When your nonprofit organization receives a donation, it’s important to provide a tax receipt letter to your donors. This letter serves as official documentation for tax purposes, allowing them to claim deductions. Use the following template to create a clear and concise letter that meets the IRS guidelines.

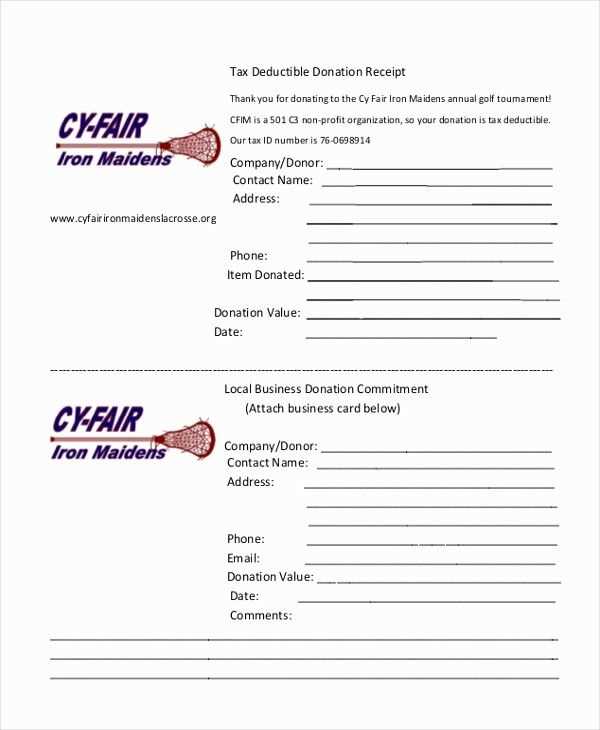

Start by including your organization’s name, address, and contact information at the top of the letter. Clearly state the purpose of the letter, specifying that it serves as a tax receipt for the donation made. Include the donor’s name and the date of the donation, along with the total amount or description of the donated goods.

Be sure to mention if any goods or services were provided in exchange for the donation, as this affects the deduction amount. If there was no exchange, confirm that the contribution is fully deductible. Finish the letter with your organization’s tax-exempt status information, and express gratitude for their support.

This simple approach ensures clarity, compliance, and professionalism in your communication with donors, which is vital for maintaining trust and transparency.

Here’s the revised version:

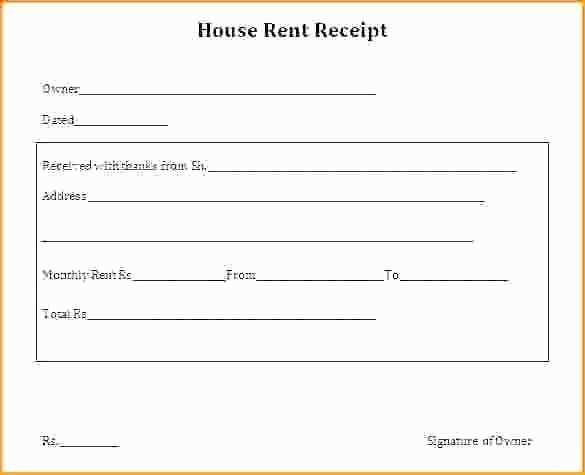

Begin by clearly stating the name of your nonprofit organization and the donor’s details. Ensure that the donor’s full name, address, and donation amount are accurate. Use a simple structure like this:

Nonprofit Organization: [Organization Name]

Donor: [Donor’s Full Name]

Date of Donation: [Donation Date]

Amount Donated: [Donation Amount]

Donation Type: [Monetary, In-kind, etc.]

Next, clarify whether the donation was a one-time or recurring contribution. This helps the donor understand how their contribution is being counted for tax purposes.

Note: If the donor received any goods or services in exchange for their contribution, you must indicate the fair market value of those goods or services. This is necessary for the donor to claim the correct deduction. Provide a simple statement, such as:

Goods/Services Received: [Description of items or services]

Fair Market Value: [Value of goods/services]

Finally, include a statement indicating that no goods or services were provided in exchange for the donation, if applicable. For example:

This contribution was fully tax-deductible as no goods or services were provided in exchange for the donation.

