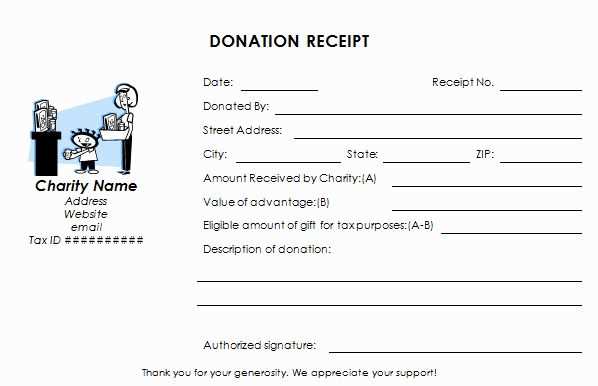

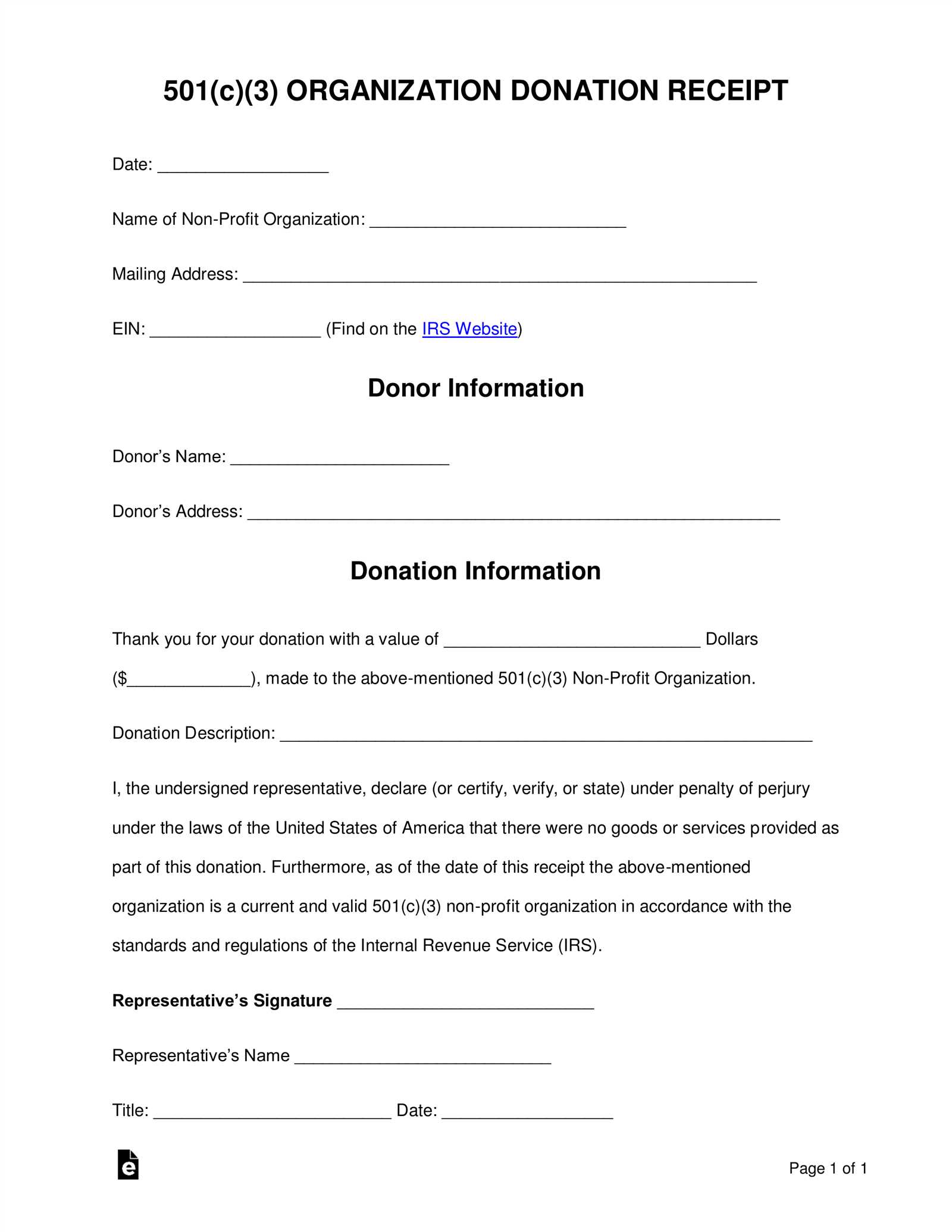

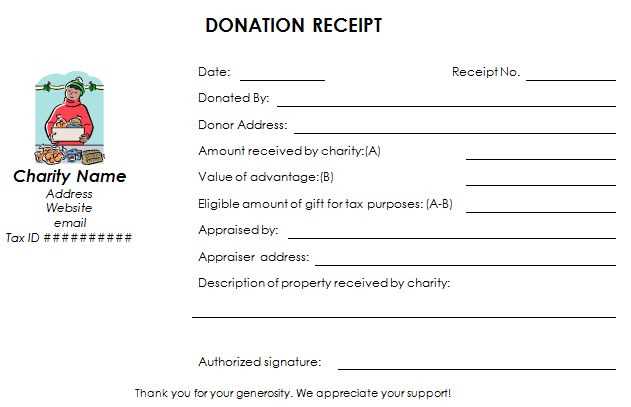

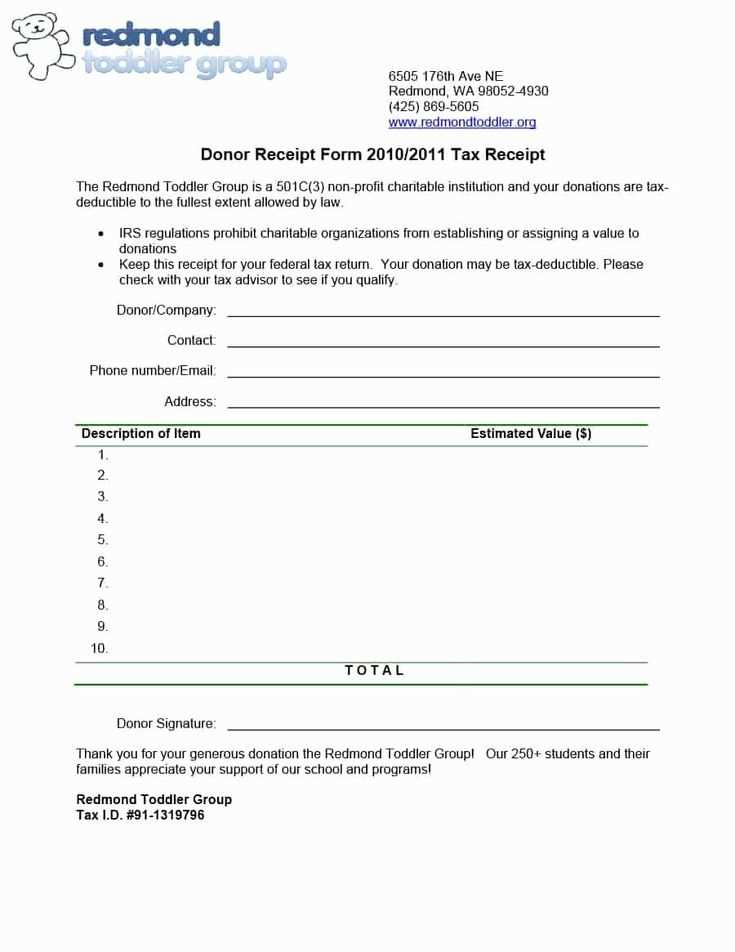

To create a tax receipt for donations, it’s important to include key details that satisfy IRS requirements. A donation receipt must specify the donor’s name, donation amount, and the organization’s name, address, and tax-exempt status. Be sure to note whether the donation was monetary or non-monetary. For non-monetary donations, include a description of the donated items, though not the value, as the donor is responsible for valuing their contribution.

Start by including the date of the donation and a clear statement that no goods or services were provided in exchange for the donation, unless applicable. If goods or services were provided, their fair market value must be stated. Additionally, ensure that the receipt is signed by an authorized representative of the organization, confirming the details of the donation.

