Need a mock receipt template for a business demonstration, a design project, or a testing scenario? The key is to make it look authentic while including only the necessary details. A well-structured receipt includes a business name, date, itemized charges, tax, total amount, and a payment method.

Start with a clean layout that resembles real receipts. Use a monospaced font like Courier for a printed look. Structure the information logically: place the business name and contact details at the top, followed by the date, transaction number, and item list. Ensure that calculations for subtotals, taxes, and totals are accurate.

For additional realism, include optional elements like a barcode, a refund policy, or a “Thank you for your purchase” message at the bottom. If the receipt is for digital use, consider adding placeholders for dynamic data to make it customizable. Whether you’re making a template for practice or a specific project, the right structure ensures it serves its purpose effectively.

Here’s the corrected version with redundancy eliminated:

Remove unnecessary phrases and repetitions from your template. Instead of using multiple lines for the same information, condense it to a single entry. For example, listing the purchase items with their prices twice in separate sections is redundant. Combine them into one clear list.

Consolidate Information

Group similar data together. If the receipt includes a summary of items at the top and again at the bottom, merge them into one section. This will save space and reduce confusion for the reader.

Simplify Layout

Avoid repeating headers or footers unless absolutely necessary. The title of the receipt should appear once, followed by the necessary details like date, amount, and items. Keep the font consistent and the spacing minimal.

Always prioritize clarity and simplicity. A clear and concise receipt not only looks more professional but also makes it easier for your customers to understand the charges.

- Mock Receipt Template: Practical Guide

To create a mock receipt template, focus on clarity and accuracy. A well-organized template helps convey all necessary information in an easily digestible format. Start by structuring it in a way that mimics the layout of a real receipt, ensuring each section is clear and legible.

- Header Section: Include a business name, address, phone number, and email. You can also add a logo if required. This section should be prominent and easy to locate.

- Receipt Title: Place the title “Receipt” at the top to clearly indicate the document’s purpose. It’s helpful to include a receipt number for reference.

- Date and Time: Make sure to list the date and time of the transaction. This can be placed just below the receipt title for quick access.

- Items List: Create a detailed list of purchased items, including product names, quantities, individual prices, and total amounts. Each item should be on a separate line for clarity.

- Subtotal, Taxes, and Total: Below the items list, break down the subtotal, tax amounts, and final total. This gives a transparent view of the costs involved.

- Payment Method: Include a section specifying how payment was made (e.g., cash, credit card, PayPal). This helps clarify the transaction.

- Footer Section: Add any necessary disclaimers, return policies, or business details. Keep this section simple and to the point, avoiding unnecessary information.

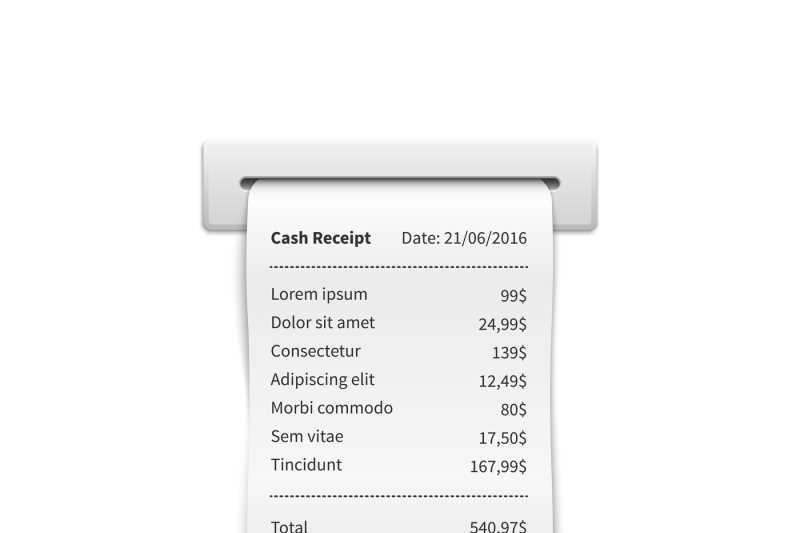

Here’s a mock receipt template example:

