Key Elements of a Donation Receipt

A well-structured donation receipt ensures compliance with tax regulations and builds donor trust. Include the following:

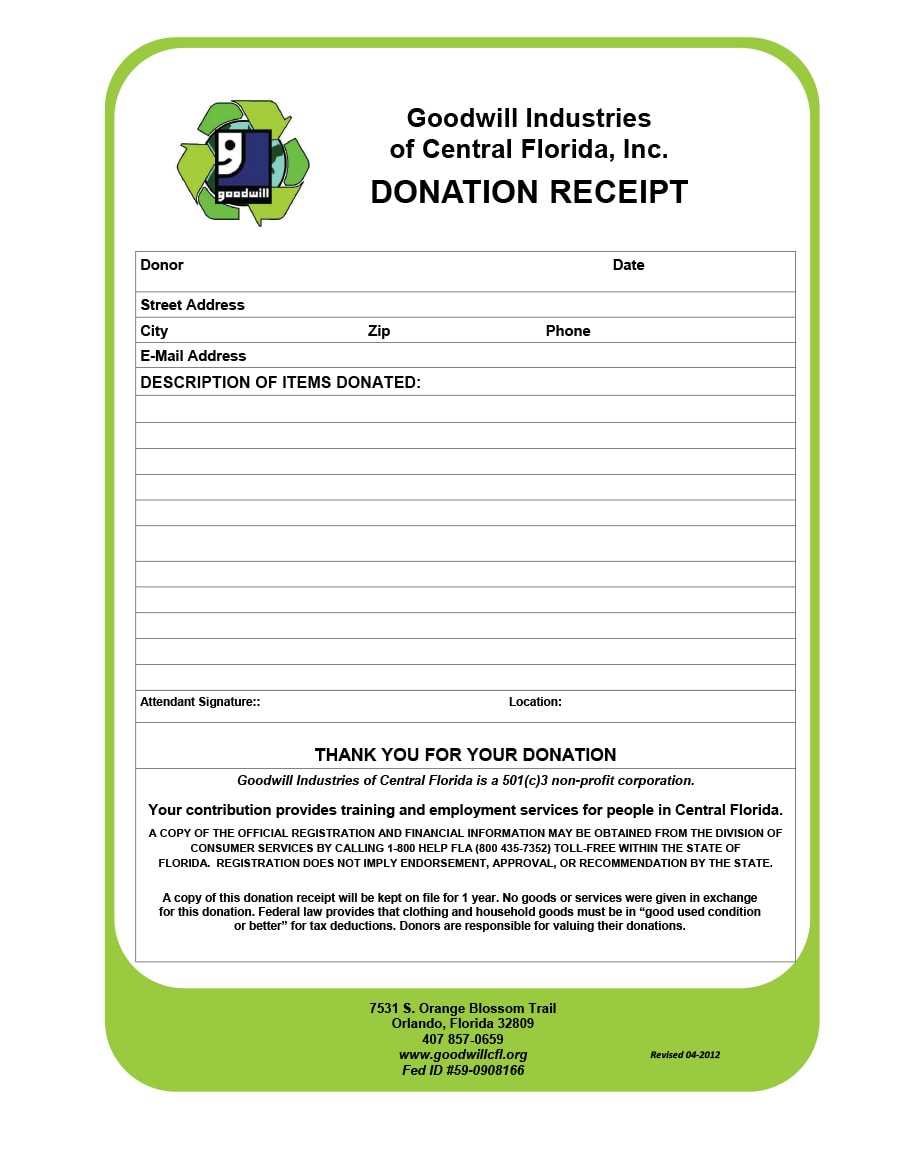

- Organization’s Name and Contact Information: Clearly display the non-profit’s legal name, address, phone number, and email.

- Donor’s Name: Accurately record the donor’s full name as it appears on their payment method.

- Donation Date: Provide the exact date the contribution was received.

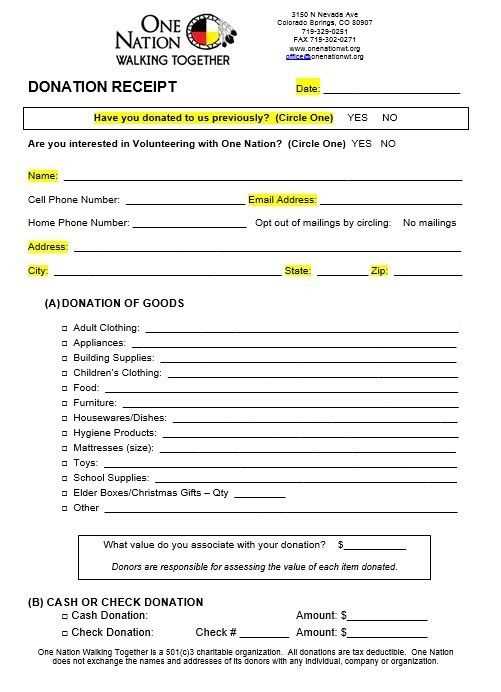

- Amount or Description: List the monetary amount or describe non-cash donations (e.g., goods or services).

- Tax-Exempt Status Statement: Confirm the organization’s status as a tax-exempt entity.

- No Goods or Services Statement: If applicable, state that no goods or services were provided in exchange for the donation.

