Receipt vouchers are crucial for documenting transactions, ensuring transparency and accountability. Whether you’re handling payments for goods or services, using a well-structured template streamlines the process and minimizes errors. A receipt voucher template offers a consistent format that captures necessary details like the payer’s name, amount, date, and description of the transaction.

Choosing the right template depends on your needs, but a standard template should include fields for transaction details, contact information, and signatures. Templates can be customized to fit business-specific requirements or personal preferences, making them a versatile tool for various financial tasks.

For simplicity, templates can be found in word processing software or spreadsheet programs, allowing for easy editing. A digital receipt voucher template saves time and reduces the chances of human error while ensuring that all relevant information is captured accurately. It’s important to consider the template layout so that all necessary data is clear and accessible at a glance.

Here’s the revised version with redundancies removed:

To improve the clarity of a receipt voucher template, focus on removing unnecessary repetition and simplifying the wording. Each section should be concise and direct. Start with basic elements like date, amount, and payer details, and then include specific payment methods used, ensuring no overlap in information.

- Date of transaction: The exact date the payment was made.

- Amount: The total amount paid.

- Payer details: Full name or business name of the payer.

- Recipient details: Name and contact details of the entity receiving the payment.

- Payment method: Specify whether the payment was via cash, card, or bank transfer.

For added clarity, remove any wording that repeats across sections. For example, avoid including “payment made” in both the amount and payment method sections, as the context is already clear from the surrounding details. Simplify language where possible without losing important information.

- Invoice number: Ensure a unique reference number is assigned to each voucher.

- Signatures: Include spaces for both payer and recipient signatures to authenticate the transaction.

In summary, a streamlined receipt voucher template should provide all necessary details without redundancy, ensuring easy understanding for both parties involved.

- Sample Receipt Voucher Templates

Receipt voucher templates provide a streamlined way to record and acknowledge transactions. Customize these templates to suit your business needs or personal requirements, ensuring all relevant details are accurately captured. Below is a basic example of what should be included in a receipt voucher template.

Key Elements of a Receipt Voucher

| Element | Description |

|---|---|

| Receipt Number | A unique identifier for tracking the transaction. |

| Date | The exact date when the payment or transaction occurred. |

| Payer Information | Name and contact details of the person or entity making the payment. |

| Payee Information | Name and contact details of the individual or company receiving the payment. |

| Amount Paid | The total payment amount, including any taxes, fees, or discounts. |

| Payment Method | Specify whether the payment was made via cash, cheque, bank transfer, etc. |

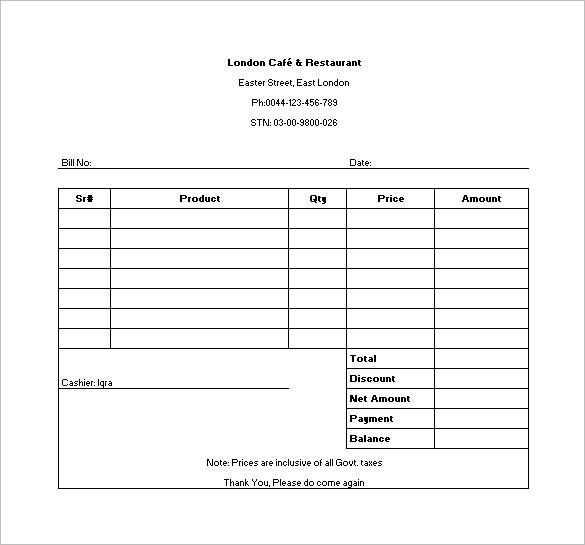

| Description of Goods/Services | A brief description of the goods or services for which payment was made. |

| Signature | A section for both parties to sign, confirming the transaction. |

Simple Receipt Voucher Template

Here is a straightforward example of a receipt voucher template:

