Choose the Right Invoice Template

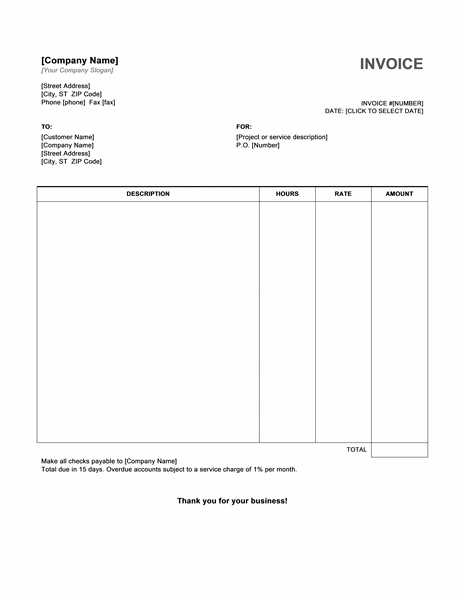

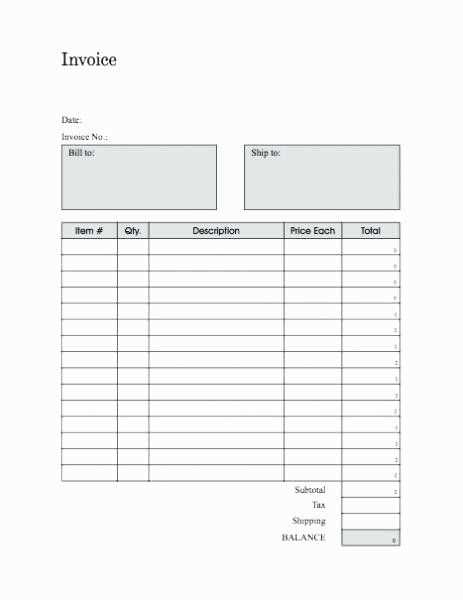

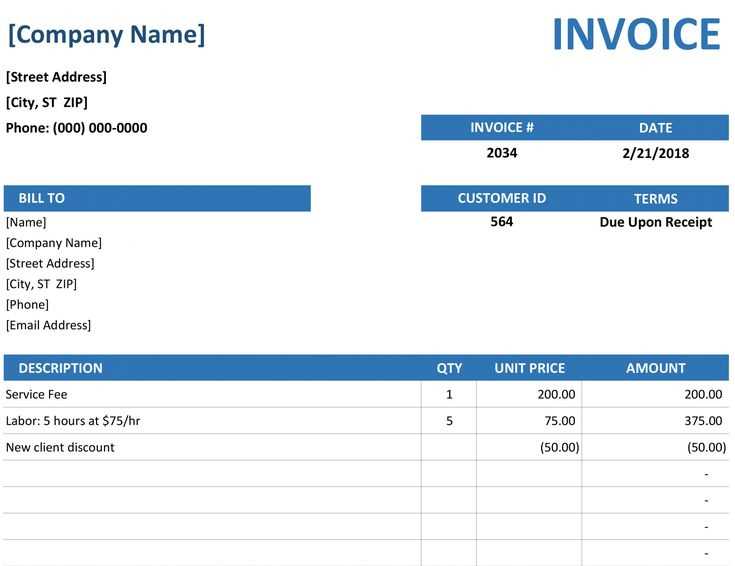

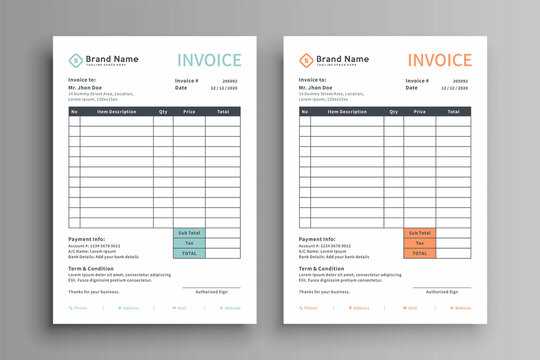

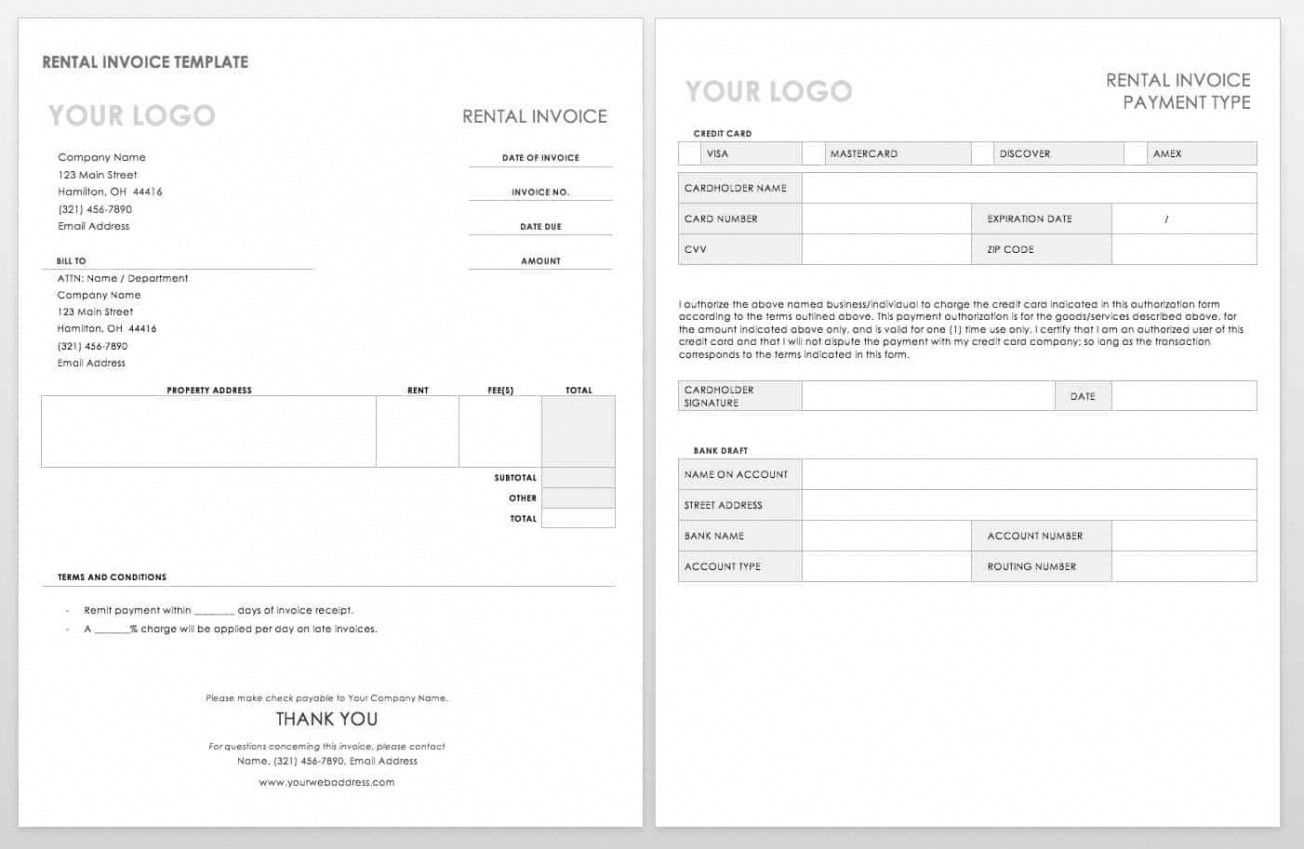

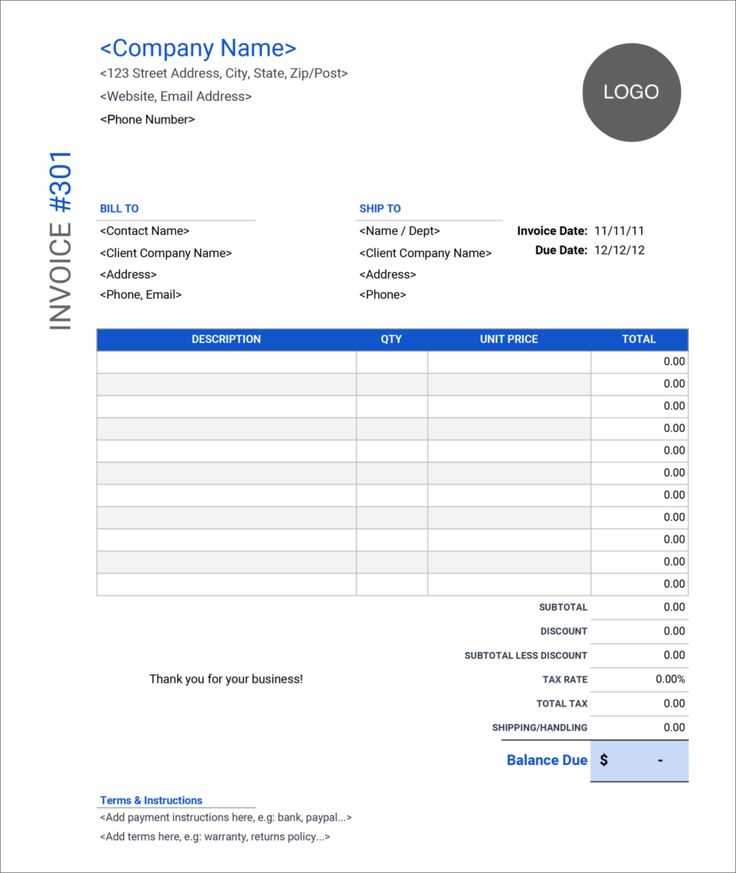

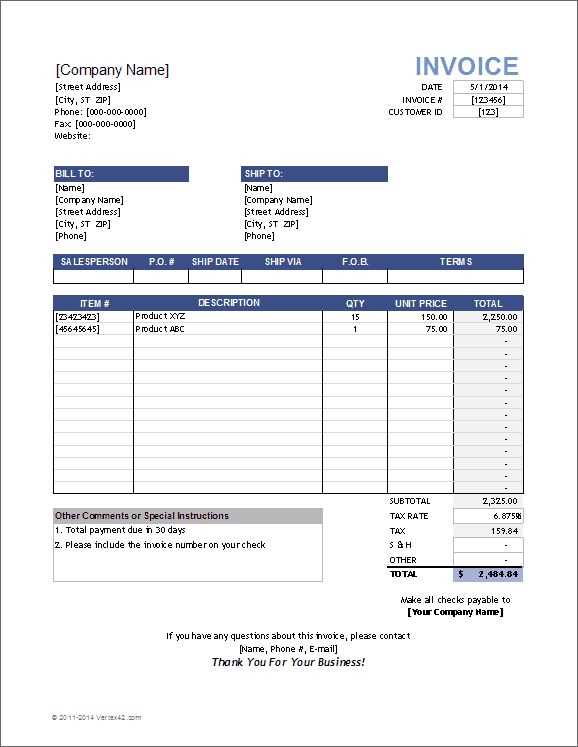

Selecting a well-structured invoice template ensures clarity and professionalism. Look for templates that include:

- Company details: Business name, address, and contact information.

- Customer information: Name, address, and relevant details.

- Invoice number: A unique identifier for tracking payments.

- Itemized list: Description, quantity, unit price, and total cost.

- Payment terms: Due date, accepted payment methods, and late fees.

Free vs. Paid Templates

Free templates work well for small businesses or occasional invoicing. They are available in Excel, Word, and PDF formats. However, paid templates often include automation, branding options, and integrations with accounting software, making them a better choice for growing businesses.

Customizing Your Template

Modify your template to align with your brand by adding:

- Logo and colors: Maintain consistency with your company’s visual identity.

- Tax details: Ensure compliance with local tax regulations.

- Personalized notes: A thank-you message or payment instructions.

