Use a structured rental receipt template to ensure clear financial records and avoid disputes. A well-formatted document provides a detailed breakdown of payments, including amount, date, payer, and payment method. This eliminates ambiguity and keeps both landlords and tenants informed.

Choose a template with editable fields to customize each receipt based on transaction details. Key elements include property address, lease period, payment breakdown, and landlord’s contact information. Digital formats allow for easy updates and instant sharing via email or cloud storage.

Automate receipts using fillable PDFs or spreadsheets to minimize errors and standardize documentation. Consistency in formatting simplifies tax filing, financial tracking, and compliance with rental agreements. Select a template that supports electronic signatures for added security.

Store all receipts in a centralized location for quick retrieval when needed. This practice enhances financial transparency and ensures compliance with legal or tax requirements. Whether managing a single property or multiple units, a structured template streamlines the process and keeps records organized.

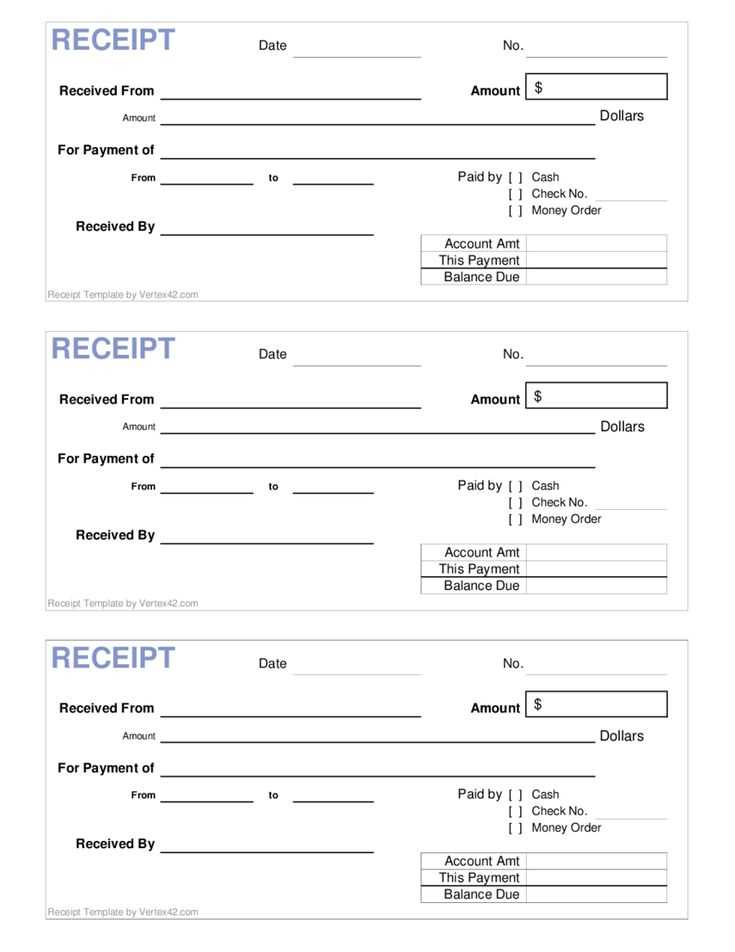

Online Rental Receipt Template

Generate a structured rental receipt instantly with a ready-made template. Ensure all key details are included for clarity and compliance.

