A well-structured donation receipt ensures transparency, simplifies tax reporting, and strengthens donor trust. To create a receipt that meets legal and accounting standards, include key details such as the donor’s name, donation amount, date of the contribution, and the nonprofit’s tax-exempt status.

Essential Elements to Include:

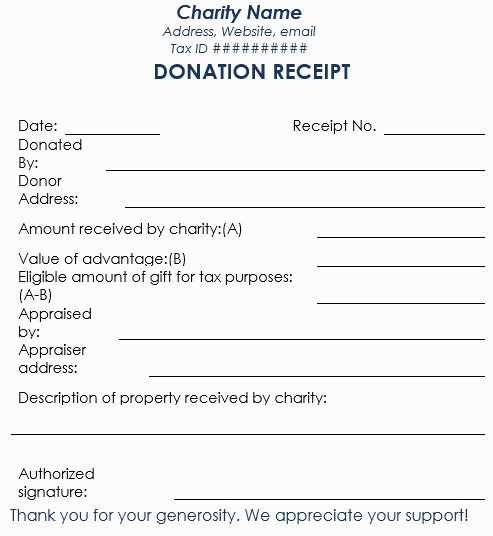

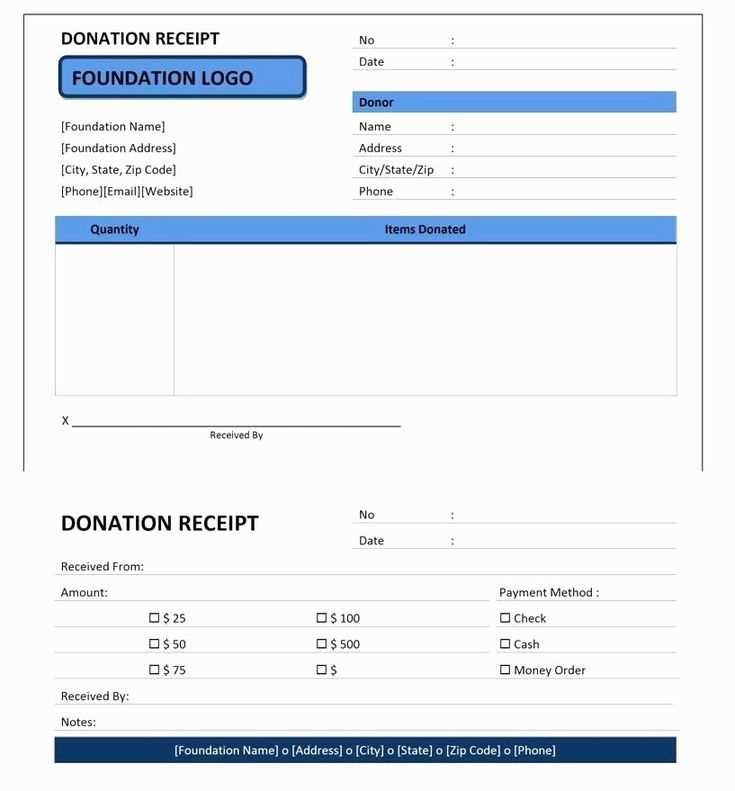

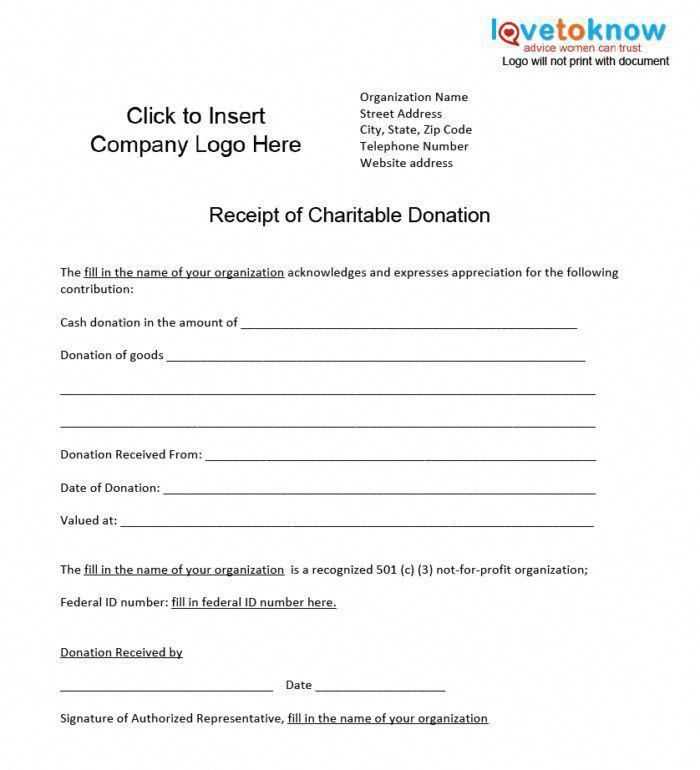

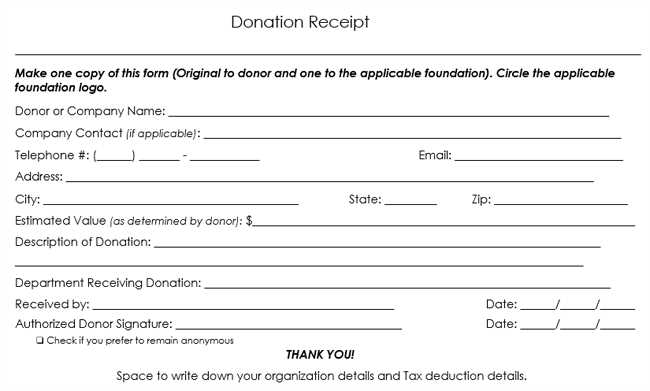

1. Donor and Organization Details: Clearly state the donor’s full name and contact information, along with the nonprofit’s legal name, address, and tax identification number.

2. Donation Description: Specify whether the donation was made in cash, by check, or as a non-monetary contribution. For non-cash donations, provide a brief description of the item but avoid assigning a value–this is the donor’s responsibility.

3. Acknowledgment Statement: Confirm that no goods or services were received in exchange for the donation, or if any benefits were provided, describe them and their estimated value.

4. Date and Signature: Include the date of the donation and an authorized signature or digital validation from the nonprofit.

Using a standardized receipt template saves time and ensures consistency. Whether you’re issuing a physical document or an automated email receipt, maintaining accuracy and compliance with tax regulations helps donors claim deductions and reinforces your organization’s credibility.

Here’s your text without unnecessary repetition:

To create a clear and legally compliant donation receipt, include the donor’s full name, the donation amount, and the date of the contribution. If the donation is non-monetary, describe the item and its fair market value.

Required Tax Information

For tax-deductible contributions, state whether the donor received goods or services in exchange. If not, include a statement confirming that no goods or services were provided. If something was received, specify its estimated value.

Best Practices for Clarity

Use simple language and a structured layout. Include your organization’s name, EIN, and contact details. Digital receipts should be in a printable format. Ensure accuracy to avoid donor confusion or compliance issues.

