Key Components of the Receipt

A well-structured sale of goods receipt should include several key pieces of information. Ensure the document clearly states the following:

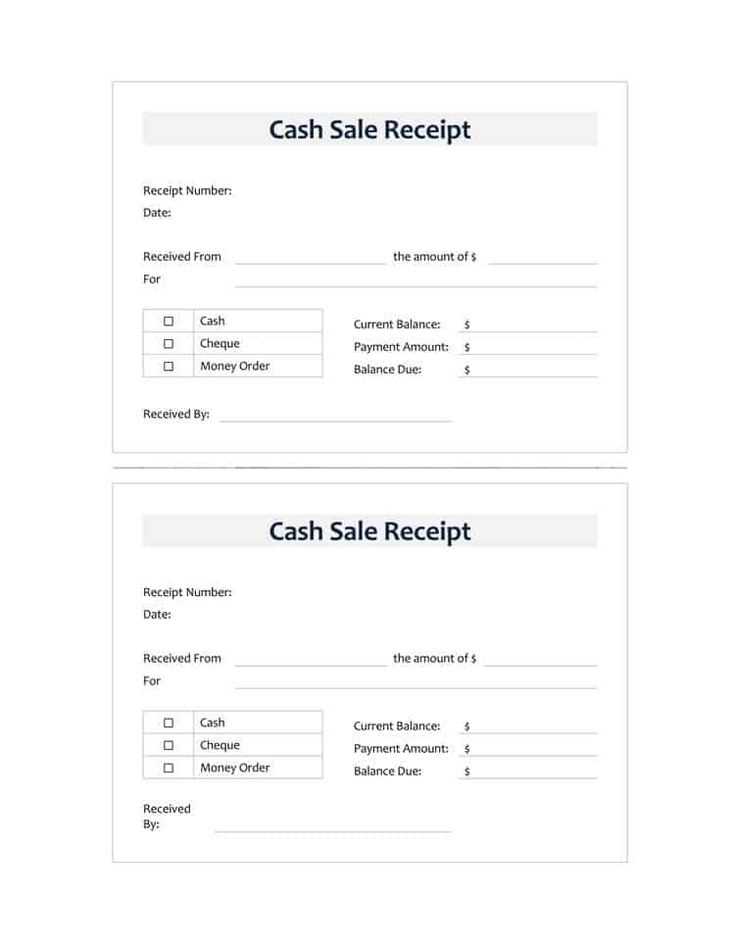

- Receipt Number: Unique identifier for each transaction.

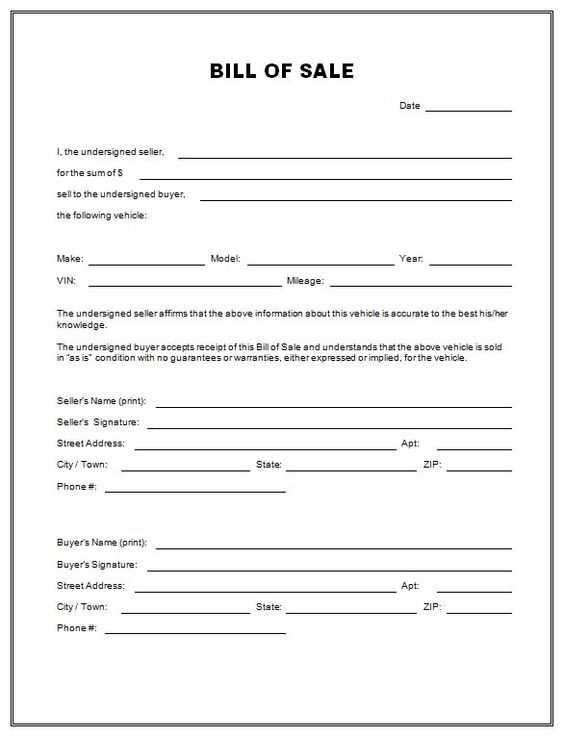

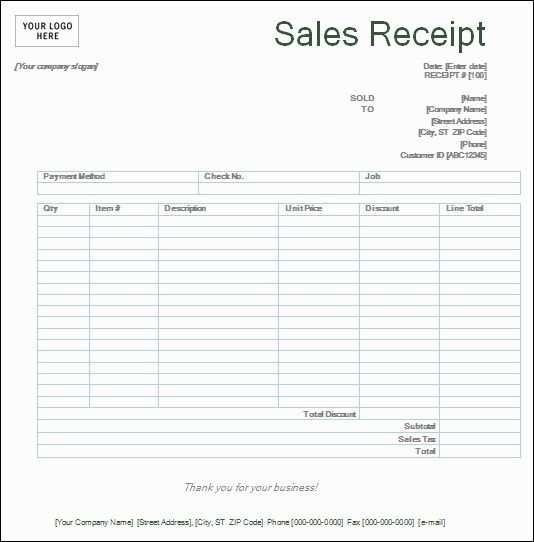

- Seller’s Information: Full name or business name, address, and contact details.

- Buyer’s Information: Full name or business name, address, and contact details.

- Transaction Date: The exact date of sale or transfer of goods.

- List of Goods Sold: Include item descriptions, quantities, unit prices, and total price.

- Total Amount: The sum of all goods sold, clearly indicating any applicable taxes.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, bank transfer).

How to Format the Template

To ensure clarity and professionalism, organize the receipt into sections with clear headings. The following layout is recommended:

- Header: This should feature the seller’s business name, logo (if applicable), and receipt title.

- Transaction Details: Follow with transaction specifics like buyer/seller info, receipt number, and date.

- Itemized List: Create a table that lists each item, its description, quantity, unit price, and total price.

- Summary: Conclude with the total amount, payment method, and any additional notes or terms.

Tips for a Professional Look

Keep the template simple but clear. Avoid clutter, use consistent fonts, and make sure all text is legible. If you’re designing a template digitally, ensure the format is compatible with common office software like Microsoft Word or Google Docs.

Make sure the receipt is easy to modify for different transactions while maintaining consistency in its layout and style. This ensures the document remains functional and adaptable for future sales.

Sale of Goods Receipt Template

Key Elements to Feature in a Bill

Legal Requirements for a Sales Slip

Adapting a Receipt for Various Transactions

Digital vs. Paper Copies: Pros and Cons

Frequent Errors in Designing a Sales Proof

Optimal Formats for Printing and Distribution

For a clear and legally compliant sales receipt, always include the following elements: the name and contact details of the seller, a unique receipt number, date of transaction, a description of goods or services sold, quantities, unit prices, total amount, and the applicable taxes. Ensure the customer’s details are noted if needed for the transaction type.

Legal requirements vary, but generally, receipts should include a tax identification number and clear breakdowns of any sales tax. In some regions, additional data like the customer’s name may be necessary. Be aware of your local laws to ensure compliance.

Sales receipts should be adaptable to various transaction types, such as returns, exchanges, or discounts. Modify the wording or format to reflect these changes, ensuring clarity on the document about the reason for any adjustments.

Digital receipts offer the benefit of easy storage and quick delivery, while paper receipts can be handed immediately and are often preferred for certain transactions, like returns. Weigh the need for physical documentation versus the convenience and environmental benefits of digital records.

Avoid errors in receipt design, such as missing information, unclear pricing, or inadequate descriptions. These can lead to customer confusion and legal issues. Double-check your templates for accuracy and ensure they are easy to read.

Consider file formats like PDF or a high-resolution image for digital receipts. These formats maintain quality when printed. For physical receipts, opt for clear, high-quality paper and ensure your printing device produces legible text to prevent readability issues.