Essential Elements of a Donation Receipt

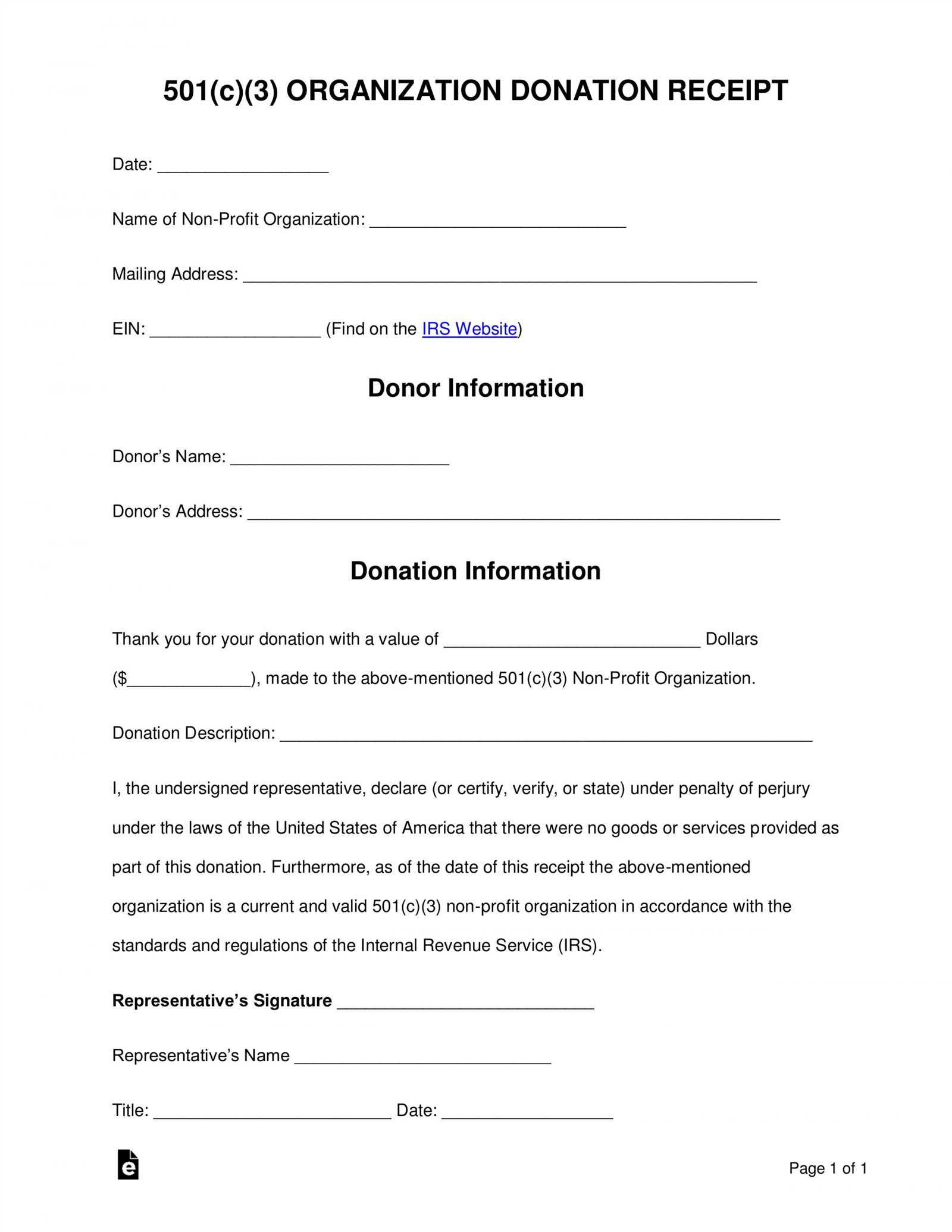

A well-structured donation receipt helps donors claim tax deductions and ensures compliance with legal requirements. Include the following details:

- Organization Name: Full legal name of the nonprofit.

- Tax Identification Number: Required for tax-deductible donations.

- Donor Information: Name and contact details.

- Donation Date: When the contribution was received.

