Key Details to Include

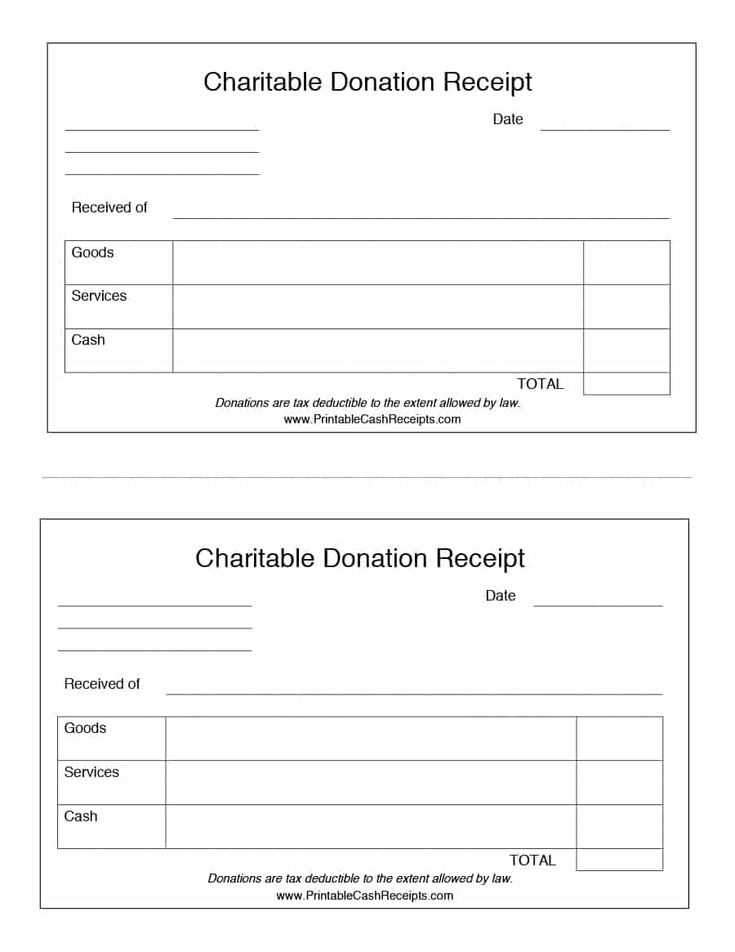

A proper donation receipt ensures compliance with tax regulations and provides proof of the contribution. Include the following:

- Donor’s Information: Full name and address.

- Charity Details: Official name, address, and tax-exempt status.

- Vehicle Description: Make, model, year, VIN, and mileage.

- Donation Date: The exact date the vehicle was handed over.

- Donation Value: The fair market value or sale price if the charity sells it.

- Statement of Goods or Services: Confirm if any benefits were received in return.

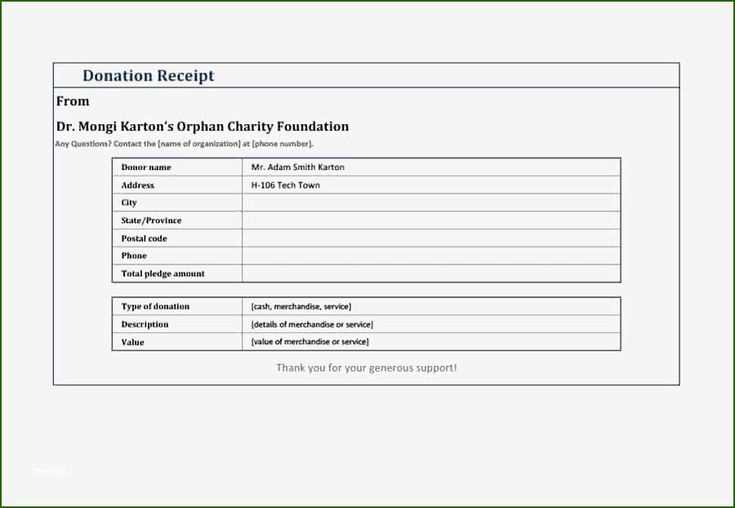

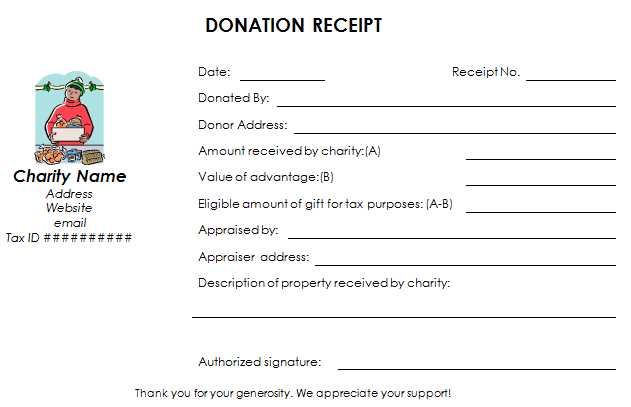

Sample Receipt Format

Use this template as a guide:

