Why You Need an End-of-Year Daycare Receipt

Parents often require a detailed receipt for tax deductions or reimbursement purposes. A structured receipt simplifies record-keeping and ensures compliance with financial reporting requirements. Below is a template that covers all necessary details.

Daycare Receipt Template

Use this template to create a clear and professional document:

Daycare Provider Information:

- Name: [Daycare Name]

- Address: [Street, City, State, ZIP]

- Phone: [Contact Number]

- Email: [Email Address]

- Tax ID: [EIN or SSN, if applicable]

Parent/Guardian Information:

- Name: [Parent/Guardian Name]

- Address: [Street, City, State, ZIP]

Child Information:

- Name: [Child’s Name]

- Date of Birth: [MM/DD/YYYY]

Payment Details:

- Payment Period: [Start Date] – [End Date]

- Total Amount Paid: $[Total Amount]

- Payment Method: [Cash, Check, Credit Card, etc.]

Signature:

- Daycare Provider Signature: ________________________

- Date: [MM/DD/YYYY]

How to Use This Template

Fill in the required details, print the document, and provide a signed copy to parents. Digital receipts are also acceptable if sent via email with a clear record of the transaction.

Additional Tips

- Keep copies of all receipts for tax and audit purposes.

- Ensure amounts match bank or cash transaction records.

- Use a consistent format throughout the year to simplify reporting.

