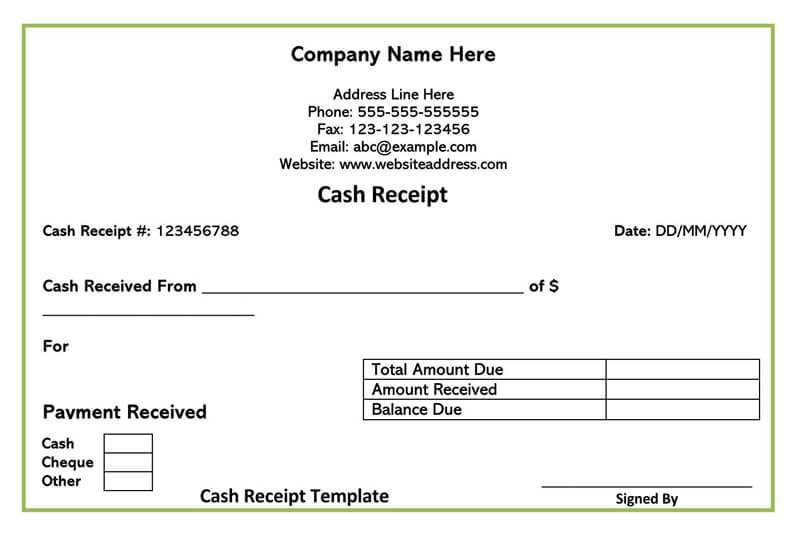

Key Components of a Legal Receipt

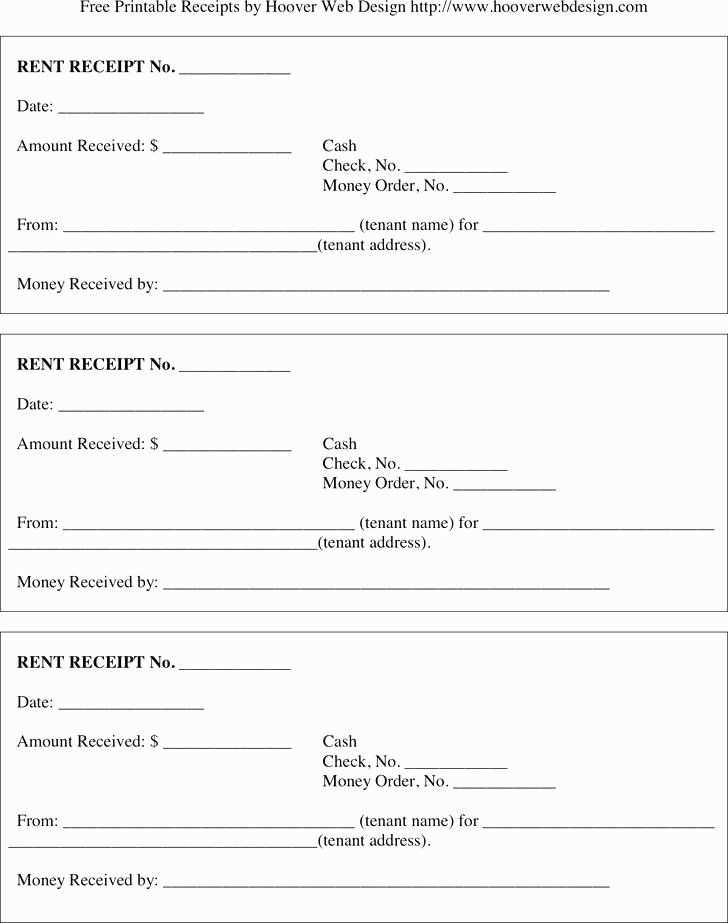

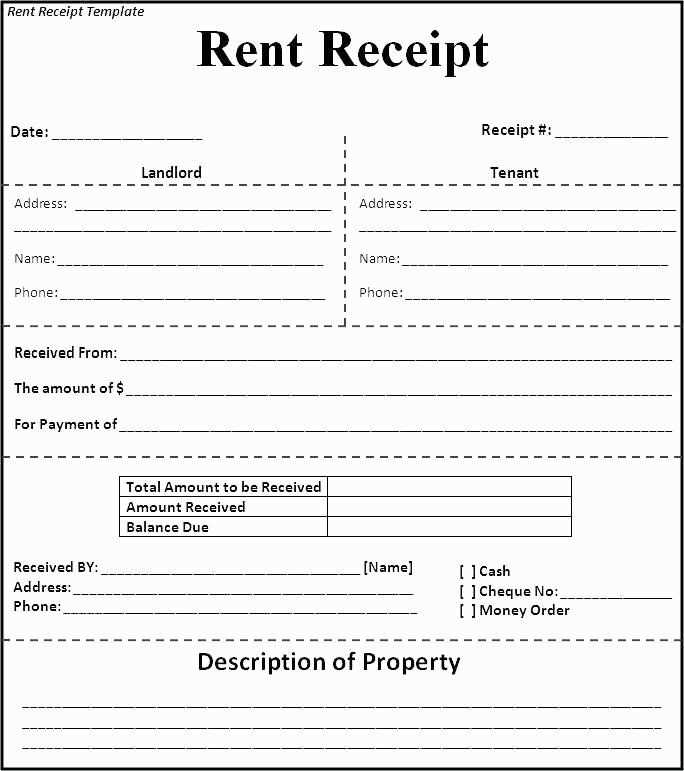

When creating a legal receipt, ensure it includes these core elements:

- Business Information: Clearly list the name, address, phone number, and email of the business or individual providing the service or product.

