Finding a reliable and professional receipt template can streamline your business transactions and record-keeping. Downloading a pre-designed template ensures that your receipts meet standard requirements while saving time on manual formatting.

Choose templates that include key elements such as company name, contact information, date of issue, payment description, and total amount. This structure ensures clear communication and accurate documentation for both parties.

Tip: Look for templates in formats like PDF, Word, or Excel to match your editing preferences. Many websites offer free downloads, but ensure they come from trustworthy sources to maintain data security.

By using an adaptable and properly formatted receipt template, you’ll create a professional impression and keep your financial records in order effortlessly.

Here’s a Version Without Redundancy:

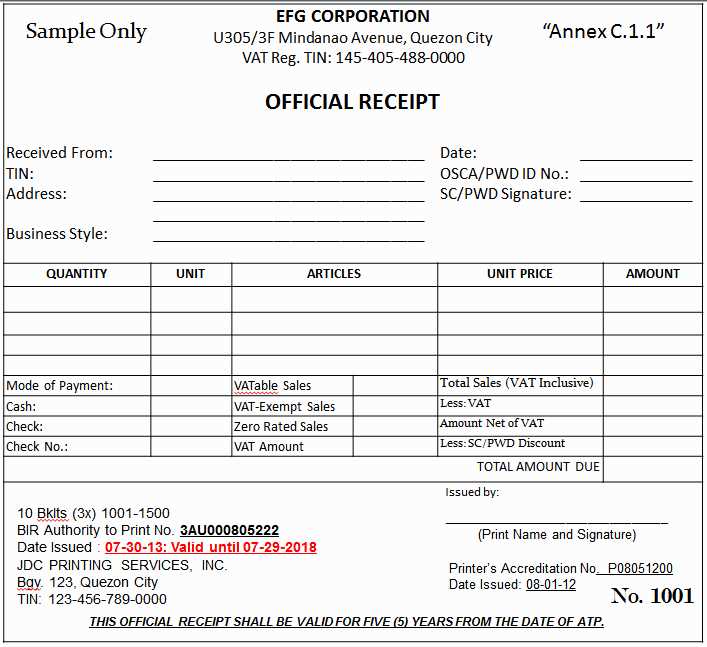

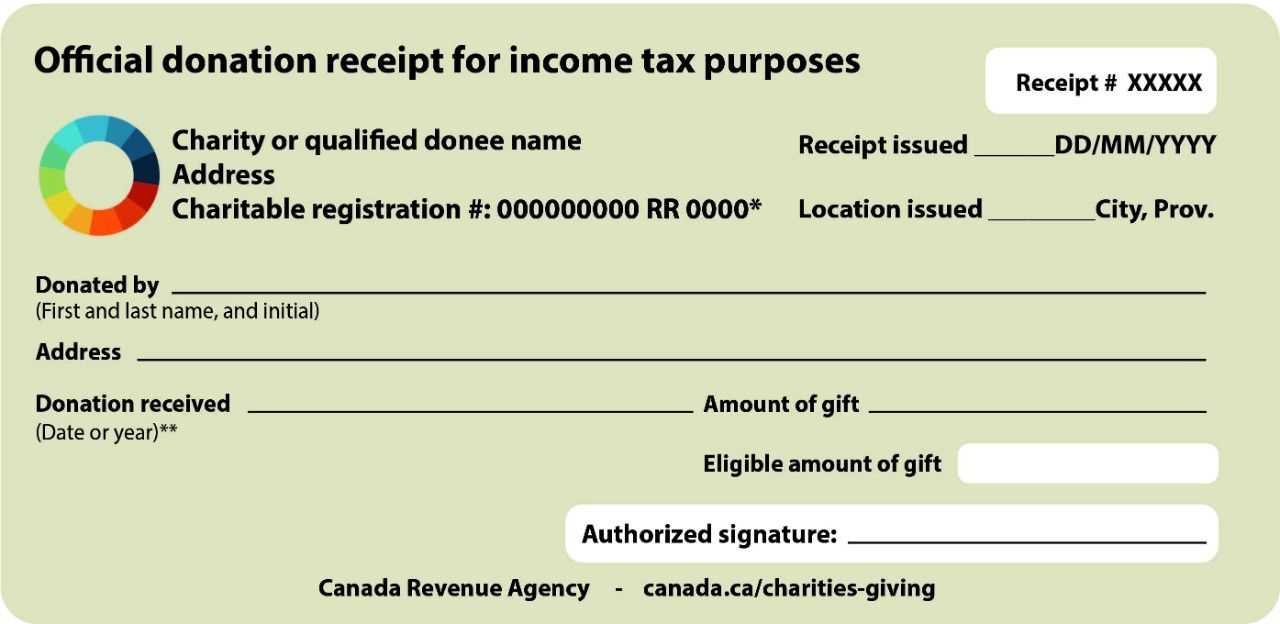

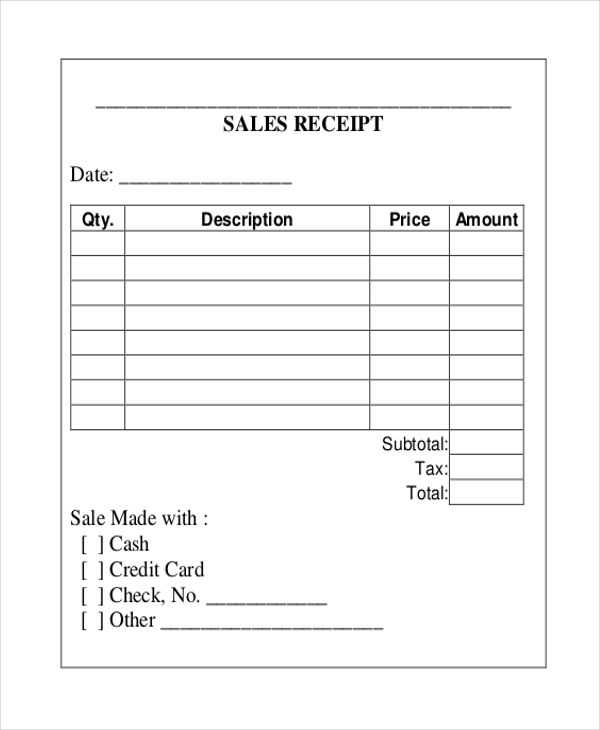

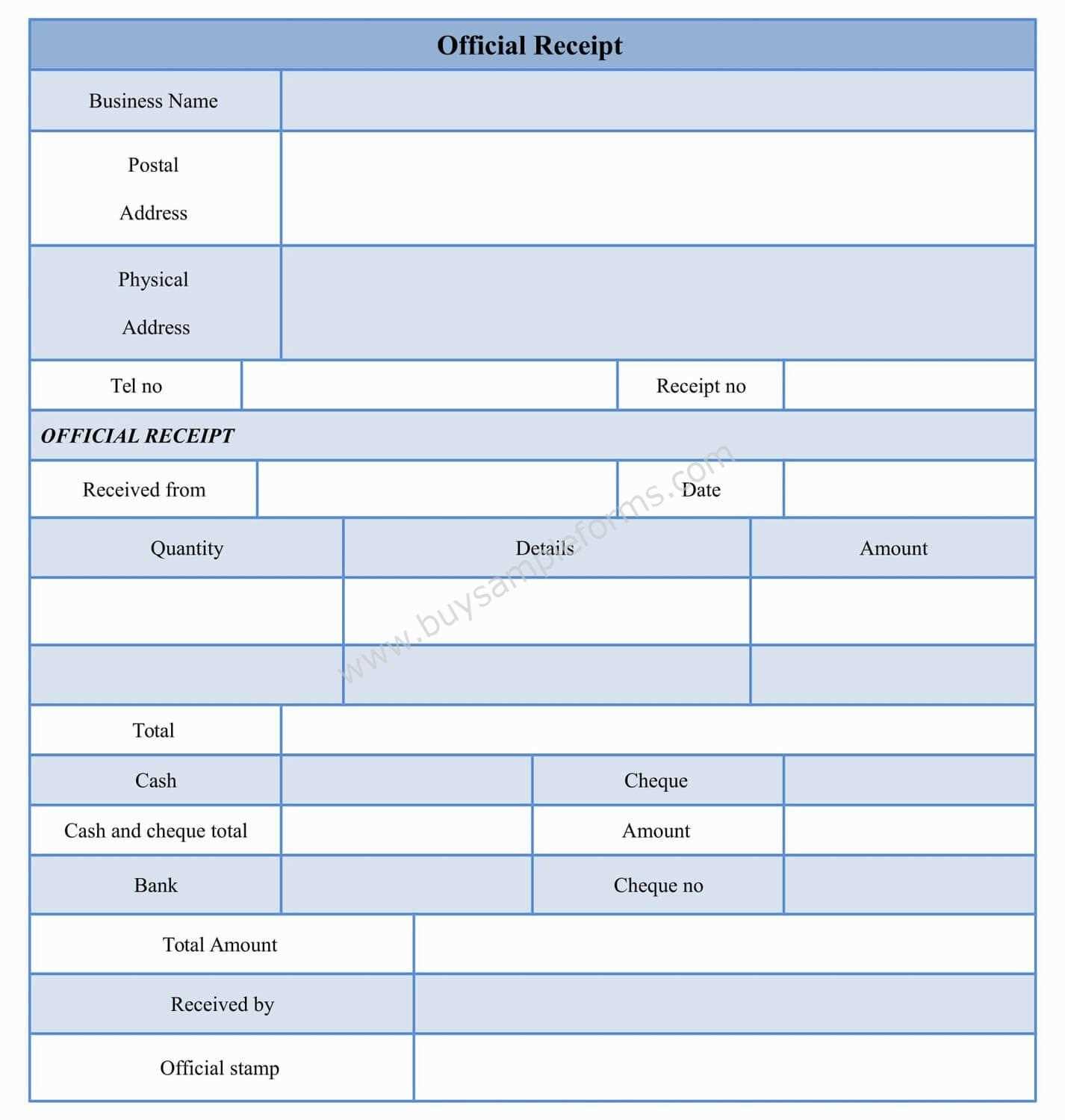

To create a professional official receipt, include essential elements such as the receipt number, date, seller’s details, and buyer’s contact information. Specify the product or service description, quantity, unit price, and total amount paid. Don’t forget payment methods and terms for clarity.

