Using a rental receipt template can simplify the process of documenting rental transactions. It provides clarity for both the landlord and tenant, ensuring all necessary details are recorded accurately. A well-designed template helps prevent misunderstandings by clearly stating the rental amount, payment method, and relevant dates.

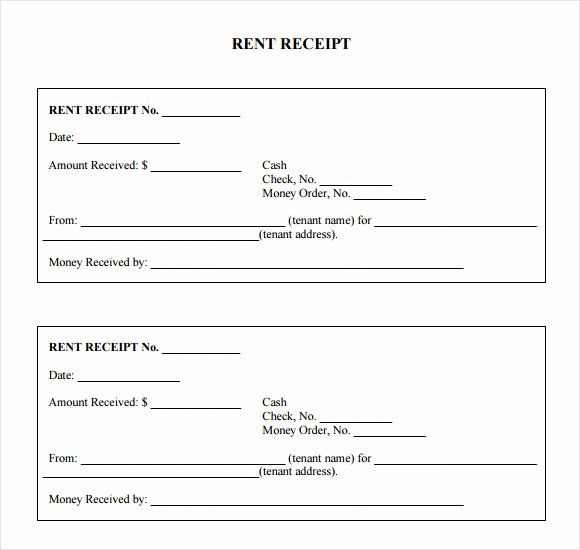

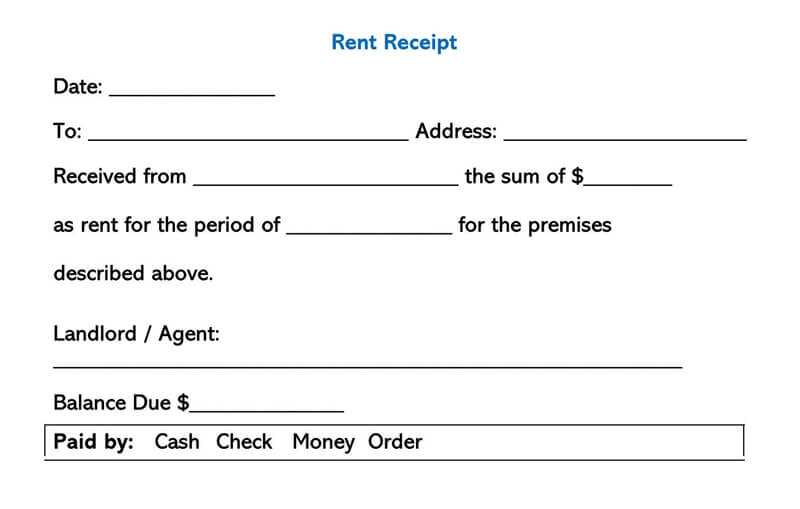

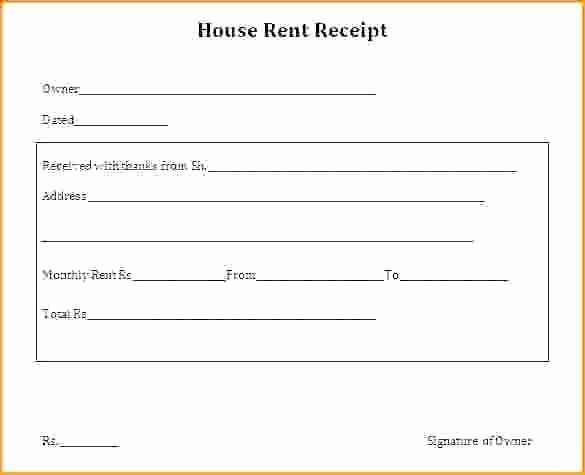

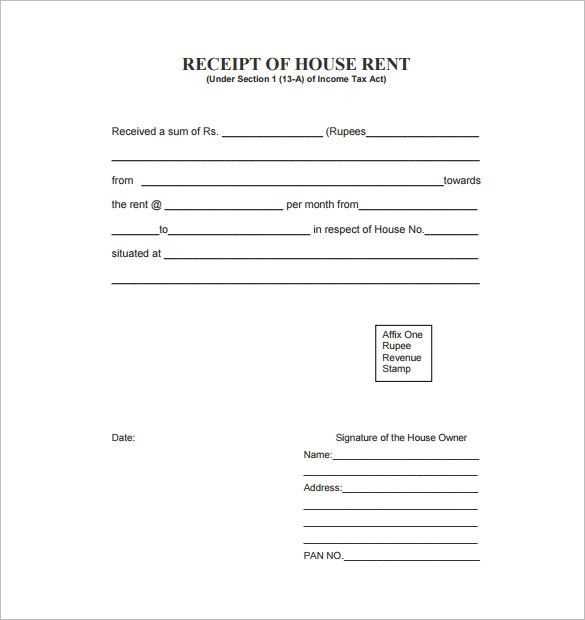

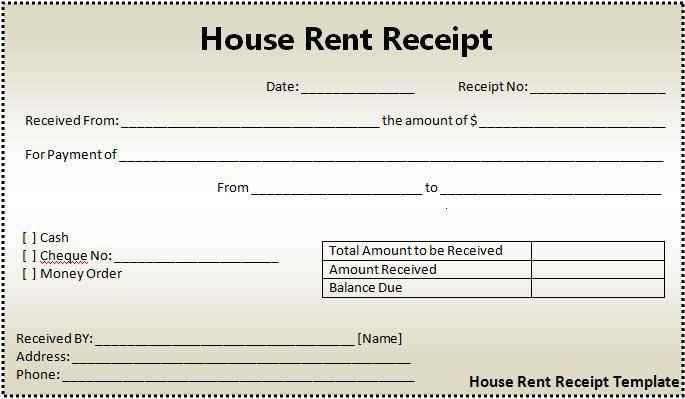

Start by including key information such as the tenant’s name, rental property address, and the payment date. Ensure that the amount paid and the remaining balance (if applicable) are easy to spot. Specify the rental period covered by the payment, and include any additional fees, if applicable.

By customizing your rental receipt template, you can ensure it meets the specific needs of your rental agreements. Keep it simple but thorough, with space for any relevant notes or terms that may need to be mentioned. This document acts as proof of payment, so accuracy is essential.

Here’s the revised version:

Ensure that the rental receipt includes all necessary details to avoid confusion. A well-structured format will make it easier to track payments and agreements. Here’s a practical example of what you need to include:

- Receipt Number: A unique identifier for the transaction.

- Tenant Information: Name, contact details, and address of the tenant.

- Landlord Information: Full name, contact details, and address of the landlord.

