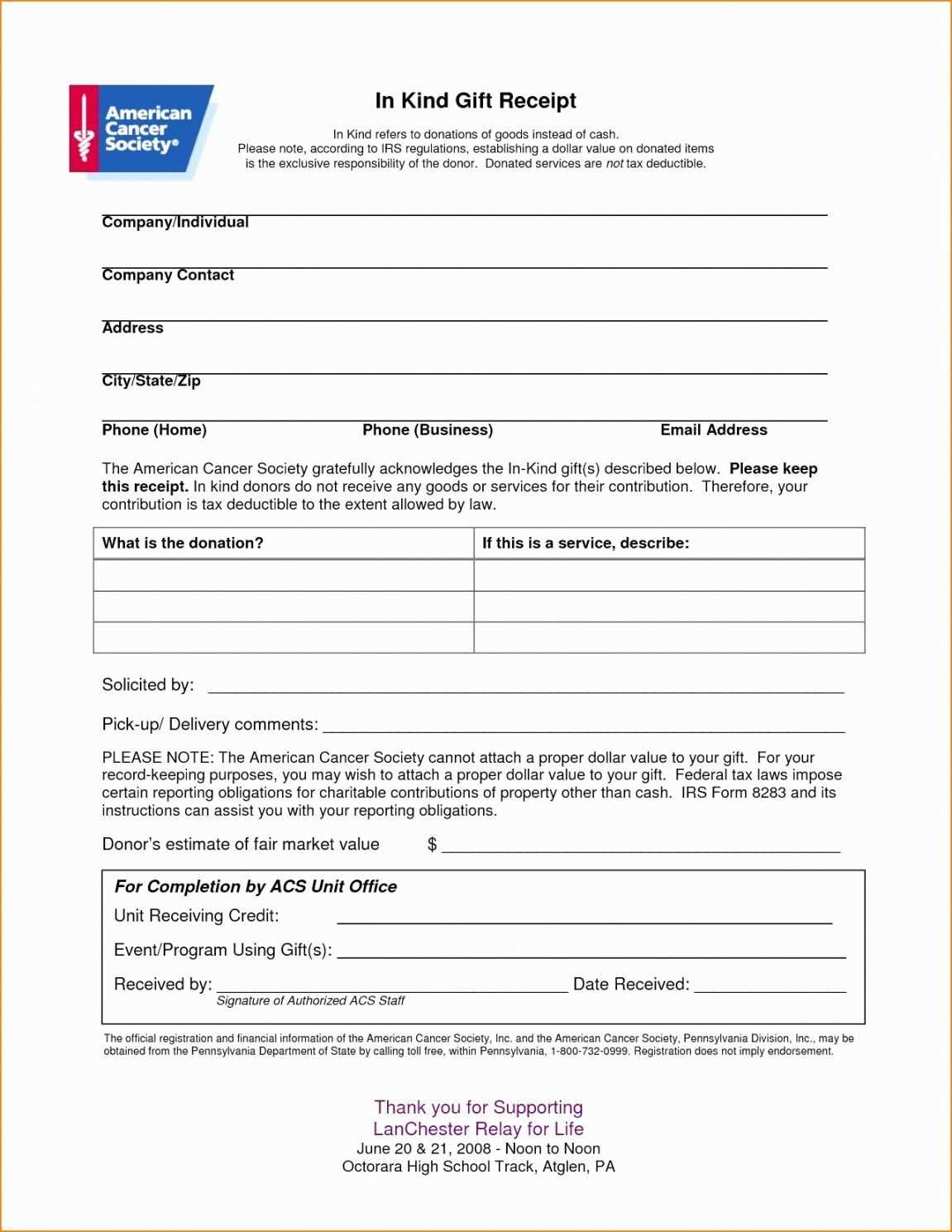

To create a valid in-kind receipt in Oregon, ensure you include key details that meet legal standards and provide clarity for both parties. Begin by clearly stating the donor’s name, contact information, and the date of the donation. It’s also important to describe the donated items accurately, specifying their condition and estimated value if applicable. Donors should be reassured that this template can also serve as a record for tax purposes if the items are of significant value.

Don’t forget to include the recipient’s information, such as their name and contact details, as well as their acknowledgment of the donation. The statement of value should be neutral if the donor is estimating the worth, but it is advised to refrain from assigning values to goods without proper evaluation. Include a signature from both the donor and the recipient to validate the transaction.

Make sure the format follows local standards for simplicity and consistency. By using this template, both parties ensure clarity, prevent any future misunderstandings, and maintain transparency in the donation process. This approach aligns with Oregon’s legal guidelines while providing an organized framework for tracking non-cash contributions.

Here’s the modified version with reduced repetition:

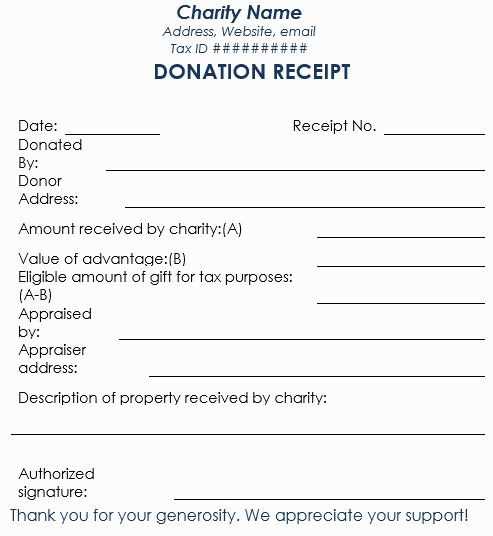

To streamline the in-kind receipt template, focus on clarity and conciseness. Avoid redundant sections that repeat the same information. Use specific terms for items being received, along with clear descriptions of quantities and values. Keep the structure simple, listing only necessary fields like recipient name, date, and a brief item breakdown.

