A well-structured salary receipt ensures clarity in financial transactions between employers and domestic helpers. This document serves as proof of payment, outlining key details such as wages, deductions, and benefits. Using a standardized template simplifies record-keeping and prevents misunderstandings.

Each receipt should include: the helper’s name, payment period, total salary, deductions (if any), and the employer’s signature. Clearly specifying these elements guarantees transparency and compliance with labor regulations.

A printed or digital receipt protects both parties by documenting salary disbursement. Employers can track expenses, while domestic helpers gain written confirmation of their earnings. Consistency in format enhances professionalism and ensures accurate financial records.

Creating a salary receipt template tailored to specific employment terms reduces administrative effort. Simple yet comprehensive formatting–listing earnings, benefits, and deductions–facilitates smooth payroll management. A reliable template eliminates confusion and strengthens trust in employer-employee relationships.

Here is the revised version with the removal of word repetitions:

To create a salary receipt for a domestic helper, be clear and concise in documenting payment details. The following key points should be included in a clean, organized format:

- Date of Payment: Specify the exact date when the payment is made.

- Amount Paid: Clearly state the amount given to the helper, including any deductions.

- Payment Period: Mention the timeframe for which the payment is applicable (e.g., weekly, monthly).

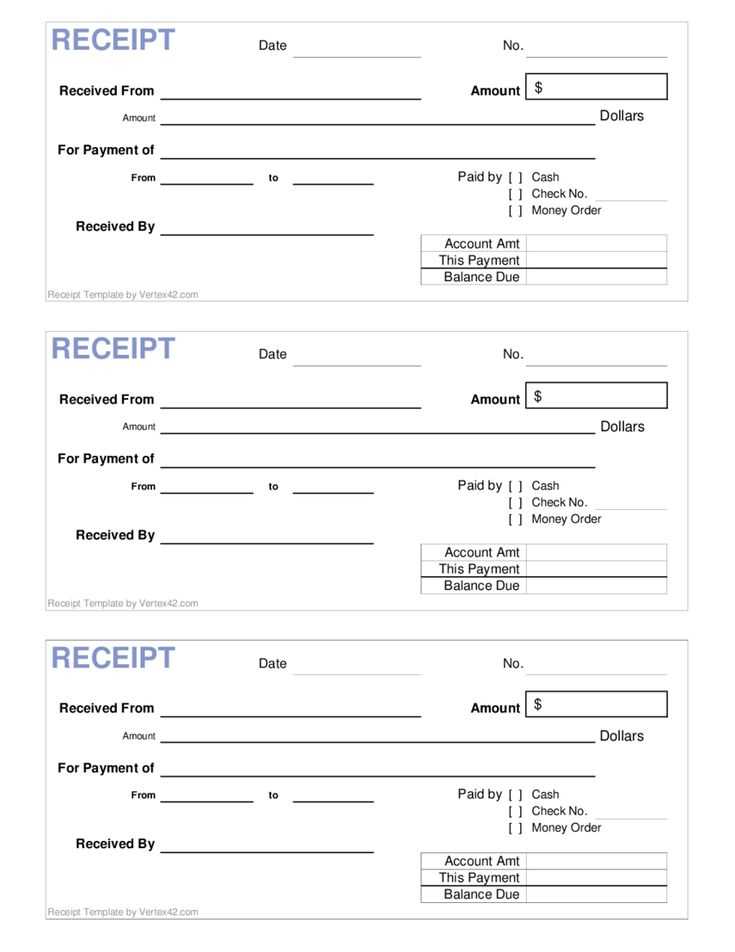

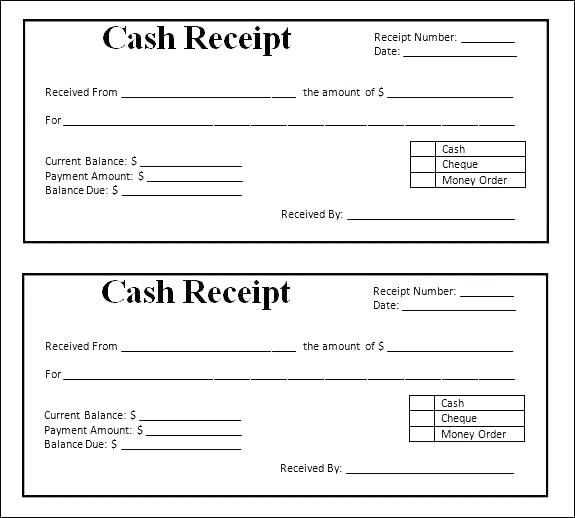

- Payment Method: Indicate whether the payment was made by cash, bank transfer, or other methods.