---------------------------------------------- Business Name Address | Phone | Email | Website ---------------------------------------------- Receipt No: 001234567 Date: 02/10/2025 12:30 PM ---------------------------------------------- Item Name Qty Price Total ---------------------------------------------- Product A 2 $10.00 $20.00 Product B 1 $15.00 $15.00 ---------------------------------------------- Subtotal: $35.00 Tax (8%): $2.80 Total: $37.80 ---------------------------------------------- Payment Method: Credit Card ---------------------------------------------- Thank you for your purchase! ----------------------------------------------

By using this structure, you can easily adapt it for different types of transactions, keeping your receipt professional and informative.

A receipt template should include the following core components for clarity and accuracy. First, ensure it features the company name and contact details such as address, phone number, and email. This allows customers to easily reach out for support or inquiries. Next, include a unique receipt number or identifier. This number should be distinct for each transaction, aiding in tracking and reference.

Transaction Details

Provide clear information about the transaction itself. This includes the date and time of the purchase, along with a breakdown of the items or services purchased. List each item with its price and any applicable taxes. This transparency helps the customer verify their purchase and understand what they are being charged for.

Payment Information

Specify the payment method used, whether it’s cash, credit card, or another method. Include any relevant details, such as the last four digits of the card number for card transactions, to further confirm the payment. Lastly, include the total amount paid, reflecting any discounts or promotions that were applied to the purchase.

Finally, don’t forget the return or refund policy, if applicable. A brief statement on how returns or exchanges are handled ensures that the customer is aware of their options after the transaction is complete.

Selecting the right format for your receipt ensures clarity and usability for both the issuer and the recipient. The format should match the nature of the transaction and be easy to process for record-keeping purposes. A simple, well-structured layout helps avoid confusion and supports quick reference later.

Paper vs. Digital

Decide between paper or digital formats based on the needs of your business and the preferences of your customers. Paper receipts are often preferred for in-person transactions, while digital receipts are efficient for online purchases and offer the advantage of easy storage and sharing. Consider providing both options to cater to a wider audience.

Layout and Design

Maintain a clean, organized design. Use a font that’s easy to read and ensure all important details–such as transaction date, total amount, and itemized list–are clearly visible. Group related information together and use sufficient spacing to make the receipt easy to scan quickly. A receipt that’s too cluttered can lead to confusion and errors.

Choose fonts that match your brand’s personality. Use a clean and easy-to-read typeface for the body text, while adding a unique or more stylized font for headings or logos to emphasize your branding. Ensure the font sizes are consistent across different sections for readability and flow.

Layout plays a significant role in how your receipt is perceived. Structure the content logically, prioritizing the most important information, like business name and transaction details, at the top. Use clear divisions for each section, such as a line break or bold headers, to help separate categories like itemized costs, taxes, and totals.

For branding, integrate your logo or colors subtly within the template. A small logo in the header or footer helps reinforce your identity without overwhelming the receipt’s function. Select a color scheme that complements the logo, keeping in mind the importance of contrast to make text legible.

Lastly, maintain balance between aesthetics and practicality. A clean, organized design ensures that your branding stands out without sacrificing the clarity of the receipt’s purpose. Keep the overall design simple but memorable to leave a positive impression.

For a clear and accurate receipt, include specific transaction details like dates, prices, and taxes. Follow these steps to ensure accuracy:

- Transaction Date: Always list the exact date when the transaction occurs. This helps both parties confirm the time of purchase and serves as a reference for potential returns or warranties. Make sure the date format is consistent with local standards (e.g., MM/DD/YYYY or DD/MM/YYYY).

- Itemized Prices: Display each item or service purchased along with its price. Be precise in listing the quantity and price per unit, especially for items sold in bulk. This breakdown allows customers to verify the charges.