- Property Details: Address of the rental property being leased.

- Rental Period: Start and end dates of the rental agreement.

- Total Rent Amount: The agreed-upon rent for the period.

- Payment Method: Specify whether the payment was made by cash, check, or electronic transfer.

- Security Deposit: Amount paid as a security deposit, if applicable.

- Date of Payment: The specific date when the payment was made.

- Signature: A space for both tenant and landlord to sign, confirming the transaction.

Final Tips:

Double-check all details before finalizing the receipt. An error in the date or amount can lead to disputes later. Always provide a copy to both parties and keep records for your reference.

- Rental Receipt Template

Include the following details in your rental receipt template for clarity and accuracy:

1. Rental Amount

Clearly state the total rent amount. Example: “$1,200 for the rental period from January 1, 2025, to January 31, 2025.” This confirms the exact sum paid.

2. Payment Date

Indicate the exact date the payment was made. This helps track payments and provides transparency on timing.

3. Property Information

Include details about the rental property, such as the address or unit number. This helps link the receipt to the specific property being rented.

4. Payment Method

Specify how the payment was made (e.g., cash, check, bank transfer). This confirms the transaction method.

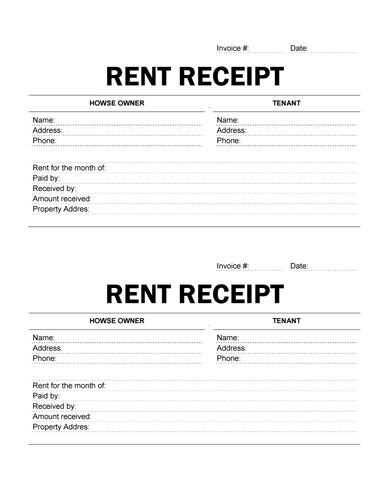

5. Landlord and Tenant Information

Include the full names and contact information of both the landlord and tenant. This ensures both parties are identified on the document.

