Provide a clear and professional receipt every time a donation is received. A well-structured template ensures transparency, simplifies tax reporting, and builds trust with donors. Use a format that includes key details, such as the donor’s name, donation amount, date, and the organization’s information.

Customize receipts to fit your organization’s needs. While basic templates include standard fields, adding a message of appreciation or tax-exemption details can enhance their value. Consider using digital formats for easy storage and retrieval.

Ensure compliance with tax regulations by including necessary legal disclaimers. In many regions, receipts must specify whether goods or services were exchanged for the donation. Double-check local requirements to avoid issues when donors claim deductions.

Using a consistent receipt template saves time and maintains professionalism. Whether printed or digital, a well-prepared document reassures donors and simplifies financial management.

Charity Receipt Template: Practical Guide

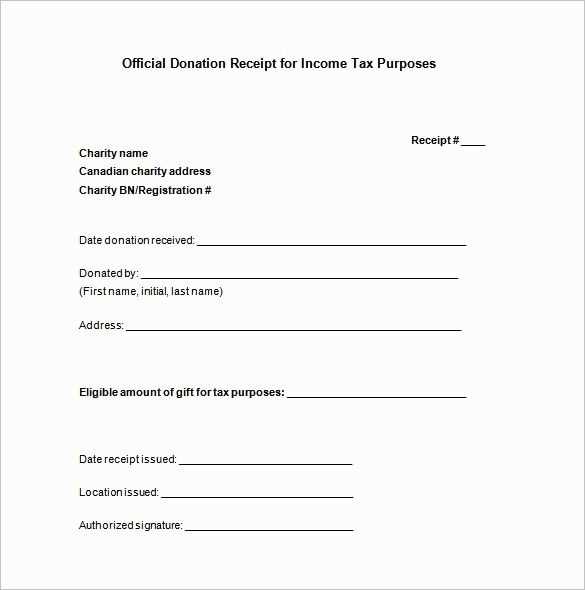

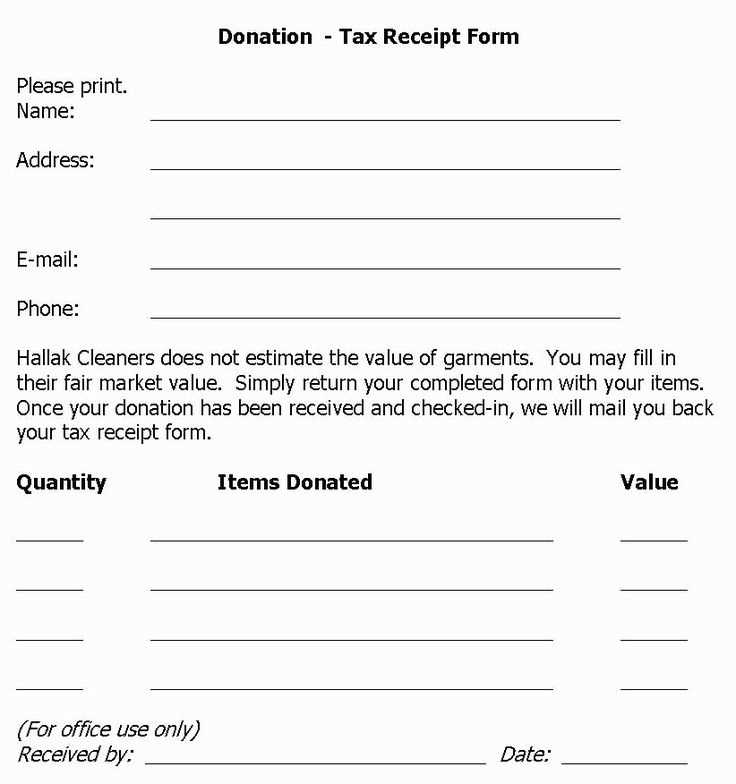

Include the donor’s full name, donation amount, and date on every receipt. Accuracy is key for tax purposes and record-keeping. Clearly state whether the contribution was monetary or non-monetary, detailing goods or services received in exchange.

Key Information to Include

Ensure the receipt meets legal requirements by structuring it correctly. The following table outlines the essential elements:

| Field | Details |

|---|---|

| Donor Name | Full legal name of the contributor |

| Date | Day the donation was made |

| Amount | Exact value of the donation |

| Description | Monetary or itemized list of donated goods |

| Charity Name | Official name of the organization |

| Tax ID | Registered identification number |

| Statement | Confirmation of no goods or services received, if applicable |

Formatting and Storage

Receipts should be legible, preferably printed or saved as PDFs. Digital storage helps maintain organized records. If issuing paper copies, use a consistent layout to avoid discrepancies.