- Helper’s Name: Include the full name of the domestic helper to avoid confusion.

- Employer’s Name: Mention the employer’s name or household name issuing the payment.

By following this structure, the salary receipt will be clear and straightforward, ensuring transparency for both parties.

Additional Information to Include

- Overtime Pay: If applicable, list the overtime hours worked and the corresponding rate.

- Bonuses or Deductions: Include any bonuses or deductions (e.g., for meals, transport, or sick leave).

- Signature: Provide space for both the employer’s and the employee’s signatures as proof of the transaction.

With these elements in place, the receipt will serve its purpose effectively, making the payment details easy to track and manage.

- Domestic Helper Salary Receipt Template

Creating a domestic helper salary receipt is straightforward. Ensure it includes the helper’s full name, the payment date, the total salary amount, and any deductions or bonuses. This simple structure avoids confusion for both employer and employee.

Key elements to include:

- Helper’s Name: Always specify the full name of the domestic helper.

- Payment Date: Clearly state the date the salary is paid.

- Salary Amount: Mention the agreed salary before and after any deductions.

- Deductions/Bonuses: List any deductions (e.g., taxes, accommodations) or bonuses provided during the payment period.

- Employer’s Name: Include the name of the employer for clear identification.

Additional tips:

- Ensure the document is signed by both the employer and the domestic helper for verification.

- Consider adding a receipt number for easy tracking of payments.

A payment receipt should provide clarity and detail about the transaction. Start by including the date of payment, clearly marking when the payment was made. This ensures that both parties have an accurate record of the timing.

Next, list the amount paid in both words and numbers. This reduces any chances of confusion or disputes over the exact figure. If there are deductions or bonuses, make sure to highlight them.

Include a brief description of services provided, making it easy to identify the nature of the payment. For example, “Monthly salary for housekeeping duties” ensures that the purpose is clear.

Don’t forget to include both parties’ names and contact details. This makes it easy to confirm the individuals involved in the transaction and adds legitimacy to the document.

Lastly, always ensure there is a signature or acknowledgment from the payer, whether it’s a physical signature or a simple statement confirming the payment was received.