Must-Have Details

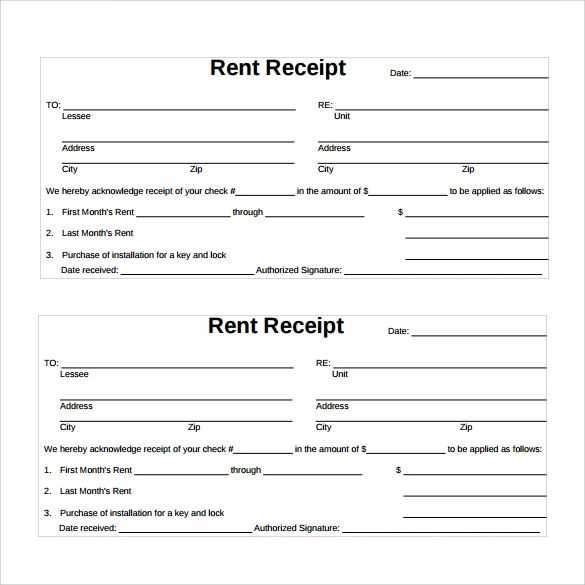

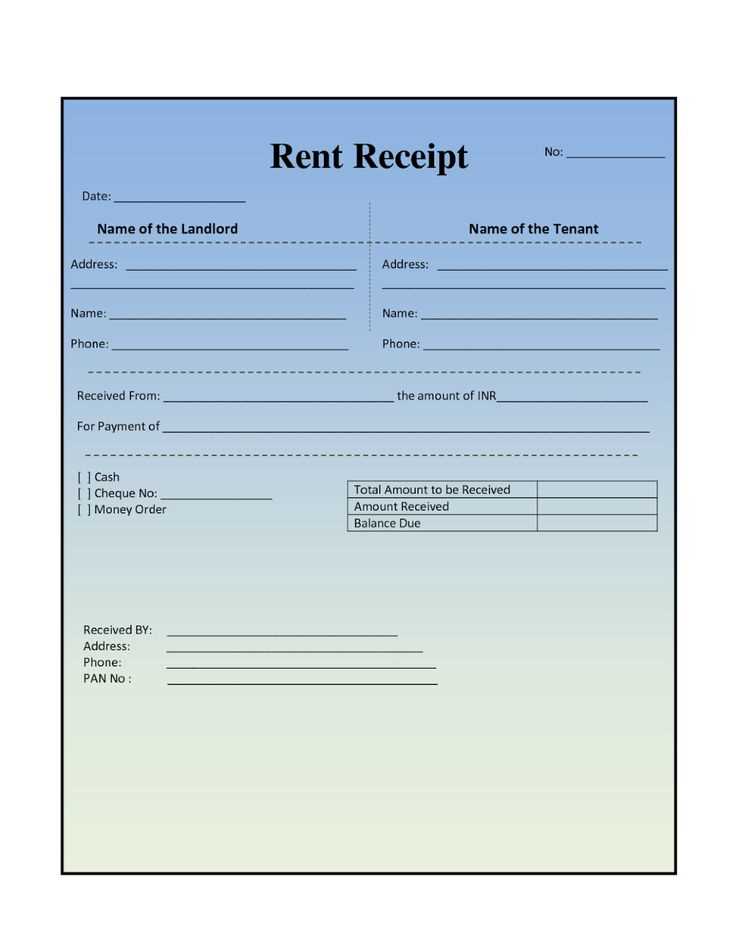

- Tenant and Landlord Information: Full names and contact details.

- Payment Breakdown: Amount paid, due date, and outstanding balance if applicable.

- Property Address: Clearly state the rented unit’s location.

- Payment Method: Specify cash, bank transfer, or check details.

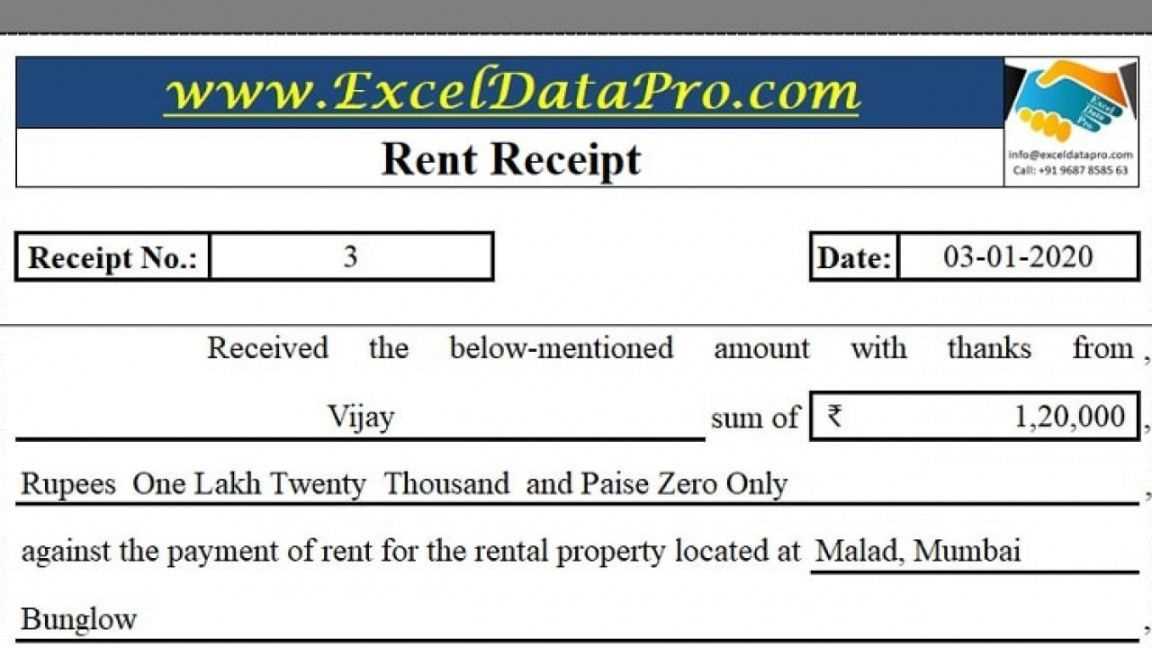

- Unique Receipt Number: Helps with record-keeping and tracking.