Clear Fields and Specific Information

Ensure each field is clearly labeled, such as “Item Description” and “Quantity.” Remove any sections that are not directly relevant to the transaction. This approach eliminates unnecessary repetition and allows for quicker understanding and processing.

Organize Information Logically

Arrange the sections in a logical order, starting with the date and party names, followed by the itemized list. This avoids confusion and keeps the template straightforward, ensuring it remains easy to fill out and use.

In-kind Receipt Template Oregon

How to Create a Simple In-kind Receipt

Key Information to Include in the Document

Understanding Legal Requirements for In-kind Donations in Oregon

Common Mistakes to Avoid When Preparing the Receipt

Customizing Your Document for Different Donation Types

How to Distribute and Store Receipts for Record Keeping

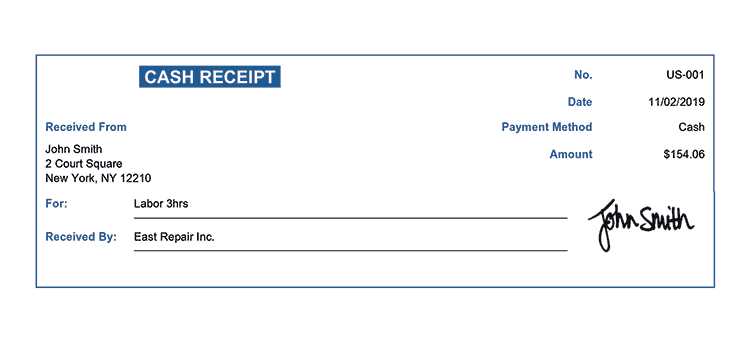

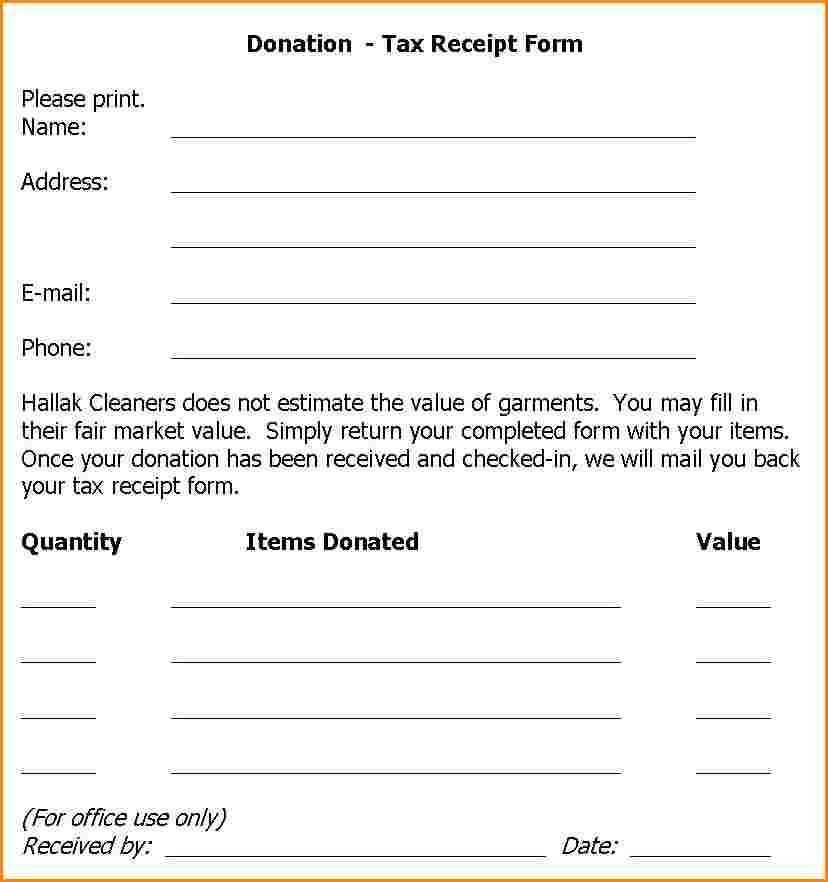

Begin with including a clear description of the donated item or service. Specify whether it is new or used, and outline any relevant details, such as quantity, condition, and value if applicable. Avoid vague descriptions like “clothing” and instead list specific items, such as “three pairs of men’s jeans.” If the donation involves multiple items, list them individually with detailed descriptions.

Key Information to Include

Along with the item description, include the donor’s full name, contact information, and the donation date. The recipient organization should also add its name, contact details, and tax identification number. Provide space for the donor’s acknowledgment of the value they assigned to the donation. This ensures clarity and transparency between both parties.

Legal Requirements in Oregon

In Oregon, as in most states, in-kind donations must include a description of the donated items and an acknowledgment that no goods or services were provided in exchange for the donation, unless this is specified. Make sure the receipt clearly reflects this. For donations valued over $250, the donor may need a qualified appraisal, which should be noted on the receipt if applicable.

To avoid errors, double-check for accuracy in every field. Mistakes such as incorrect donation values or missing donor contact details can cause issues during tax filing. Always be specific about the items donated, as this helps avoid confusion later.

Customize the template for different types of donations. For example, if you’re receiving services, specify the number of hours worked and the hourly rate as an estimate of value. For donations like food, include details on the type, amount, and date of delivery. This helps ensure the document is valid for various types of in-kind contributions.

Once the receipt is prepared, distribute it immediately. Provide one copy to the donor for their records, and store one securely for the organization’s records. You can keep these documents in digital form for easier access and organization. Regularly review your receipts to ensure compliance with both state and federal laws.