A well-structured rent receipt is essential for both landlords and tenants in Indianapolis. It serves as proof of payment, simplifies record-keeping, and helps avoid disputes. Whether renting out a single unit or managing multiple properties, using a clear and professional receipt template ensures smooth financial tracking.

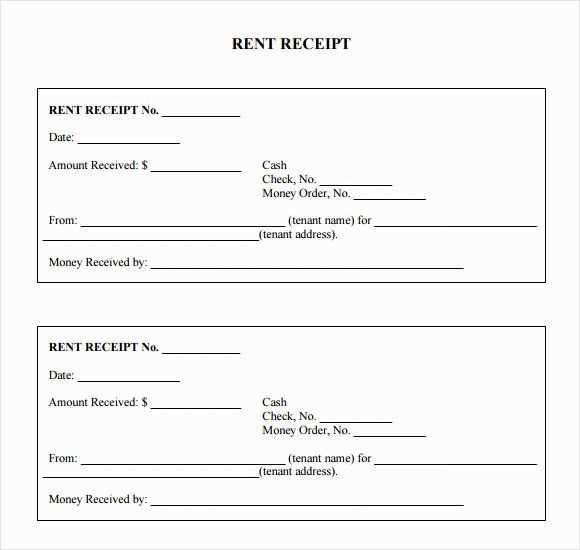

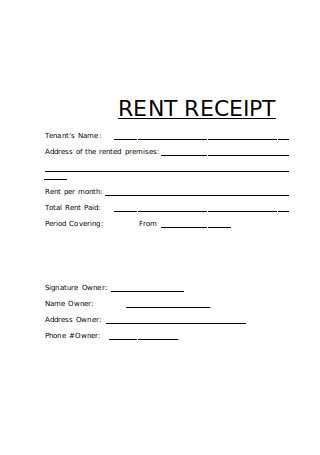

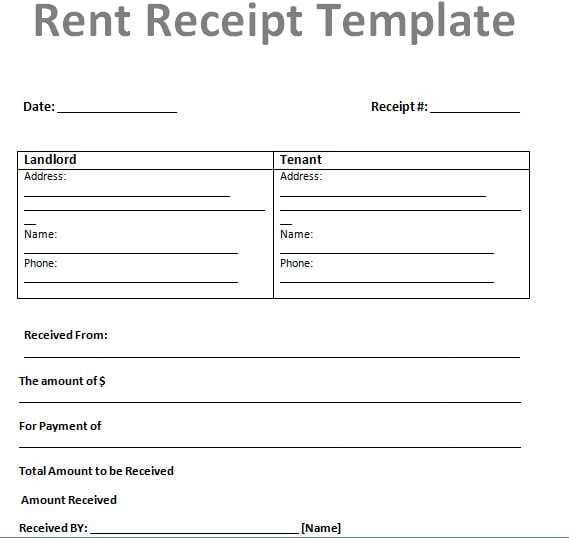

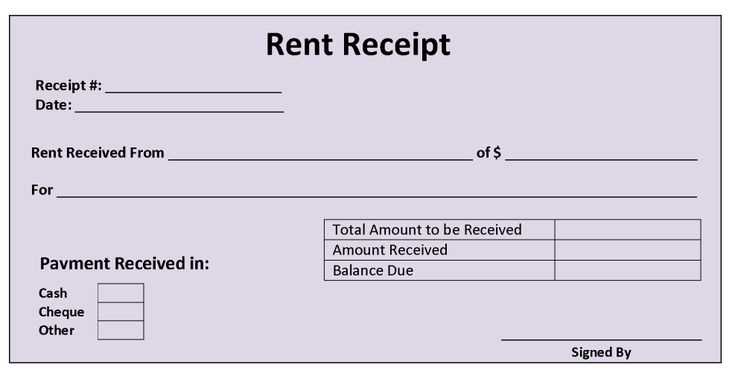

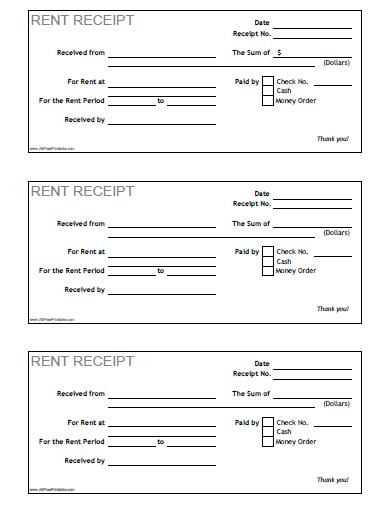

Each rent receipt should include key details such as the tenant’s name, rental property address, payment date, amount paid, payment method, and the landlord’s signature. Adding a unique receipt number can further improve organization and simplify tax reporting.

Indianapolis landlords must also consider state and local regulations when issuing receipts. While not legally required for every transaction, providing a written acknowledgment of rent payments can help establish transparency and build trust with tenants. Digital receipts are also an option, offering convenience and secure documentation.

Using a structured template saves time and reduces errors. A well-formatted document–whether printed or digital–ensures consistency and helps both parties maintain accurate financial records. Downloading or customizing a template tailored to Indianapolis rental agreements makes the process even more efficient.

- Rent Receipt Template for Indianapolis

A well-structured rent receipt should include the tenant’s name, rental property address, payment date, amount paid, and payment method. Specify whether the amount covers the full rent or a partial payment. Include the landlord’s name and contact details to ensure transparency.

Use a clear format with labeled sections. For example, create a simple table or structured list to display payment details neatly. Always include a unique receipt number for easy record-keeping.

Indianapolis landlords should ensure receipts comply with local tax and rental regulations. Providing a signed copy to the tenant strengthens documentation and prevents disputes.

