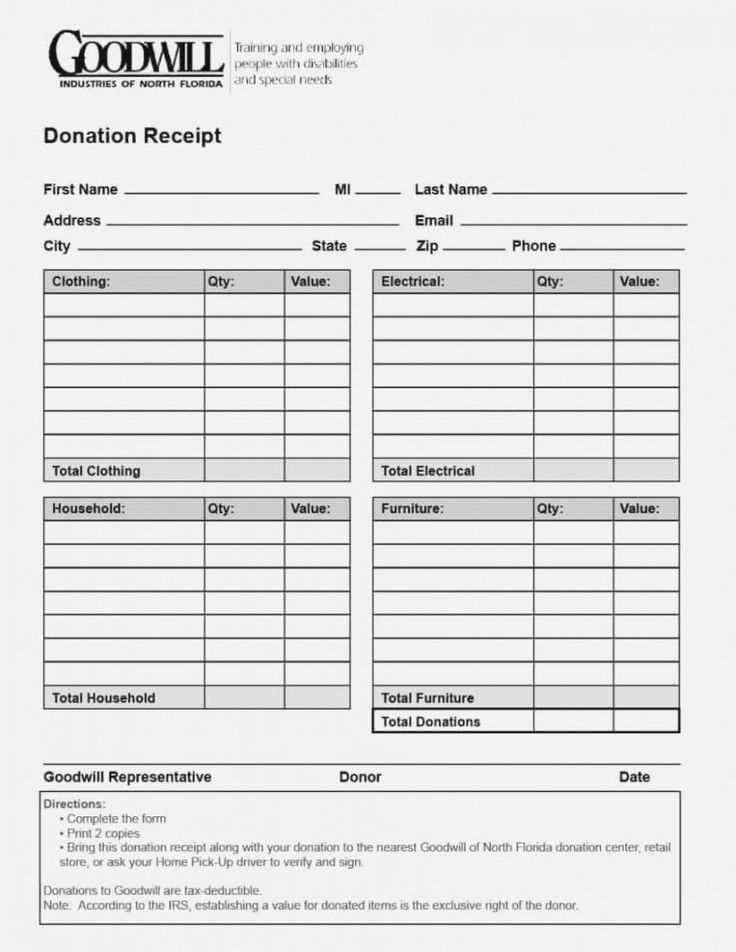

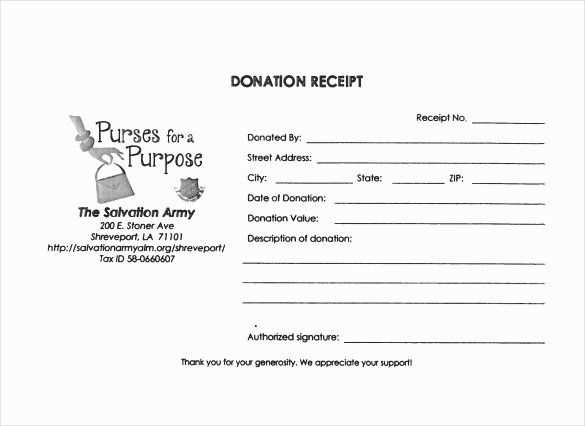

To provide donors with accurate tax receipts, create a clear and concise printable donation receipt for silent auction contributions. The template should list the donor’s name, contact information, and the item donated, along with its estimated value. Include a statement confirming no goods or services were exchanged for the donation. This ensures compliance with tax regulations and provides transparency for donors.

For better tracking, include a unique receipt number, the event date, and the organization’s details, such as name and tax ID number. A thank-you message will also help reinforce the donor’s positive experience and commitment to future contributions. Keep the format simple yet professional to streamline processing and avoid errors.

By offering a printable version, you make it easier for your team to handle donations and for donors to keep records for tax purposes. The receipt can be sent via email or provided physically during the event, ensuring convenience for all parties involved.