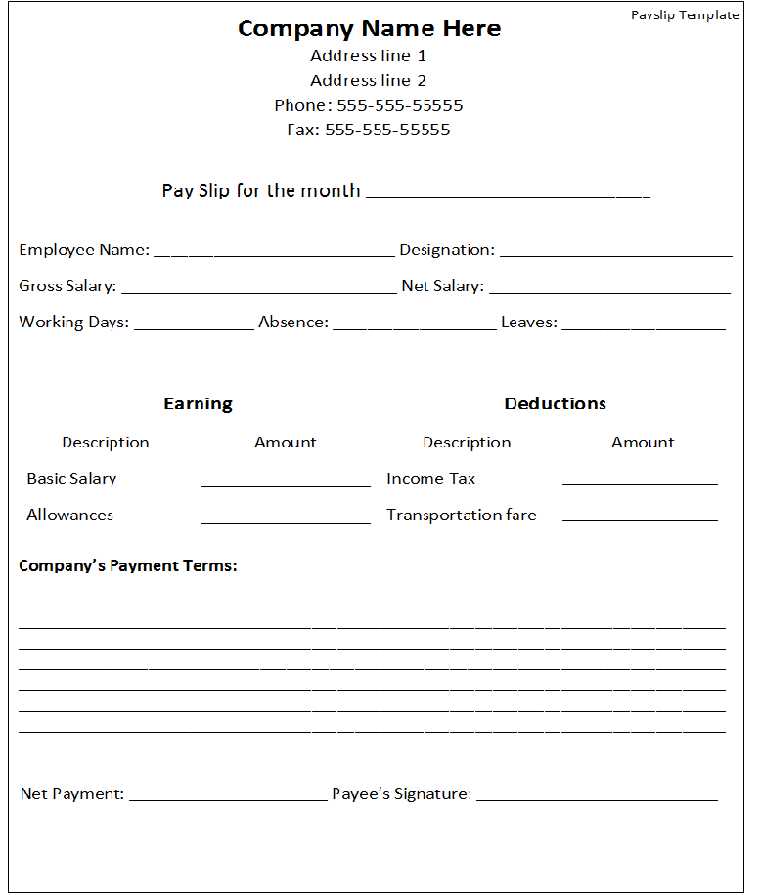

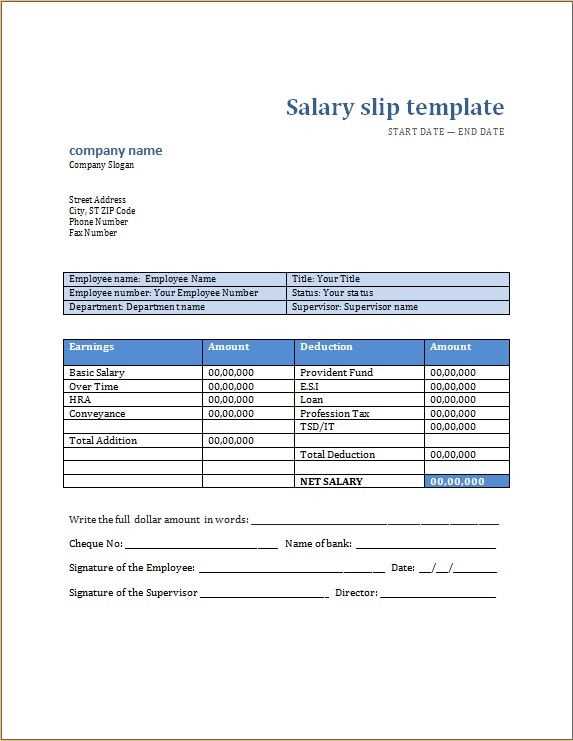

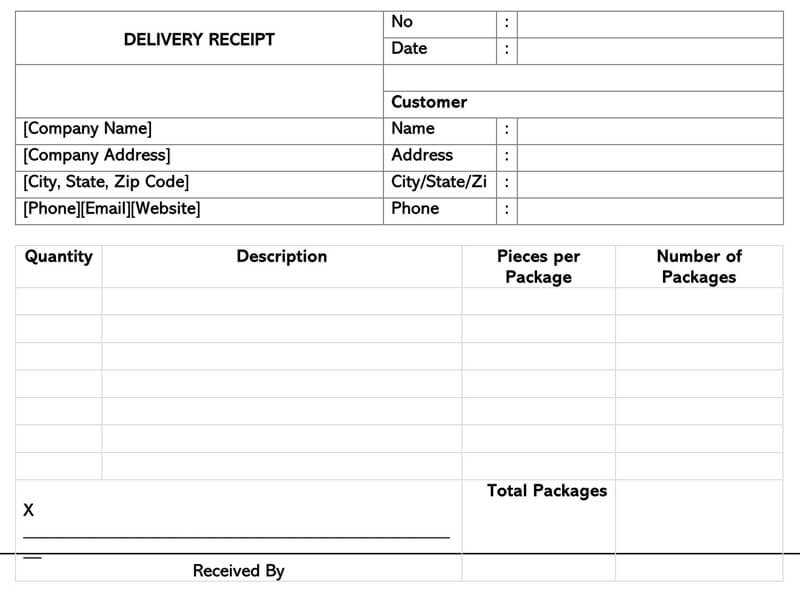

Begin with the header section, listing the employer’s name, address, and contact information. This is important for identification. Then, include the employee’s details, such as their name, position, and contact information.

Next, specify the payment period–this could be weekly, bi-weekly, or monthly. Make sure to clearly state the start and end dates of the period being paid for.

Include the total gross earnings of the employee for the specified period. Break this down into base salary and any additional earnings, such as overtime or bonuses. Use clear labels to avoid confusion.

List all deductions, like taxes, insurance premiums, or any other withholding amounts. It’s helpful to show the nature of each deduction to ensure transparency.