- Receipt Number: Assign a unique number to each receipt for proper tracking and reference.

- Date of Transaction: Include the exact date the transaction took place to avoid confusion.

- Description of Goods or Services: Briefly describe what was sold or provided, along with any relevant details such as quantity and price.

- Total Amount Paid: Clearly display the total sum the customer paid, including any taxes or discounts applied.

- Payment Method: Indicate how the payment was made, whether by cash, credit, or another method.

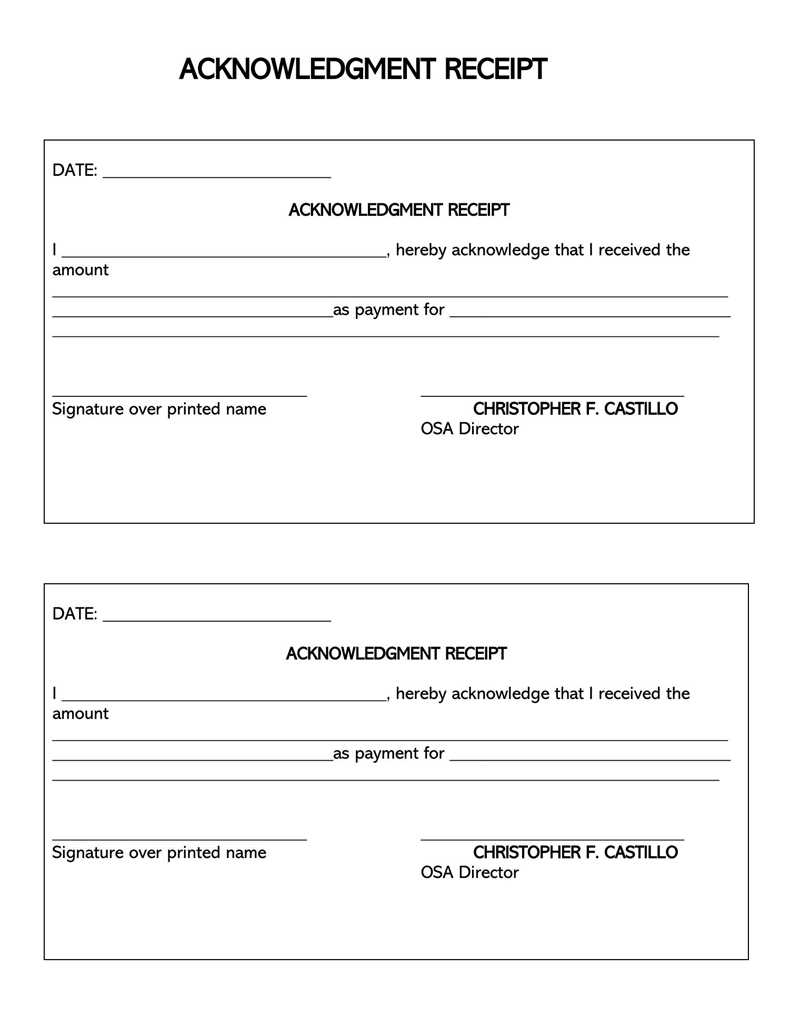

- Signature or Authorizing Mark: A signature or stamp from the business owner or authorized person verifies the receipt’s authenticity.

Formatting Tips

Keep the receipt layout neat and organized. Use a clean font and ensure the text is legible. Align information consistently and use bullet points or tables for clarity. You may also want to incorporate a company logo for branding purposes, but make sure it doesn’t overwhelm the text. Including a clear title, like “Receipt” or “Invoice,” can also help distinguish the document from other records.

Additional Recommendations

For legal purposes, receipts should be retained for a period of time based on local laws or business requirements. Always provide a copy to the customer and ensure that both parties have access to accurate records of the transaction.

Legal Receipt Template: Practical Guide

Creating a legal receipt for your business is straightforward once you understand the key elements required. Include the transaction date, the buyer and seller’s names, a clear description of the items or services provided, the total amount paid, and the method of payment. Don’t forget to add your business details, such as the business name, address, and contact information, to make the receipt fully valid.

Key Elements to Include in a Legal Document

Every legal receipt should feature the following details:

– Transaction date: Helps both parties verify when the exchange occurred.

– Item or service description: Provides clarity on what was purchased.

– Amount paid: Clearly state the total amount and any applicable taxes.

– Payment method: Whether it’s cash, credit card, or another method.

– Business information: Ensures the receipt can be traced back to your company.By covering these points, your receipt will hold up in any legal situation.

How to Customize Your Receipt for Various Transactions

Receipts can be tailored to suit different types of transactions. For example, for online sales, include a transaction ID and a link to the order details. For services, specify the hourly rate and the total service hours. Customize the wording to reflect the nature of your business while ensuring all required legal information remains intact.

Ensuring compliance with local laws is important. Research the specific regulations in your area to confirm that your receipts meet all required standards.

Digital receipts are becoming more popular, but they must still meet the same legal requirements as paper ones. Whether you issue paper or digital receipts, protect your business from fraudulent activity by using unique transaction codes or barcodes. These elements help prevent counterfeit receipts and ensure security for both you and your customers.