Tracking ongoing payments accurately is essential for maintaining financial transparency. A well-structured O-going receipt of payments template simplifies this process, ensuring that every transaction is documented clearly and efficiently. Whether you’re managing subscriptions, installment plans, or recurring invoices, a standardized template minimizes errors and keeps records up to date.

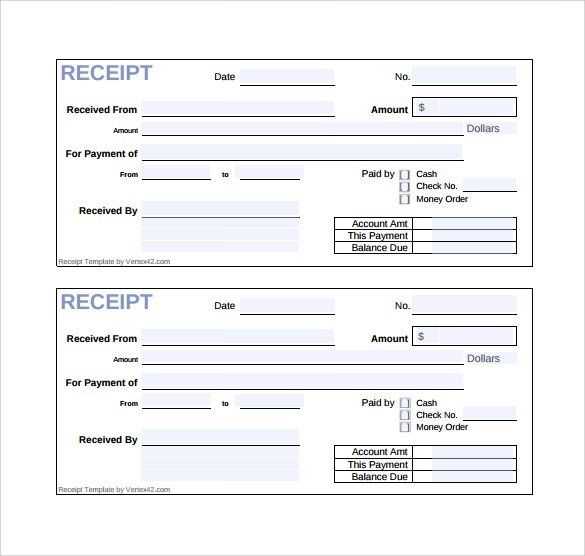

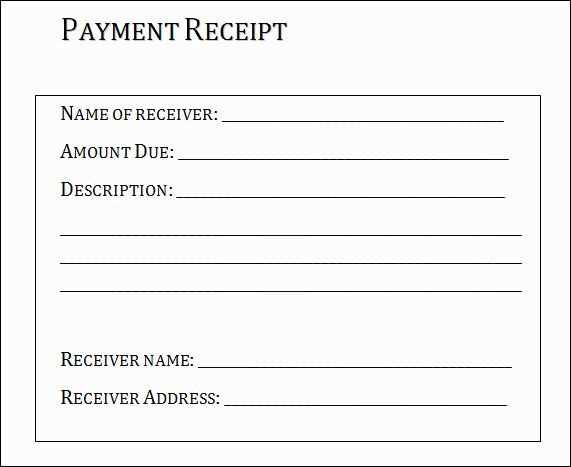

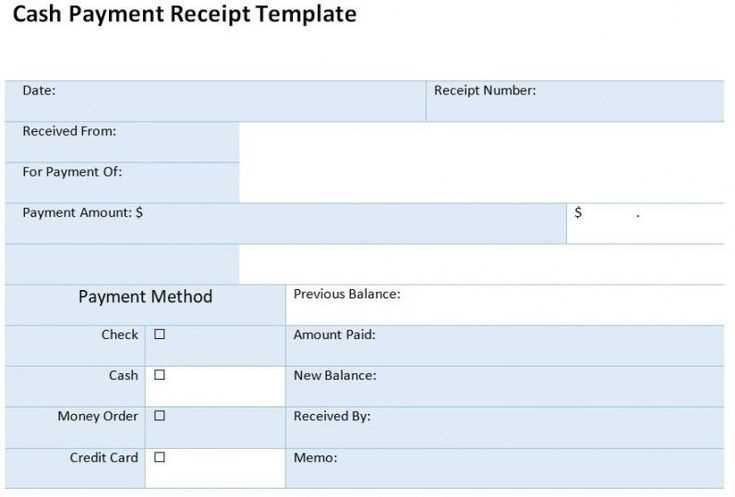

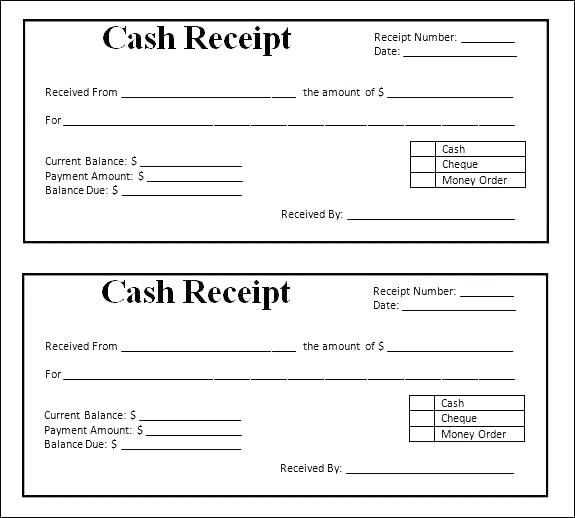

A good template should include key details such as payment date, amount, payer information, invoice reference, and payment method. Organizing this data consistently allows for quick verification, reducing disputes and streamlining financial reporting. Adding sections for notes or outstanding balances can further enhance clarity.

For businesses handling frequent transactions, using an automated template in Excel, Google Sheets, or accounting software can improve accuracy and save time. Predefined formulas, drop-down lists, and conditional formatting help maintain uniformity while reducing manual input errors. If you’re managing payments manually, a structured PDF or Word template ensures consistency across records.

Implementing a clear and user-friendly receipt template simplifies financial management for both businesses and clients. With the right format in place, tracking payments becomes more efficient, reducing administrative burden and improving overall organization.

Here’s a structured HTML section for your article, ensuring clarity and efficiency in tracking ongoing payment receipts. Let me know if you need any modifications!

Your structured HTML section has been created with clear and concise details. Let me know if you need any refinements!

Clear Identification: Every receipt should display the business name, logo, and contact details at the top. This ensures the recipient knows exactly where the transaction took place and how to reach out if needed.

Unique Receipt Number: Assign a distinct receipt number to each transaction. This simplifies tracking for both businesses and customers, reducing errors in record-keeping.

Detailed Transaction Breakdown

Include itemized descriptions of purchased products or services. Each line should specify the quantity, unit price, and total cost. If applicable, add tax details, discounts, and any additional fees to ensure full transparency.