Practical Formatting Tips:

Align text neatly for readability. Consider using a table structure to organize data like itemized purchases and taxes. Include a signature field if needed and ensure proper branding with your business logo.

- Official Receipt Template Download

Start by choosing a template compatible with your preferred software, such as Word, Excel, or PDF. This ensures easy customization and professional formatting. Look for templates that include essential fields like receipt number, date, payment method, and a clear itemized list of goods or services. Including your business logo and contact details enhances credibility.

After downloading the template, personalize it by filling out fixed sections, such as business name, tax identification number, and payment terms. Save this as a master copy to avoid repetitive edits for future receipts. Keeping a consistent layout across all transactions helps maintain clear financial records and promotes brand identity.

Ensure every receipt generated contains legally required information, including accurate totals, tax breakdowns, and proper timestamps. For digital recordkeeping, convert completed receipts to PDF format to prevent unauthorized changes. Back up your receipt files regularly to secure financial documentation.

Start by exploring trusted online platforms like template libraries and professional resource hubs. Websites such as Template.net and Invoice Simple offer a wide selection of downloadable receipt templates without hidden costs. Look for customizable formats compatible with Word, Excel, or PDF to suit your specific needs.

Direct Sources for Businesses

Visit financial or accounting software websites like Wave Apps and Zoho, where free receipt templates are often included as part of their basic tools. These options typically offer user-friendly designs that comply with tax and record-keeping standards.

Select formats that ensure clarity and meet specific requirements. A simple PDF format works well for standardized layouts and secure sharing. It prevents unauthorized edits while preserving the original design. For businesses with frequent changes in data, an editable format like Excel or Google Sheets allows for easy customization and data management.

Digital formats should also support compatibility with your accounting software. Consider formats that enable direct imports, such as CSV. Always check if your chosen format complies with local regulations regarding tax documentation and record retention periods.