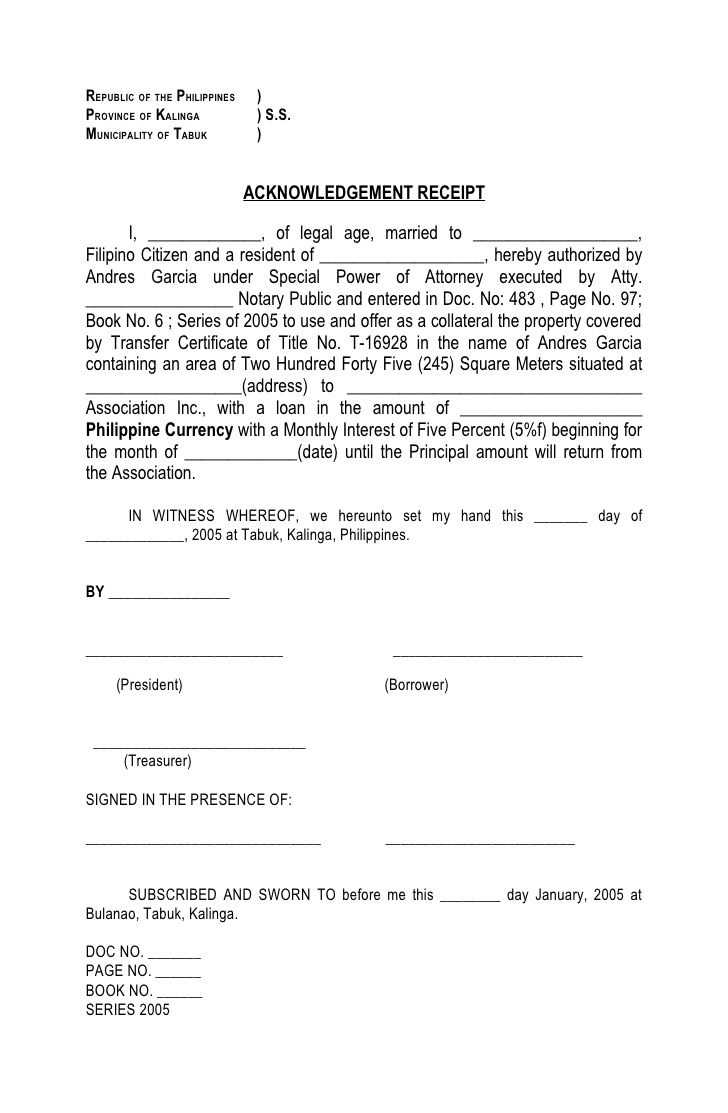

Receipt Voucher Receipt Number: [Unique ID] Date: [Date] Payer: Name: [Payer Name] Contact: [Payer Contact Info] Payee: Name: [Payee Name] Contact: [Payee Contact Info] Amount Paid: $[Amount] Payment Method: [Cash, Bank Transfer, etc.] Description: [Goods/Services Details] Signature: Payer's Signature: ____________________ Payee's Signature: ____________________

Use this template as a reference, and adjust it to fit your specific needs. Always ensure the clarity of the data to maintain accuracy in record-keeping.

To create a voucher template, begin by defining the core information you need to include. This typically involves the business name, address, and contact details. Add fields for the voucher amount or value, expiration date, and any terms and conditions that apply. Make sure the voucher number is clearly visible to help with tracking and validation.

Step 1: Design the Layout

The layout should be clean and straightforward. Place your business logo at the top for easy identification. Below that, create separate sections for the voucher value, terms, and the recipient’s name. Include a barcode or QR code for digital verification, which will streamline the redemption process.

Step 2: Choose the Right Font and Colors

Select fonts that are readable and professional. Avoid using too many different fonts to keep the design simple. Stick to your brand’s color scheme to maintain consistency with other marketing materials.

Finally, review the template to ensure all fields are customizable, allowing flexibility for various promotions or customer needs. Once you’re satisfied with the design, save it as a reusable template for future use.

Include these key details in your receipt voucher to ensure clarity and professionalism:

- Receipt Number: This unique identifier helps track the voucher for future reference or any disputes.

- Issuing Date: Clearly mark the date the receipt was issued to avoid any confusion regarding timing.