Finish with a thank you note, expressing appreciation for the donor’s support. A simple closing line like this is sufficient:

Thank you for your generous contribution to [Organization Name]. Your support makes a difference!

- Tax Receipt Letter Template for Nonprofits

Start with clear and concise information at the top of the letter. Include the nonprofit’s name, address, and tax identification number (TIN). Clearly state that the letter serves as a receipt for the donation made. For example, “This letter confirms that we received your donation of [amount] on [date].” Be specific about the type of donation: cash, property, or goods.

Provide the donor’s name and address as listed in your records. Make sure the donation amount or description is accurate and complete. For in-kind donations, provide a detailed description of the items donated. If the donor receives any goods or services in return, include a statement indicating the value of these benefits.

Conclude with a thank you note to show appreciation for the donor’s support. Always remind them of their impact, such as “Your contribution helps us [brief description of the nonprofit’s mission].” Sign off with the signature of an authorized representative from your nonprofit.

Ensure that your tax receipt complies with local tax laws and provides all necessary details for the donor to claim tax deductions, including the value of any benefits received in return for their donation.

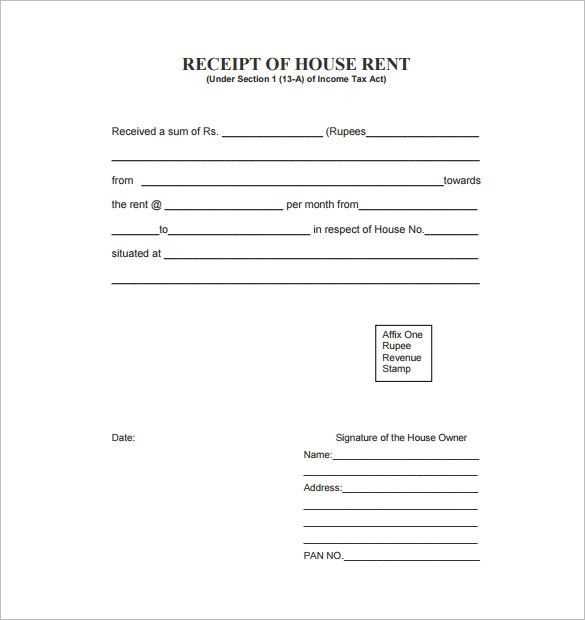

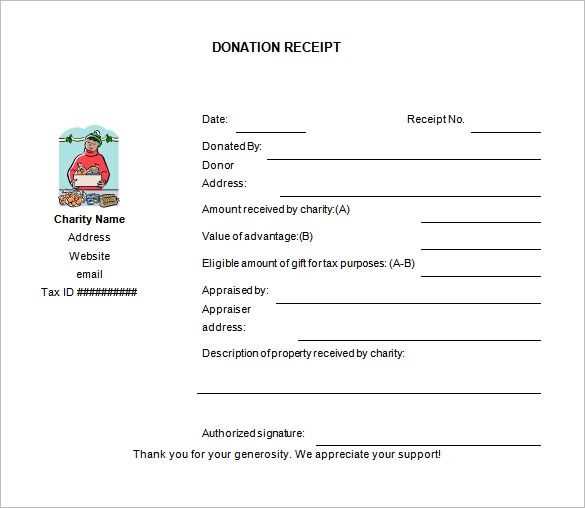

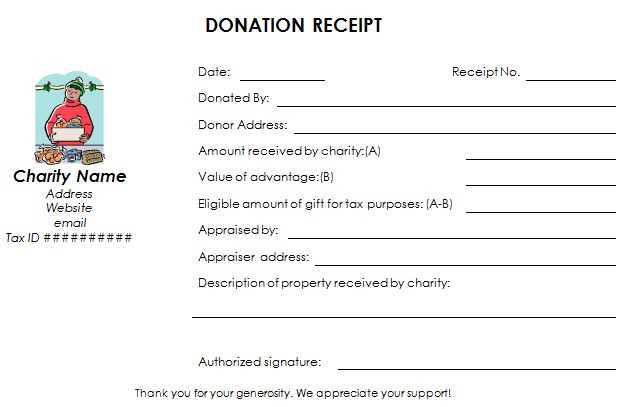

A nonprofit tax receipt letter must include specific details to meet IRS guidelines and provide transparency to donors. Here’s a breakdown of key components:

- Organization’s Name and Address: Clearly state the nonprofit’s legal name and primary address.