6. Signature Section

Ensure both the landlord and tenant sign the receipt. This confirms mutual agreement on the details.

By following this structure, you can ensure your rental receipt is complete and legally valid for both parties involved.

To create a simple rental receipt, include the following details to ensure both the tenant and landlord have a clear record of the transaction:

1. Tenant and Landlord Information

Start by including the full names and contact details of both parties. This information establishes who is involved in the rental agreement and makes it easier to resolve any future issues.

2. Payment Details

Clearly state the amount paid, the date of the payment, and the rental period covered. If the payment is for multiple months, specify the months included. For added clarity, mention the method of payment (e.g., cash, check, bank transfer).

Including these key details ensures the rental receipt serves as an accurate and effective proof of payment.

Key Information to Include in a Rental Receipt

A rental receipt must include several key pieces of information to ensure clarity and accuracy for both parties involved. These details help in avoiding misunderstandings and provide a clear record of the transaction.

- Tenant’s Name: Always list the full name of the tenant who made the payment. This ensures you are referencing the correct person in case of any future disputes or inquiries.

- Landlord’s Name or Business Name: The name of the landlord or the business renting the property must be included, ensuring the receipt can be tied to the correct property owner.

- Property Address: Include the complete address of the rental property. This confirms the exact location being paid for and avoids any confusion with other rental properties.

- Payment Date: Clearly mention the date the payment was received. This helps in maintaining an accurate record of rent payments and shows when the payment was made.

- Amount Paid: Specify the exact amount paid by the tenant. Break it down if necessary, such as including rent, late fees, or other charges separately.

- Payment Method: Note how the payment was made, whether by cash, check, bank transfer, or other methods. This can be useful for future reference and verifying payment history.

- Rental Period: Include the specific rental period that the payment covers. This could be for a week, month, or other duration, depending on the agreement.

- Receipt Number: Assign a unique receipt number to each rental payment for easy tracking and reference. This is especially helpful for recordkeeping purposes.

- Signature: If necessary, have the landlord’s or agent’s signature on the receipt to confirm it was issued by the appropriate party. This adds a level of authenticity to the document.

Additional Considerations

- Late Fees: If there are late fees or penalties involved, these should be clearly listed as separate items on the receipt.

- Security Deposit: If the tenant is paying a security deposit, include the amount paid and any terms regarding its return or use.

Opt for a format that ensures clarity and meets your specific needs. A rental receipt should include key details such as the tenant’s name, property address, payment amount, and date of payment. Select a template that clearly organizes this information for easy reference.

- Paper receipts are suitable for situations where digital records are not required. They are tangible and can be signed, making them a reliable option for tenants who prefer physical documentation.

- Digital receipts are convenient for both landlords and tenants. They provide quick access and can be stored on multiple devices, making future retrieval easier. Digital formats, like PDF, can also be easily customized and emailed to tenants.

- Hybrid formats combine both paper and digital elements. Landlords can print a receipt and send a digital copy to the tenant. This approach ensures flexibility for different preferences.

Choose a format that aligns with your business practices and the preferences of your tenants. If you have multiple properties, a digital solution might help streamline your process. For smaller rental operations, a paper receipt may suffice, but consider digitizing receipts for long-term record-keeping.

Adjust the receipt template based on the property type to ensure all relevant details are included and presented clearly. For residential properties, focus on tenant names, rental amounts, and lease terms. For commercial properties, include business names, property address, and terms specific to business usage. Consider adding sections for security deposits, maintenance fees, and utilities for both types, depending on what is applicable.

Residential Property Customization

For residential leases, include the tenant’s full name, rental period, and rent amount in a clear layout. Specify whether utilities are included in the rent or billed separately. If applicable, add space for security deposits or late fees. It’s also useful to note whether the payment is for rent, parking, or other amenities. Keep the layout simple and organized for easy reference.