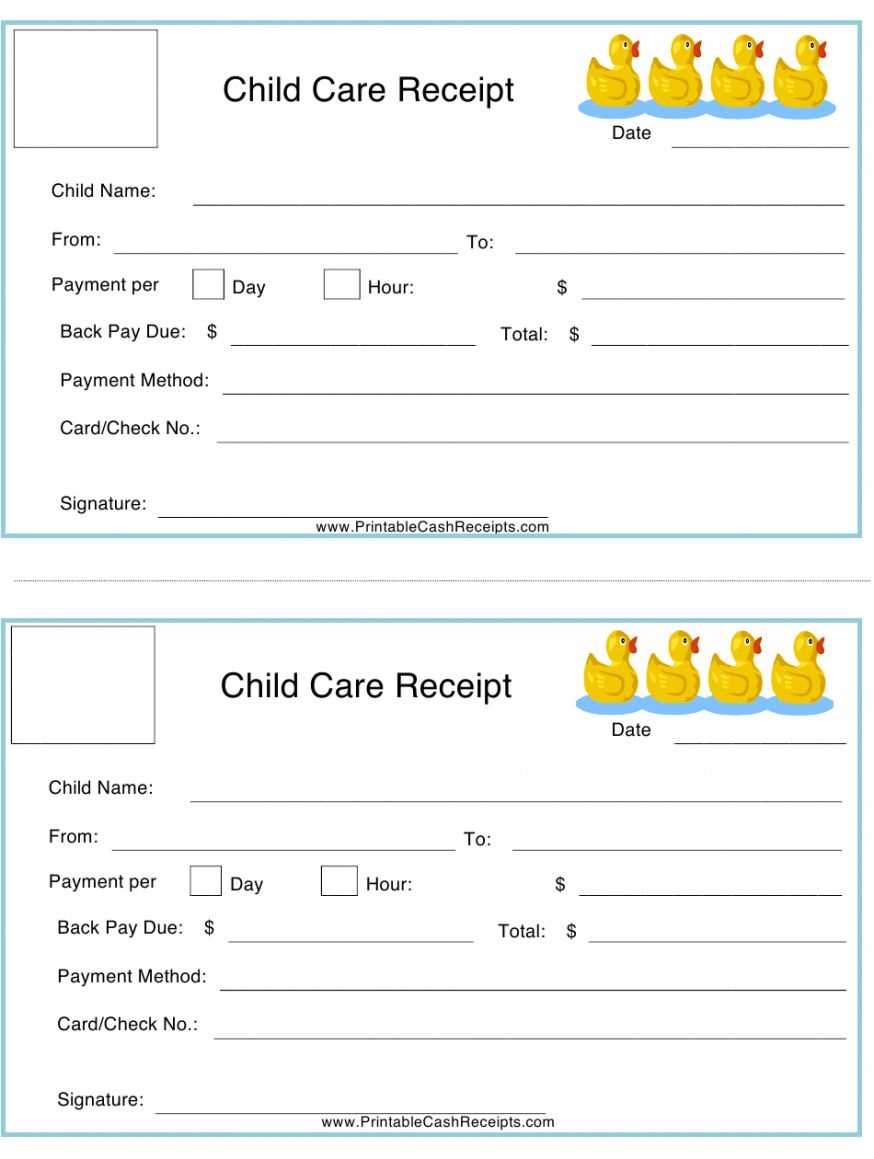

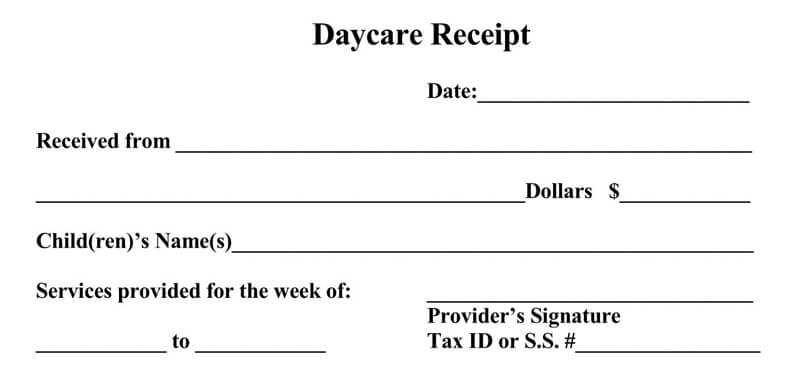

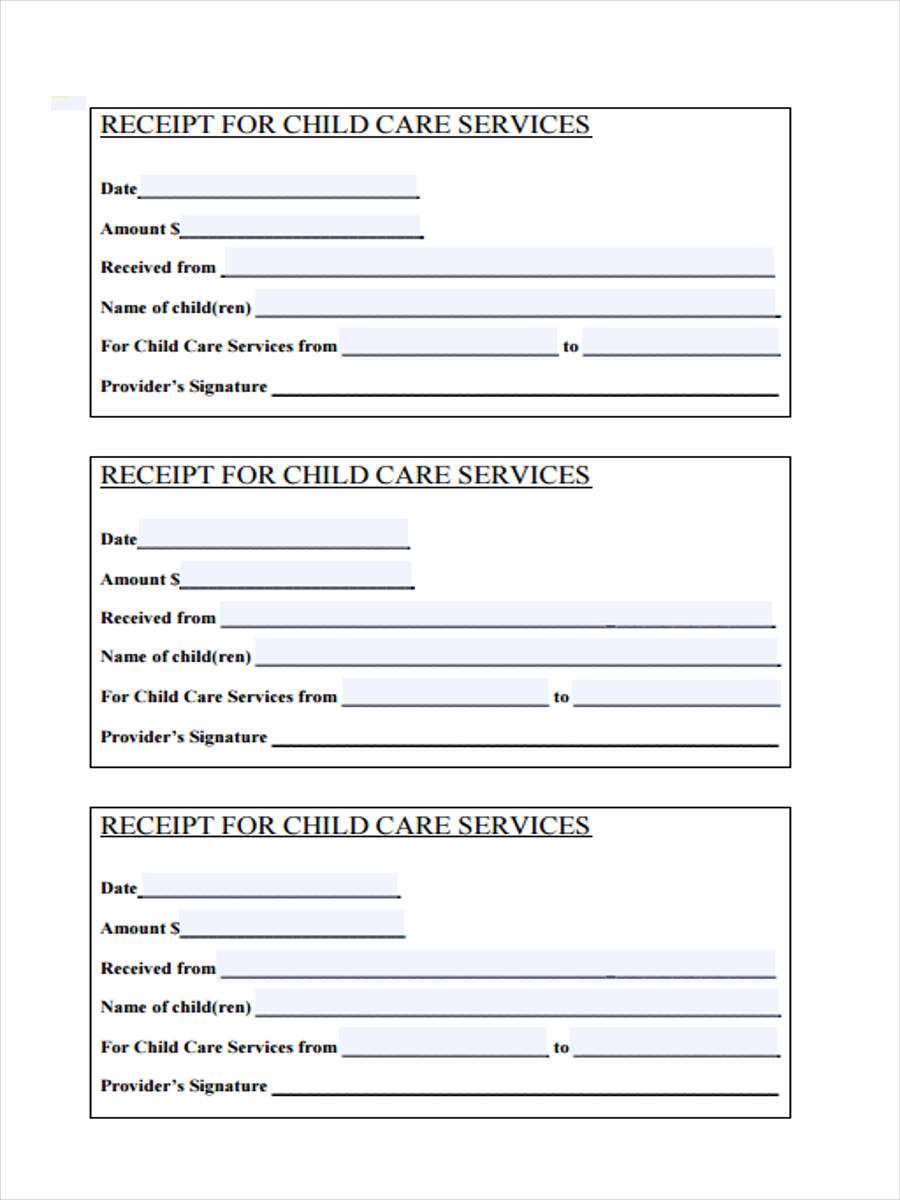

End of Year Daycare Receipt Template

What Information Should Be Included in a Year-End Childcare Receipt?

Include the daycare provider’s name, address, and tax identification number. List the parent’s name, child’s name, total amount paid, and payment dates. Specify the payment method and provide a signature if required for tax documentation.

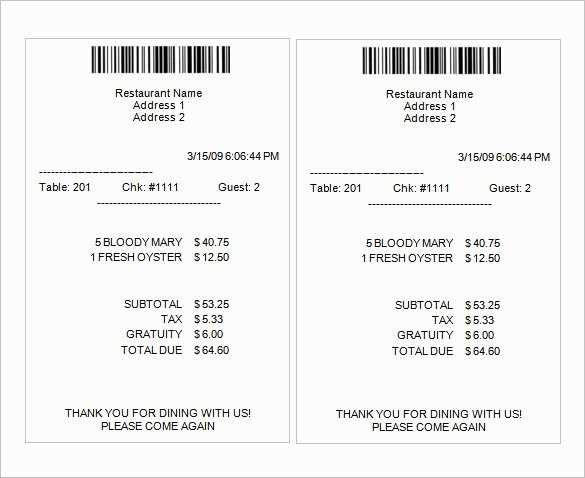

How to Format a Payment Receipt for Tax Purposes

Use a clear layout with columns for date, amount, and payment method. Ensure totals are accurate and match financial records. If applicable, add a section for deductible expenses and a provider’s certification statement.

Printable vs. Digital Templates: Pros and Cons for Daycare Receipts

Printable receipts offer a physical record but require storage space. Digital templates save time and reduce paperwork but may require secure backups. Choose a format that aligns with parents’ preferences and regulatory requirements.

Customizing a Receipt Template to Meet Parents’ Needs

Include fields for multiple children, itemized breakdowns, and provider contact details. Offer receipts in PDF and editable formats to accommodate different documentation preferences.

Common Mistakes to Avoid When Creating a Childcare Receipt

Avoid missing or incorrect tax ID numbers, inconsistent formatting, and vague descriptions. Double-check calculations and confirm that all required details meet tax authority standards.

Where to Find Free and Paid Templates for Daycare Receipts

Explore accounting software, official tax websites, and template marketplaces. Free versions may require manual edits, while paid options often include automation features and customization tools.