Begin by opening the template file in a compatible editor such as Microsoft Word, Google Docs, or Excel. Ensure the editor supports the template’s format for smooth customization.

Next, locate the placeholders for key information like recipient name, date, and payment details. Replace these placeholders with your specific data to maintain accuracy.

Adjust the layout if necessary to fit your branding. This includes selecting suitable fonts, aligning text, and incorporating your logo if available.

| Customization Step | Action Required |

|---|---|

| Update Text Fields | Replace placeholders with real data. |

| Change Formatting | Modify fonts, colors, and spacing to match your brand. |

| Insert Company Logo | Upload and position the logo appropriately. |

| Save Template | Export or save as a PDF for distribution. |

Complete the process by reviewing the final version for errors and inconsistencies. Save multiple copies to accommodate future edits or adjustments.

Receipts must include specific details to be legally valid and protect both the buyer and the seller. Begin with the full legal name of the business or individual issuing the receipt, along with the business address and contact information. This establishes accountability and clarity.

Transaction Details

Clearly state the date and time of the transaction. It should also include a breakdown of the purchased items or services, specifying their quantity and price. If taxes are applied, these should be listed separately to show the exact calculation and amount.

Payment Information

The payment method used should be indicated, whether it’s cash, credit card, or any other form of payment. If a partial payment was made, this should be noted with the remaining balance. A receipt number or unique identifier adds an extra layer of authenticity and traceability.

Choose the appropriate file format for saving receipts to ensure compatibility with different devices and software. PDF is the most widely accepted format for official receipts due to its stable layout and ease of use. Other formats like DOCX or XLSX may be suitable for editable templates.

- Cloud storage: Use cloud services like Google Drive, Dropbox, or OneDrive to store your files. These platforms provide easy access from any device, ensuring that your receipt templates are always available.

- Email sharing: For quick sharing, email the file as an attachment. It’s a straightforward method for small batches of receipts or one-off transactions.

- File compression: If the files are large, consider compressing them into a ZIP archive. This helps reduce file size and makes it easier to upload or send via email.

Always check file permissions and access settings before sharing, especially if sensitive information is included in the receipt template. You can control who can view, edit, or download the file using cloud sharing options.

- Sharing links: If you prefer not to send attachments, use the sharing link feature available in most cloud services. This allows you to send a link to the file without worrying about email size limits.

- Version control: Keep track of different versions of the file, especially if the receipt template is regularly updated. Most cloud services offer version history, so you can easily revert to previous versions if needed.

Organize your receipts and records by categorizing them based on the type of transaction. For example, keep receipts for purchases, repairs, and services in separate folders or digital files. This makes it easier to find specific records when needed.

Store records in a secure and accessible place. Use cloud storage to back up digital copies of your receipts. If you prefer physical storage, use labeled folders or filing cabinets with easy access to the relevant records.

Keep records for a set period, such as seven years, to meet tax requirements or business needs. Regularly review and discard unnecessary records to prevent clutter and maintain organization.

Update your records regularly. Set a weekly or monthly reminder to file new receipts and update any changes to existing records. This practice helps to avoid backlogs and ensures accuracy in your records.

Use software or apps to track and organize your receipts. Many tools offer automatic scanning and categorization of receipts, making record maintenance faster and more efficient.

To create an official receipt, download a template that suits your needs and customize it. Start by adding the company or personal information, including name, address, and contact details. Then, list the items or services provided, their corresponding prices, and any taxes applied.

Ensure your receipt has clear sections for:

- Receipt Number: A unique identifier for each transaction.

- Date of Issue: The date when the transaction took place.

- Amount: Total cost including any taxes and discounts.

- Payment Method: Indicate whether the payment was cash, credit card, or another method.

Once you’ve tailored the template to your business needs, make sure to save it for future use. Printing and digital formats are both options depending on your preference. Consider using PDF format for easy sharing and maintaining professional standards.

For a more streamlined process, look for templates with automatic fields or calculations, reducing manual data entry errors. Many free and paid options are available online, allowing you to select one that aligns best with your requirements.