It’s helpful to use a template document to streamline the process and ensure that all necessary information is included. This not only saves time but also ensures consistency across receipts. Many organizations use a simple Word document for this purpose, which can easily be customized with the donor’s details. Keep a copy of each receipt for your records, as they are vital for both donor and organizational tax reporting.

Here are the corrected lines:

Make sure the donation amount is listed clearly, including the currency type. Double-check that the donor’s full name and address are spelled correctly, as this ensures the document’s validity for tax purposes.

The date of the donation must be precise, with no ambiguity. If there are multiple donations, list each separately along with its specific date and amount.

Clarify whether the donation was made in cash, goods, or services. This detail is crucial for accurate reporting and for the donor’s tax deduction eligibility.

Include the tax-exempt organization’s name and EIN (Employer Identification Number), confirming their tax-exempt status. If applicable, provide a statement confirming no goods or services were exchanged for the donation.

- Tax Receipt for Donation Template Document

When creating a tax receipt for donations, ensure the template includes specific, required details to comply with tax regulations. A proper document should feature the following elements:

Key Elements to Include

Donor Information: Full name, address, and contact details of the donor. Include the donation amount and the method of payment used.

Non-Profit Organization Details: The name, address, and contact details of the organization receiving the donation. Ensure the tax-exempt status is clearly mentioned.

Additional Details

Include the date of the donation and a brief description of the item or service donated, if applicable. If the donation was a non-monetary item, provide a fair market value for tax purposes.

Indicate that no goods or services were provided in exchange for the donation (if applicable). This ensures the donor receives full credit for the charitable gift on their taxes.

Once all details are included, the tax receipt template should be ready for issuing. Keep copies for your records, and ensure each receipt complies with local tax laws.

Begin with the donor’s name and contact information at the top of the receipt. Include the full name of the donor and their address or email to confirm the contribution. This establishes clear identification and recordkeeping.

Next, specify the donation amount and describe the type of donation. Indicate whether the donation was monetary or in-kind, along with the value of the donation if applicable. If the donor gave a physical item, provide a brief description to ensure the donation’s nature is clear.

Include a section for the organization’s details. This should cover the name, address, and contact information of the non-profit. Also, add the organization’s tax-exempt status number or EIN (Employer Identification Number) to validate its charitable status.

Provide the date of the donation. This helps establish the timing of the contribution for tax purposes. It’s essential that this section is filled out clearly to avoid any discrepancies during tax filings.

List any goods or services provided in exchange for the donation. If the donor received anything in return, include this information and provide the estimated value of the goods/services. This ensures the donor can account for the tax implications of their contribution.

End with a clear statement confirming the donation. Use wording like “No goods or services were provided in exchange for this donation” if that’s the case, or “The donor received goods or services valued at [amount]” if applicable.

| Field | Details |

|---|---|

| Donor Name | [Insert Donor’s Full Name] |

| Donation Amount | [Insert Donation Amount] |

| Donation Type | [Monetary or In-kind] |

| Organization Details | [Insert Non-Profit Name, EIN, and Address] |

| Donation Date | [Insert Date of Donation] |

| Goods or Services | [Details if applicable] |

Clearly list the donation amount, specifying whether it’s in cash or goods. If it’s a non-cash donation, include a description of the items, their fair market value, and an acknowledgment that the donor did not receive anything in return.

Receipt Information

- Donor’s Name and Address: Include the full name and address of the donor for proper identification and tax filing.

- Organization’s Details: Add the name, address, and tax-exempt status of the charitable organization issuing the receipt.

- Donation Date: State the exact date the donation was made, as this is needed for tax reporting purposes.

- Tax-exempt Number: Include the charity’s tax-exempt ID number to validate its eligibility for providing tax receipts.

Additional Notes

- No Goods or Services: Clearly state if the donor did not receive any goods or services in exchange for the donation. This ensures the donation is fully tax-deductible.

- Value of Goods/Services (if applicable): If goods or services were provided, mention their value, as this amount should be subtracted from the total donation for tax deduction purposes.