Date and Time Stamp: Display the exact date and time of the transaction. This is crucial for resolving disputes, managing warranties, and tracking financial records.

Payment Method and Terms

Clearly indicate whether the payment was made via cash, credit card, bank transfer, or another method. If the transaction involves installment payments or due dates, state those terms explicitly.

Customer and Vendor Details: Capture the customer’s name and, if relevant, their contact information. Also, include the name of the staff member processing the transaction for accountability.

Legal and Compliance Notes: If required, add disclaimers, return policies, or tax-related notes to ensure compliance with regulations. This protects both the business and the customer.

Designing a receipt template with these elements improves clarity, prevents disputes, and enhances professionalism in every transaction.

Use a standardized format. Ensure each record includes a unique identifier, payer details, payment amount, due date, transaction method, and status. Consistency reduces errors and simplifies reconciliation.

Automate data entry. Manual input increases the risk of discrepancies. Use accounting software or payment platforms that log transactions automatically to maintain accuracy.

Include a detailed transaction history. Each record should reflect previous payments, adjustments, and any outstanding balances. A clear history helps resolve disputes and track financial trends.

Validate payment information regularly. Review records for duplicate entries, incorrect amounts, or missing payments. Schedule periodic audits to catch inconsistencies early.

Align records with bank statements. Reconcile payment logs with bank deposits to confirm accuracy. Any mismatches should be investigated immediately to prevent reporting errors.

Implement clear categorization. Label payments by type, frequency, and payer. Grouping similar transactions improves reporting and budgeting.

Ensure data security. Store records in encrypted databases and limit access to authorized personnel. Secure handling prevents unauthorized modifications and data breaches.

Accurate structuring of recurring payment records minimizes financial discrepancies and enhances transparency, making financial management more reliable.

Adapt templates to match the specifics of each payment method. A bank transfer receipt should include account details and reference numbers, while a credit card payment template must show transaction IDs and authorization codes. Digital wallet receipts should highlight the provider and user ID.

