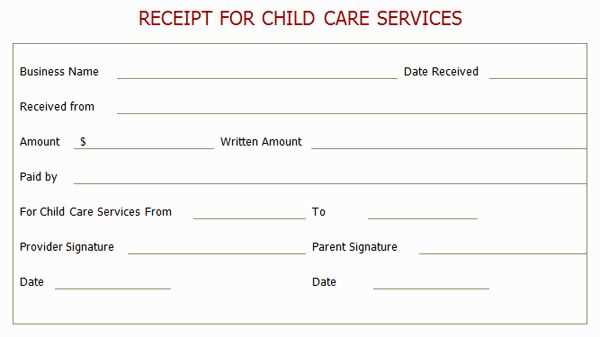

Providing clear and organized receipts for child care services can streamline your operations and build trust with parents. A receipt book template is a simple, yet effective tool to ensure all transactions are documented properly. Whether it’s for daily care, special activities, or extra services, having a consistent format reduces the risk of errors and helps maintain professional standards.

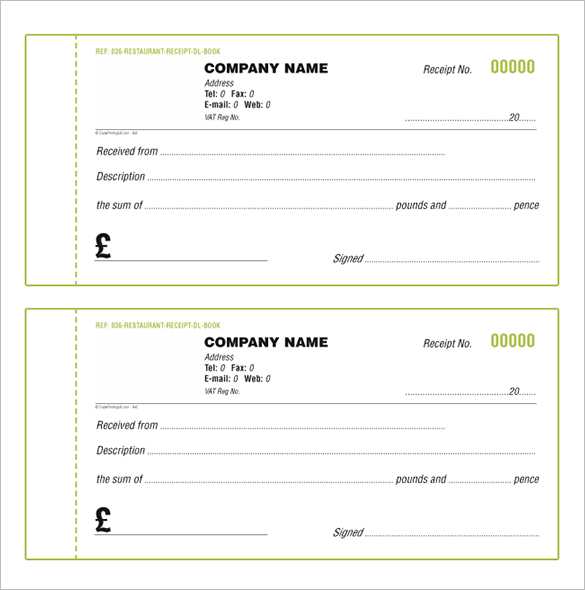

The template should include key details such as the date of service, the amount charged, and the specific services rendered. This information allows parents to easily track their payments and ensures transparency. You can personalize the receipt with your business name, contact information, and logo, making it clear and professional.

Make sure your receipt includes a section for signatures, both from the caregiver and the parent, to confirm the service was provided as agreed. Additionally, including a breakdown of services and charges can help clarify the costs for parents, especially for those using child care services on a part-time or ad-hoc basis.

Using a template not only simplifies the process but also ensures that you are covering all legal and financial bases. Customizable templates allow for flexibility while maintaining a professional look. Consider creating or downloading a template that suits your specific needs and enhances the overall experience for both parents and caregivers.

Here’s the adjusted version of your text:

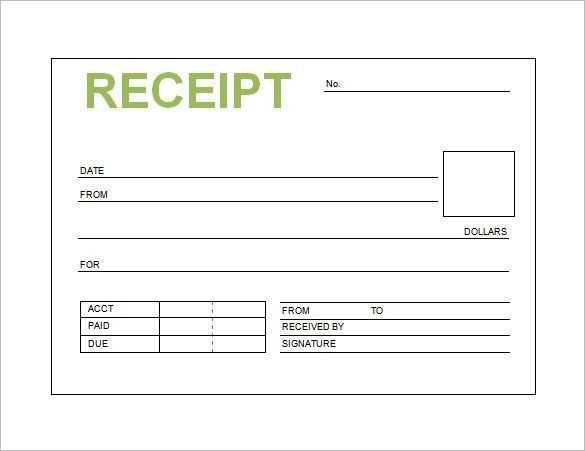

To streamline your childcare service receipt book, focus on clarity and organization. Each receipt should clearly list the child’s name, the date, the service provided, and the amount paid. A simple layout ensures that both parents and caregivers can quickly find important information. Use a clean, easy-to-read font and space the details so they don’t feel cramped.

Include a unique receipt number for tracking purposes. This helps in maintaining records and prevents confusion in case of disputes. A section for additional notes can be useful for mentioning special arrangements, such as discounts or extra hours.

Ensure your receipt book includes a footer with your childcare service’s contact details. This makes it easier for parents to get in touch with you if needed. Double-check your formatting to avoid any clutter, keeping the focus on essential details for both parties.