- Template Donation Receipt: A Practical Guide

Every donation receipt should include key details to ensure compliance and transparency. Missing critical information can lead to issues with tax deductions or donor trust. Here’s what to include:

Essential Components

- Donor Information: Full name and address.

- Organization Details: Legal name, tax-exempt status, and EIN (if applicable).

- Donation Date: Exact date the contribution was received.

- Donation Amount: Precise value of cash donations or fair market value for non-cash gifts.

- Statement of No Goods or Services: Confirm that nothing was received in exchange, unless applicable.

Formatting Tips

- Use a clear structure with bold labels for readability.

- Ensure all required fields are present before issuing.

- Provide digital and printable formats for convenience.

Accuracy and completeness prevent donor inquiries and audit risks. Always verify legal requirements based on location.

Ensure that each donation receipt includes the donor’s full name, the organization’s legal name, and a statement confirming its tax-exempt status. This helps both parties comply with tax regulations and simplifies reporting.

Mandatory Receipt Elements

| Requirement | Details |

|---|---|

| Organization Information | Full legal name, address, and tax identification number. |

| Donor Details | Name and, if applicable, contact information. |

| Donation Description | Monetary amount or a detailed description of non-cash contributions. |

| Tax Exemption Statement | Clarification of whether the donation is tax-deductible. |

| Declaration of Benefits | Statement on whether goods or services were provided in exchange. |

Compliance Best Practices

Issue receipts promptly after receiving a donation. For non-cash contributions, include a fair market value estimate if legally required. Digital and paper receipts must meet the same legal standards. Retain copies for auditing purposes and donor reference.

A proper donation receipt must include key details to meet legal requirements and provide transparency for donors. The table below outlines the mandatory and recommended information.

| Category | Details |

|---|---|

| Mandatory |

|

| Recommended |

|

Ensuring a receipt contains all necessary elements prevents compliance issues and enhances donor trust.