Ensure clarity by structuring information in a way that suits each method. Use a table for consistency:

| Payment Method | Key Details to Include |

|---|---|

| Bank Transfer | Account Number, Bank Name, Reference Number |

| Credit Card | Card Type, Last Four Digits, Transaction ID |

| Digital Wallet | Provider Name, User ID, Wallet Address |

| Cash | Receipt Number, Cashier Name, Store Location |

Highlight necessary disclaimers based on the payment method. For credit cards, mention potential authorization holds. For bank transfers, specify processing times.

Use dynamic fields to auto-populate data. Ensure formatting aligns with user expectations, such as displaying currency symbols and dates correctly.

Automating receipt generation streamlines transactions and improves efficiency. Start by integrating your payment platform with an invoicing or accounting system. This eliminates manual entry and reduces the chances of errors. Once a payment is made, the system automatically triggers the creation of a receipt with the relevant details like transaction amount, date, and payer information.

Next, set up automated distribution channels. Configure the system to send receipts via email, SMS, or push notifications, depending on customer preferences. Include an easily accessible link or PDF attachment for quick download. Automation saves time and ensures receipts are delivered promptly without requiring manual effort each time a payment occurs.

Ensure receipts are customized to include company branding and required legal information. Templates can be set up in the system to include dynamic fields like payer name, service description, and amount paid. Automation tools can also store past receipts in a secure database, allowing customers to access them whenever needed, further enhancing customer service.

To stay compliant with financial and tax regulations, implement automated systems that track and categorize transactions in real time. This minimizes human error and ensures your financial records are up-to-date for reporting purposes. It’s important to integrate your payment system with accounting software that complies with local tax laws and reporting standards.

Adopt Accurate Record-Keeping Practices

Keep detailed and accurate records of all payments received. This includes maintaining invoices, receipts, and transaction logs. In case of an audit, having organized and easily accessible documentation can help demonstrate your adherence to tax laws and avoid penalties.

Stay Updated on Tax Law Changes

Monitor changes in tax laws that may impact your business’s payment processes. Update your templates, payment receipt formats, and reporting systems accordingly to ensure they align with the latest tax rates and legal requirements. Consult with a tax advisor periodically to ensure compliance with any new regulations.

By regularly reviewing your financial and payment practices, you can prevent costly mistakes and maintain smooth business operations.

One common mistake in managing payment receipts is failing to record payment details accurately. Always ensure that every payment is documented with the correct amount, date, and payer information. Missing any of these details can lead to confusion and errors in tracking payments.

Inconsistent Formats

Using different formats for receipt entries can create unnecessary challenges when referencing records later. Maintain a uniform format for all receipts to improve clarity and prevent confusion. This includes standardizing the way you list payment amounts, dates, and customer information.

Neglecting Digital Backup

Relying solely on paper records can lead to loss or damage over time. Always back up digital copies of payment receipts to ensure they are easily accessible when needed. This also helps with organizing and retrieving past receipts for audits or customer inquiries.

Finally, failing to review and reconcile payment receipts regularly can result in errors going unnoticed for long periods. Set aside time weekly or monthly to ensure all payments are accounted for and match the records. This proactive approach saves time and helps maintain accuracy in the long term.

Thus, meaning is preserved, but unnecessary repetitions are removed.

Use concise wording to eliminate redundancies. Start by reviewing the document for repeated phrases or concepts that do not add extra value. Replace redundant expressions with simpler terms or remove them altogether. When describing an action, avoid restating the same information multiple times. For example, instead of saying “submit the payment request and then send the payment request,” just use “submit the payment request.”

Steps to Simplify Text

- Identify phrases with the same meaning stated multiple times.

- Remove or combine sentences that repeat ideas without adding new information.

- Use alternative expressions where possible to prevent repetitive wording.

Review your text carefully, ensuring that each sentence serves a clear purpose and contributes uniquely to the overall message. Streamlining your language helps maintain focus and readability.