Landlords must provide rental receipts upon request, especially when tenants pay in cash. Indiana law does not mandate automatic issuance, but it becomes necessary if the tenant asks for documentation. Keeping accurate records helps prevent disputes and ensures compliance with tax obligations.

Mandatory Information

A valid receipt must include the payment date, amount received, tenant’s name, rental property address, and payment method. If paying by check or electronic transfer, referencing the transaction ID adds clarity. Both parties should retain copies for their records.

Legal Implications

Failure to issue a receipt when requested may lead to legal complications if a dispute arises. Tenants relying on these documents for reimbursement or proof of payment can challenge unauthorized fees or incorrect balances. Consistently issuing receipts fosters transparency and trust between landlords and tenants.

Include the full name of the tenant and landlord to avoid disputes. Clearly state the rental property address to specify the location covered by the payment.

Record the exact amount paid and the date of the transaction. Specify the payment method, whether cash, check, or electronic transfer, to provide clarity on how the funds were received.

List the rental period covered, ensuring there is no confusion about what the payment applies to. If the receipt includes additional charges like late fees, detail them separately.

Conclude with the landlord’s or property manager’s signature, reinforcing the document’s authenticity. If issued electronically, a digital signature or stamp can serve the same purpose.

Use a logical layout: Organize information into distinct sections, such as payer and payee details, payment amount, date, and method. Align text neatly for easy readability.

Choose a readable font: Stick to professional, easy-to-read fonts like Arial or Times New Roman. Avoid decorative or overly stylized fonts that may reduce clarity.

Maintain consistent spacing: Ensure even spacing between lines and sections. Overcrowded text makes scanning difficult, while excessive spacing wastes space.

Highlight key details: Use bold or italics to emphasize essential information, such as payment amounts or due dates, without overusing formatting styles.

Include clear labels: Clearly define each field to eliminate confusion. For example, instead of just “Amount,” specify “Total Amount Paid” or “Monthly Rent.”

Align numerical values: Keep payment amounts right-aligned for easy comparison. If listing multiple charges, ensure they follow a uniform format.

Use a professional tone: Keep language formal and straightforward. Avoid abbreviations or casual phrases that might reduce credibility.

Choose digital receipts for easier storage, quick retrieval, and reduced clutter. They integrate seamlessly with accounting software and minimize paper waste. Many landlords and tenants prefer them for convenience and security.

Comparison of Key Features

| Feature | Digital Receipts | Paper Receipts |

|---|---|---|

| Storage | Cloud-based, easy to organize | Physical copies, risk of loss |

| Access | Instant retrieval from any device | Manual search required |

| Security | Password-protected, encrypted | Prone to damage or theft |

| Legality | Accepted in most jurisdictions | Widely recognized for official purposes |

| Environmental Impact | Paperless, eco-friendly | Requires printing, more waste |

When to Use Each Option

Digital receipts work best for landlords and tenants who prefer automation and accessibility. Paper receipts remain useful when dealing with parties who require hard copies or in areas where electronic formats lack legal recognition. Choose based on convenience, security, and legal requirements.

Ensure all details are accurate. Double-check tenant names, property addresses, and payment amounts. Mistakes in these areas can lead to confusion or disputes later.

- Incorrect Payment Dates: Always record the exact date the payment was made. Leaving this out or adding the wrong date may cause issues during audits or legal matters.

- Missing Rent Period: Clearly state the rent period covered by the payment (e.g., from January 1 to January 31). This prevents ambiguity in cases of multiple payments.

- Absence of Signature: A rent receipt should always be signed by the landlord or their representative. An unsigned receipt may not hold up in legal situations.

- Failure to Record Mode of Payment: Specify whether the payment was made by check, cash, or electronic transfer. Not noting the payment method can create doubts over transaction validity.

- Not Providing Receipts Timely: Give the receipt promptly after payment. Delays can lead to misunderstandings or tenants forgetting payments they’ve already made.

- Ignoring Rent Increases: If the rent changes, make sure the new amount is reflected in the receipt for the applicable period. Failing to update rent changes can cause confusion later.

To find free rental receipt templates, check reliable online platforms offering customizable options. These templates come in various formats, including Word, PDF, and Excel, allowing easy adaptation for your specific needs.

1. Websites Offering Free Templates

- Template.net: This platform provides free downloadable rental receipt templates. You can filter templates based on the style or format you prefer.

- Invoice Simple: A user-friendly site that offers a variety of rental receipt templates for free. The templates are editable and easy to download.

- JotForm: This site offers free rental receipt templates that can be customized and downloaded in PDF format. They also provide forms that you can integrate with payment systems.

2. Free Google Docs Templates

- Google Docs: Google Docs offers free rental receipt templates in the template gallery. These are fully customizable and easy to share or print.

- DocFly: You can find free templates designed specifically for rental receipts, editable directly in your browser, and available for download in various formats.

These options offer flexibility in customizing rental receipts without spending money, ensuring you get a professional template suited to your rental business needs.

Ensure the rent receipt template for Indianapolis includes the tenant’s name, property address, and the rental period covered by the payment. Clearly state the amount paid, along with the payment method (e.g., cash, check, bank transfer). Be sure to specify whether the payment is for the full month or a partial period.

It’s important to include the landlord’s name and contact details for clarity. If applicable, list any outstanding balances or adjustments, such as late fees. Make sure both parties sign and date the document, confirming that the transaction has been completed. This simple step can help avoid future misunderstandings and keep your rental records organized.

Remember to keep copies of the receipt for both the tenant and landlord. This serves as documentation for future reference, especially if any disputes arise regarding payments or rental terms.