- Amount or Description: Specify the donation amount or describe non-cash contributions.

- Statement of No Goods or Services: Confirm if no benefits were received in return.

- Signature: Representative’s name and title.

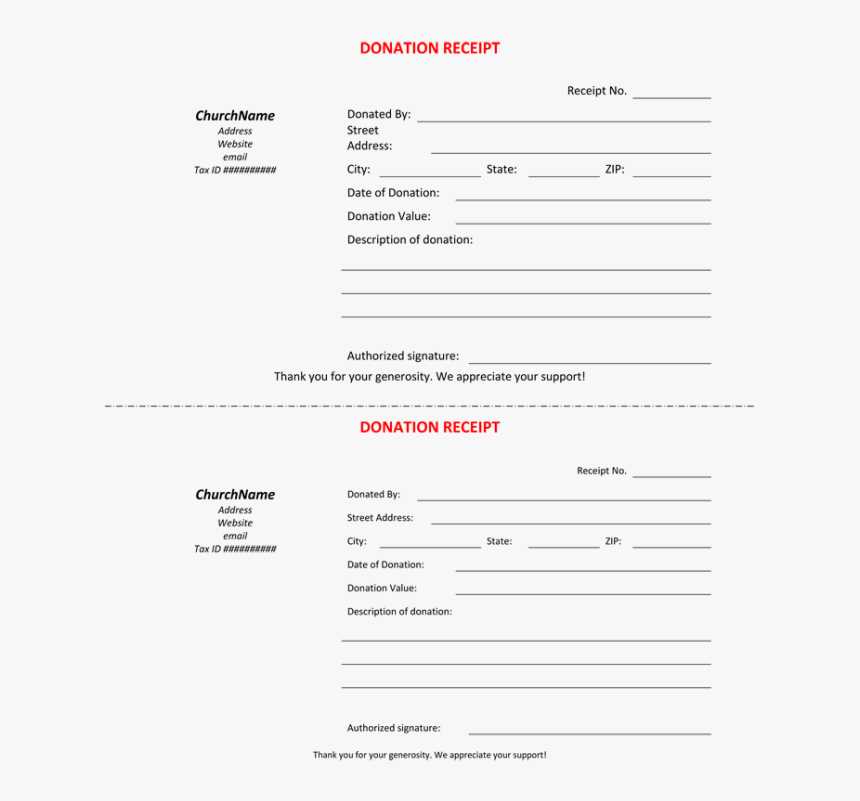

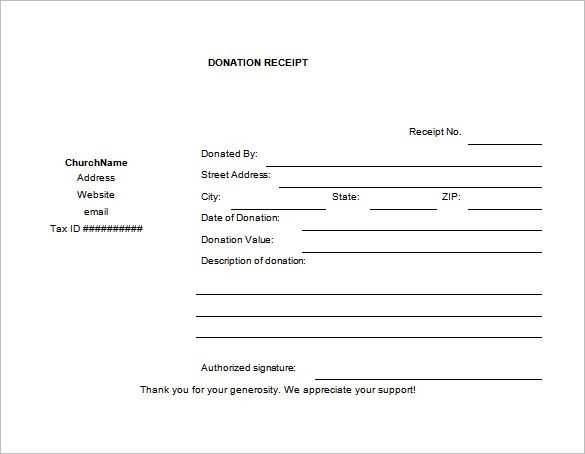

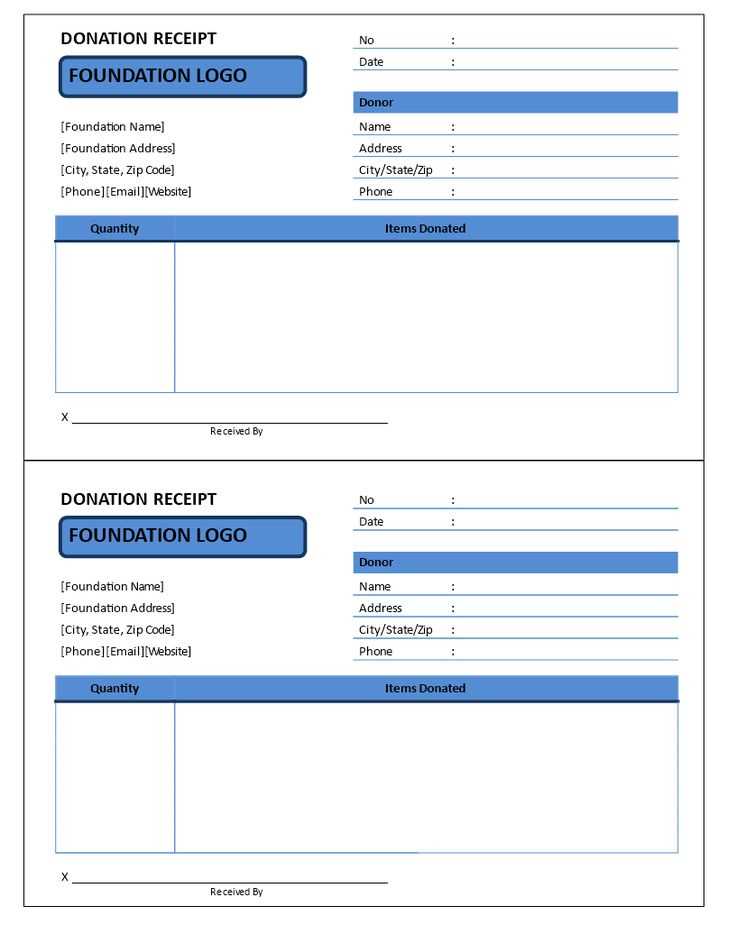

Donation Receipt Template

Use this template to create a professional receipt:

[Organization Name]

[Organization Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Tax Identification Number]

Donation Receipt

Donor: [Donor Name]

Address: [Donor Address]

Date of Donation: [MM/DD/YYYY]

Amount: [Donation Amount]

[If applicable, include a description of non-cash donations]

No goods or services were provided in exchange for this donation. This receipt serves as documentation for tax purposes.

Thank you for your generous support!

[Authorized Signature]

[Representative Name]

[Title]

Template for Donation Receipt

Key Elements to Include in a Receipt