How to Automate the Process

- Choose a Template: Select one that fits rental agreements.

- Customize Fields: Add necessary sections like deposit details.

- Use Digital Signatures: Authenticate without printing.

- Save and Send: Export as PDF and share via email.

With a structured template, both parties maintain accurate records, preventing disputes and simplifying financial tracking.

Key Elements of a Rental Receipt

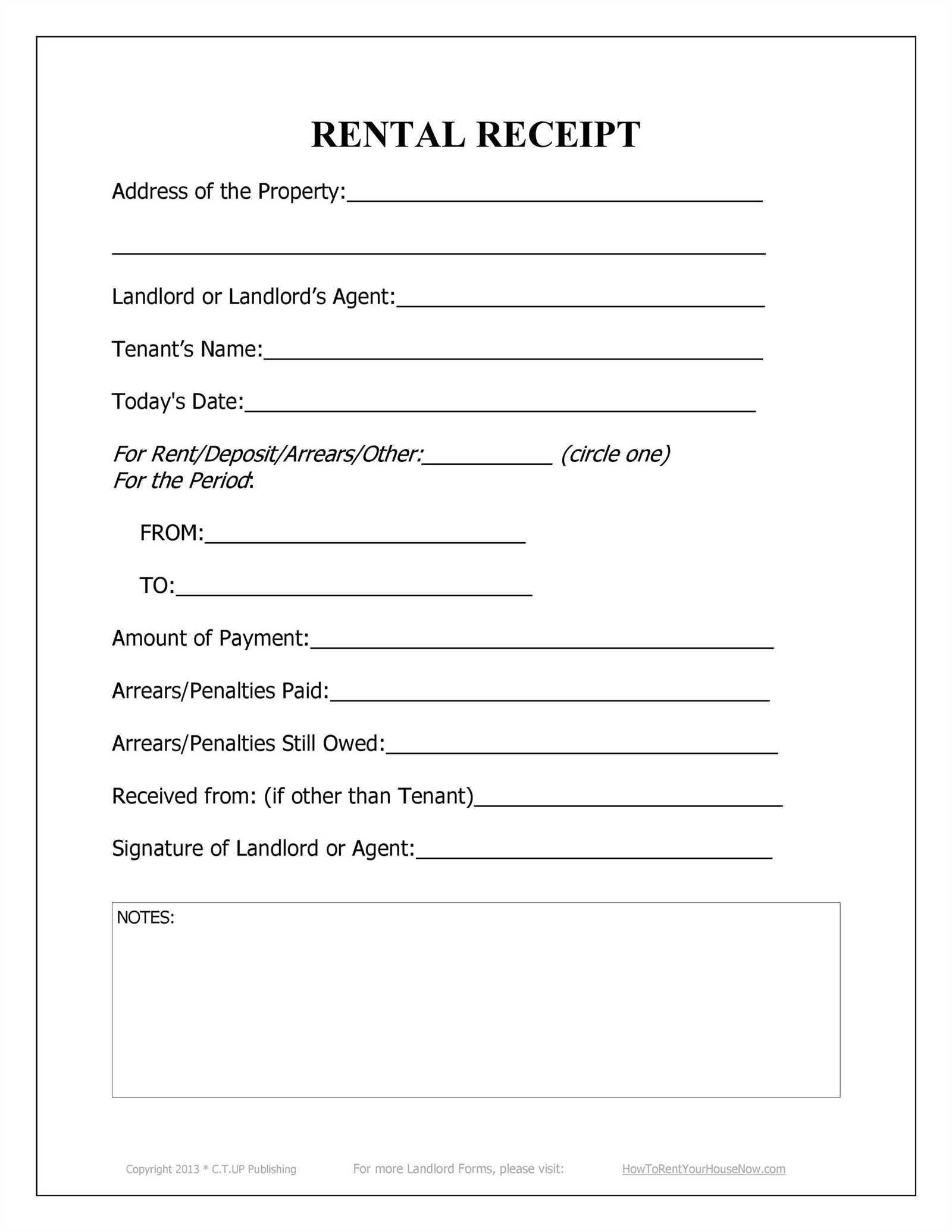

Date of Payment: Always include the exact date when the rent was received. This detail helps both parties track transactions and resolve any disputes.

Amount Paid: Specify the total sum received, ensuring clarity by indicating the currency and payment method. If there are additional fees or deductions, break them down for transparency.