- Taxes: Clearly state the tax rate applied to the purchase. For transparency, include the percentage and the final tax amount. If multiple tax types (e.g., sales tax, VAT) apply, list them separately.

- Total Price: Provide the final total, including all item prices and taxes. Ensure this amount matches the final charge processed by the payment system.

- Payment Method: Indicate the method of payment, such as credit card, cash, or digital wallet. This adds an extra layer of detail for tracking and reference.

These details create a transparent and professional receipt, which is crucial for both business and customer records. Make sure all values are clearly visible and easy to interpret. This minimizes confusion and prevents errors during returns or refunds.

For creating receipts, various tools and software can streamline the process, whether for small businesses or personal use. These options allow for customization, integration with payment systems, and quick generation of receipts.

Online receipt generators like Invoice Generator or Free Invoice Builder provide easy-to-use interfaces where you can fill in your details, save receipts in PDF format, and share them instantly. These are perfect for one-off receipts, quick transactions, or occasional use.

For businesses looking to automate the receipt process, QuickBooks and Zoho Invoice integrate invoicing, billing, and receipt generation. They offer more robust features, like automated recurring invoices, tax calculations, and payment tracking.

For more advanced customization, Canva allows users to design fully personalized receipts. You can choose from various templates, adjust fonts, colors, and even logos to create a receipt that fits your brand’s identity.

For a more hands-on approach, spreadsheet software like Microsoft Excel or Google Sheets can be customized with formulas to generate detailed receipts. This method gives flexibility for calculating totals, taxes, and discounts but requires more manual input.

If you’re dealing with a high volume of transactions, integrating a POS (Point of Sale) system is highly recommended. Popular options like Square and Lightspeed provide receipt templates, automatic transaction tracking, and reporting features that fit businesses of all sizes.

| Tool | Features | Best For |

|---|---|---|

| Invoice Generator | Customizable templates, PDF download | Occasional use, freelancers |

| QuickBooks | Automated invoices, tax tracking, recurring billing | Small to medium-sized businesses |

| Canva | Fully customizable designs, templates | Business branding, creative professionals |

| Google Sheets | Custom formulas, manual tracking | Individuals, custom setups |

| POS Systems (Square, Lightspeed) | Integrated transaction tracking, receipt generation | Retailers, restaurants, high-volume businesses |

Choosing the right tool depends on the scale and frequency of your receipt generation needs. For simplicity, go for online generators. For businesses, more integrated solutions will ensure smooth operations and ease of use.

Ensure you use receipts in a way that respects privacy laws and avoids misleading representations. Creating or altering receipts with incorrect information, especially for financial transactions, can result in severe legal consequences, such as fraud charges. Always ensure that any mock receipts used for demonstration or testing purposes are clearly marked as “for example only” to prevent confusion.

Privacy and Data Protection

Receipts often contain personal and financial data, which makes it vital to handle them with care. If you are working with receipts that contain sensitive customer information, adhere to data protection regulations, like GDPR or CCPA, depending on your location. Never disclose private information without explicit consent, and avoid sharing receipts unless necessary for legitimate purposes.

Intent and Transparency

Mock receipts must be transparent about their non-legitimacy. Do not use mock receipts in a way that could be mistaken for real transactions. Always ensure that the intent behind creating these receipts is clear to others, whether for design, educational purposes, or testing software, to avoid ethical issues related to deception or fraud.

To create an accurate and professional mock receipt, follow a clear and straightforward structure. Begin by using bullet points to display items and their prices. This ensures clarity and makes the information easier to digest for the reader.

Basic Structure

Each item should be listed with a description, quantity, unit price, and total price. For example, if you’re selling a product, you might display:

- Item: Widget A

- Quantity: 2

- Unit Price: $10.00

- Total: $20.00

Formatting Tips

For consistency, use clear sections. Group the items together, followed by totals. Add taxes and any additional fees separately at the bottom for transparency.