Key Elements to Include in a Charity Receipt

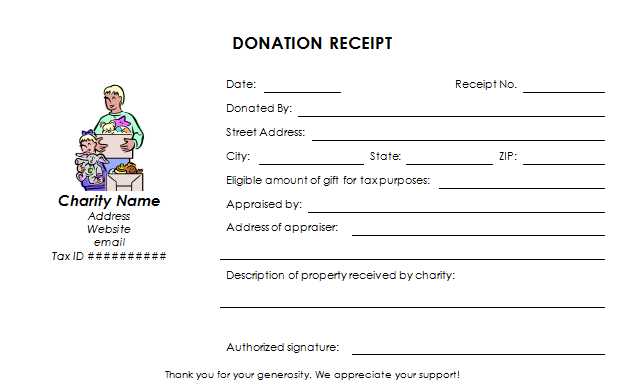

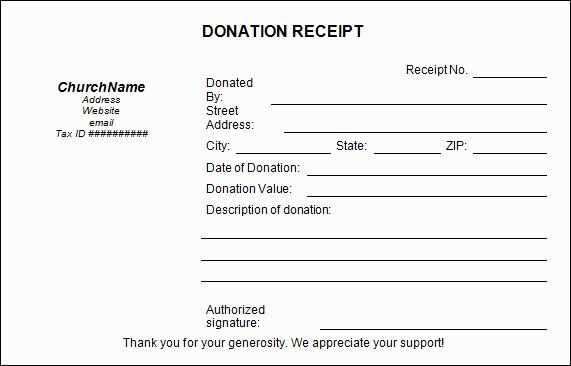

- Full Legal Name and Address: Clearly display the organization’s registered name and official address to establish authenticity.

- Donor’s Details: Include the full name and address of the donor to ensure proper record-keeping and facilitate tax deductions.

- Date of Donation: Specify the exact date to confirm when the contribution was made.

- Description of Donation: If monetary, state the exact amount. For non-monetary contributions, describe the donated items or services without assigning a value.

- Statement of No Goods or Services: If applicable, confirm whether the donor received anything in exchange for the donation, ensuring compliance with tax regulations.

- Tax-Exempt Status: Include a statement verifying the organization’s tax-exempt status and registration number to validate eligibility for deductions.

- Receipt Number: Assign a unique identification number to simplify tracking and verification.

- Authorized Signature: Add a signature from an authorized representative to confirm the receipt’s legitimacy.

Providing all necessary details prevents errors and ensures donors receive proper documentation for tax purposes.

Legal Requirements for Donation Receipts

Ensure that each donation receipt includes the donor’s full name, the organization’s legal name, and its tax identification number. Without this information, the receipt may not be valid for tax purposes.

Mandatory Receipt Details

Every receipt must specify the donation date, the amount given (or a description of non-monetary gifts), and a statement confirming whether any goods or services were provided in exchange. If benefits were received, their estimated value should be included.

Compliance with Tax Laws

Charitable organizations must follow regulations set by tax authorities, which may require receipts for donations above a certain amount. Digital or printed receipts should be stored securely for future audits.

How to Format a Professional Charity Receipt

Include the charity’s name, address, and contact details at the top. Use a clear, legible font to ensure readability. Follow this with a unique receipt number for tracking purposes.

Essential Donation Details

List the donor’s full name and address exactly as provided. Specify the donation amount in both numerical and written form to avoid misinterpretation. If the contribution was non-monetary, describe the item or service with an estimated fair market value.

Legal Compliance and Final Touches

Add a statement confirming whether the donor received goods or services in exchange. If nothing was given in return, explicitly state that the donation is tax-deductible. Include a signature from an authorized representative for credibility.

Customizing Templates for Different Organizations

Adjust the layout to match the organization’s branding. Modify fonts, colors, and logos to ensure consistency with other materials. A well-aligned template strengthens recognition and trust.

Include relevant details specific to the organization’s reporting needs. Some may require tax-exempt numbers, donation categories, or additional disclaimers. Ensure all required fields are present.

Optimize for different formats. Some organizations prefer printed receipts, while others use digital versions. Configure templates for both options, keeping readability and accessibility in mind.

Streamline automation by integrating templates with donor management systems. Pre-filled sections reduce errors and save time, especially for frequent contributors.

Ensure compliance with legal and financial requirements. Different regions have specific regulations, so verify that templates include all necessary statements for transparency and accuracy.

Common Mistakes and How to Avoid Them

Failing to include all required details can lead to issues with tax authorities. Ensure the document includes the donor’s full name, donation date, amount, and confirmation of no goods or services received in exchange.

Incorrect Formatting

Unreadable or unstructured receipts may cause confusion. Use clear headings, uniform font sizes, and a simple layout to enhance readability. Avoid handwritten receipts, as they can be misinterpreted or rejected.

Missing Organization Details

Not including the charity’s legal name, registration number, and contact details can make the receipt invalid. Double-check that all required information is present to prevent disputes or rejections.

Verifying accuracy before issuing the receipt saves time and prevents corrections. A small mistake can lead to compliance issues, so always review each receipt carefully.

Digital vs. Paper Receipts: Pros and Cons

Choose digital receipts for their convenience and accessibility. You can easily store and organize them on devices, eliminating clutter. Searching for a specific transaction becomes quick and efficient, saving you time during tax season.

Paper receipts offer a tactile experience and are useful for those who prefer physical documentation. They don’t require battery life or technology, making them reliable in any situation. However, they can fade over time, leading to potential loss of information.

Digital receipts often come with automated features like expense tracking and categorization. Many services integrate with budgeting apps, providing insights into your spending habits. This feature enhances financial awareness and planning.

In contrast, paper receipts lack integration capabilities, requiring manual entry into financial records. They can also be cumbersome to manage, especially for frequent transactions. Consider using a scanner app for important paper receipts to keep them organized digitally.

Both options have their merits. Evaluate your lifestyle and preferences. If you frequently access receipts and value organization, digital is the way to go. If you prefer physical copies, ensure you have a reliable storage method to prevent loss.