Subtract the deductions from the gross earnings to calculate the net pay, which is the amount the employee will receive after all deductions are made. Clearly display this final figure.

Finally, include the date of payment and the method (e.g., bank transfer, check). Always double-check for accuracy to prevent any discrepancies.

Payroll documents, such as salary receipts, can be generated and shared in either printable or digital formats. Printable formats like PDF or Word documents are commonly used for employees who prefer physical copies. These formats are easy to store, share, and print, making them ideal for personal records or for submission to external authorities. PDFs are especially useful for keeping the layout intact, regardless of the device used to view them.

On the other hand, digital formats such as spreadsheets (Excel or Google Sheets) or email-based receipts offer a more flexible and cost-effective way to manage payroll documents. Digital formats can be easily edited, updated, and stored on cloud platforms for easy access at any time. These documents also facilitate seamless communication between employers and employees, reducing paperwork and the need for physical storage.

For businesses aiming to streamline their payroll process, integrating both formats can offer flexibility. Employees can receive their payslips via email in a digital format, with an option for printable versions upon request. This ensures that both digital-savvy employees and those preferring paper-based records are accommodated.

| Format | Advantages | Disadvantages |

|---|---|---|

| Printable (PDF, Word) | Easy to store, print, and share | Physical storage space required, printing cost |

| Digital (Excel, Email) | Easy to edit, share, and store online | May require technology setup, potential for data breaches |

Ensure that all compensation records align with local labor laws. These laws dictate the required elements for wage documentation, such as payment dates, total hours worked, and deductions. Failure to comply may result in legal consequences for both the employer and employee.

- Include the exact salary amount, specifying whether it’s hourly, weekly, or monthly compensation.

- Ensure that the receipt reflects all applicable deductions, including taxes, insurance, or pension contributions.

- Provide clear records of overtime pay, bonuses, or any other additional earnings.

- Maintain transparency by listing any reimbursements or other expenses that are being covered by the employer.

- Keep accurate records for the legally required period, which may vary depending on the jurisdiction.

Always consult with a legal expert to verify that your compensation receipts meet local requirements and avoid penalties. Accurate and transparent records not only protect both parties but also streamline any potential audits or disputes.

Ensure the employee’s name is spelled correctly. Incorrect spelling can lead to confusion or payroll errors. Double-check for typos before issuing the slip.

Miscalculating overtime pay is another common mistake. Verify the correct hourly rate for overtime and the number of hours worked to avoid errors in pay calculations.

Not including all relevant deductions can cause discrepancies in the final salary. Always account for taxes, insurance, and other deductions to ensure the amount matches the agreed-upon salary.

Failing to list the correct payment date is an easily overlooked mistake. Make sure the payment date is accurate and clearly visible on the receipt to avoid confusion regarding payment schedules.

Lastly, neglecting to provide a breakdown of the salary can make the payment slip unclear. Include detailed information such as basic pay, allowances, bonuses, and deductions for transparency.

Many websites offer free and paid templates for domestic helper salary receipts. A few reliable platforms provide customizable templates suitable for your needs:

1. Microsoft Office Templates

Microsoft offers a wide range of templates through Word and Excel, where you can easily download and modify them to suit your requirements. Simply visit the Microsoft templates website, search for “salary receipt,” and choose from available designs.

2. Google Docs Templates

If you prefer working online, Google Docs provides free templates for salary receipts. After signing into your Google account, navigate to Google Docs, select “Template Gallery,” and search for “receipt” to find various options.

These resources will help you quickly generate a professional-looking salary receipt without starting from scratch. Customize the templates with the required details, print or email them, and stay organized.

Ensure clarity and accuracy by listing all components of the domestic helper’s salary in the receipt. Begin with the agreed-upon base salary amount and break it down further if there are any bonuses, overtime pay, or allowances provided. Specify the exact payment period, whether weekly, bi-weekly, or monthly, and include the total sum paid. Provide a clear deduction section for any withholdings like taxes, insurance, or other agreed-upon expenses. Finally, include the net salary, which reflects the amount the domestic helper actually takes home after deductions.

For transparency, use simple language and avoid ambiguity in each section. The receipt should clearly show both the gross and net amounts, ensuring there are no misunderstandings about the payment details.