- Donor’s Name and Address: Include the donor’s full name and mailing address.

- Date of Donation: Indicate the exact date when the donation was made.

- Donation Amount or Description: For monetary gifts, list the exact amount. For in-kind donations, describe the donated items in detail.

- Statement of No Goods or Services Provided: Include a statement confirming that no goods or services were exchanged for the donation, or if they were, provide an estimate of their value.

- Nonprofit’s Tax-Exempt Status: Mention the organization’s IRS tax-exempt status, including its EIN (Employer Identification Number), to confirm eligibility for tax deduction.

Additional Details

- Thank You Statement: Express gratitude for the donor’s support and highlight how their contribution will be used.

- Signatory: Have an authorized representative from the nonprofit sign the letter for authenticity.

Clearly structure the donation receipt with all necessary details for both your organization and the donor. This ensures legal compliance and transparency.

Key Components of the Receipt

The receipt must include the name of your nonprofit, its address, and a statement confirming its tax-exempt status. Add the donor’s name and address to identify both parties. Clearly state the donation amount and specify whether it was cash, property, or services. If the donation includes goods, provide a description, but do not assign a value.

Date and Signature

Include the date of the donation and your nonprofit’s authorized signature. If the donation exceeds a certain value, a signature may be required to validate the receipt for tax deduction purposes.

For gifts of goods or services, include a note that no goods or services were provided in exchange for the donation, or, if applicable, the value of the benefits received by the donor.

Nonprofit organizations must follow specific rules when issuing tax receipts. These requirements ensure compliance with IRS guidelines and provide donors with the necessary documentation for tax deductions.

Required Information

- The name and address of the nonprofit organization.

- The date of the donation.

- The amount of the contribution, or a description of donated goods or services if applicable.

- A statement confirming that no goods or services were provided in exchange for the donation, or a description of what was received in return.

- The organization’s tax-exempt status, often including the IRS determination letter or 501(c)(3) status reference.

Timing and Delivery

Tax receipts should be provided to donors promptly after the donation is made. For cash donations, receipts must be issued within a reasonable timeframe. For non-cash donations, the receipt should be given when the items are received or shortly thereafter.

Failure to meet these requirements could result in donors being unable to claim deductions. Nonprofits should maintain proper records and issue receipts in a timely manner to ensure smooth tax filing for both parties.

Use the donor’s full name at the beginning of the receipt. This small touch makes the donor feel recognized and appreciated. For example, “Dear [Donor’s Name], we sincerely thank you for your generous contribution.”

Include Specific Donation Details

List the exact amount donated, along with the date of the donation. Providing a breakdown of the donation helps donors track their contributions. If the donation was designated for a specific program or project, mention that as well.

Tailor the Acknowledgment Message

Write a personalized thank you message that aligns with the donor’s past support or interests. Reference any specific events they may have attended or initiatives they have supported. This creates a connection and reinforces their role in your organization’s mission.

Lastly, ensure that the receipt is signed or personally addressed by a member of your team to add a personal touch, strengthening the relationship with the donor.

Send receipts within 48 hours after receiving donations to maintain donor trust and keep records current. This will help ensure your donors have the necessary documentation for tax purposes and feel valued for their contributions.

Ensure each receipt includes clear details: the donor’s name, date of the donation, amount given, and a statement that no goods or services were provided in exchange, if applicable. This makes the letter both tax-compliant and transparent.

For large donations, include a personalized message that highlights the donor’s impact. This makes the receipt feel more like a thank-you note than just a formal document.

Use clear, concise language and avoid jargon. Donors appreciate straightforward communication, especially when it’s about something as important as tax deductions.

Consider automating the process if your nonprofit receives a high volume of donations. This will speed up response time and ensure consistency, but make sure the messages still feel personal and appreciative.

Always include your nonprofit’s legal name and tax identification number (TIN) for verification. This is crucial for IRS reporting and donor confidence.