Payer and Recipient Information: Include the tenant’s full name and the landlord’s or property manager’s name. This confirms who made the payment and who received it.

Property and Rental Period

Address of the Rental Unit: Clearly state the property’s location to prevent confusion, especially if multiple units are managed by the same owner.

Billing Period: Specify the time frame covered by the payment. This confirms whether the amount applies to a single month, multiple months, or a partial period.

Additional Notes and Confirmation

Payment Reference: If applicable, provide a receipt number or transaction ID. This is particularly useful for electronic payments.

Signature or Authorization: A landlord’s signature or official stamp adds credibility. If issuing a digital receipt, an authorized name or email confirmation serves the same purpose.

Customizing Templates for Different Agreements

Adjust fields to match the agreement type. Lease contracts may require sections for security deposits, while short-term stays benefit from flexible payment terms. Remove irrelevant details to keep the document concise.

Use placeholders for names, dates, and amounts. This allows quick modifications without altering the structure. Automate calculations for late fees or discounts to minimize errors.

Incorporate legal clauses based on jurisdiction. Local laws may require disclosures on maintenance responsibilities or cancellation terms. Ensure compliance by referencing official regulations.

Opt for digital signatures if electronic approval is needed. Many platforms integrate e-signature functionality, reducing paperwork and speeding up processing.

Test the template before use. Fill it with sample data to check formatting, readability, and accuracy. Refining details in advance prevents misunderstandings.

Legal Considerations and Compliance

Ensure the receipt includes the full names of both parties, the rental address, payment amount, date, and payment method. Missing details may lead to disputes or legal complications.

Verify that the document aligns with local tax regulations. Some jurisdictions require landlords to issue receipts for tax reporting, and non-compliance may result in penalties.

Include a statement confirming receipt of payment and specify whether it covers rent, utilities, or deposits. This prevents misunderstandings about outstanding balances.

Electronic receipts should follow e-signature laws if used as proof in legal matters. Check if digital signatures hold the same validity as handwritten ones in your location.

Keep copies for record-keeping. Landlords and tenants may need receipts for tax deductions, audits, or legal claims.

Digital vs. Paper-Based Receipt Formats

Choose digital receipts for speed and organization. They arrive instantly, reduce clutter, and integrate with accounting software. Cloud storage keeps them safe from loss or damage.

Paper receipts work best for legal compliance in regions requiring physical copies. They provide a tangible backup but can fade, get lost, or require manual entry into financial records.

For flexibility, offer both options. Digital copies ensure quick access, while printed versions meet specific needs. Many businesses email receipts automatically while providing a print option on request.

Best Platforms to Create and Download Templates

For a quick and reliable way to generate a structured document, Adobe Express provides customizable forms with editable fields. The interface allows users to adjust layouts, insert branding, and export files in multiple formats.

Canva offers a user-friendly editor with a vast selection of pre-designed layouts. The drag-and-drop functionality makes modifications simple, and the cloud-based system ensures access from any device.

Microsoft Office provides professionally formatted templates directly in Word. Users can modify sections, apply custom styles, and save documents in different formats for compatibility with various systems.

| Platform | Key Features | Export Options |

|---|---|---|

| Adobe Express | Fully customizable, supports branding, various file types | PDF, PNG, JPG |

| Canva | Pre-made layouts, cloud storage, drag-and-drop tools | PDF, PNG, JPG |

| Microsoft Office | Integrated with Word, supports advanced formatting | DOCX, PDF |

For those preferring a streamlined experience, Template.net offers ready-made forms with easy download options. The platform provides industry-specific designs, ensuring compliance with standard formatting.

Each option caters to different needs, whether prioritizing ease of use, customization, or professional formatting.

Common Mistakes When Using Templates

Skipping Customization

Using a template as-is creates issues with accuracy and compliance. Adjust fields to reflect local regulations, specific payment terms, and unique rental agreements. Omitting this step can lead to disputes.

Ignoring Formatting Issues

Many templates have preset styles that may not align with professional standards. Ensure consistent font sizes, spacing, and alignment before sending the document. Poor formatting affects readability and credibility.

- Missing Key Details: Verify that all fields, including tenant and landlord names, payment amount, and due date, are filled in correctly.

- Not Saving Editable Versions: Always keep a copy in an editable format for future updates. PDFs alone limit modifications.

- Overlooking Legal Requirements: Some regions require specific clauses. Cross-check with local laws to ensure compliance.

- Failing to Verify Accuracy: Double-check numbers, dates, and names to prevent errors that could complicate record-keeping.

Taking a few extra minutes to personalize and review a template avoids misunderstandings and ensures a professional document.