax purposes. For major donations, customize the template to reflect the donor’s tier or recognition level, offering a more formal tone and additional acknowledgment for their significant contribution.

For crowdfunding donations, ensure the template is straightforward, listing the campaign or cause the donation supports, as well as the donor’s contribution. Be sure to include a call-to-action, encouraging future engagement. Finally, for memorial or tribute donations, include a space to note the person or cause being honored, which adds a personal touch for the donor and the recipient of the funds.

Use a clean, simple layout with clear headings to organize the information. Start with the nonprofit’s name, logo, and contact details at the top, followed by the donor’s name and contribution details. This ensures immediate recognition of the key information. Keep the text easy to read by using a standard font size and avoiding cluttered text blocks.

Break the donation details into sections, such as “Donation Amount,” “Date of Contribution,” and “Transaction Type.” Use bold or italic fonts for important details like the donation amount to draw attention. Include a separate section for tax-deductible information, clearly stating whether the donation is fully or partially deductible.

Ensure the total amount stands out, and provide a breakdown of any fees or deductions if applicable. Make sure all dates are formatted consistently to avoid confusion. Lastly, include a simple, clear thank-you message and a reminder of the nonprofit’s mission to personalize the experience for the donor.

Ensure that the donation amount is accurate. Double-check the donor’s contribution to prevent discrepancies. It’s easy to make a mistake when manually entering numbers, so verify the amount twice before finalizing the receipt.

Don’t skip the donor’s information. Always include their full name and address for clarity. Missing details can complicate record-keeping and make it harder for both the donor and the nonprofit to track donations.

Failing to provide the correct date of donation can create confusion, especially if donations are claimed for tax deductions. Always include the exact date the donation was made to avoid any misunderstandings.

Avoid generic wording that could confuse the donor. Be specific about the donation’s nature (e.g., monetary, in-kind) and note if anything was received in return, like goods or services. This helps clarify the status of the donation for tax purposes.

Don’t forget the nonprofit’s tax identification number. This is crucial for donors who wish to claim tax deductions, so include it on every receipt to make sure the donor has everything they need for tax reporting.

| Mistake | Fix |

|---|---|

| Incorrect donation amount | Verify the contribution twice before issuing the receipt |

| Missing donor information | Include the donor’s full name and address |

| No donation date | Ensure the exact date of donation is recorded |

| Vague description of donation | Provide clear and specific information about the donation |

| Omitting tax ID number | Include the nonprofit’s tax ID number on all receipts |

Integrating donation receipts into your nonprofit’s accounting system requires clear processes and consistent tracking methods. Use accounting software that can generate donation receipts and automatically log them into your system. Here’s how to ensure seamless integration:

1. Choose Accounting Software with Donation Tracking Features

Select software that allows you to easily record donations and issue receipts. Many platforms like QuickBooks, Xero, or specialized nonprofit software offer features designed for donation management. These systems can track donor details, donation amounts, and issue receipts automatically when donations are entered.

2. Set Up a Dedicated Donation Account

Create a separate donation account within your accounting software to isolate donations from other financial activities. This simplifies reporting and ensures all receipts are tied directly to the incoming funds, making audits and financial reviews straightforward.

3. Automate Receipt Generation

- Configure your software to generate receipts as soon as a donation is processed.

- Ensure each receipt includes required information such as donor name, donation amount, date, and your nonprofit’s tax-exempt status.

- Set up email automation to send receipts directly to donors after their donation is recorded.

4. Track Donor Information for Reporting

Use the donor database in your accounting system to store contact details and donation history. This enables easy access to donor records for generating reports or fulfilling IRS requirements, especially for large donors who may require year-end summaries.

5. Reconcile Donations Regularly

- Perform monthly reconciliations to ensure all donation receipts are recorded accurately.

- Cross-check your bank deposits with the donation entries in the system to verify consistency.

By integrating receipts directly into your accounting workflow, you maintain accurate financial records and provide transparency to your donors. This also simplifies compliance with tax regulations and enhances donor trust.

Donation Receipts for Nonprofits Template

Include donor details clearly: name, address, and contact information. This ensures easy communication in case of discrepancies. Be specific about the donation amount, whether it’s monetary or an item. Specify the value of the item donated if it’s non-cash, or simply state “in-kind” if you’re unsure of its worth.

Include your nonprofit’s tax identification number (TIN) for the donor’s tax deduction purposes. Make sure the receipt states that no goods or services were provided in exchange for the donation, especially for donations over a certain amount, to comply with tax regulations.

Use the donation date and a unique receipt number to maintain an organized record of all contributions. This helps with both tracking and accountability for the nonprofit. If donations are ongoing, issue separate receipts for each contribution.

Keep your receipt wording clear and simple, avoiding any unnecessary legal jargon. The receipt should be easy to read, concise, and informative to ensure that donors can use it for their tax returns without difficulty.

Make sure to sign the receipt manually or include a digital signature to give it authenticity. This helps the donor know it’s from a legitimate source and adds a personal touch to the process.