- Vendor Information: Include the name, address, and contact details of the vendor to ensure transparency and ease of follow-up.

- Buyer Information: List the buyer’s name or company, and relevant contact details to validate the transaction.

- Detailed Description of Goods/Services: Provide clear descriptions of the purchased items or services, including quantities and unit prices, to avoid any misinterpretation.

- Total Amount: Show the exact total, including any taxes or additional fees, to offer a complete breakdown.

- Payment Method: Specify how the payment was made (e.g., cash, card, bank transfer) to record the method of transaction.

- Authorized Signatures: A signature from the vendor or the buyer confirms the receipt of payment and the completion of the transaction.

- Refund or Return Policy: If applicable, briefly mention the terms for returns or refunds, making the process clearer to the buyer.

By including these elements, your receipt voucher will provide all necessary information for both parties and enhance the professionalism of your business transactions.

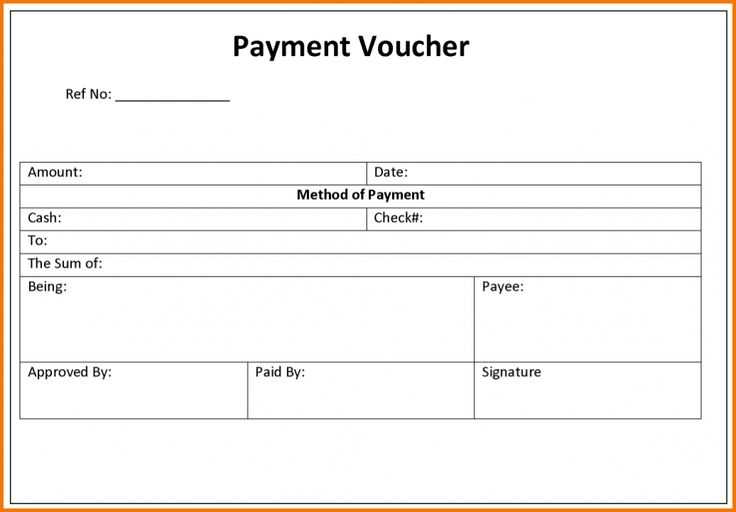

Adapt the receipt voucher template to accommodate various payment methods. Adjustments ensure that each transaction type is clearly documented. Below are tips for tailoring your template for cash, credit cards, and digital payments.

Cash Payments

For cash payments, include fields to specify the exact amount tendered and any change provided. This is crucial for both the payer and the recipient to have a clear understanding of the transaction. Make sure to note the payment in full without requiring further verification, as cash transactions are straightforward.

Credit/Debit Card Payments

For card payments, include fields for the card type, last four digits of the card number, and authorization code. These details ensure transparency while protecting sensitive data. Do not include the full card number to maintain security. Optionally, add a section for the payment processor’s name or transaction ID to further track the payment.

Digital Payments (e.g., PayPal, Venmo)

For digital payments, note the payment provider (e.g., PayPal, Venmo) and the transaction ID. This helps track payments from online sources, which may involve additional processing or verification steps. Include the email address or username associated with the payment account, ensuring that both parties can easily confirm the payment details.

| Payment Method | Details to Include |

|---|---|

| Cash | Amount tendered, change provided |

| Credit/Debit Card | Card type, last 4 digits, authorization code, transaction ID |

| Digital Payment (PayPal, Venmo) | Payment provider, transaction ID, email/username |

By customizing each section of the receipt voucher for different payment methods, you create a more organized and transparent record for both the payer and the payee.

Legal Considerations When Designing a Voucher Template

Ensure that your voucher clearly defines its terms and conditions, including the expiration date, usage limits, and any exclusions. This helps avoid misunderstandings and disputes later on.

Make sure your voucher complies with consumer protection laws. For example, if the voucher is non-refundable or has specific redemption conditions, these should be clearly stated to prevent misleading customers.

If the voucher is part of a promotional offer, it must follow advertising laws. Ensure that the offer is not deceptive and that all claims made about the voucher are accurate and substantiated.