Incorrect donor information is a frequent error. Always double-check the donor’s name, address, and other details to ensure accuracy. Mistakes in this area can cause confusion or delays in tax filings. Verify the information with the donor before issuing the receipt.

Missing donation details can also be problematic. Clearly state the donation amount, the date it was made, and the type of donation, such as cash, goods, or services. If the donation is a non-cash item, provide a description and estimated value.

Failure to include a statement of no goods or services provided is another common oversight. The IRS requires that a receipt for donations over $75 include a statement confirming that no goods or services were exchanged for the donation. This prevents confusion and ensures compliance with tax laws.

Improper wording can lead to misunderstandings. Avoid using language that might imply the donor received something of equal or greater value than their donation. Be clear that the donation was made without any expectation of return.

Not issuing receipts in a timely manner can cause problems for donors when filing their taxes. Issue receipts promptly after the donation is made to ensure the donor has adequate time to prepare their returns.

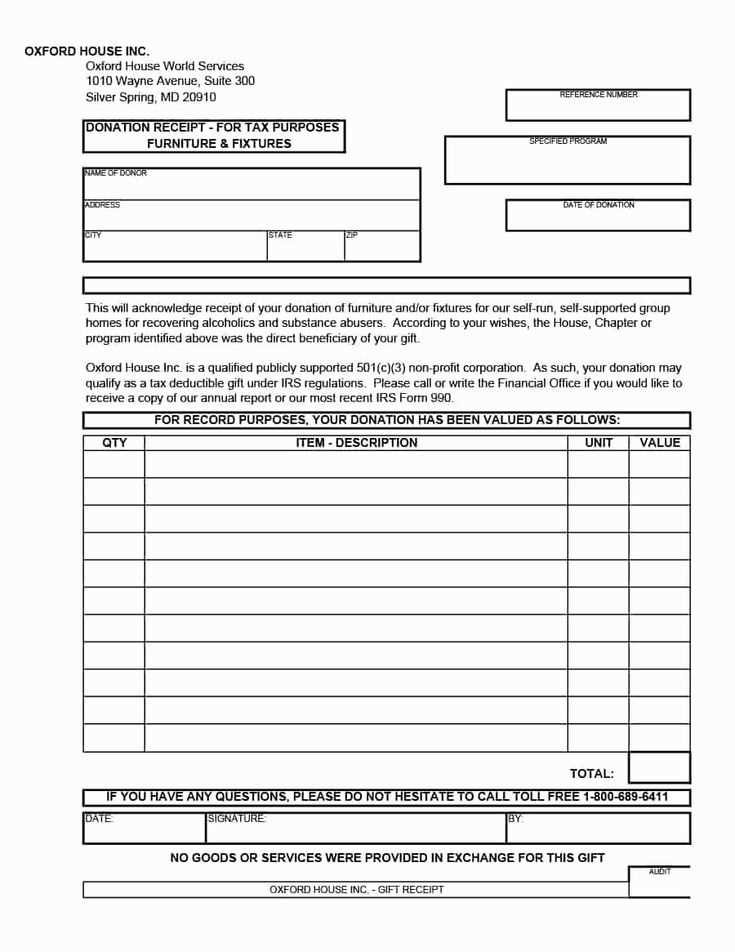

To create a clear and professional tax receipt letter template for a nonprofit, focus on including key elements that comply with IRS requirements. Start with the nonprofit’s name, address, and contact details at the top. Below, include a statement of the donation amount, the date it was received, and a clear declaration of whether any goods or services were exchanged for the contribution.

Important Sections to Include

| Section | Description |

|---|---|

| Nonprofit Information | Include the full name, address, and tax-exempt status of the nonprofit. |

| Donor Information | Include the donor’s full name and address. |

| Donation Details | List the exact amount of the donation or a description of property donated. |

| Goods or Services | State if any goods or services were provided in exchange for the donation. |

| Tax-Exempt Status | Include a statement confirming that the organization is tax-exempt under IRS rules. |

| Thank You Statement | Include a brief expression of appreciation for the donor’s support. |

Ensure that all statements are clear and factual. This will help ensure the letter meets IRS standards and provides the necessary documentation for the donor’s tax purposes.