- Signature or Digital Authorization: Include an authorized representative’s signature or digital verification.

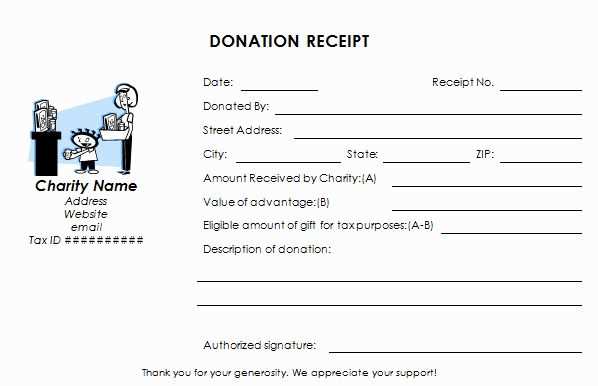

Sample Template

Use this template as a starting point for creating donation receipts:

[Non-Profit Organization Name] [Address] [City, State, ZIP Code] [Phone Number] | [Email] Date: [MM/DD/YYYY] Dear [Donor’s Name], Thank you for your generous contribution of [Donation Amount or Description] on [Donation Date]. We appreciate your support in furthering our mission. [Non-Profit Organization Name] is a registered 501(c)(3) non-profit organization. No goods or services were provided in exchange for this donation, making it fully tax-deductible to the extent allowed by law. Please retain this receipt for your records. If you have any questions, feel free to contact us. Sincerely, [Authorized Representative’s Name] [Title] [Non-Profit Organization Name]

Additional Tips

- Issue receipts promptly to ensure donors have proper documentation for tax purposes.

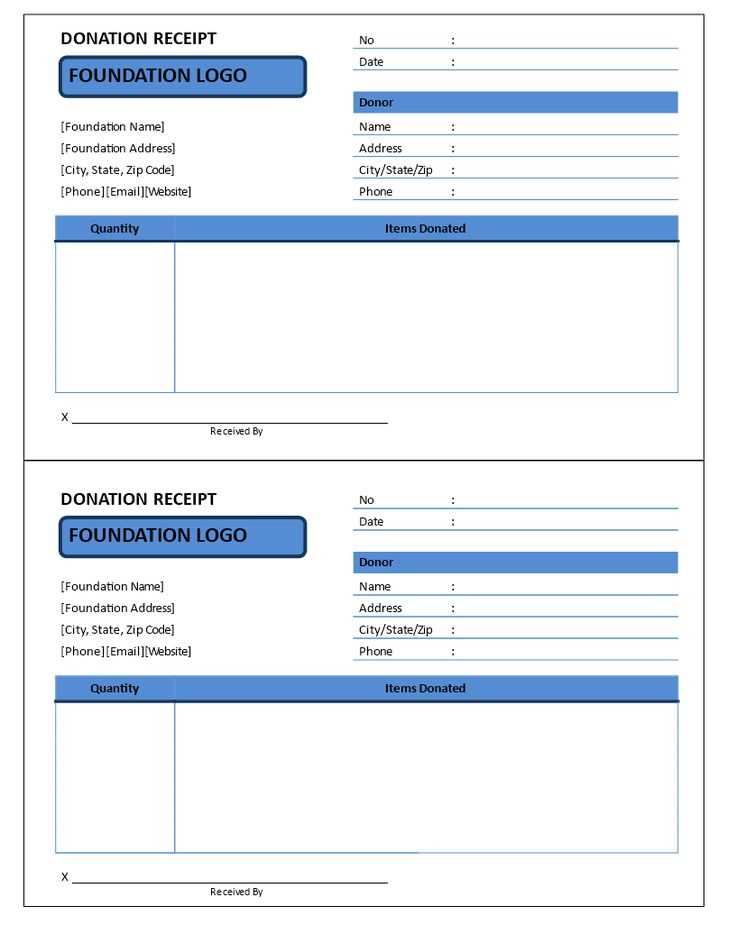

- For recurring donations, consider providing an annual summary receipt.

- Ensure compliance with local tax laws and consult a legal expert if needed.

Non-Profit Donation Receipt Template

Key Legal Requirements for Acknowledging Contributions

Essential and Optional Details to Include

Formatting Guidelines for Clear and Professional Documents

Customizing Templates for Various Donation Types

Digital vs. Paper Records: Pros and Cons

Best Practices for Documentation and Audits

A proper donation receipt must include key details to comply with tax regulations and ensure transparency. At a minimum, include the donor’s name, contribution date, amount, and a statement confirming whether any goods or services were provided in return.

Mandatory and Optional Information

Tax-exempt organizations must specify their registered name, EIN, and a declaration of their nonprofit status. If the donation is non-monetary, describe the item but avoid assigning a value. Additional details such as the donor’s address and a unique receipt number can enhance record-keeping.

Formatting for Clarity

Use a clean layout with clearly labeled sections. A header with the organization’s logo and contact details improves credibility. Group related information logically, keeping receipts concise while maintaining completeness.

For recurring donors, digital templates with auto-fill capabilities simplify issuance. Standardized templates prevent inconsistencies, reducing administrative workload and audit risks.

Maintaining both digital and paper copies ensures accessibility. Digital records allow for quick retrieval, while physical copies provide a backup in case of system failures. Secure encrypted storage is necessary to protect sensitive donor data.