Include privacy and data protection notices if the voucher involves the collection of personal data. Follow the relevant privacy regulations, such as GDPR or CCPA, and ensure transparency about data collection and usage practices.

Check for copyright and trademark issues when designing the voucher. If you use logos, images, or other proprietary content, verify that you have permission or the necessary licenses to include them in your design.

Designing and automating vouchers can streamline your workflow and ensure accuracy. Use design software like Canva or Adobe InDesign for creating visually appealing templates. These tools offer customizable templates, making it easy to align your vouchers with your brand identity.

For automation, consider integrating tools like Microsoft Excel, Google Sheets, or more specialized voucher management systems such as Voucherify or GiftUp. These tools allow you to create batch vouchers quickly and apply personalized details for each customer without manual intervention.

- Choose software with built-in templates to save time on layout design.

- Automate voucher creation by importing customer data from spreadsheets.

- Set expiration dates and redemption conditions to ensure timely use.

- Link voucher generation to your payment system for seamless transactions.

Ensure your tools are compatible with your other business systems to avoid errors and save time. With proper automation, you can generate and send vouchers within seconds, giving your business more flexibility and control.

One of the most frequent mistakes is using outdated templates. Always check if the template you are using is up-to-date and compatible with the latest software versions. Using outdated formats may lead to errors when processing vouchers or cause compatibility issues with other systems.

Another common issue is neglecting to customize the template to suit your specific needs. Generic voucher templates might not include the necessary fields for your transaction or business type. Ensure all relevant information such as date, item description, and pricing is accurately added to avoid confusion.

Missing or incorrect contact information is another mistake to watch for. Make sure the contact details for both parties (the issuer and recipient) are clearly visible. This helps to resolve any issues quickly if questions arise later.

Not including proper security features can also cause trouble. Adding security elements such as serial numbers or unique codes to your vouchers will help prevent fraud and ensure each voucher is authentic.

Finally, ensure that the terms and conditions are clearly stated. Ambiguous language can lead to disputes or confusion. Be clear about the voucher’s expiration date, limitations, and any other important details to ensure a smooth transaction process.

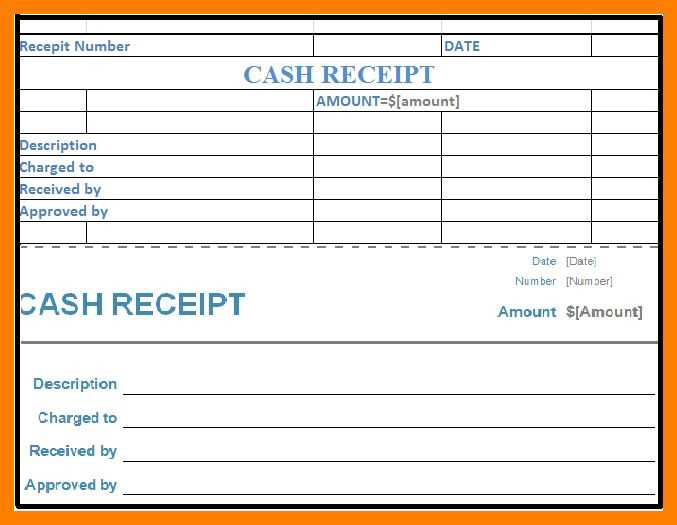

When creating a receipt voucher, focus on clarity and accuracy. A well-organized voucher not only provides essential information but also ensures smooth transaction tracking. Start with a clear header that identifies the voucher type, such as “Payment Receipt” or “Purchase Voucher”.

Key Elements to Include

Each voucher must have the following details: the date of the transaction, a unique voucher number, the name of the payee, the amount received, and the method of payment (cash, check, or electronic). Additionally, include a brief description of the goods or services exchanged to avoid any ambiguity.

Format and Design Tips

Keep the layout clean with enough spacing between each section to enhance readability. Use bullet points or numbered lists to separate details, making the voucher easy to read. Stick to a simple font style, and avoid adding unnecessary logos or graphics that might distract from the important information.