Commercial Property Customization

Commercial properties often require more detailed receipts. Include the business name, contact information, and specific property identifiers (e.g., suite or unit number). Detail any property taxes, insurance costs, and maintenance fees separately. Clarify the payment frequency (e.g., monthly, quarterly) and specify if payments are for rent or additional services. If the lease involves a percentage rent clause, ensure this is also highlighted.

By tailoring the receipt to the unique aspects of each property type, you can avoid confusion and ensure both landlords and tenants have all the necessary information at hand. Make sure to adjust the receipt template regularly as lease agreements or property features change.

To automate the generation of receipts, integrate a software solution that supports customizable templates and connects with your payment systems. This way, receipts are automatically generated based on transaction data without manual input. Most accounting or invoicing software includes this feature. These platforms allow you to set up rules for receipt generation and delivery, reducing the need for manual tracking and entry.

Key Features to Look for in Receipt Automation Tools

When selecting a tool, ensure it offers the following:

- Customizable receipt templates with placeholders for dynamic fields like date, amount, customer information, and payment method.

- Integration with payment gateways (e.g., PayPal, Stripe) to automatically pull transaction details.

- Automatic email delivery of receipts to customers after each transaction.

- Compliance with local tax regulations for automatic tax calculations on receipts.

Step-by-Step Process for Setting Up Automated Receipt Generation

Here’s a simple breakdown:

- Choose a receipt automation tool that integrates with your accounting or payment software.

- Customize receipt templates within the tool to match your branding and include necessary details like transaction ID, amount, and taxes.

- Connect the tool to your payment systems to allow for automatic data syncing.

- Set rules for receipt delivery, such as automatically sending them to customers via email immediately after payment confirmation.

- Test the system by processing a few transactions to ensure receipts are generated correctly and delivered as expected.

| Feature | Benefit |

|---|---|

| Custom Templates | Allows personalization to reflect your brand and provides clarity on transaction details. |

| Payment Gateway Integration | Automatically pulls transaction data, reducing manual entry and errors. |

| Automatic Email Delivery | Ensures customers receive receipts promptly, improving user experience and record-keeping. |

| Tax Calculation | Helps comply with tax regulations by automatically applying the correct tax rates based on location and transaction type. |

Ensure that your rental receipt template includes all necessary details to comply with local and national laws. Include the full names and addresses of both the renter and the property owner, the rental period, and the exact amount paid. This documentation provides proof of the transaction and can be essential for both parties in case of disputes.

Check for any mandatory tax requirements in your jurisdiction. In some areas, receipts need to display tax amounts separately or follow specific tax formats. Failing to do so could result in penalties or invalidation of the receipt in legal matters.

Also, make sure your receipt template clarifies the terms of the rental agreement, including security deposits, return conditions, and any additional fees. This minimizes confusion and provides clarity if the agreement is questioned later. Always make sure your template reflects the current rental contract accurately.

| Required Information | Legal Compliance |

|---|---|

| Names and addresses of both parties | Essential for proof of transaction |

| Rental period and payment details | Accurate details avoid disputes |

| Tax amounts (if applicable) | Prevents potential fines |

| Security deposits or additional fees | Clarifies terms of agreement |

Lastly, always review local laws or consult a legal professional to ensure your template is fully compliant with the requirements in your area. Templates may need to be updated periodically to remain legally valid.

Reducing Word Repetition While Retaining Meaning and Accuracy

To enhance readability and clarity, focus on varying vocabulary and sentence structure. Repeating the same words can weaken the message and cause monotony. Use synonyms, rephrase sentences, and swap word order where appropriate. For example, instead of saying “tenant” multiple times, try using “renter” or “lessee” for variety. This method preserves the meaning while keeping the text engaging and dynamic.

Adjusting Sentence Structure

Changing the way you construct sentences can significantly cut down on repetition. Break long sentences into smaller, more digestible ones or combine shorter ones to make the writing flow better. Ensure each sentence adds unique value to the overall message without redundancy.

Utilizing Pronouns and Passive Voice

Substitute nouns with pronouns, such as “it,” “they,” or “them,” to avoid repeating the same subject over and over. Additionally, passive voice can shift the focus of the sentence and reduce reliance on active subject repetition. This not only refines the text but also directs attention where it’s needed most.