Charity Name: [Charity Name]

Charity Address: [Street, City, State, ZIP]

Tax ID: [EIN or Registration Number]

Donor Name: [Full Name]

Donor Address: [Street, City, State, ZIP]

Vehicle Details: [Year, Make, Model, VIN]

Donation Date: [MM/DD/YYYY]

Fair Market Value: [$Amount]

Sale Price (if applicable): [$Amount]

Statement: “No goods or services were provided in exchange for this donation.”

Authorized Signature: _______________________

Date: [MM/DD/YYYY]

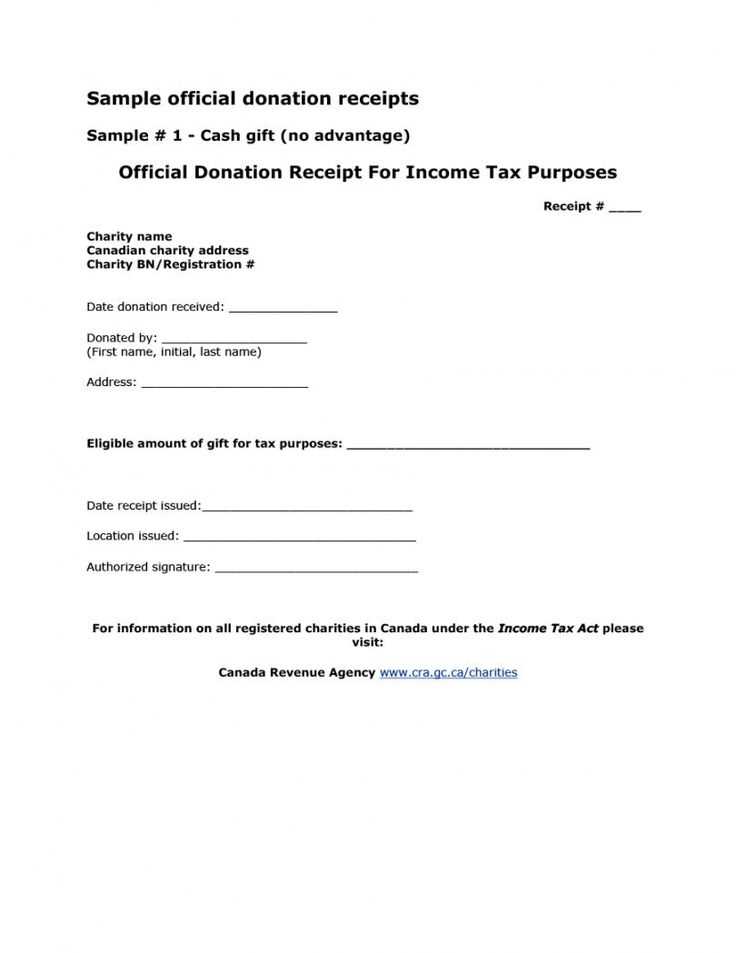

IRS Requirements

The IRS mandates Form 1098-C for vehicle donations exceeding $500. Ensure the receipt aligns with tax guidelines and consult a tax professional for compliance.

Additional Tips

- Keep a copy of the receipt for at least three years.

- If the charity sells the vehicle, request documentation of the sale price.

- Verify the charity’s tax-exempt status before donating.

Charitable Donation Receipt Template for Vehicle Contribution

A proper receipt for a vehicle donation must include specific details to meet legal and tax requirements. Ensure the document contains the donor’s full name, address, and a clear description of the vehicle, including make, model, year, and VIN.

The receipt should confirm whether the charity provided goods or services in exchange for the donation. If none were given, include a statement that the contribution was entirely charitable. If benefits were received, specify their nature and estimated value.

Format the receipt with a clear heading, followed by structured sections for donor and charity details, vehicle description, and a statement of donation. Include the date of contribution and the organization’s tax-exempt status.

For IRS compliance, the document must be issued before the donor files their tax return. Donations valued over $500 require Form 8283, while contributions exceeding $5,000 may need a qualified appraisal.

Common errors include omitting the charity’s EIN, failing to state if goods were received, or providing an incorrect vehicle description. Incomplete receipts can lead to disqualification of the tax deduction.

Deliver the acknowledgment in writing via mail or email. Digital copies are acceptable but must be retained for record-keeping. Ensure the donor receives the receipt promptly to support their tax filing process.