Here’s the revised version with reduced repetition while maintaining clarity and correctness:

To create a printable silent auction donation tax receipt template, include specific details that comply with tax regulations. First, clearly state the donation amount or fair market value of the item. If the donation is an item, describe it concisely, and if it’s cash, specify the amount given. Ensure to mention whether the donor received any goods or services in exchange for the donation, as this affects the deductible amount.

Key Elements for the Template

List the donor’s name and address accurately. Include the date of the donation and the name of the organization receiving the donation. You must also provide the tax-exempt status number or IRS identification number of the organization. For donations over a certain threshold, a detailed description of the item should be included, making it clear whether an appraisal is necessary.

Clarity and Simplicity in Design

Make sure the receipt is formatted for easy printing, with clear sections and enough space to write the necessary information. Keep the font legible and the layout simple, ensuring all required data is visible and easy to fill in by both the donor and the recipient organization.

- Printable Silent Auction Contribution Tax Receipt Template

For a clean, organized donation receipt, use a template that clearly includes key details like donor name, contribution value, and the auction event’s date. Ensure the receipt specifies whether the donation is tax-deductible, along with the charity’s information for transparency. It’s crucial that the form is customizable to fit the specifics of each donation type. You can either offer a fixed amount for the contribution or leave space for appraised values if the donation is a physical item.

Consider including a statement that the donor received no goods or services in exchange for the donation if the value exceeds $250, which is required by tax authorities. A professional layout and clear instructions help both the donor and the organization maintain records without confusion.

Download a ready-made template or design your own, ensuring it includes fields for the donor’s contact details, description of the item donated, its fair market value, and the signature of an authorized representative from your organization. Providing a printable version of this receipt will also help donors claim their deductions accurately when filing taxes.

Ensure that your donation receipt includes the following key elements to maintain transparency and compliance:

Donor Information

Start by clearly stating the donor’s name and contact details. This helps with proper record-keeping and allows for easy communication, if necessary. You should also note the donor’s status (individual or organization).

Donation Description

Provide a detailed description of the donation. If it’s a physical item, list the item’s name, quantity, and general condition. For monetary contributions, indicate the exact amount donated.

Date of Donation

The date the donation was received is vital for both tax reporting and legal purposes. Ensure it is correctly recorded.

Value of Donation

If the donation is a non-cash item, include an estimated value of the item, or state that the donor is responsible for determining the value. For monetary donations, the exact amount should be stated.

Tax-Exempt Status

Clearly indicate your organization’s tax-exempt status. This helps donors claim tax deductions where applicable. Include the organization’s IRS or equivalent registration number.

Statement of No Goods or Services Provided

If the donation is a charitable gift without any benefit or services in return, make a statement to that effect. This is required for the donor’s tax deduction purposes.

| Element | Description |

|---|---|

| Donor Name | Full name and contact information |

| Donation Description | Details of the donation (item or amount) |

| Date of Donation | The date the donation was received |

| Value of Donation | Estimated or exact value |

| Tax-Exempt Status | IRS registration number |

| Statement of No Goods or Services | Confirmation that no goods/services were received |

Ensure your text is aligned and well-organized. Stick to left-aligned text for a clean and uniform look. This simple choice gives your document a polished, structured appearance.

Choose Readable Fonts

Use easy-to-read fonts like Arial, Calibri, or Times New Roman. Keep the font size between 10 and 12 points for optimal legibility. Avoid decorative fonts that may distract from the document’s purpose.

Maintain Consistency in Margins

Set uniform margins on all sides of the page (typically 1 inch). This gives the document a balanced and professional look, making it easier to read and more visually appealing.

Use bullet points or numbered lists to break down complex information. This helps your reader quickly find key details without having to sift through dense paragraphs.

For headers, use bold or slightly larger font sizes to make them stand out. This structure adds clarity and guides the reader through the document efficiently.