Donation receipts must meet specific legal standards to be valid for tax purposes. The IRS requires certain information to be included in receipts, especially for donations over a specific amount. For donations of $250 or more, the organization must provide a written acknowledgment of the gift, including the amount donated and a statement regarding any goods or services provided in exchange for the donation.

For cash donations, a simple receipt indicating the donor’s name, the date of the contribution, and the amount is usually sufficient. Non-cash donations require additional details, such as a description of the items donated and their estimated value. If the value exceeds $500, the donor must complete IRS Form 8283.

It’s also important for the receipt to state whether the organization is a qualified tax-exempt entity, which allows the donor to claim tax deductions. This ensures the donor’s eligibility for any applicable tax benefits.

Failure to provide a compliant receipt could result in the donor being unable to claim a tax deduction, potentially leading to penalties. Therefore, ensuring the receipt includes the correct information is crucial for both the donor and the receiving organization.

Include the donor’s name and contact details at the top of the receipt for clear identification. This should be followed by the donation amount and the date it was made. Specify whether the donation was monetary or in-kind, and if in-kind, provide a brief description of the items donated.

Incorporate the name of your organization and its tax ID number to make the receipt official. Add a thank you message to show appreciation, and consider including your organization’s mission statement to remind donors of the impact of their contributions.

If possible, provide a specific reference or transaction number for the donation. This will help both the donor and your organization track contributions easily for future reference. Personalizing each receipt with this level of detail helps to create a meaningful connection with the donor.

Ensure the template has your logo and brand colors to maintain consistency with your organization’s identity. You may also want to include a signature from a representative, which adds a personal touch to the acknowledgment of the donation.

Store donation receipts in clearly labeled folders or digital files for easy access. Use separate folders for different years or types of donations, such as cash, items, or special fundraising events. Keep physical receipts organized by date, and ensure that the donation organization’s name and the amount are clearly visible.

- For digital records, scan receipts and save them in clearly named folders on your computer or cloud storage service.

- Consider using document management apps or software that allow easy categorization and searchability by donation type or date.

- Label digital files with key details like donor name, amount, and date for quick retrieval during tax season or audits.

- Ensure backups are made for digital records, and regularly check that all files are correctly stored and accessible.

Periodically review and remove unnecessary or outdated receipts. Maintain a system that allows for easy retrieval of older documents when needed. Digital tools can automate this process and help you stay on top of organization without much effort.

If you notice any discrepancies in a donation receipt, contact the issuing organization directly. Start by gathering relevant information, such as the donation date, amount, and receipt number. This will help resolve the issue quickly.

If the donation amount is incorrect, confirm whether the error lies in the organization’s records or your payment method. Sometimes, processing delays or system errors can result in incorrect data being recorded.

If the donor’s name or address is misspelled, provide the correct details to the organization so they can issue an updated receipt. Be sure to check if the correct format for names is being used, as some systems may have strict guidelines.

If a tax exemption status is missing, confirm with the organization that the necessary tax information has been applied to your donation. They may need additional documentation to issue a correct receipt.

When receiving receipts electronically, check that the correct date is listed. If it’s incorrect, it’s likely due to system glitches. Contact the organization for clarification or a new receipt with the accurate information.

Errors in charity tax receipts can be quickly corrected if the donor communicates promptly with the charity’s financial or support team. Ensuring proper documentation helps maintain compliance and supports accurate tax reporting.

Ensure your tax receipt for donations includes clear and accurate details to meet IRS requirements. Begin with the donor’s full name, address, and the date of the donation. Specify the amount donated, whether it’s cash, property, or other assets. If the donation is property, provide a brief description and its estimated value, but avoid placing a value on the donation unless it’s professionally appraised.

Template Components

A solid tax receipt template should include the name of the charity or nonprofit organization, their tax identification number, and a statement that no goods or services were provided in exchange for the donation. If something was exchanged, state the fair market value of those items. Remember to clearly mark the receipt as “tax-deductible” for clarity.

Formatting Tips

Keep the document simple and easy to understand. Use bullet points or a table for clarity and organization, especially when detailing items donated. Always verify that the tax receipt contains all the necessary elements before sending it to the donor.