Receipt Book Template for Child Care Services

Key Information to Include in a Child Care Receipt

Designing a Clear and Easy-to-Use Receipt Template

Printable vs. Digital Receipts: Choosing the Right Format

Legal and Tax Considerations for Child Care Invoices

Customizing Templates to Suit Your Child Care Business

Best Tools and Software for Creating and Managing Receipts

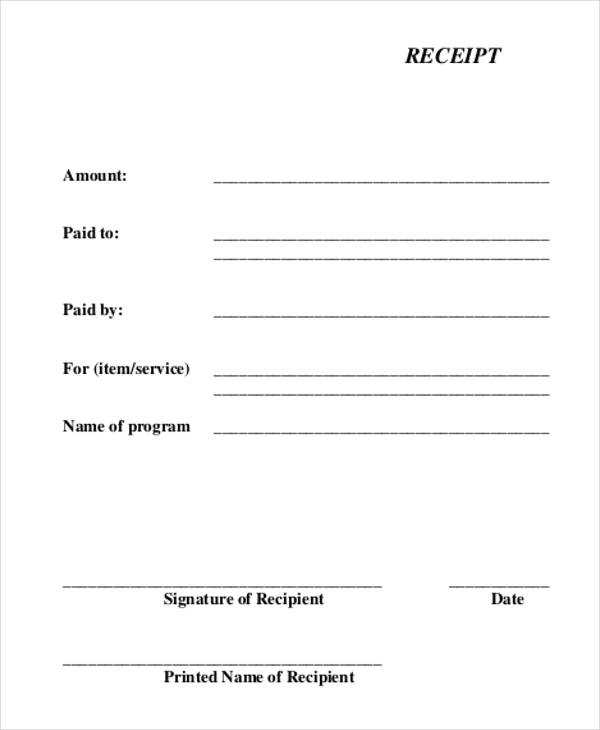

When creating a child care receipt template, include clear, essential details: the date of service, provider and client names, child’s name, payment amount, and payment method. Specify the period covered by the payment (weekly, monthly, etc.), and note if any discounts, late fees, or additional charges apply. A receipt should also include the business’s contact information, including address, phone number, and email. Don’t forget to add a unique receipt number for tracking purposes.

Designing a Clear and Easy-to-Use Receipt Template

The layout should be simple, with a logical flow of information. Use separate sections for each category: provider information, client details, service description, and payment summary. Ensure there is enough space for both the required data and for any additional notes. The design should be easy to read on both printed and digital formats. Using clear fonts and appropriate headings helps improve readability.

Printable vs. Digital Receipts: Choosing the Right Format

For child care services, both printable and digital receipts are suitable. If you choose to go digital, ensure your receipt is in a universally accessible format like PDF. This makes it easier for parents to store or print on their own. Printable receipts may be more familiar to some clients, but the added convenience of digital receipts makes them ideal for businesses with tech-savvy clients. Choose the format that best fits your clientele’s preferences and your operational style.

Consider tax implications when choosing the format. Some regions require receipts to be issued in a specific way, especially for tax reporting. Always check your local tax guidelines to ensure compliance.

Legal and Tax Considerations for Child Care Invoices

Child care services must adhere to specific tax regulations. Ensure your receipt clearly identifies the payment as for child care services, so it can be used for tax deductions where applicable. Including a tax ID number on your receipts may be required in some jurisdictions. It’s also important to maintain accurate records of all transactions to facilitate accurate tax filings and avoid any potential issues during audits.

Customizing Templates to Suit Your Child Care Business

Your receipt template should reflect the identity of your child care service. Customize the template with your logo, business name, and a consistent color scheme. You may also choose to add a brief description of the services offered, such as hourly care or extended daycare. Consider including a note thanking the client for their payment or providing details about future payments or schedules. Personalizing the template helps maintain a professional and approachable image.

Best Tools and Software for Creating and Managing Receipts

Several tools can help you design and manage your child care receipts effectively. Options like QuickBooks and Zoho Invoice offer customizable templates and track payments automatically. Alternatively, Microsoft Word or Google Docs can be used for simpler, manual templates. For those who prefer simplicity, online tools such as Canva provide easy-to-edit, professional receipt templates. Ensure the tool you choose fits your business needs and streamlines your invoicing process.