Tax-deductible donations must comply with specific legal requirements to ensure the donor can claim them. The Internal Revenue Service (IRS) provides clear criteria for what constitutes a valid donation. For instance, donors can only deduct gifts made to qualified organizations that have 501(c)(3) status. It’s critical to confirm this status before issuing tax receipts.

Donation Value and Documentation

The fair market value (FMV) of the donated item must be assessed accurately. Donors cannot deduct the full amount of their contribution if they receive something in return, such as event tickets or goods. The receipt should reflect the value of the donation minus any benefits received. For non-cash donations, a qualified appraisal may be required for items valued over $500.

Record-Keeping Requirements

Maintaining proper records is vital for both the donor and the recipient organization. Donors should receive a written acknowledgment for donations of $250 or more. The acknowledgment should detail the amount or description of the gift and state whether the donor received any goods or services in exchange. Without proper documentation, the IRS may disallow the deduction.

Adjust the format of your printable tax receipt to match the needs of different donor types. Personalizing the donation receipt ensures clarity and correctness for each contributor. Start by tailoring the header section with relevant donor information such as their full name, address, and donation details.

For Corporate Donors

- Include company name and contact details.

- Add the name of a contact person or representative who managed the donation.

- Consider adding the company’s tax-exempt status or employer identification number (EIN).

For Individual Donors

- Ensure the donor’s full name is listed correctly, including any applicable titles (e.g., Dr., Mr., Mrs.).

- If the donation is in memory or honor of someone, make sure to include this information clearly.

- For high-value donations, note whether the item is a gift or a financial contribution, along with its appraised value.

Additionally, tailor the thank-you message and donation description to match the donor’s contribution. This customization enhances the donor’s experience and improves their record-keeping for tax purposes.

Ensure that all receipts contain the correct donor’s name. Double-check for spelling errors and ensure full names are used as they appear in legal documents.

- Incorrect Donation Value: Always verify the value of the donation. Inaccurate or estimated values could cause issues for both the donor and the organization during tax filing.

- Lack of Proper Descriptions: Be specific when describing the items or services donated. Ambiguity in what was donated may cause confusion when a donor claims their deduction.

- Missing Donation Date: Ensure the date of the donation is clearly stated on the receipt. This helps match the donation to the correct tax year.

- Failure to Acknowledge Non-Cash Donations: Non-cash donations need to be recognized accurately, including descriptions and estimated value, to avoid issues with the IRS.

- Improper Language: Avoid using vague or overly generalized terms like “gift” or “contribution” without specifying the nature of the donation.

- Omitting the Organization’s Tax ID: Donors rely on the tax-exempt status of an organization for their deductions. Always include the organization’s tax identification number (TIN).

Double-check every receipt for accuracy before issuing. Small mistakes can lead to major complications for both parties during tax season.