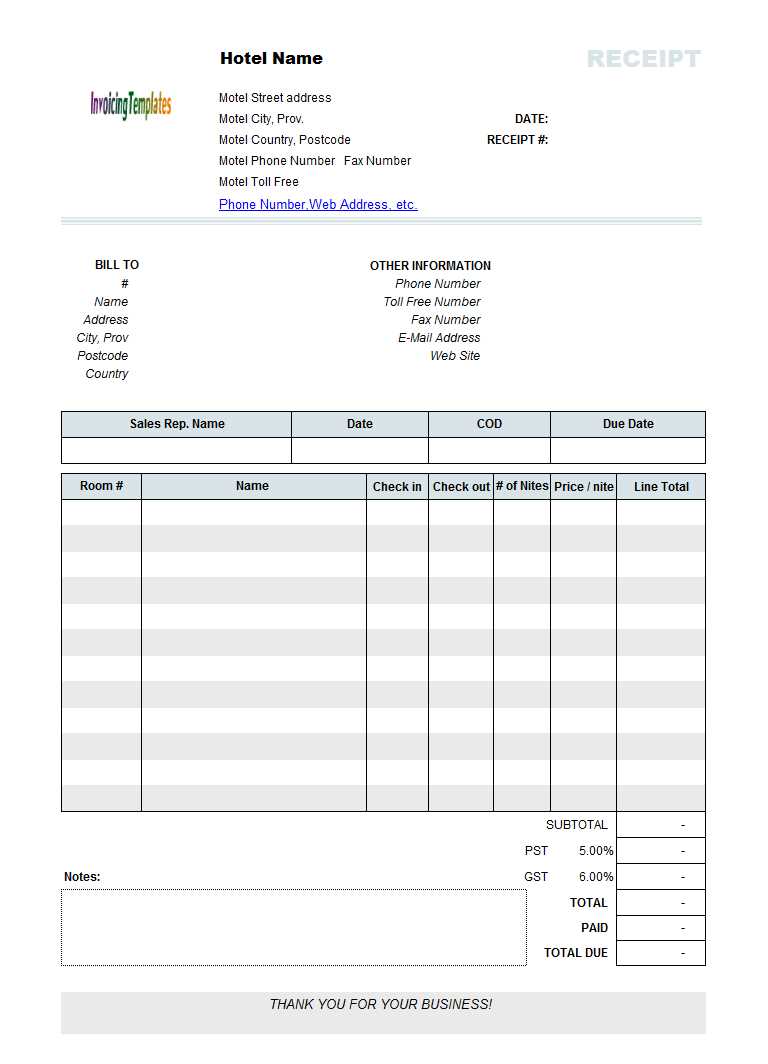

Generate and Send Receipts Efficiently

After receiving payment, issue a receipt promptly. Use templates that mirror your invoices for consistency. Digital receipts sent via email simplify record-keeping and enhance customer experience.

Best Tools for Invoice and Receipt Management

- Microsoft Excel & Word: Simple, customizable templates.

- Google Docs & Sheets: Cloud-based and easily shareable.

- Accounting software: QuickBooks, FreshBooks, and Wave automate invoicing and receipts.

Using well-designed templates saves time, improves accuracy, and ensures a professional image. Choose one that fits your business needs and simplifies financial tracking.

Invoices Templates Receipt: Practical Guide

Key Elements to Include in a Billing Template

How to Customize a Template for Different Business Needs

Choosing the Right Format: PDF, Excel, or Word for Billing Documents

Legal Requirements and Compliance for Receipts

Automating Billing: Tools and Software Overview

Common Mistakes in Templates and How to Avoid Them

A well-structured invoice should always include the business name, contact details, invoice number, issue date, due date, itemized list of products or services, subtotal, taxes, discounts, and the total amount due. Missing any of these elements can cause disputes or delays in payment.

Customization allows businesses to align invoices with branding and industry-specific requirements. Add a logo, adjust color schemes, and choose fonts that maintain a professional look. For service-based businesses, include hourly rates and billable hours. Retail businesses should highlight SKU numbers and product descriptions.

Choosing the right format depends on operational needs. PDFs are ideal for secure, uneditable invoices. Excel provides flexibility for calculations, while Word is useful for personalized layouts. Automated templates in accounting software eliminate manual data entry and reduce errors.

Receipts must comply with tax regulations, including proper tax identification numbers and legally required disclosures. For international transactions, ensure compliance with VAT or GST rules in the relevant jurisdiction.

Billing automation speeds up the process and reduces human error. Tools like QuickBooks, FreshBooks, and Zoho Invoice offer customizable templates with automatic tax calculations, recurring billing, and multi-currency support.

Common mistakes include incorrect invoice numbering, missing payment terms, and inconsistent formatting. Always double-check totals and ensure that payment instructions are clear to prevent delays.