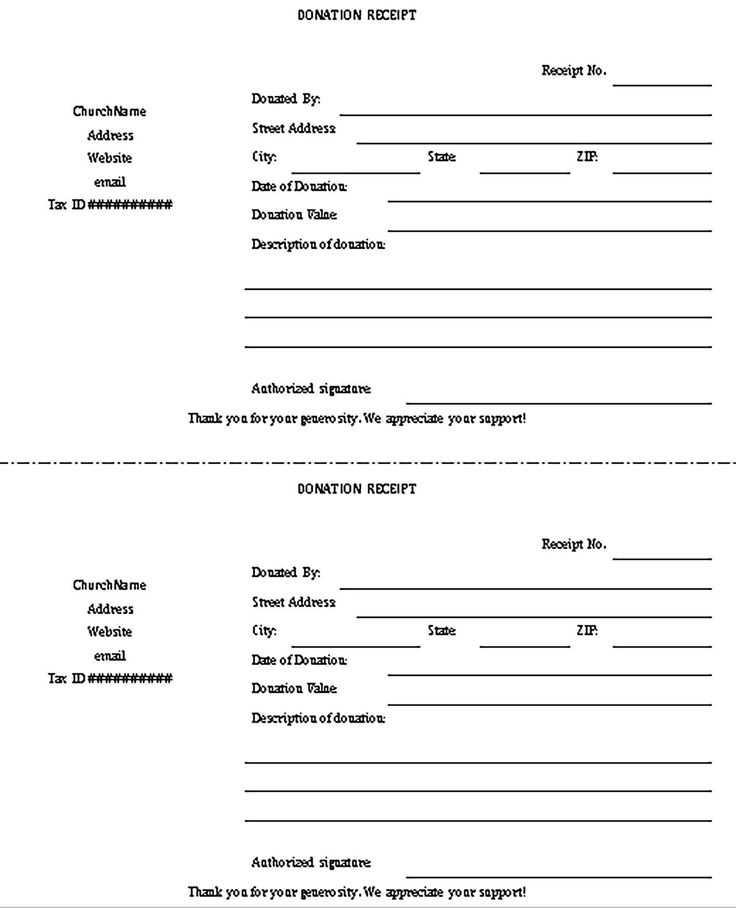

Use a clear and logical layout to ensure readability. Organize the receipt into distinct sections with concise labels.

- Header: Display the organization’s name, logo, and contact details at the top.

- Title: Clearly state “Donation Receipt” to remove ambiguity.

- Donor Information: Include the donor’s full name and contact details.

- Donation Details: List the amount, date, and method of donation. If applicable, describe donated items with estimated values.

- Tax Information: Add a statement confirming the nonprofit’s tax-exempt status and whether goods or services were provided in return.

- Authorized Signature: Provide a space for a representative’s signature to validate the receipt.

Use a standard font and align text for clarity. Keep margins consistent, and ensure key details stand out with bold or capitalized headings.

Missing Essential Details

Every donation receipt must include the donor’s full name, the donation amount, and the date. For non-cash donations, describe the item without assigning a value. If your organization is tax-exempt, mention its status and provide the EIN. Omitting any of these details can render the receipt invalid for tax purposes.

Failing to Include a Statement of No Goods or Services

For donations above $250, clearly state whether the donor received any goods or services in return. If not, include a phrase like: “No goods or services were provided in exchange for this donation.” If something was given, specify its fair market value. Leaving this out may cause tax deductions to be denied.

Avoid handwritten receipts, as they can appear unprofessional and lead to errors. Use a standardized template to ensure consistency. Double-check all information before sending receipts to prevent donor confusion and compliance issues.

Adapt donation receipts to reflect your organization’s unique identity and compliance requirements. Include your logo, official name, and contact details to ensure credibility. Format the document to align with your branding by adjusting fonts and colors.

Tax Compliance and Legal Requirements

Nonprofits in different regions follow specific tax regulations. Verify which details are mandatory, such as donor name, donation amount, date, and tax-deductibility statements. Charities in the U.S., for example, must state whether goods or services were exchanged, while organizations in the UK should reference Gift Aid eligibility.

Tailoring for Different Donation Types

Customize receipts based on donation type. For recurring contributions, specify the frequency and total amount received within the tax year. For in-kind donations, describe the donated items without assigning a value unless required. For event-based fundraising, mention ticket purchases separately from pure donations.

Use templates that allow dynamic content fields to personalize receipts efficiently. Automation ensures consistency while saving time for high-volume donations.

Maintain a Consistent Layout

Ensure that both digital and printed donation receipts have a uniform structure. Use the same fonts, spacing, and branding elements across versions to maintain professionalism. Digital receipts should be optimized for mobile and desktop screens, while printed versions must use high-resolution formatting to prevent blurriness.

Optimize for Readability

Choose a clean, legible font with a size that remains readable across formats. Avoid excessive decorative elements that may compromise clarity in print. Use clear section headings to make key information, such as donor details, donation amount, and tax information, easy to find.

For digital versions, use live text instead of images to ensure accessibility and searchability. PDFs should include selectable text and embedded fonts to prevent formatting issues when opened on different devices.

Printed versions should be designed with adequate margins to prevent content from being cut off when using standard printers. High-contrast color schemes work best to ensure readability in black-and-white prints.

By applying these guidelines, donation receipts remain clear, professional, and functional in both formats.

Optimizing Your Donation Receipt Template

Ensure your donation receipt includes all necessary details for tax deductions and transparency. Use a structured format to make it easy for donors to reference.

Key Information to Include

- Donor Details: Full name and contact information.

- Organization Information: Legal name, address, and tax-exempt status.

- Donation Description: Amount, date, and type of donation (cash, goods, services).

- Statement of No Goods or Services: Confirm if the donor received anything in return.

- Authorized Signature: Representative’s name and signature for validation.

Formatting Tips for Clarity

- Use Clear Headings: Separate sections to enhance readability.

- Keep It Concise: Avoid unnecessary details that might confuse donors.

- Provide a Copy: Offer digital and printed versions for convenience.

A well-structured donation receipt simplifies record-keeping and ensures compliance with tax regulations.