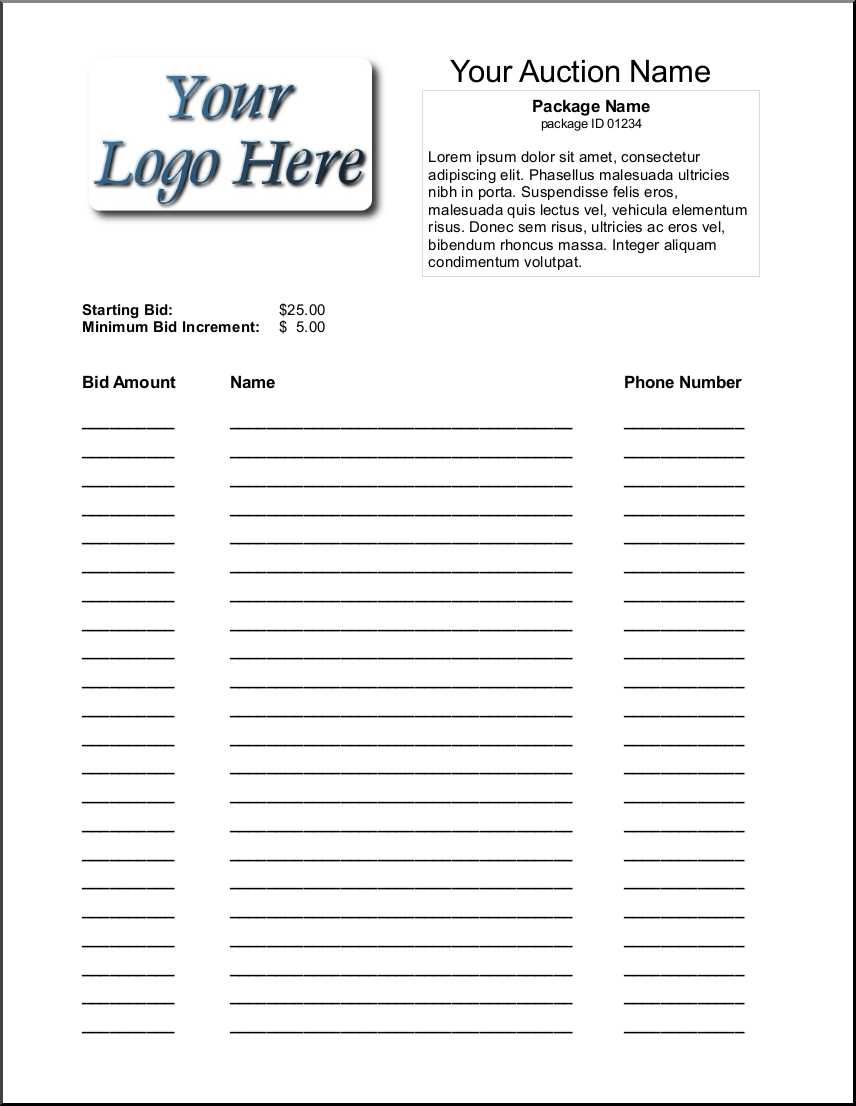

Online marketplaces and websites offer a variety of silent auction templates that are easy to customize. Many of these resources provide free and paid options, allowing you to quickly find what fits your event’s needs.

1. Template Websites

Several dedicated websites specialize in ready-to-use templates. Websites like Template.net and Canva offer silent auction templates that can be edited online. They often provide various styles, from simple forms to more professional layouts.

2. Auction Platform Tools

Online auction platforms, such as 32auctions and BiddingOwl, often provide free templates as part of their service. These tools are designed for users running auctions, ensuring that the templates are perfectly aligned with the auction process.

3. Microsoft Office Templates

Microsoft Office has a variety of downloadable templates. You can find auction templates on Microsoft’s template gallery for programs like Word and Excel. These can be tailored to suit the specifics of your silent auction.

4. Nonprofit Websites

Many nonprofit organizations offer free downloadable templates to help with fundraising events. These templates are often designed to meet IRS requirements for tax receipts and donation tracking, which is useful for silent auction events.

5. Customizable Google Docs Templates

Google Docs has a wide range of customizable templates that can be used for silent auctions. These templates are convenient for collaboration and can be shared easily with your team.

| Source | Template Type | Cost |

|---|---|---|

| Template.net | Editable Online | Free & Paid |

| 32auctions | Auction Form | Free |

| Microsoft Office | Word/Excel Template | Free |

| Google Docs | Editable Document | Free |

Printable Silent Auction Donation Tax Receipt Template

When creating a printable silent auction donation tax receipt, ensure all required information is included for donors to claim tax deductions. Include the donor’s name, the description of the donated item, and its estimated value. Make sure to clearly state that no goods or services were exchanged for the donation to comply with IRS guidelines.

Key Elements to Include

- Donor’s full name and contact information

- Description of the donated item, including its condition

- Estimated fair market value of the donation

- Statement confirming no goods or services were provided in exchange

- Date of the donation

- Tax-exempt organization’s name and address

By including these elements, the tax receipt will serve as a valid document for tax purposes. Make sure to format it clearly and professionally to enhance donor trust and comply with tax laws.