Legal Requirements for Donations

Formatting and Structuring a Receipt

Digital vs. Paper Receipts: Pros and Cons

Common Mistakes to Avoid in Receipts

How to Automate the Process

Key Elements to Include in a Receipt

A proper donation receipt should include the donor’s full name, the organization’s legal name, date of donation, amount or description of the donated item, and a statement confirming whether goods or services were provided in return. If the donation is tax-deductible, mention the organization’s tax-exempt status and any applicable reference numbers.

Legal Requirements for Donations

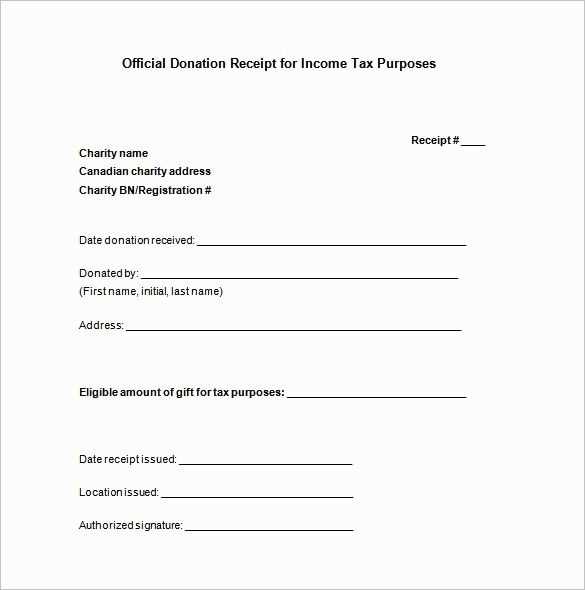

Charitable receipts must comply with local tax regulations. In the U.S., the IRS requires receipts for donations of $250 or more to include a written acknowledgment. In Canada, registered charities must issue receipts with specific details like a unique serial number. Always verify the requirements in your country to ensure compliance.